独狼KL

voted

$Vanguard S&P 500 ETF (VOO.US)$ What’s up tomorrow?

2

1

独狼KL

voted

After Trump confirmed the creation of a U.S. strategic crypto reserve, Bitcoin $Bitcoin (BTC.CC)$ has risen sharply, momentarily surpassing $94,000. However, it did not last long before Bitcoin turned around and fell again. Is it a pullback or a reversal?

Source: moomoo. Data as of March 3, 2025.

Factors affecting crypto

Since the U.S. election, Bitcoin has increasingly become a market investment wave, recognized as an emerging digital asset. As the pr...

Source: moomoo. Data as of March 3, 2025.

Factors affecting crypto

Since the U.S. election, Bitcoin has increasingly become a market investment wave, recognized as an emerging digital asset. As the pr...

+3

404

171

74

$GFM (0039.MY)$

Based on the analysis of GFM Services Berhad's Q4 2024 financial report and strategic outlook, the investment decision involves balancing risks and opportunities:

### **Key Positives**

1. **Revenue Growth**: Group revenue increased by **30.5% YoY** (FY2024: RM190.27 million vs. FY2023: RM145.90 million), driven by the consolidation of Highbase and expansion in the Oil & Gas (O&G) segment.

2. **Strategic Acquisitions**: The finalized acquisition of Highbase...

Based on the analysis of GFM Services Berhad's Q4 2024 financial report and strategic outlook, the investment decision involves balancing risks and opportunities:

### **Key Positives**

1. **Revenue Growth**: Group revenue increased by **30.5% YoY** (FY2024: RM190.27 million vs. FY2023: RM145.90 million), driven by the consolidation of Highbase and expansion in the Oil & Gas (O&G) segment.

2. **Strategic Acquisitions**: The finalized acquisition of Highbase...

1

$JAKS (4723.MY)$

**Investment Conclusion on JAKS Resources Berhad (Q4 2024):**

### **Strengths & Positives**

1. **Profitability Boost from Joint Ventures & Asset Sales**:

- The Group’s net profit of RM36.98 million (year-to-date) is heavily supported by a **RM121.59 million share of profit from joint ventures** and a **RM54.62 million gain from property disposal**. These non-core items offset operational weaknesses.

- The Power Energy division’s new 50MW solar ...

**Investment Conclusion on JAKS Resources Berhad (Q4 2024):**

### **Strengths & Positives**

1. **Profitability Boost from Joint Ventures & Asset Sales**:

- The Group’s net profit of RM36.98 million (year-to-date) is heavily supported by a **RM121.59 million share of profit from joint ventures** and a **RM54.62 million gain from property disposal**. These non-core items offset operational weaknesses.

- The Power Energy division’s new 50MW solar ...

1

$L&G (3174.MY)$

**Summary and Investment Conclusion: Land & General Berhad (L&G)**

### **Key Highlights**

1. **Quarterly Performance (Q3 FY2025):**

- **Revenue:** RM58.8 million (+68.8% YoY), driven by strong contributions from property and education divisions.

- **Operating Profit:** RM10.4 million (+92% YoY).

- **Profit Before Tax (PBT):** RM6.16 million (+35.6% YoY).

2. **Year-to-Date (9M FY2025):**

- **Revenue:** RM144.2 million (-14% YoY), prim...

**Summary and Investment Conclusion: Land & General Berhad (L&G)**

### **Key Highlights**

1. **Quarterly Performance (Q3 FY2025):**

- **Revenue:** RM58.8 million (+68.8% YoY), driven by strong contributions from property and education divisions.

- **Operating Profit:** RM10.4 million (+92% YoY).

- **Profit Before Tax (PBT):** RM6.16 million (+35.6% YoY).

2. **Year-to-Date (9M FY2025):**

- **Revenue:** RM144.2 million (-14% YoY), prim...

1

独狼KL

voted

Hi, mooers! 👋

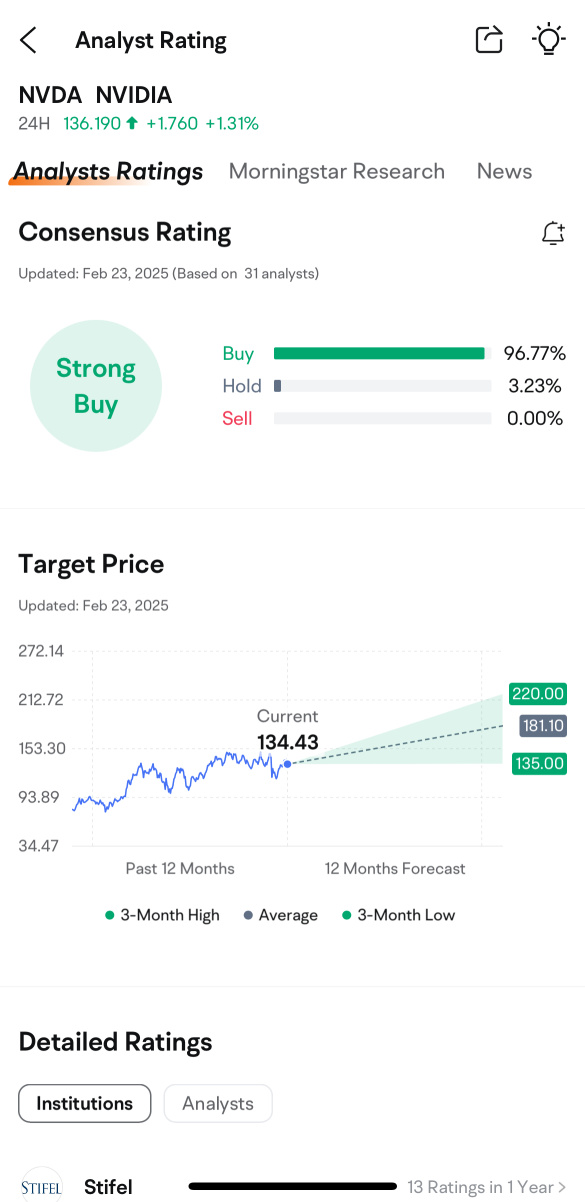

The AI world holds its breath! $NVIDIA (NVDA.US)$ will release its Q4 FY2025 earnings on February 26, just before the market opens. As the AI kingpin faces heightened scrutiny amid market volatility, will it defy expectations again? This is your chance to earn rewards and gain insights by predicting the opening price. Let’s get into it! 🎉

Stay Ahead of the Game

Subscribe to @Moo Live for real-time updates, expert analysis, and t...

The AI world holds its breath! $NVIDIA (NVDA.US)$ will release its Q4 FY2025 earnings on February 26, just before the market opens. As the AI kingpin faces heightened scrutiny amid market volatility, will it defy expectations again? This is your chance to earn rewards and gain insights by predicting the opening price. Let’s get into it! 🎉

Stay Ahead of the Game

Subscribe to @Moo Live for real-time updates, expert analysis, and t...

645

1022

40

Summary of Important Points:

1. Financial Performance:

- **Revenue Growth:** Q3 revenue increased to RM89.47 million (vs. RM85.75 million in Q3 2023). Cumulative 9-month revenue rose to RM263.42 million (vs. RM241.87 million in 2023).

- **Profit Decline:** Q3 profit before tax dropped to RM11.11 million (vs. RM13.39 million in 2023), attributed to higher selling/distribution expenses (delivery fleet expansion). Cumulative 9-month profit increased to RM36.10 million (vs...

1. Financial Performance:

- **Revenue Growth:** Q3 revenue increased to RM89.47 million (vs. RM85.75 million in Q3 2023). Cumulative 9-month revenue rose to RM263.42 million (vs. RM241.87 million in 2023).

- **Profit Decline:** Q3 profit before tax dropped to RM11.11 million (vs. RM13.39 million in 2023), attributed to higher selling/distribution expenses (delivery fleet expansion). Cumulative 9-month profit increased to RM36.10 million (vs...

12

独狼KL

liked

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)