米亚儿

liked

I won't say anything else, nvidia was awesome in the first half of the year. I hope it can hold up in the second half.

Translated

221

53

12

米亚儿

commented on

The first half of 2024 has been a consistently profitable period for my investments, largely driven by my disciplined and strategic responses to earnings reports and news ![]() . And by carefully analyzing financial statements and market sentiment, I have been able to profit significantly from selling options and employing strangle strategies. Additionally, buying stocks ahead of anticipated positive news and earnings reports has proven to be highly effective! ...

. And by carefully analyzing financial statements and market sentiment, I have been able to profit significantly from selling options and employing strangle strategies. Additionally, buying stocks ahead of anticipated positive news and earnings reports has proven to be highly effective! ...

+4

149

47

35

米亚儿

liked

米亚儿

voted

The race to $4 trillion is on. $Apple (AAPL.US)$, $Microsoft (MSFT.US)$and $NVIDIA (NVDA.US)$are in the $3 trillion club. So, which technology behemoth can adapt to keep growth rates elevated enough to keep the good times going?

We believe over the next year the race to $4 Trillion Market Cap in tech will be front and center between Nvidia, Apple, and Microsoft," wrote Wedbush analyst Daniel Ives in a research note.

Nvidia?

Nvidia could reach a $4 tril...

We believe over the next year the race to $4 Trillion Market Cap in tech will be front and center between Nvidia, Apple, and Microsoft," wrote Wedbush analyst Daniel Ives in a research note.

Nvidia?

Nvidia could reach a $4 tril...

107

28

39

米亚儿

voted

Amidst the non-farm payroll data significantly surpassing expectations, the May CPI figures were released, showing an unadjusted year-over-year increase of 3.3%, with a forecast of 3.4%. Following the announcement, major stock indices began to surge, heralding the commencement of another episode in the interest rate cut saga. My speculation is that the influx of illegal immigrants in the United States may have contributed to the prosperity of the...

14

3

米亚儿

voted

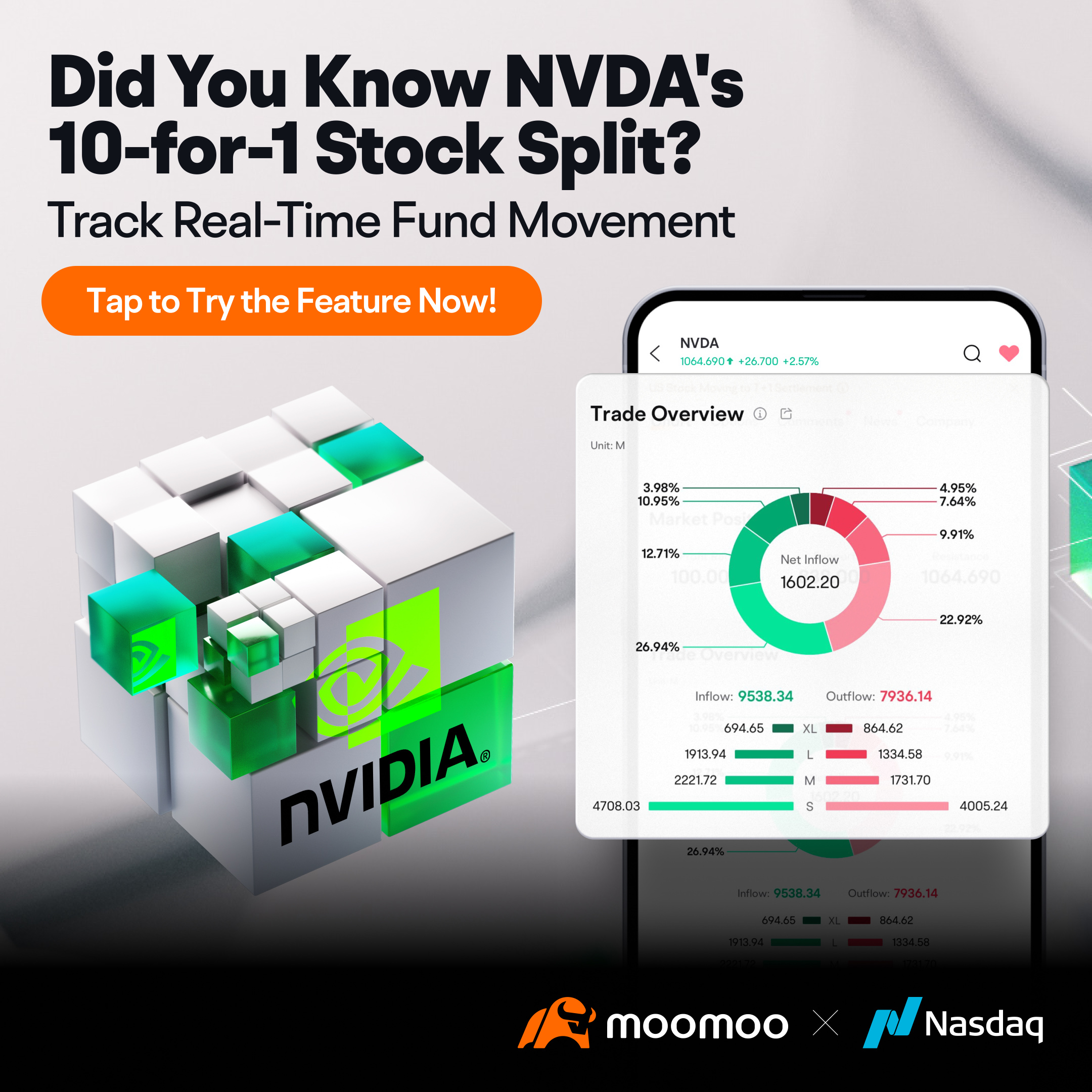

The AI giant Nvidia announced a 10-for-1 forward stock split in its Fiscal Q1 earnings conference call on May 22. According to a release, the shares will begin trading split-adjusted at the market open on June 10.🚀🚀🚀

Although a stock split does not change the market value of a company, it provides a wider range of investors with the opportunity to purchase shares. How do you think the market will react to NVIDIA's stock split? ...

Although a stock split does not change the market value of a company, it provides a wider range of investors with the opportunity to purchase shares. How do you think the market will react to NVIDIA's stock split? ...

235

419

20

米亚儿

liked

$Alibaba (BABA.US)$

$BABA is now below its 2014 IPO price.

2014 - Revenue $12.3 Billion per year.

2023 - Revenue $126 Billion per year.

Exactly 10 X increase on revenue but a lower share price now.

PE: 10

FWD PE: 8

P/S: 1.44

New Profit Margin: 14.45%

Verdict: Severely undervalued.

$BABA is now below its 2014 IPO price.

2014 - Revenue $12.3 Billion per year.

2023 - Revenue $126 Billion per year.

Exactly 10 X increase on revenue but a lower share price now.

PE: 10

FWD PE: 8

P/S: 1.44

New Profit Margin: 14.45%

Verdict: Severely undervalued.

10

5

In January 2023, I officially started my journey of investing in US stocks. At the beginning of 2023, I set a goal for myself to generate profits of 100,000 CNY (20,000 SGD, 14,000 USD) through investing in leading stocks and rsp fund.

Actual Profit:

From December 31, 2022 to December 31, 2023, the principal investment in stocks was 38,635 USD, with a total profit of 10,782 USD (14.2K SGD; 76.3K CNY), resulting in a return rate of 27.9%. Half of the profit came from Microsoft (6,773 USD).

Reflecting on what I haven't done well:

1) Lost 447.5 USD buying Xiaomi Hong Kong stocks. Fortunately, I promptly liquidated and switched to US stocks.

2) At the end of November, upon hearing the news of Xi Jinping's visit to the US and China's government purchasing Boeing aircraft, I immediately invested in Boeing stocks at a low price. Simultaneously, upon learning about Tesla's new car release, I promptly invested in Tesla at a low stock price. However, due to fear generated by a friend sharing the warning of the 'Stock God,' I immediately sold, resulting in me earning nearly 1,000 USD less.

3) Did not follow the personal plan to invest in QQQ and VOO. The reason being, I previously had invested in China's CSI 300 and CSI 500 through rsp, and it backfired. Feeling a sense of fear as if the wolf was at the door, I hesitated to invest, opting to observe for a while. As of now, the investment returns for QQQ and VOO are 14.71% and 18.71% respectively.

Actual Profit:

From December 31, 2022 to December 31, 2023, the principal investment in stocks was 38,635 USD, with a total profit of 10,782 USD (14.2K SGD; 76.3K CNY), resulting in a return rate of 27.9%. Half of the profit came from Microsoft (6,773 USD).

Reflecting on what I haven't done well:

1) Lost 447.5 USD buying Xiaomi Hong Kong stocks. Fortunately, I promptly liquidated and switched to US stocks.

2) At the end of November, upon hearing the news of Xi Jinping's visit to the US and China's government purchasing Boeing aircraft, I immediately invested in Boeing stocks at a low price. Simultaneously, upon learning about Tesla's new car release, I promptly invested in Tesla at a low stock price. However, due to fear generated by a friend sharing the warning of the 'Stock God,' I immediately sold, resulting in me earning nearly 1,000 USD less.

3) Did not follow the personal plan to invest in QQQ and VOO. The reason being, I previously had invested in China's CSI 300 and CSI 500 through rsp, and it backfired. Feeling a sense of fear as if the wolf was at the door, I hesitated to invest, opting to observe for a while. As of now, the investment returns for QQQ and VOO are 14.71% and 18.71% respectively.

Translated

2

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)