美投365

liked

$NVIDIA (NVDA.US)$ $Tesla (TSLA.US)$ $NIO Inc (NIO.US)$ $Alibaba (BABA.US)$

The establishment of the United Arab Emirates (UAE) is one of the most significant political events in the Middle East in the 20th century. The founding of this modern country not only marks the beginning of a new historical chapter but also symbolizes the power of regional cooperation and unity. Here is an overview of the history of the founding of the UAE.:

In-depth exploration of the former British protectorate period

In the early 19th century, a series of protectorate treaties were signed between the tribal sheikhdoms in the northeast of the Arabian Peninsula and Britain, these sheikhdoms later unified to become the United Arab Emirates (UAE) as we know it today.

During this period, these regions were collectively known as the 'Trucial States,' named after the 'Truce' clauses signed with Britain, aimed at ensuring British protection against piracy and foreign aggression, while also securing Britain's strategic interests in the Persian Gulf.

These protection treaties granted Britain the right to establish military bases in these sheikhdoms, and allowed Britain to control the foreign policies of these sheikhdoms. In exchange, Britain provided military protection and diplomatic support. This relationship reflected colonialism in the global political landscape at the time...

The establishment of the United Arab Emirates (UAE) is one of the most significant political events in the Middle East in the 20th century. The founding of this modern country not only marks the beginning of a new historical chapter but also symbolizes the power of regional cooperation and unity. Here is an overview of the history of the founding of the UAE.:

In-depth exploration of the former British protectorate period

In the early 19th century, a series of protectorate treaties were signed between the tribal sheikhdoms in the northeast of the Arabian Peninsula and Britain, these sheikhdoms later unified to become the United Arab Emirates (UAE) as we know it today.

During this period, these regions were collectively known as the 'Trucial States,' named after the 'Truce' clauses signed with Britain, aimed at ensuring British protection against piracy and foreign aggression, while also securing Britain's strategic interests in the Persian Gulf.

These protection treaties granted Britain the right to establish military bases in these sheikhdoms, and allowed Britain to control the foreign policies of these sheikhdoms. In exchange, Britain provided military protection and diplomatic support. This relationship reflected colonialism in the global political landscape at the time...

Translated

+1

1

美投365

liked

$Amazon (AMZN.US)$ $Tesla (TSLA.US)$ $NVIDIA (NVDA.US)$

Search the official account: meitou365

Daily stock selection, character biography, slow reading

Recently, a piece of news has once again attracted people's attention to the former world's richest man - Bezos. In addition to some personal gossip about him, the commercial empire he created has been slowly expanding and appreciating. While living an exciting life, his career has also been very successful. How did he succeed step by step, perhaps the following story will give you some inspiration.

A teenager working at McDonald's

His mother Jackie was a girl under the age of sixteen when she gave birth to him in the mid-1960s, and his biological father was a circus performer. Shortly afterwards, Jackie married Cuban immigrant Miguel Bezos, who adopted her child and treated him as his own son. In fact, it wasn't until he was ten that Jeff found out that Miguel was not his biological father.

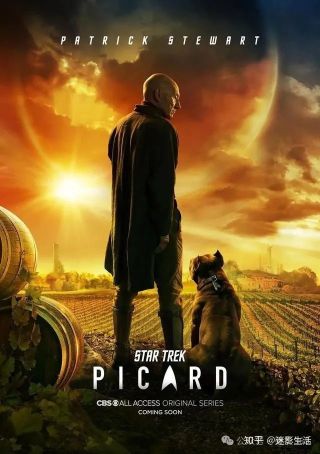

During his childhood and adolescence, Jeff was evidently a talented child who had a special interest in the popular sci-fi movie "Star Trek". This obsession was an important factor in his character and later prompted him to establish his own aerospace company, "Blue Origin". This obsession has led some people to believe that Bezos's current appearance - bald and extremely thin - is an attempt to imitate Captain Jean-Luc Picard from "Star Trek".

When Bezos was 16, he worked at Dairy Queen...

Search the official account: meitou365

Daily stock selection, character biography, slow reading

Recently, a piece of news has once again attracted people's attention to the former world's richest man - Bezos. In addition to some personal gossip about him, the commercial empire he created has been slowly expanding and appreciating. While living an exciting life, his career has also been very successful. How did he succeed step by step, perhaps the following story will give you some inspiration.

A teenager working at McDonald's

His mother Jackie was a girl under the age of sixteen when she gave birth to him in the mid-1960s, and his biological father was a circus performer. Shortly afterwards, Jackie married Cuban immigrant Miguel Bezos, who adopted her child and treated him as his own son. In fact, it wasn't until he was ten that Jeff found out that Miguel was not his biological father.

During his childhood and adolescence, Jeff was evidently a talented child who had a special interest in the popular sci-fi movie "Star Trek". This obsession was an important factor in his character and later prompted him to establish his own aerospace company, "Blue Origin". This obsession has led some people to believe that Bezos's current appearance - bald and extremely thin - is an attempt to imitate Captain Jean-Luc Picard from "Star Trek".

When Bezos was 16, he worked at Dairy Queen...

Translated

+3

4

Columns Daily inventory of demon stocks

Public account search: meitou365

Daily stock selection, character history, slow reading

$Laird Superfood (LSF.US)$ $CXApp (CXAI.US)$ $Gaxos.ai (GXAI.US)$ $Arq Inc (ARQ.US)$ $LI-CYCLE (LICY.US)$

Top 1 Demon Stock: Laird Superfood (ticker: LSF)

Recently, the stock performance of Laird Superfoods has attracted market attention. The stock price of Laird Superfoods has soared 104.30% in one day, up 131.99% in one month, and rose 140.54% in one month. Today's closing price was 1.9,000, with a trading volume of 5531,128 million, far exceeding the average trading volume of 2.293,400 in the past 10 days. The turnover rate reached 76.5%, and the market value also climbed to 225 million.

This sharp fluctuation in stock prices shows the market's high level of attention and investment interest in Laird Superfoods. A number of recent positive developments at Laird Superfoods have been key factors driving it to become a “monster stock.” First, the sharp increase in the company's stock price reflects the market's confidence in it, in particular by implementing a series of strategic initiatives, including a shift to e-commerce and direct-to-consumer sales models, and a shift of business focus to the city of Boulder to expand its business and improve financial statements...

Daily stock selection, character history, slow reading

$Laird Superfood (LSF.US)$ $CXApp (CXAI.US)$ $Gaxos.ai (GXAI.US)$ $Arq Inc (ARQ.US)$ $LI-CYCLE (LICY.US)$

Top 1 Demon Stock: Laird Superfood (ticker: LSF)

Recently, the stock performance of Laird Superfoods has attracted market attention. The stock price of Laird Superfoods has soared 104.30% in one day, up 131.99% in one month, and rose 140.54% in one month. Today's closing price was 1.9,000, with a trading volume of 5531,128 million, far exceeding the average trading volume of 2.293,400 in the past 10 days. The turnover rate reached 76.5%, and the market value also climbed to 225 million.

This sharp fluctuation in stock prices shows the market's high level of attention and investment interest in Laird Superfoods. A number of recent positive developments at Laird Superfoods have been key factors driving it to become a “monster stock.” First, the sharp increase in the company's stock price reflects the market's confidence in it, in particular by implementing a series of strategic initiatives, including a shift to e-commerce and direct-to-consumer sales models, and a shift of business focus to the city of Boulder to expand its business and improve financial statements...

Translated

+2

$Chubb Ltd (CB.US)$ $NVIDIA (NVDA.US)$ $Trane Technologies (TT.US)$ $Applied Materials (AMAT.US)$ $Parker Hannifin (PH.US)$ $TransDigm (TDG.US)$ $Thermo Fisher Scientific (TMO.US)$ $Amazon (AMZN.US)$ $Intuit (INTU.US)$ $Phillips 66 (PSX.US)$

TOP-1

Stock code: CB, company name: Chubb Ltd

Large Cap Investment Rating: ★★★★☆, Ranking Change: NEW

Individual stock evaluation:

Chubb Ltd has seen a significant annual growth of over 34% and is trading at a price higher than its 50-day and 200-day moving averages, reflecting strong positive momentum. Its recent market performance and position in the insurance industry make it a potentially safer investment choice.

TOP-2

Stock code: NVDA, Company name: NVIDIA Corp

Large Cap Investment Rating: ★★★★☆, Ranking Change: NEW

Individual stock evaluation:

NVIDIA has shown remarkable annual changes and achieved rapid growth. The high trading volume may indicate market confidence in their strategic position in AI, gaming, and chip sectors.

TOP-1

Stock code: CB, company name: Chubb Ltd

Large Cap Investment Rating: ★★★★☆, Ranking Change: NEW

Individual stock evaluation:

Chubb Ltd has seen a significant annual growth of over 34% and is trading at a price higher than its 50-day and 200-day moving averages, reflecting strong positive momentum. Its recent market performance and position in the insurance industry make it a potentially safer investment choice.

TOP-2

Stock code: NVDA, Company name: NVIDIA Corp

Large Cap Investment Rating: ★★★★☆, Ranking Change: NEW

Individual stock evaluation:

NVIDIA has shown remarkable annual changes and achieved rapid growth. The high trading volume may indicate market confidence in their strategic position in AI, gaming, and chip sectors.

Translated

1

$NONGFU SPRING (09633.HK)$ $NVIDIA (NVDA.US)$ $Tesla (TSLA.US)$

Welcome to follow: Meitou365

"The Farmer and the Snake"

What started as a tribute to one entrepreneur has unexpectedly turned into a criticism of another. This is something Zhong Shengsheng never expected. Recently, there has been a continuous wave of public opinion surrounding Nongfu Spring, Wahaha, and their founders Zhong Shengsheng and Zong Qinghou.

The whole thing started because some self-media published articles claiming that Nongfu Spring, which is also based in Hangzhou, had a "grudge" against Wahaha. They also claimed that "the first entrepreneurial income of Nongfu Spring's founder, Zhong Shengsheng, came from Wahaha" and that he was fired for hoarding goods.

On the evening of March 3, Nongfu Spring's high-level management responded intensively, stating that the rumors are not true. Before we discuss this matter, let's first understand a bit about Nongfu Spring and its founder, Zhong Shantant.

The rise of Nongfu Spring

In the Chinese beverage market, the rise of Nongfu Spring is a remarkable phenomenon.

Under the leadership of Zhong Shantant, the brand has not only won the trust and love of consumers with its high-quality products, but also established its leadership position in the industry through a series of unique and innovative marketing strategies. Zhong Shantant understands the importance of brand image and market perception, so he has implemented a series of forward-looking marketing plans.

The most significant marketing event was when Nongfu Spring became the official drinking water supplier for the 2008 Olympic Games in Beijing. This partnership brought great visibility and credibility to the brand, and significantly increased its market share.

Welcome to follow: Meitou365

"The Farmer and the Snake"

What started as a tribute to one entrepreneur has unexpectedly turned into a criticism of another. This is something Zhong Shengsheng never expected. Recently, there has been a continuous wave of public opinion surrounding Nongfu Spring, Wahaha, and their founders Zhong Shengsheng and Zong Qinghou.

The whole thing started because some self-media published articles claiming that Nongfu Spring, which is also based in Hangzhou, had a "grudge" against Wahaha. They also claimed that "the first entrepreneurial income of Nongfu Spring's founder, Zhong Shengsheng, came from Wahaha" and that he was fired for hoarding goods.

On the evening of March 3, Nongfu Spring's high-level management responded intensively, stating that the rumors are not true. Before we discuss this matter, let's first understand a bit about Nongfu Spring and its founder, Zhong Shantant.

The rise of Nongfu Spring

In the Chinese beverage market, the rise of Nongfu Spring is a remarkable phenomenon.

Under the leadership of Zhong Shantant, the brand has not only won the trust and love of consumers with its high-quality products, but also established its leadership position in the industry through a series of unique and innovative marketing strategies. Zhong Shantant understands the importance of brand image and market perception, so he has implemented a series of forward-looking marketing plans.

The most significant marketing event was when Nongfu Spring became the official drinking water supplier for the 2008 Olympic Games in Beijing. This partnership brought great visibility and credibility to the brand, and significantly increased its market share.

Translated

+2

$Broadcom (AVGO.US)$ $NVIDIA (NVDA.US)$ $Tesla (TSLA.US)$ $HP Inc (HPQ.US)$

Welcome to follow: Meitou365

The editor says:

In this era of 'cooked food', it is common to only read the titles and abstracts of articles, and short videos are just brushed through. We hope to bring to everyone some articles that need to be read slowly over the weekend through this special topic. We don't give advice on whether to buy or sell. We just present all the information and data as comprehensively as possible to the readers, and they can make their own judgment whether it's bullish or bearish.

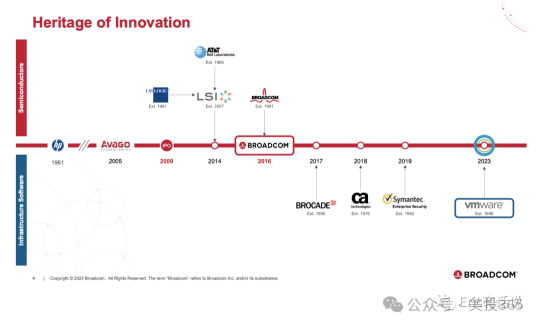

Started from HP, all the way to become a big guy

Broadcom Inc.The origin of Broadcom Inc. can be traced back to its predecessor Avago Technologies Limited, a company that was founded in 1961 and acquired Broadcom Inc. for 37 billion USD in 2016, and then renamed as Broadcom Limited. As a global leader in analog semiconductor equipment supply, the company is committed to providing various semiconductor products for wireless communications, wired infrastructure, enterprise storage, and industrial sectors. Its products are widely used in mobile phones, data networks, storage and telecommunications equipment, and industrial automation, etc.

The origin of Avago Technologies can be traced back to a branch of Hewlett-Packard called Agilent Technologies...

Welcome to follow: Meitou365

The editor says:

In this era of 'cooked food', it is common to only read the titles and abstracts of articles, and short videos are just brushed through. We hope to bring to everyone some articles that need to be read slowly over the weekend through this special topic. We don't give advice on whether to buy or sell. We just present all the information and data as comprehensively as possible to the readers, and they can make their own judgment whether it's bullish or bearish.

Started from HP, all the way to become a big guy

Broadcom Inc.The origin of Broadcom Inc. can be traced back to its predecessor Avago Technologies Limited, a company that was founded in 1961 and acquired Broadcom Inc. for 37 billion USD in 2016, and then renamed as Broadcom Limited. As a global leader in analog semiconductor equipment supply, the company is committed to providing various semiconductor products for wireless communications, wired infrastructure, enterprise storage, and industrial sectors. Its products are widely used in mobile phones, data networks, storage and telecommunications equipment, and industrial automation, etc.

The origin of Avago Technologies can be traced back to a branch of Hewlett-Packard called Agilent Technologies...

Translated

+4

美投365

liked

$Berkshire Hathaway-A (BRK.A.US)$ $NVIDIA (NVDA.US)$ $Tesla (TSLA.US)$ $BABA (03012.MY)$

On Tuesday (November 28), Berkshire Hathaway issued a statement through its subsidiary's US Business Information website announcing that Vice Chairman of the Board Charlie Munger (Charlie Munger) passed away that morning at a California hospital at the age of 99, just over a month until his 100th birthday.

In addition to playing an important role in Berkshire Hathaway as Buffett's deputy, Munger also serves as a director of the Daily Journal Company and Market Opener. As of November 28, Munger's net worth reached $2.6 billion, according to Forbes data.

Buffett said in a statement that without Munger's wisdom, inspiration, and participation, Berkshire Hathaway would not have achieved what it is today. On the eve of his 100th birthday, at the age of 99, Mr. Munger is known for his outstanding wisdom. The best way to remember him is to practice his wise teachings.

Meet this investment giant again

Charlie Munger (Charlie Munger), vice chairman of Berkshire Hathaway and long-time partner of Warren Buffett, is an outstanding investor and influential thinker. He was born on January 1, 1919 and raised in Omaha, Michigan.

Mang...

On Tuesday (November 28), Berkshire Hathaway issued a statement through its subsidiary's US Business Information website announcing that Vice Chairman of the Board Charlie Munger (Charlie Munger) passed away that morning at a California hospital at the age of 99, just over a month until his 100th birthday.

In addition to playing an important role in Berkshire Hathaway as Buffett's deputy, Munger also serves as a director of the Daily Journal Company and Market Opener. As of November 28, Munger's net worth reached $2.6 billion, according to Forbes data.

Buffett said in a statement that without Munger's wisdom, inspiration, and participation, Berkshire Hathaway would not have achieved what it is today. On the eve of his 100th birthday, at the age of 99, Mr. Munger is known for his outstanding wisdom. The best way to remember him is to practice his wise teachings.

Meet this investment giant again

Charlie Munger (Charlie Munger), vice chairman of Berkshire Hathaway and long-time partner of Warren Buffett, is an outstanding investor and influential thinker. He was born on January 1, 1919 and raised in Omaha, Michigan.

Mang...

Translated

+4

4

1

2

美投365

liked

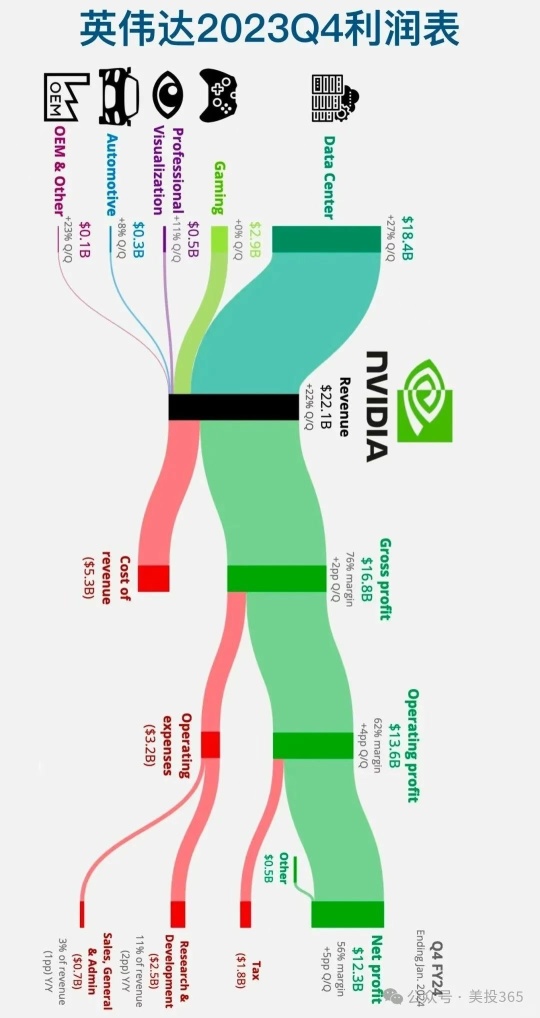

Columns Weekend slow reading: Nvidia's “Seven Heroes” lead the way, the tech giants that shape the future

$NVIDIA (NVDA.US)$ $Tesla (TSLA.US)$ $Taiwan Semiconductor (TSM.US)$

relatesRead:Biography: Huang Renxun, computing power is a right

Xiaobian said:

In this “cooked food” era, articles only read titles and abstracts, and short videos are just a passing of the norm. We hope to go through this small topic over the weekend to bring you some articles that you will need to take time to read. We don't give advice on whether to buy or sell? We just display all the information and data as much and comprehensively as possible in front of our readers, making our own judgments about being bullish or bearish.

The tech giants that are shaping the future

Over the past few years, NVIDIA Corporation (NVIDIA Corporation) has not only established a leading position in gaming and professional visualization with its innovative graphics processing units (GPUs), but also demonstrated its profound influence in cutting-edge technologies such as artificial intelligence and autonomous driving. Since it was co-founded by Wong In-hoon, Chris Malakowski, and Curtis Prim in 1993, Nvidia's growth story is a perfect interpretation of the relentless pursuit of continuous innovation and technology investment.

Nvidia's successful trajectory is inseparable from the leadership of its CEO Hwang In-hoon. Wong In-hoon's deep technical insight and sharp grasp of market trends have kept Nvidia ahead of the competition in the tech industry. His leadership style not only drove technological innovation, but also shaped a dynamic...

relatesRead:Biography: Huang Renxun, computing power is a right

Xiaobian said:

In this “cooked food” era, articles only read titles and abstracts, and short videos are just a passing of the norm. We hope to go through this small topic over the weekend to bring you some articles that you will need to take time to read. We don't give advice on whether to buy or sell? We just display all the information and data as much and comprehensively as possible in front of our readers, making our own judgments about being bullish or bearish.

The tech giants that are shaping the future

Over the past few years, NVIDIA Corporation (NVIDIA Corporation) has not only established a leading position in gaming and professional visualization with its innovative graphics processing units (GPUs), but also demonstrated its profound influence in cutting-edge technologies such as artificial intelligence and autonomous driving. Since it was co-founded by Wong In-hoon, Chris Malakowski, and Curtis Prim in 1993, Nvidia's growth story is a perfect interpretation of the relentless pursuit of continuous innovation and technology investment.

Nvidia's successful trajectory is inseparable from the leadership of its CEO Hwang In-hoon. Wong In-hoon's deep technical insight and sharp grasp of market trends have kept Nvidia ahead of the competition in the tech industry. His leadership style not only drove technological innovation, but also shaped a dynamic...

Translated

4

2

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)