1

1

$GameStop (GME.US)$ This is a myth

Translated

4

5

聋的传人

voted

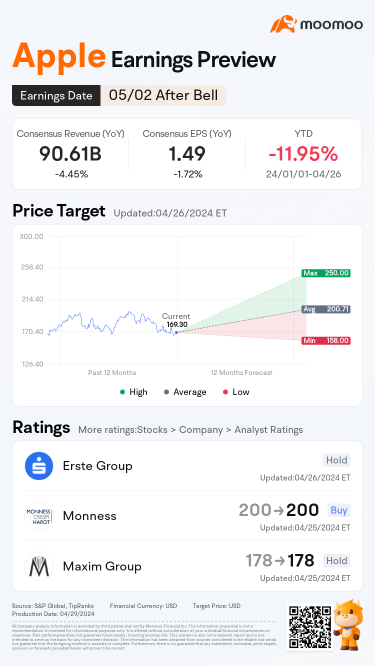

$Apple (AAPL.US)$

So, their fiscal Q2 earnings are in, and guess what? They managed to slightly outdo Wall Street's predictions. But hold your iPhones tight because here comes the kicker: overall revenue took a 4% nosedive, and iPhone sales? Whew, they dropped by 10%! But wait, there's more! Apple's board just greenlit a whopping $110 billion for share buybacks, the biggest move they've ever made. And what does Tim Cook have to say about all this? W...

So, their fiscal Q2 earnings are in, and guess what? They managed to slightly outdo Wall Street's predictions. But hold your iPhones tight because here comes the kicker: overall revenue took a 4% nosedive, and iPhone sales? Whew, they dropped by 10%! But wait, there's more! Apple's board just greenlit a whopping $110 billion for share buybacks, the biggest move they've ever made. And what does Tim Cook have to say about all this? W...

8

$Apple (AAPL.US)$ It's all retail investors buying, retail investors, please come and join! 🤭🤭🤭 The big players are leaving first...

Translated

4

$DXN (5318.MY)$ The little bird that can't fly.

Translated

1

1

聋的传人

voted

Apple is releasing its Q2 2024 earnings after the market closes on May 2.

Since its Q1 earnings release, shares of $Apple (AAPL.US)$ have seen a decrease of 6%.![]() Its implied move on the earnings date is 4.2%. How will the market react to the upcoming results? Make your guess now!

Its implied move on the earnings date is 4.2%. How will the market react to the upcoming results? Make your guess now! ![]()

Rewards

● An equal share of 5,000 points: For mooers who correctly guess the price range of $Apple (AAPL.US)$'s opening price at 9:30 AM ET Ma...

Since its Q1 earnings release, shares of $Apple (AAPL.US)$ have seen a decrease of 6%.

Rewards

● An equal share of 5,000 points: For mooers who correctly guess the price range of $Apple (AAPL.US)$'s opening price at 9:30 AM ET Ma...

121

222

25

聋的传人

liked

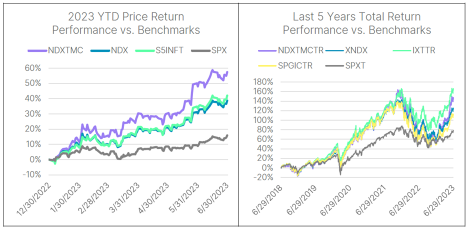

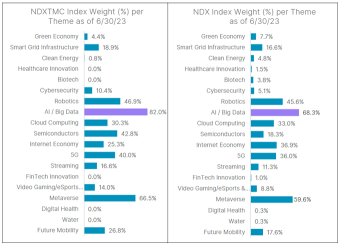

The Nasdaq-100 Technology Sector Market-Cap Weighted™ Index (NDXTMC) offers investors the option of tracking only those constituents that are considered pure Technology companies (per the Industry Classification Benchmark (ICB), the sector classification system of FTSE Russell) and, as a result, provides a concentrated approach to investing in the innovation-driven growth of the Nasdaq-100.

NDXTMC Performance vs. Benchmarks...

NDXTMC Performance vs. Benchmarks...

239

8

9

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)