股勇者

liked

$Dell Technologies (DELL.US)$ RSI levels are roughly in the 50 levels. not a bad buy, but i wouldnt be suprised if it dipped a little more. as another AI stock its not a bad asset to keep your eye on.

2

股勇者

liked

$Celsius Holdings (CELH.US)$It’s interesting for sure. If using P/S=6 as its peer, e.g., MNST, the price of this stock is about 33-35. The present price indicates further deterioration of the sales, is this correct?

1

2

$TENCENT (00700.HK)$ Finance | Tencent repurchased shares 129 times in 2024, involving a total of 112 billion in investment.

Tencent (00700) stated that the promised at least billion repurchase plan for early 2024 was successfully completed. As of December 31, 2024, Tencent made a total of 129 repurchases throughout the year, repurchasing 0.307 billion shares, with a total amount of 112 billion yuan.

Tencent stated that while orderly implementing the billion repurchase plan, the company actively chose to cancel all repurchased shares. The cancellation-style repurchase method significantly reduced Tencent's total share capital, helping to increase EPS and enhancing shareholder returns. As of the end of 2024, Tencent's total share capital decreased to 9.22 billion, reaching the lowest level in the past 10 years.

Tencent's repurchase amounts for each quarter last year were 14.835 billion yuan, 37.515 billion yuan, 35.913 billion yuan, and 23.739 billion yuan, with a daily average repurchase amount of 0.868 billion yuan. Moving into 2025, Tencent's repurchase momentum has not stopped, repurchasing 1.68 million shares on January 2, costing approximately 0.7 billion yuan.

Tencent (00700) stated that the promised at least billion repurchase plan for early 2024 was successfully completed. As of December 31, 2024, Tencent made a total of 129 repurchases throughout the year, repurchasing 0.307 billion shares, with a total amount of 112 billion yuan.

Tencent stated that while orderly implementing the billion repurchase plan, the company actively chose to cancel all repurchased shares. The cancellation-style repurchase method significantly reduced Tencent's total share capital, helping to increase EPS and enhancing shareholder returns. As of the end of 2024, Tencent's total share capital decreased to 9.22 billion, reaching the lowest level in the past 10 years.

Tencent's repurchase amounts for each quarter last year were 14.835 billion yuan, 37.515 billion yuan, 35.913 billion yuan, and 23.739 billion yuan, with a daily average repurchase amount of 0.868 billion yuan. Moving into 2025, Tencent's repurchase momentum has not stopped, repurchasing 1.68 million shares on January 2, costing approximately 0.7 billion yuan.

Translated

1

股勇者

liked

$BABA-W (09988.HK)$ UPDATE: Alibaba Set On Growth Path After Divesting Bricks-And-Mortar Retailing Assets: Analysts

“Alibaba Group Holding surprised investors a few years ago when the e-commerce giant’s employee headcount surged to 252,084 at the end of December 2020, more than double its 122,399 total in the previous quarter.

The nearly 130,000 increase in staff primarily came from consolidating the operations of Sun Art Retail Group, China’s largest hypermarket operator, which Alibaba took co...

“Alibaba Group Holding surprised investors a few years ago when the e-commerce giant’s employee headcount surged to 252,084 at the end of December 2020, more than double its 122,399 total in the previous quarter.

The nearly 130,000 increase in staff primarily came from consolidating the operations of Sun Art Retail Group, China’s largest hypermarket operator, which Alibaba took co...

3

1

股勇者

liked

$Hang Seng Index (800000.HK)$ Financial | People's Banks reportedly cut interest rates this year.

The Financial Times of the United Kingdom cited comments from the People's Banks of China published in the newspaper, stating that the central bank may cut interest rates from the current 1.5% at an appropriate time in 2025.

The People's Banks indicated that it will prioritize the impact of interest rate adjustments, moving away from the quantitative targets of loan growth, which represents a shift in China's MMF policy.

The Financial Times of the United Kingdom cited comments from the People's Banks of China published in the newspaper, stating that the central bank may cut interest rates from the current 1.5% at an appropriate time in 2025.

The People's Banks indicated that it will prioritize the impact of interest rate adjustments, moving away from the quantitative targets of loan growth, which represents a shift in China's MMF policy.

Translated

2

股勇者

commented on

$Celsius Holdings (CELH.US)$ looks good actually

1

$Hang Seng Index (800000.HK)$ Financial News: Citi expects Hang Seng Index to reach 28,000 points by the end of this year.

Director of Citibank's Investment Strategy and Global Wealth Planning Department, Liao Jiahao, predicts that the mid-year and year-end target prices for Hang Seng Index in 2025 are 26,000 points and 28,000 points, respectively. He pointed out that currently, the performance of mainland China and Hong Kong stock markets is bullish, but he is confident in the mainland's stimulus policies. He expects that after the policy "combo move" in September last year, the macroeconomic environment has improved, supporting the stock markets of the two regions.

Given the policy vacuum period before the Two Sessions in March, Liao Jiahao believes that the current market lacks focus, leading to fluctuations in the Hong Kong stock market. However, investors do not need to be too pessimistic about the mainland and Hong Kong stock markets. Citibank expects that the mainland will implement a 3 trillion yuan stimulus consumption policy, along with recent improvement in the real estate sector. With the improvement of China's macroeconomic conditions, the earnings of Chinese companies are expected to improve. In addition, Chinese companies actively reward shareholders through buybacks and other means, which is also a positive factor.

Liao Jiahao believes that policy efforts will help boost Chinese stocks. As A-shares are more directly benefited from policy stimulus, he is more bullish on A-shares than H-shares. He urges investors to choose sectors that align with national policies, namely domestic stocks that can benefit from Chinese policy stimulus, mainly due to greater profit growth potential. In addition, under the shadow of tariffs, the bank does not prefer export-oriented stocks. He estimates that the internet, consumer, technology, and industrial sectors will perform better, as they face less policy headwinds, and he expects the mainland real estate market to stabilize this year.

Director of Citibank's Investment Strategy and Global Wealth Planning Department, Liao Jiahao, predicts that the mid-year and year-end target prices for Hang Seng Index in 2025 are 26,000 points and 28,000 points, respectively. He pointed out that currently, the performance of mainland China and Hong Kong stock markets is bullish, but he is confident in the mainland's stimulus policies. He expects that after the policy "combo move" in September last year, the macroeconomic environment has improved, supporting the stock markets of the two regions.

Given the policy vacuum period before the Two Sessions in March, Liao Jiahao believes that the current market lacks focus, leading to fluctuations in the Hong Kong stock market. However, investors do not need to be too pessimistic about the mainland and Hong Kong stock markets. Citibank expects that the mainland will implement a 3 trillion yuan stimulus consumption policy, along with recent improvement in the real estate sector. With the improvement of China's macroeconomic conditions, the earnings of Chinese companies are expected to improve. In addition, Chinese companies actively reward shareholders through buybacks and other means, which is also a positive factor.

Liao Jiahao believes that policy efforts will help boost Chinese stocks. As A-shares are more directly benefited from policy stimulus, he is more bullish on A-shares than H-shares. He urges investors to choose sectors that align with national policies, namely domestic stocks that can benefit from Chinese policy stimulus, mainly due to greater profit growth potential. In addition, under the shadow of tariffs, the bank does not prefer export-oriented stocks. He estimates that the internet, consumer, technology, and industrial sectors will perform better, as they face less policy headwinds, and he expects the mainland real estate market to stabilize this year.

Translated

1

5

股勇者

commented on

$Super Micro Computer (SMCI.US)$ I noticed that he never drops below 30. Should I enter now and wait for a breakout at once?

Translated

2

4

股勇者

commented on

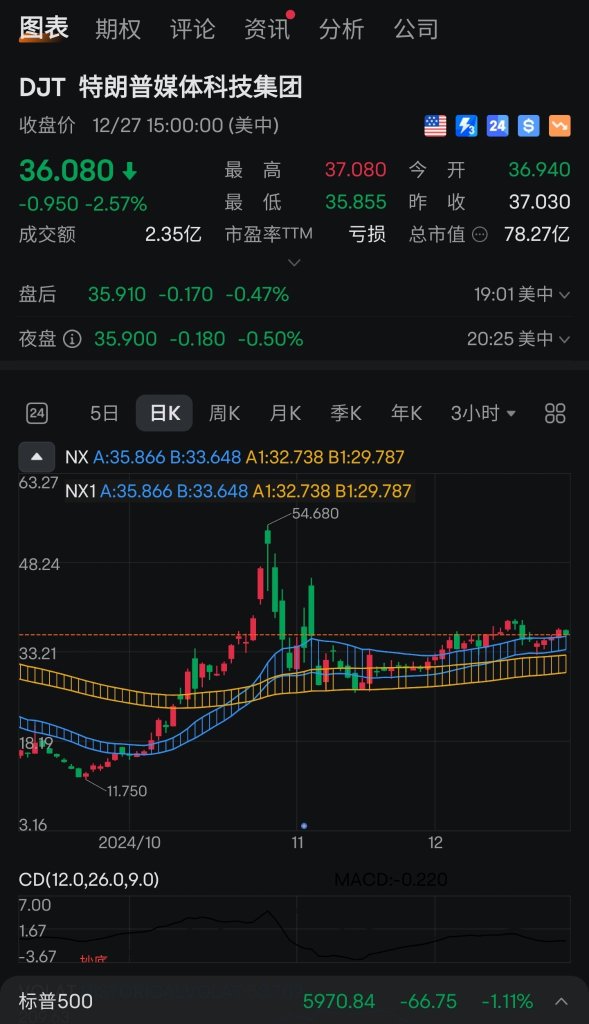

$Trump Media & Technology (DJT.US)$ so many pulling out… sea of red

2

4

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)