股 股 叫

liked

$Maxeon Solar Technologies (MAXN.US)$ adding more! 5k

4

4

股 股 叫

commented on

$Unity Software (U.US)$

Just bought a little the other day, cost 25. Immediately got stuck. Fortunately, I only bought a little. This thing, like pltr, really can't have a large position.

However, this is also good. When everyone is trapped, there is no selling pressure.![]() After all, there are no fundamental issues with this company, U. and no risk of bankruptcy. After the previous falls to 22, it has always risen, so it is better to accept the situation. At this point, no one will cut losses.

After all, there are no fundamental issues with this company, U. and no risk of bankruptcy. After the previous falls to 22, it has always risen, so it is better to accept the situation. At this point, no one will cut losses.

But if there is another bearish news and it plunges below 22 with high trading volume, then it will truly be a bottomless pit.![]()

Just complaining. After all, today my heavy-position stock $Taiwan Semiconductor (TSM.US)$ Surged by 5%, just added to my position $NVIDIA (NVDA.US)$ Also increased slightly, should be able to confirm the successful breakthrough. $Utilities Select Sector SPDR Fund (XLU.US)$ Have been doing well recently, $iShares Bitcoin Trust (IBIT.US)$ Even admitted defeat and cut losses yesterday, waiting for it to drop before buying back. Anyway, in a very good mood, can enjoy a happy weekend.![]()

Just bought a little the other day, cost 25. Immediately got stuck. Fortunately, I only bought a little. This thing, like pltr, really can't have a large position.

However, this is also good. When everyone is trapped, there is no selling pressure.

But if there is another bearish news and it plunges below 22 with high trading volume, then it will truly be a bottomless pit.

Just complaining. After all, today my heavy-position stock $Taiwan Semiconductor (TSM.US)$ Surged by 5%, just added to my position $NVIDIA (NVDA.US)$ Also increased slightly, should be able to confirm the successful breakthrough. $Utilities Select Sector SPDR Fund (XLU.US)$ Have been doing well recently, $iShares Bitcoin Trust (IBIT.US)$ Even admitted defeat and cut losses yesterday, waiting for it to drop before buying back. Anyway, in a very good mood, can enjoy a happy weekend.

Translated

7

7

股 股 叫

liked

$Tesla (TSLA.US)$

In less than a week, tesla has once again grabbed the headlines.

If I had not sold my call option at 160, it would not just be hotpot money by now.![]()

![]()

![]()

However, it doesn't matter. Ordinary people cannot earn this kind of money, and even if they do, it's all due to luck.

If fsd can be successfully approved in china, it will definitely be a good thing, but I am very curious about how many paying users there will be. The road conditions in china are much more complex than in the usa, with congested roads, aggressive driving styles, a severe lack of courtesy, and a large number of illegally operated non-motor vehicles, which also pose a significant challenge to fsd. However, I have to say, even though I am an experienced driver, I really dare not drive in china myself. If I need to drive when I return to my home country, I may really need to rent a tesla with fsd.![]()

Returning to the main point. My current view on tesla: around 180, there is a high probability of fluctuating between 160-200, continuously digesting the trapped positions above. Concentrate the chips around 180, and then choose a direction to break through. This direction depends not only on tesla itself but also on the macro environment and the china-us relationship. It is currently unpredictable. However, if it chooses to rise at that time, the increase will not be less than 50%.

If you like short-term trading, at this stage, you can play with small positions by selling high and buying low. If you do not like it, then wait for a breakthrough later on and go heavy on that wave.

In less than a week, tesla has once again grabbed the headlines.

If I had not sold my call option at 160, it would not just be hotpot money by now.

However, it doesn't matter. Ordinary people cannot earn this kind of money, and even if they do, it's all due to luck.

If fsd can be successfully approved in china, it will definitely be a good thing, but I am very curious about how many paying users there will be. The road conditions in china are much more complex than in the usa, with congested roads, aggressive driving styles, a severe lack of courtesy, and a large number of illegally operated non-motor vehicles, which also pose a significant challenge to fsd. However, I have to say, even though I am an experienced driver, I really dare not drive in china myself. If I need to drive when I return to my home country, I may really need to rent a tesla with fsd.

Returning to the main point. My current view on tesla: around 180, there is a high probability of fluctuating between 160-200, continuously digesting the trapped positions above. Concentrate the chips around 180, and then choose a direction to break through. This direction depends not only on tesla itself but also on the macro environment and the china-us relationship. It is currently unpredictable. However, if it chooses to rise at that time, the increase will not be less than 50%.

If you like short-term trading, at this stage, you can play with small positions by selling high and buying low. If you do not like it, then wait for a breakthrough later on and go heavy on that wave.

Translated

3

6

股 股 叫

liked

$Alphabet-C (GOOG.US)$

I'm really shocked by this financial report. Google tells everyone, I'm still the boss, I haven't become the little brother! (Meme: referring to being surpassed by Microsoft in AI)

I was bullish on Goog between 136-140, bought and held it until around 156, then sold it, it's really regrettable to miss out. But it's okay, I believe this upward trend is just the beginning, not the end. After all, the reason why Big Brother's stocks have been lukewarm is due to doubts: Has the search business been taken away by AI? Can cloud business get a bigger piece of the cake in competition with AWS and Azure? Most importantly, has AI long been overtaken by Microsoft by a large margin?

A financial report answers investors' doubts with facts. Google has also returned from being undervalued to reasonable.

In this financial report, my biggest feeling: overvalued stocks fall, undervalued stocks rise, oversold stocks soar. It's a reasonable trend of bull market adjustment, everything returns to a reasonable price, which is conducive to further rise. I predict, $Amazon (AMZN.US)$ And $Apple (AAPL.US)$ will be the same with its financial report. As for dragon brother $NVIDIA (NVDA.US)$ , it will still be the heaviest-weighted financial report in the market, which will determine the future trend of AI and all technology stocks. Currently in consolidation, I choose to wait for an opportunity.

Today's operation: $Microsoft (MSFT.US)$ sold, made a few points, all positions switched to $Alphabet-C (GOOG.US)$ ! Microsoft encountered resistance and fell back, in...

I'm really shocked by this financial report. Google tells everyone, I'm still the boss, I haven't become the little brother! (Meme: referring to being surpassed by Microsoft in AI)

I was bullish on Goog between 136-140, bought and held it until around 156, then sold it, it's really regrettable to miss out. But it's okay, I believe this upward trend is just the beginning, not the end. After all, the reason why Big Brother's stocks have been lukewarm is due to doubts: Has the search business been taken away by AI? Can cloud business get a bigger piece of the cake in competition with AWS and Azure? Most importantly, has AI long been overtaken by Microsoft by a large margin?

A financial report answers investors' doubts with facts. Google has also returned from being undervalued to reasonable.

In this financial report, my biggest feeling: overvalued stocks fall, undervalued stocks rise, oversold stocks soar. It's a reasonable trend of bull market adjustment, everything returns to a reasonable price, which is conducive to further rise. I predict, $Amazon (AMZN.US)$ And $Apple (AAPL.US)$ will be the same with its financial report. As for dragon brother $NVIDIA (NVDA.US)$ , it will still be the heaviest-weighted financial report in the market, which will determine the future trend of AI and all technology stocks. Currently in consolidation, I choose to wait for an opportunity.

Today's operation: $Microsoft (MSFT.US)$ sold, made a few points, all positions switched to $Alphabet-C (GOOG.US)$ ! Microsoft encountered resistance and fell back, in...

Translated

10

13

股 股 叫

voted

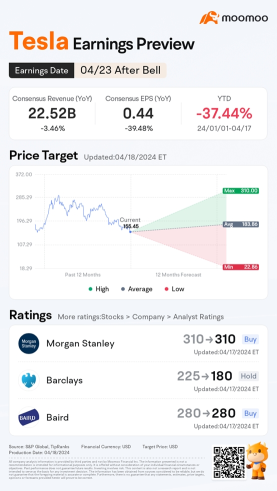

Tesla is releasing its Q1 2024 earnings after the market closes on April 23.

Since its Q4 earnings release, shares of $Tesla (TSLA.US)$ have seen a decrease of 29%.![]() Overall earnings estimates have been revised lower since the company's last earnings release. How will the market react to the upcoming results? Make your guess now!

Overall earnings estimates have been revised lower since the company's last earnings release. How will the market react to the upcoming results? Make your guess now! ![]()

Rewards

● An equal share of 5,000 points: For mooers who correctly guess the price range ...

Since its Q4 earnings release, shares of $Tesla (TSLA.US)$ have seen a decrease of 29%.

Rewards

● An equal share of 5,000 points: For mooers who correctly guess the price range ...

145

371

34

股 股 叫

liked

$iShares Bitcoin Trust (IBIT.US)$

Possibility 1: If today's sharp decline is due to the risk of the Middle East war, resulting in rational selling due to hedging demand, then I may not stop loss at the position of 38. Personally, I believe that war does not pose a systemic risk to bitcoin; instead, bitcoin has hedging properties. At the end of February 2022, when Russia and Ukraine clashed, bitcoin did not fall. Instead, it was the subsequent interest rate hikes and liquidity tightening that caused the sharp decline.

Evidence supporting this view: tlt rose against the trend. However, gold and crude oil did not rise, so this reason is temporarily insufficient. Tlt may just be oversold bounce, and one day's data is not enough to prove it is bid for hedging. $iShares 20+ Year Treasury Bond ETF (TLT.US)$

Possibility 2: Disappointment in interest rate cut expectations. The strong US dollar supports this view, but it's a bit far-fetched, after all, tlt still rose. Moreover, CPI data have been released for the past two days, this reaction seems a bit exaggerated. If this is the reason, then stop loss must be executed. Liquidity tightening, a stronger usd will definitely suppress the price of bitcoin.![]() And with CPI data released for the past two days, this reaction seems a bit exaggerated. If this is the reason, then stop loss must be executed. Liquidity tightening, a stronger usd will definitely suppress the price of bitcoin.

And with CPI data released for the past two days, this reaction seems a bit exaggerated. If this is the reason, then stop loss must be executed. Liquidity tightening, a stronger usd will definitely suppress the price of bitcoin.

Possibility 3: Irrational panic, including irrational selling caused by the risk of war. After all, today, except for apple's counter-trend slight increase, tlt rebounded from oversold, the entire market basically fell across the board, and the panic index vix also soared. If this is the reason for the irrational decline, there is even less need for stop-loss, instead, it is a good time for position accumulation...

Possibility 1: If today's sharp decline is due to the risk of the Middle East war, resulting in rational selling due to hedging demand, then I may not stop loss at the position of 38. Personally, I believe that war does not pose a systemic risk to bitcoin; instead, bitcoin has hedging properties. At the end of February 2022, when Russia and Ukraine clashed, bitcoin did not fall. Instead, it was the subsequent interest rate hikes and liquidity tightening that caused the sharp decline.

Evidence supporting this view: tlt rose against the trend. However, gold and crude oil did not rise, so this reason is temporarily insufficient. Tlt may just be oversold bounce, and one day's data is not enough to prove it is bid for hedging. $iShares 20+ Year Treasury Bond ETF (TLT.US)$

Possibility 2: Disappointment in interest rate cut expectations. The strong US dollar supports this view, but it's a bit far-fetched, after all, tlt still rose. Moreover, CPI data have been released for the past two days, this reaction seems a bit exaggerated. If this is the reason, then stop loss must be executed. Liquidity tightening, a stronger usd will definitely suppress the price of bitcoin.

Possibility 3: Irrational panic, including irrational selling caused by the risk of war. After all, today, except for apple's counter-trend slight increase, tlt rebounded from oversold, the entire market basically fell across the board, and the panic index vix also soared. If this is the reason for the irrational decline, there is even less need for stop-loss, instead, it is a good time for position accumulation...

Translated

12

4

1

股 股 叫

liked

$NVIDIA (NVDA.US)$

But I decided to reduce my position. Yesterday we added 3%, today we reduced our positions by 2%, so let's keep half. A day trip. After all, Brother Yu fell below the critical position of 870; today is probably a backdraw.

Continue to take heavy positions and hold high-dividend versions, that is, $Taiwan Semiconductor (TSM.US)$

Bitcoin has held a critical position, and the risk has been temporarily mitigated $iShares Bitcoin Trust (IBIT.US)$

But I decided to reduce my position. Yesterday we added 3%, today we reduced our positions by 2%, so let's keep half. A day trip. After all, Brother Yu fell below the critical position of 870; today is probably a backdraw.

Continue to take heavy positions and hold high-dividend versions, that is, $Taiwan Semiconductor (TSM.US)$

Bitcoin has held a critical position, and the risk has been temporarily mitigated $iShares Bitcoin Trust (IBIT.US)$

Translated

3

1

股 股 叫

liked

$iShares Bitcoin Trust (IBIT.US)$

There is no way to talk about CPI. The Federal Reserve's interest rate cut was expected too soon; the retaliation has finally arrived.

The stock market and bond market don't look good now. Gold and Bitcoin are definitely also implicated.

Bitcoin speculation. The Ibit stop loss is set at 38, and meat is cut when the closing price falls below.

$iShares 20+ Year Treasury Bond ETF (TLT.US)$ I don't know how long this crap will continue to prosper. Anyway, I don't plan to touch it anytime soon.

There is no way to talk about CPI. The Federal Reserve's interest rate cut was expected too soon; the retaliation has finally arrived.

The stock market and bond market don't look good now. Gold and Bitcoin are definitely also implicated.

Bitcoin speculation. The Ibit stop loss is set at 38, and meat is cut when the closing price falls below.

$iShares 20+ Year Treasury Bond ETF (TLT.US)$ I don't know how long this crap will continue to prosper. Anyway, I don't plan to touch it anytime soon.

Translated

9

1

股 股 叫

reacted to and commented on

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)