股 股 叫

commented on

$Unity Software(U.US$

I just bought a few days ago and it cost 25. The duvet was immediately covered. Luckily I only bought a few. With this thing and PLTR, you really can't open big positions.

But that's fine; when everyone is caught, there's no pressure![]() After all, the U company still doesn't have any problems of principle, and there is no risk of bankruptcy. After falling 22 the first few times, they all went up, so if they came, they settled down; on the contrary, no one would cut meat at this time.

After all, the U company still doesn't have any problems of principle, and there is no risk of bankruptcy. After falling 22 the first few times, they all went up, so if they came, they settled down; on the contrary, no one would cut meat at this time.

However, if there is another negative gap and the volume falls below 22, then it really is a bottomless hole![]()

Just a comment. After all, today's stock holdings $Taiwan Semiconductor(TSM.US$ It skyrocketed by 5%, and the one that just added a position $NVIDIA(NVDA.US$ It has also risen a bit, which should confirm that the breakthrough was successful. $Utilities Select Sector SPDR Fund(XLU.US$ It's been good lately, $iShares Bitcoin Trust(IBIT.US$ Yesterday, I also confessed to cutting meat and waited until it fell before buying it back. Anyway, I'm in a good mood, I can enjoy a nice weekend![]()

I just bought a few days ago and it cost 25. The duvet was immediately covered. Luckily I only bought a few. With this thing and PLTR, you really can't open big positions.

But that's fine; when everyone is caught, there's no pressure

However, if there is another negative gap and the volume falls below 22, then it really is a bottomless hole

Just a comment. After all, today's stock holdings $Taiwan Semiconductor(TSM.US$ It skyrocketed by 5%, and the one that just added a position $NVIDIA(NVDA.US$ It has also risen a bit, which should confirm that the breakthrough was successful. $Utilities Select Sector SPDR Fund(XLU.US$ It's been good lately, $iShares Bitcoin Trust(IBIT.US$ Yesterday, I also confessed to cutting meat and waited until it fell before buying it back. Anyway, I'm in a good mood, I can enjoy a nice weekend

Translated

7

7

股 股 叫

liked

$Tesla(TSLA.US$

Less than a week later, Tesla is stealing headlines again.

If my 160 call didn't sell, now it's not hot pot money![]()

![]()

![]()

But it doesn't matter. Ordinary people can't make this kind of money; even if they do, it's because of luck.

If FSD can be successfully approved in China, it would definitely be a good thing, but I'm curious exactly how many paying users it will have. Road conditions in China are much more complicated than in the US. The congested roads, aggressive driving style, serious lack of courtesy, and a large number of illegal non-motor vehicles are also quite a challenge to the FSD. But then again, even though I'm an old driver, I really don't dare to drive in China. If I need to drive home, I probably really need to rent a Tesla with an FSD![]()

Get back to business. My current opinion on Tesla: At around 180, probably between 160 and 200, it fluctuates widely and continuously digests the trap above. Concentrate your chips around 180, then choose a direction to break through. This direction depends not only on Tesla itself, but also on the macro environment and Sino-US relations. It is currently impossible to predict. But if you choose to go up at that time, the increase will not be less than 50%.

If you like the band, you can play by throwing small positions high and low at this stage. If you don't like it, just wait for a breakthrough later, and it will take a huge amount of money.

Less than a week later, Tesla is stealing headlines again.

If my 160 call didn't sell, now it's not hot pot money

But it doesn't matter. Ordinary people can't make this kind of money; even if they do, it's because of luck.

If FSD can be successfully approved in China, it would definitely be a good thing, but I'm curious exactly how many paying users it will have. Road conditions in China are much more complicated than in the US. The congested roads, aggressive driving style, serious lack of courtesy, and a large number of illegal non-motor vehicles are also quite a challenge to the FSD. But then again, even though I'm an old driver, I really don't dare to drive in China. If I need to drive home, I probably really need to rent a Tesla with an FSD

Get back to business. My current opinion on Tesla: At around 180, probably between 160 and 200, it fluctuates widely and continuously digests the trap above. Concentrate your chips around 180, then choose a direction to break through. This direction depends not only on Tesla itself, but also on the macro environment and Sino-US relations. It is currently impossible to predict. But if you choose to go up at that time, the increase will not be less than 50%.

If you like the band, you can play by throwing small positions high and low at this stage. If you don't like it, just wait for a breakthrough later, and it will take a huge amount of money.

Translated

3

6

股 股 叫

liked

$Alphabet-C(GOOG.US$

I was really shocked by this wave of earnings. Google tells everyone that I'm still an older brother, and I haven't become a younger brother! (Idiom: AI is being surpassed by Microsoft)

I used to be bullish on Goog from 136-140, bought it, held it, and sold it when it was around 156. Unfortunately, I went short. But it doesn't matter; I believe this wave of gains is only the beginning, not the end. After all, the reason why my brother's stock has always been tepid is to question: has the search business been taken away by AI? Can the cloud business have a bigger share of the competition with AWS and Azure? Most importantly, has AI already been greatly surpassed by Microsoft?

An earnings report used facts to respond to investors' questions. Google has also gone back from being underrated to being reasonable.

My biggest feeling about this financial report: the overvalued ones fell, the underestimated jumped up, and the oversold ones skyrocketed. It is a reasonable trend of the bull market to adjust and accumulate energy. Everything has returned to a reasonable price, which is conducive to continued growth in the future. I predict, $Amazon(AMZN.US$ with $Apple(AAPL.US$ The same will be true of financial reports. As for Brother Hao $NVIDIA(NVDA.US$ It will still be the most heavyweight financial report on the market. It will determine the subsequent trend of AI and all technology stocks. Currently in turmoil, I chose to wait for an opportunity.

Today's operations: $Microsoft(MSFT.US$ I sold it, earned a few points, and replaced all positions $Alphabet-C(GOOG.US$ ! Microsoft fell back after being blocked, at...

I was really shocked by this wave of earnings. Google tells everyone that I'm still an older brother, and I haven't become a younger brother! (Idiom: AI is being surpassed by Microsoft)

I used to be bullish on Goog from 136-140, bought it, held it, and sold it when it was around 156. Unfortunately, I went short. But it doesn't matter; I believe this wave of gains is only the beginning, not the end. After all, the reason why my brother's stock has always been tepid is to question: has the search business been taken away by AI? Can the cloud business have a bigger share of the competition with AWS and Azure? Most importantly, has AI already been greatly surpassed by Microsoft?

An earnings report used facts to respond to investors' questions. Google has also gone back from being underrated to being reasonable.

My biggest feeling about this financial report: the overvalued ones fell, the underestimated jumped up, and the oversold ones skyrocketed. It is a reasonable trend of the bull market to adjust and accumulate energy. Everything has returned to a reasonable price, which is conducive to continued growth in the future. I predict, $Amazon(AMZN.US$ with $Apple(AAPL.US$ The same will be true of financial reports. As for Brother Hao $NVIDIA(NVDA.US$ It will still be the most heavyweight financial report on the market. It will determine the subsequent trend of AI and all technology stocks. Currently in turmoil, I chose to wait for an opportunity.

Today's operations: $Microsoft(MSFT.US$ I sold it, earned a few points, and replaced all positions $Alphabet-C(GOOG.US$ ! Microsoft fell back after being blocked, at...

Translated

10

13

股 股 叫

voted

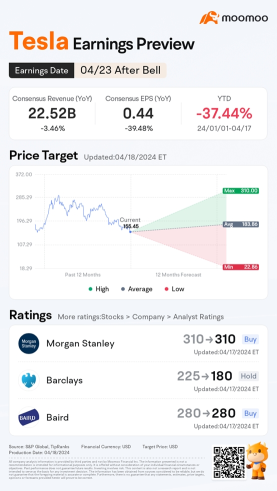

Tesla is releasing its Q1 2024 earnings after the market closes on April 23.

Since its Q4 earnings release, shares of $Tesla(TSLA.US$ have seen a decrease of 29%.![]() Overall earnings estimates have been revised lower since the company's last earnings release. How will the market react to the upcoming results? Make your guess now!

Overall earnings estimates have been revised lower since the company's last earnings release. How will the market react to the upcoming results? Make your guess now! ![]()

Rewards

● An equal share of 5,000 points: For mooers who correctly guess the price range ...

Since its Q4 earnings release, shares of $Tesla(TSLA.US$ have seen a decrease of 29%.

Rewards

● An equal share of 5,000 points: For mooers who correctly guess the price range ...

143

371

股 股 叫

liked

$iShares Bitcoin Trust(IBIT.US$

Possibility 1: If today's sharp decline was due to the risk of a war in the Middle East and a rational sell-off caused by safe-haven demand, then I probably wouldn't have stopped losing at 38. I personally believe that war does not pose a systemic risk to Bitcoin; on the contrary, Bitcoin has safe-haven properties. At the end of February 2022, Russia and Ukraine started, and Bitcoin did not fall. Instead, interest rates were raised later, and liquidity tightened, which led to a sharp decline.

Evidence supporting this view: TLT bucked the trend. However, gold and crude oil have not risen, so this reason is not sufficient for the time being. TLT is probably just an overrun rebound; one-day data is not enough to prove that it is a safe-haven purchase. $iShares 20+ Year Treasury Bond ETF(TLT.US$

Possibility 2: Expectations of interest rate cuts have fallen short. The strengthening of the US dollar supports this view, but it is also a bit far-fetched. After all, TLT is still rising![]() Also, two days have passed since the CPI; this reflection arc is probably a bit too long. If this is the reason, a stop-loss must be executed. The tightening of liquidity and the strengthening of the USD will definitely suppress the price of Bitcoin.

Also, two days have passed since the CPI; this reflection arc is probably a bit too long. If this is the reason, a stop-loss must be executed. The tightening of liquidity and the strengthening of the USD will definitely suppress the price of Bitcoin.

Possibility 3: Irrational panic, including irrational selling due to the risk of war. After all, apart from Apple bucking the trend and rising slightly today, TLT overfell and rebounded. The entire market basically fell across the board, and the panic index VIX also soared. If this is the reason, for an irrational decline, there is no need to stop loss; instead, it is a position that attracts funds...

Possibility 1: If today's sharp decline was due to the risk of a war in the Middle East and a rational sell-off caused by safe-haven demand, then I probably wouldn't have stopped losing at 38. I personally believe that war does not pose a systemic risk to Bitcoin; on the contrary, Bitcoin has safe-haven properties. At the end of February 2022, Russia and Ukraine started, and Bitcoin did not fall. Instead, interest rates were raised later, and liquidity tightened, which led to a sharp decline.

Evidence supporting this view: TLT bucked the trend. However, gold and crude oil have not risen, so this reason is not sufficient for the time being. TLT is probably just an overrun rebound; one-day data is not enough to prove that it is a safe-haven purchase. $iShares 20+ Year Treasury Bond ETF(TLT.US$

Possibility 2: Expectations of interest rate cuts have fallen short. The strengthening of the US dollar supports this view, but it is also a bit far-fetched. After all, TLT is still rising

Possibility 3: Irrational panic, including irrational selling due to the risk of war. After all, apart from Apple bucking the trend and rising slightly today, TLT overfell and rebounded. The entire market basically fell across the board, and the panic index VIX also soared. If this is the reason, for an irrational decline, there is no need to stop loss; instead, it is a position that attracts funds...

Translated

12

4

股 股 叫

liked

$NVIDIA(NVDA.US$

不过我决定减仓。昨天加了3%,今天减仓2%,留一半吧。一日游。毕竟龘哥跌破了870的关键位置,今天可能是反抽。

继续重仓持有高股息版龘哥,也就是 $Taiwan Semiconductor(TSM.US$

比特币守住了关键位置,风险暂时缓解了 $iShares Bitcoin Trust(IBIT.US$

不过我决定减仓。昨天加了3%,今天减仓2%,留一半吧。一日游。毕竟龘哥跌破了870的关键位置,今天可能是反抽。

继续重仓持有高股息版龘哥,也就是 $Taiwan Semiconductor(TSM.US$

比特币守住了关键位置,风险暂时缓解了 $iShares Bitcoin Trust(IBIT.US$

3

1

股 股 叫

liked

$iShares Bitcoin Trust(IBIT.US$

There is no way to talk about CPI. The Federal Reserve's interest rate cut was expected too soon; the retaliation has finally arrived.

The stock market and bond market don't look good now. Gold and Bitcoin are definitely also implicated.

Bitcoin speculation. The Ibit stop loss is set at 38, and meat is cut when the closing price falls below.

$iShares 20+ Year Treasury Bond ETF(TLT.US$ I don't know how long this crap will continue to prosper. Anyway, I don't plan to touch it anytime soon.

There is no way to talk about CPI. The Federal Reserve's interest rate cut was expected too soon; the retaliation has finally arrived.

The stock market and bond market don't look good now. Gold and Bitcoin are definitely also implicated.

Bitcoin speculation. The Ibit stop loss is set at 38, and meat is cut when the closing price falls below.

$iShares 20+ Year Treasury Bond ETF(TLT.US$ I don't know how long this crap will continue to prosper. Anyway, I don't plan to touch it anytime soon.

Translated

9

1

股 股 叫

reacted to and commented on

股 股 叫

liked

$Tesla(TSLA.US$

I wonder how many people have watched the FSD live stream? I've probably watched it, and it feels pretty good; it just takes time to test. I think Tesla will no doubt be the first to commercialize fully automated driving on a large scale. After all, artificial intelligence competes for data. Whoever has more data for training will win this game. I'm optimistic $Alphabet-C(GOOG.US$ This is also the logic.

Although Tesla doesn't have many models, the coverage is good, and they can pull people and goods. Once fully automated driving is achieved, it will greatly boost the development of productivity.

The core logic behind the continued prosperity of US stocks is that there are always excellent companies in the US that drive progress in productivity, and even disrupt many traditional industries. There is nothing wrong with long-term investment grasping this general direction and betting on the most advanced productivity. Even if you don't enter the market right away, you can succeed. For example, when Buffett was heavily involved in Apple, there were several generations of iPhones, but this investment was still a huge success.

Back to business, can Tesla beat so many traditional car companies? That's a great question. So where are the Nokia, Blackberry, and Sony phones? Autonomous driving, can't other brands do it? With so many smartphone brands, is Apple still more than three trillion dollars alone?

If one day in the future, Musk smiles and sells cars at a profit close to zero, then it is likely that it will be the time for Stuart Tesla. The value created by fully automated driving is far from being comparable to a sofa with four wheels...

I wonder how many people have watched the FSD live stream? I've probably watched it, and it feels pretty good; it just takes time to test. I think Tesla will no doubt be the first to commercialize fully automated driving on a large scale. After all, artificial intelligence competes for data. Whoever has more data for training will win this game. I'm optimistic $Alphabet-C(GOOG.US$ This is also the logic.

Although Tesla doesn't have many models, the coverage is good, and they can pull people and goods. Once fully automated driving is achieved, it will greatly boost the development of productivity.

The core logic behind the continued prosperity of US stocks is that there are always excellent companies in the US that drive progress in productivity, and even disrupt many traditional industries. There is nothing wrong with long-term investment grasping this general direction and betting on the most advanced productivity. Even if you don't enter the market right away, you can succeed. For example, when Buffett was heavily involved in Apple, there were several generations of iPhones, but this investment was still a huge success.

Back to business, can Tesla beat so many traditional car companies? That's a great question. So where are the Nokia, Blackberry, and Sony phones? Autonomous driving, can't other brands do it? With so many smartphone brands, is Apple still more than three trillion dollars alone?

If one day in the future, Musk smiles and sells cars at a profit close to zero, then it is likely that it will be the time for Stuart Tesla. The value created by fully automated driving is far from being comparable to a sofa with four wheels...

Translated

11

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)

股 股 叫 : So is U going to go into the bottomless pit now