臆病な投資家

liked

Tomorrow, there is a chance for a big rise in Japanese stocks.

Translated

7

2

Laser Tech has experienced a significant decline today. The relentless decline is frustrating. The road to recovering from unrealized losses is long.

Translated

9

1

There are less than 4 months left in the year. I will now write down the investment strategy for the rest of the year with a sense of self-discipline. It is predicted that there will be an acceleration in sales for tax purposes at the end of the year. To prepare for the rebound from the beginning of the year, secure cash or a credit line. Therefore, if the stock price rises before the dividend is realized in September, it is permissible to sell. Stocks that can be held for the long term (trading companies, megabanks) should be continued to hold. Selling off too early is for mediocre stocks. Calculate the tax refund and if the acceptable loss can be handled, process it early.

Translated

4

臆病な投資家

liked

Nikkei average has the third decline this year. I was suppressing the urge to buy the dip and calmly observing.

Including the semiconductor stocks I hold, the unrealized loss has worsened by 1 million yen. August 5th was not like this, so I can still endure. And fortunately, profited from partial sale yesterday.

I will continue to observe tomorrow.

The decline should not continue for a third day.

Including the semiconductor stocks I hold, the unrealized loss has worsened by 1 million yen. August 5th was not like this, so I can still endure. And fortunately, profited from partial sale yesterday.

I will continue to observe tomorrow.

The decline should not continue for a third day.

Translated

6

Is it the opportunity for a bargain sale? Be prepared for further decline without rushing. Watch the situation today. Stay calm.

Translated

2

Today, I liquidated some excess positions to take profits. It's a complex feeling that the remaining stocks will be exposed to tomorrow's decline. At times like this, don't forget about long-term diversified investment.

Translated

5

Lucky. But there is nothing more expensive. Be cautious without changing your investment style.

Translated

5

臆病な投資家

commented on

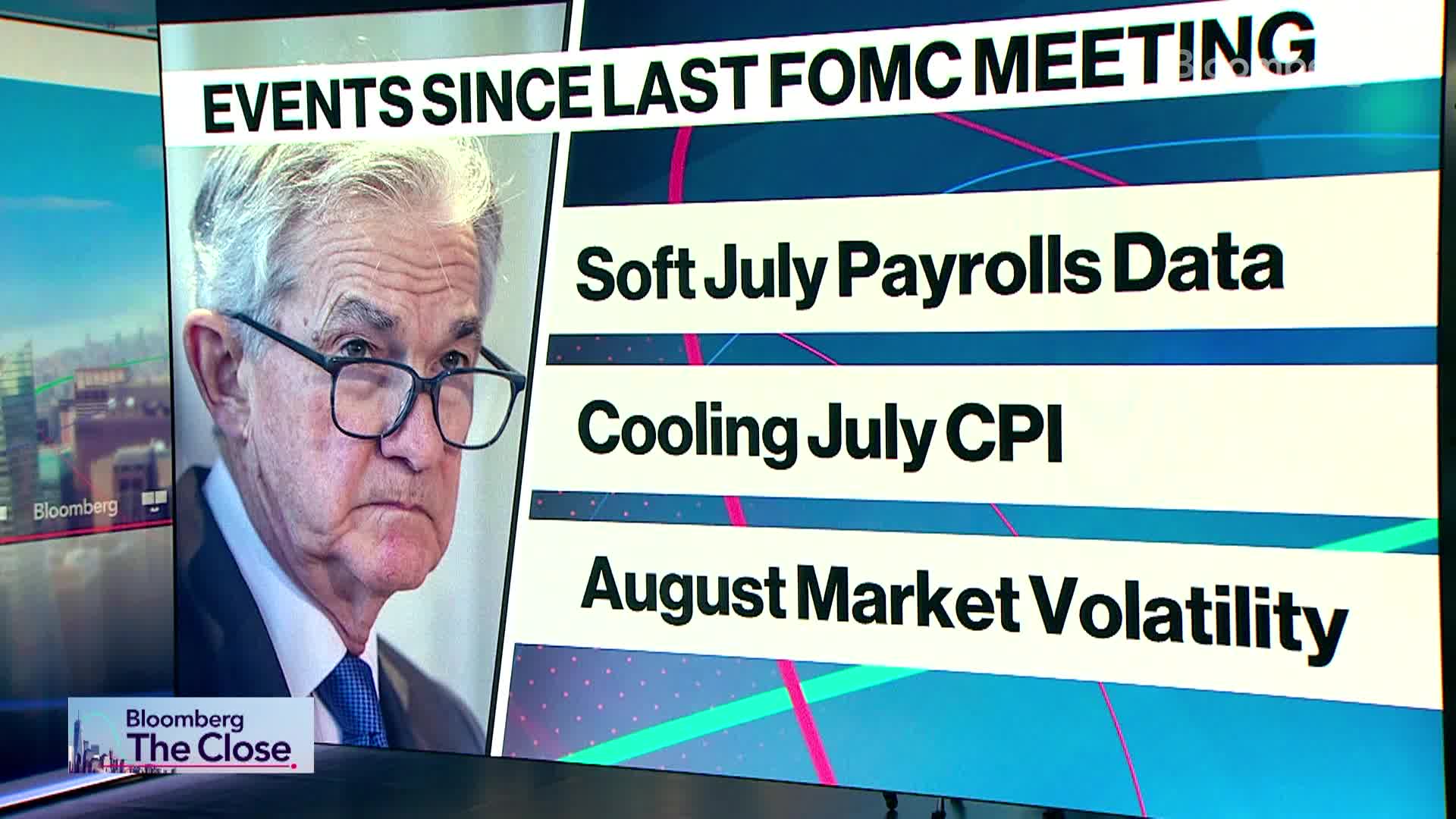

Shlyatieva, senior US economist at BNP Paribas, stated in “Bloomberg The Close” that there are signs of a slowdown in the US labor market. There is a possibility that the number of US salaried workers will be revised downward by approximately 0.81 million8,000 in the 12 months to March, which will indicate that US employment growth has not been as strong as previously reported.

Translated

1

1

臆病な投資家

liked

Good evening to all Moomoo users!![]() This is the reading for tonight's NY stock.

This is the reading for tonight's NY stock.![]()

Market Overview

The US market started, and the Dow Jones Industrial Average, which consists of excellent stocks, rose 46.06 dollars to 40881.03 dollars, and the Nasdaq Composite Stock Price Index, which has a high high-tech stock ratio, began at 17840.51 with a 23.57 point increase. The S&P 500 average, which consists of stocks of 500 companies that are large US stocks, is 5.97 points higher at 5603.09.

$Dow Jones Industrial Average (.DJI.US)$

$Nasdaq Composite Index (.IXIC.US)$

$S&P 500 Index (.SPX.US)$

Top news

Market trends

● Traders were prepared to get busy for the end of the week ahead of Fed Chairman Powell's Jackson Hole speech on Wednesday.

● The European Stock Exchange 600 stock price index rose slightly, and US stock futures also showed small movements. $U.S. 10-Year Treasury Notes Yield (US10Y.BD)$ It leveled off, and the index showing a strong dollar stopped falling for 3 days.

Employment statistics correction

● In the US...

Market Overview

The US market started, and the Dow Jones Industrial Average, which consists of excellent stocks, rose 46.06 dollars to 40881.03 dollars, and the Nasdaq Composite Stock Price Index, which has a high high-tech stock ratio, began at 17840.51 with a 23.57 point increase. The S&P 500 average, which consists of stocks of 500 companies that are large US stocks, is 5.97 points higher at 5603.09.

$Dow Jones Industrial Average (.DJI.US)$

$Nasdaq Composite Index (.IXIC.US)$

$S&P 500 Index (.SPX.US)$

Top news

Market trends

● Traders were prepared to get busy for the end of the week ahead of Fed Chairman Powell's Jackson Hole speech on Wednesday.

● The European Stock Exchange 600 stock price index rose slightly, and US stock futures also showed small movements. $U.S. 10-Year Treasury Notes Yield (US10Y.BD)$ It leveled off, and the index showing a strong dollar stopped falling for 3 days.

Employment statistics correction

● In the US...

Translated

31

15

臆病な投資家

commented on

It seems that the asset management company Orvis Investments, which concentrated on investing in Japanese trading company stocks ahead of famous investor Warren Buffett and also accurately captured this year's bank stock appreciation, is aiming for the drugstore industry next. $TSURUHA HOLDINGS INC (TSUSF.US)$Ya $SUGI HOLDINGS CO.LTD. (SGIPF.US)$Stock buybacks are conspicuous. President Tokikoku Tsukasa of Orvis Investments Japan Corporation pointed out in response to Bloomberg's coverage that the drugstore industry has the following three medium-term growth drivers.

[Drugstore medium- to long-term growth drivers]

① There is room for conformism and balance: The US has already been consolidated into about 2 major companies (CVS Health, Walgreens Boots Alliance), but there is a high possibility that Japan will reorganize in the future

② You can gain share of dispensing pharmacies: By using one corner of the sales floor, there is no need for additional costs such as real estate

③ You can earn supermarket shares: We have secured high profit margins in pharmaceuticals and cosmetics, and food at low prices...

[Drugstore medium- to long-term growth drivers]

① There is room for conformism and balance: The US has already been consolidated into about 2 major companies (CVS Health, Walgreens Boots Alliance), but there is a high possibility that Japan will reorganize in the future

② You can gain share of dispensing pharmacies: By using one corner of the sales floor, there is no need for additional costs such as real estate

③ You can earn supermarket shares: We have secured high profit margins in pharmaceuticals and cosmetics, and food at low prices...

Translated

+2

51

2

27

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)