Translated

蛤蛤

commented on

$Moderna (MRNA.US)$ Dear colleagues: What is the reason for the stock's rise and fall?

Translated

2

4

$Moderna (MRNA.US)$ Moderna (NASDAQ:MRNA) Strength tied to Speculation About New Coronavirus

1

蛤蛤

liked

Last week review 👉🏻Market Review + Hold Positions (03/02-07/02 2025)

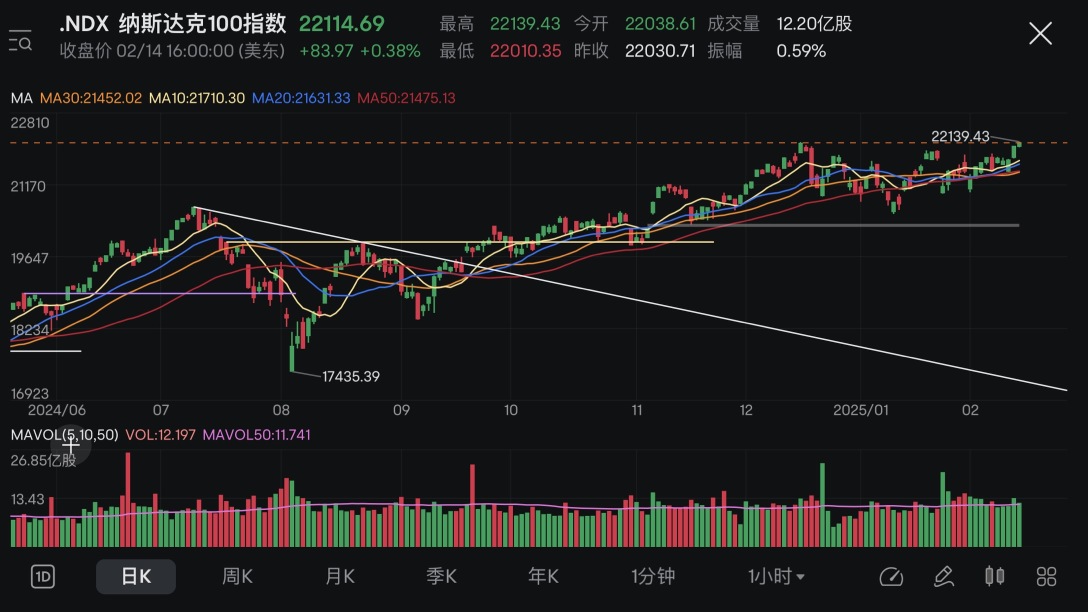

Market behavior this week:

$NASDAQ 100 Index (.NDX.US)$ Distributions on Tuesday and Wednesday; accumulation on Thursday;

$S&P 500 Index (.SPX.US)$ and $Russell 2000 Index (.RUT.US)$ Distributed on Wednesday, accumulated on Thursday.

SPX > NDX > RUT.

The terrible CPI data on Wednesday caused the market to plunge at the opening, but it rebounded back up from intraday to close, demonstrating a strong upward trend; after an elusive 4T VCP, NDX finally reached a new high, SPX returned to the highest level range, and the moving averages are almost about to become positively ordered, while RUT formed a higher low in the second base; all of the above feedback shows a strong willingness of the market to go up. 🚴🏻

Weekly Charts:

There has been no change, and the upward trend remains strong; for a long time, the RUT has accumulated energy for 8 weeks, waiting to see when it starts to release it.

Breadth:

Only Wednesday is in red, serving as a watershed in distinguishing the strength of individual stocks, and good names will be retained in the 2362.

Weekly Notes:

Change of RS in trading names within the system: UNFI +1.

Market Sentiment:

Since last week when AAII reached a record red, this week red has set another record, with the Put ratio reaching a new high again, and at the same time the market has reached a new high... For me, nothing is better than this; the counter-trend market behavior on Thursday was strong, and the week...

Market behavior this week:

$NASDAQ 100 Index (.NDX.US)$ Distributions on Tuesday and Wednesday; accumulation on Thursday;

$S&P 500 Index (.SPX.US)$ and $Russell 2000 Index (.RUT.US)$ Distributed on Wednesday, accumulated on Thursday.

SPX > NDX > RUT.

The terrible CPI data on Wednesday caused the market to plunge at the opening, but it rebounded back up from intraday to close, demonstrating a strong upward trend; after an elusive 4T VCP, NDX finally reached a new high, SPX returned to the highest level range, and the moving averages are almost about to become positively ordered, while RUT formed a higher low in the second base; all of the above feedback shows a strong willingness of the market to go up. 🚴🏻

Weekly Charts:

There has been no change, and the upward trend remains strong; for a long time, the RUT has accumulated energy for 8 weeks, waiting to see when it starts to release it.

Breadth:

Only Wednesday is in red, serving as a watershed in distinguishing the strength of individual stocks, and good names will be retained in the 2362.

Weekly Notes:

Change of RS in trading names within the system: UNFI +1.

Market Sentiment:

Since last week when AAII reached a record red, this week red has set another record, with the Put ratio reaching a new high again, and at the same time the market has reached a new high... For me, nothing is better than this; the counter-trend market behavior on Thursday was strong, and the week...

Translated

+20

16

2

1

$Moderna (MRNA.US)$ prepare U-TURN guys

1

蛤蛤

reacted to

Review of last week👉🏻Market review + current holdings (21/10-25/10 2024)

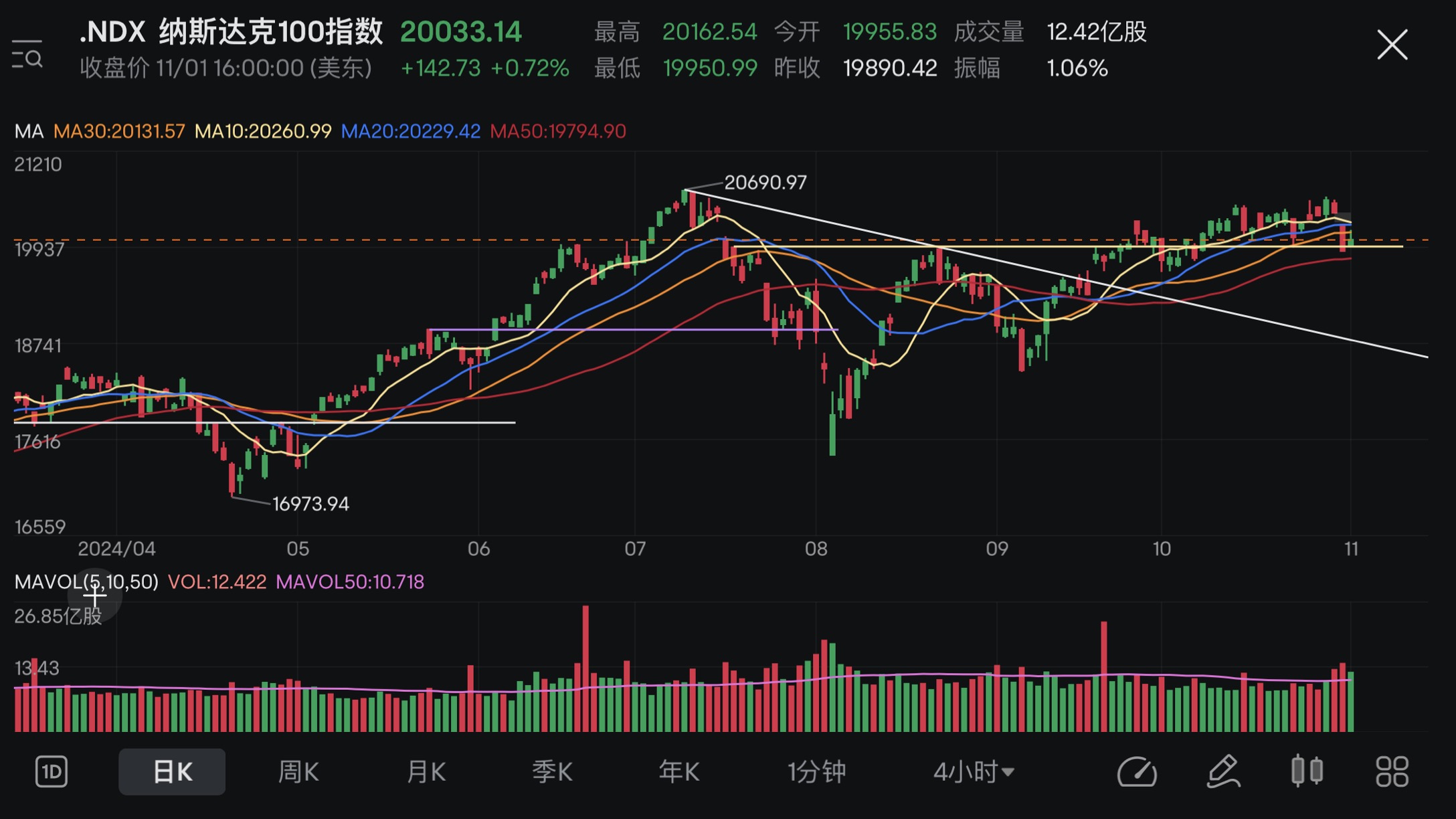

Market behavior this week:

$NASDAQ 100 Index (.NDX.US)$ Tuesday absorbs funds, Wednesday and Thursday distribute;

$S&P 500 Index (.SPX.US)$ Distributions will be made on Tuesday, Wednesday, and Thursday;

$Russell 2000 Index (.RUT.US)$ Accumulation on Monday, distributions on Thursday.

RUT ended up above NDX and SPX.

NDX and SPX experienced a sharp drop in trading volume on Thursday, breaking through three moving averages. Currently testing the 50-day moving average position; RUT is relatively better, with Thursday's low still slightly higher than last Wednesday's low; Traders do not need to search for potential support levels as they are generated by the combined buying power of the market's large capital players; However, the previous day's close price of SPX, especially compared to September 19, is still worthy of reference. Whether the price can close above that level determines the effectiveness of September 19 and recent days.

Weekly charts:

All three indices are currently testing the 10-week moving average. The volatility of NDX and SPX has increased, while the volatility of RUT has decreased compared to the previous week; Most market participants are concerned about major upcoming events in the short term. Traders should not predict unknown events or develop emotional biases. All actions should be based on price feedback, maintaining the long-term consistency of their trading systems.

...

Market behavior this week:

$NASDAQ 100 Index (.NDX.US)$ Tuesday absorbs funds, Wednesday and Thursday distribute;

$S&P 500 Index (.SPX.US)$ Distributions will be made on Tuesday, Wednesday, and Thursday;

$Russell 2000 Index (.RUT.US)$ Accumulation on Monday, distributions on Thursday.

RUT ended up above NDX and SPX.

NDX and SPX experienced a sharp drop in trading volume on Thursday, breaking through three moving averages. Currently testing the 50-day moving average position; RUT is relatively better, with Thursday's low still slightly higher than last Wednesday's low; Traders do not need to search for potential support levels as they are generated by the combined buying power of the market's large capital players; However, the previous day's close price of SPX, especially compared to September 19, is still worthy of reference. Whether the price can close above that level determines the effectiveness of September 19 and recent days.

Weekly charts:

All three indices are currently testing the 10-week moving average. The volatility of NDX and SPX has increased, while the volatility of RUT has decreased compared to the previous week; Most market participants are concerned about major upcoming events in the short term. Traders should not predict unknown events or develop emotional biases. All actions should be based on price feedback, maintaining the long-term consistency of their trading systems.

...

Translated

+25

20

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)