豆腐好吃

liked

STI Hits Record High, Boosted by the Big Three Bank Stocks

As we approach 2025, it's the perfect moment to look back at how the Singapore stock market performed in 2024. The year was a strong one for Singapore's equities, with the Straits Times Index (STI) $FTSE Singapore Straits Time Index (.STI.SG)$ surging by 16.9% up to December 31, 2024, hitting its highest level since 2007.

The STI, being a market-capitalization-weight...

As we approach 2025, it's the perfect moment to look back at how the Singapore stock market performed in 2024. The year was a strong one for Singapore's equities, with the Straits Times Index (STI) $FTSE Singapore Straits Time Index (.STI.SG)$ surging by 16.9% up to December 31, 2024, hitting its highest level since 2007.

The STI, being a market-capitalization-weight...

+4

62

4

46

豆腐好吃

liked

Hello, mooers! 📢

Today, we have the privilege of hearing from a seasoned investor who has navigated the ups and downs of the financial markets since 2008, @DividendKopi . His journey began just before the Global Financial Crisis, and he has since transformed challenges into invaluable lessons about patience, discipline, and the pursuit of long-term value. ✍️

@DividendKopi experiences, including the trials of sp...

Today, we have the privilege of hearing from a seasoned investor who has navigated the ups and downs of the financial markets since 2008, @DividendKopi . His journey began just before the Global Financial Crisis, and he has since transformed challenges into invaluable lessons about patience, discipline, and the pursuit of long-term value. ✍️

@DividendKopi experiences, including the trials of sp...

80

13

31

豆腐好吃

liked

Today, the KLCI is at 1597.33 (-9.52 points), with a red candlestick, showing another period of decline. Watching that gradually downward candlestick, there is a sense of heaviness in the heart, but it's not too surprising. This is how the market works, with ups and downs, alternating between red and green, nobody can guarantee smooth sailing.

Although today's decline is not significant, breaking through the psychological barrier of 1600 points set halfway through the year, always makes one's heart skip a beat. It's as if all the efforts have been nullified by this 9.52 point drop. But calming down and thinking, this is just the short-term sentiment of the market, not the long-term outcome.

While it is true that the market always has fluctuations, with a 0.59% decrease, market confidence may be slightly shaken, but the amplitude is still moderate. One must learn to accept the red days, because they are part of the investment journey. Even though it has been declining for three months 🥹, I know that only by falling down can there be opportunities, and each pullback is also giving me a chance, right? The more it falls, the more likely to find good stocks that have been undervalued. Patience is key, patience is key... The market will ultimately prove the value of those excellent companies. But what if one is already fully invested?

Perhaps focusing on the future rather than the present, investing is not a one-day thing. Even if it's red today, the green tomorrow, and the rise the day after, are what I should look forward to... I continue to try to hypnotize myself... It may drop, but my belief remains. The red line is like the lows of life, short-lived and real, but it will also pass. Hold onto the stocks in hand, diversify the risks, and position yourself low. When others panic, perhaps it's the best time for me to calmly think and seek opportunities.

Write...

Although today's decline is not significant, breaking through the psychological barrier of 1600 points set halfway through the year, always makes one's heart skip a beat. It's as if all the efforts have been nullified by this 9.52 point drop. But calming down and thinking, this is just the short-term sentiment of the market, not the long-term outcome.

While it is true that the market always has fluctuations, with a 0.59% decrease, market confidence may be slightly shaken, but the amplitude is still moderate. One must learn to accept the red days, because they are part of the investment journey. Even though it has been declining for three months 🥹, I know that only by falling down can there be opportunities, and each pullback is also giving me a chance, right? The more it falls, the more likely to find good stocks that have been undervalued. Patience is key, patience is key... The market will ultimately prove the value of those excellent companies. But what if one is already fully invested?

Perhaps focusing on the future rather than the present, investing is not a one-day thing. Even if it's red today, the green tomorrow, and the rise the day after, are what I should look forward to... I continue to try to hypnotize myself... It may drop, but my belief remains. The red line is like the lows of life, short-lived and real, but it will also pass. Hold onto the stocks in hand, diversify the risks, and position yourself low. When others panic, perhaps it's the best time for me to calmly think and seek opportunities.

Write...

Translated

8

豆腐好吃

voted

Today $S&P 500 Index (.SPX.US)$ showing slight gains hovering at 5910 range. ![]()

$Alphabet-A (GOOGL.US)$dipped to 165, seems like a good entry point for me if it falls further.![]()

$NVIDIA (NVDA.US)$climbed from 139 during premarkets 🚀 and landed on 144. Looking forward to its real 🚀 hopefully before next ER.![]()

Slight drop in todays P/L, still looking forward to EOY.![]()

$Alphabet-A (GOOGL.US)$dipped to 165, seems like a good entry point for me if it falls further.

$NVIDIA (NVDA.US)$climbed from 139 during premarkets 🚀 and landed on 144. Looking forward to its real 🚀 hopefully before next ER.

Slight drop in todays P/L, still looking forward to EOY.

+2

21

2

豆腐好吃

voted

Good morning, traders. Happy Monday, November 18th. You will not make it through the day without news about the animal spirits moving the market today.

My name is Kevin Travers, and the S&P 500 climbed on Monday, but key stocks were pulling down the Dow.

$Super Micro Computer (SMCI.US)$ was the highest climbing stock on the S&P 500, up 11% after a rumor Friday that the firm might file a plan to file their still dela...

My name is Kevin Travers, and the S&P 500 climbed on Monday, but key stocks were pulling down the Dow.

$Super Micro Computer (SMCI.US)$ was the highest climbing stock on the S&P 500, up 11% after a rumor Friday that the firm might file a plan to file their still dela...

34

13

1

豆腐好吃

reacted to

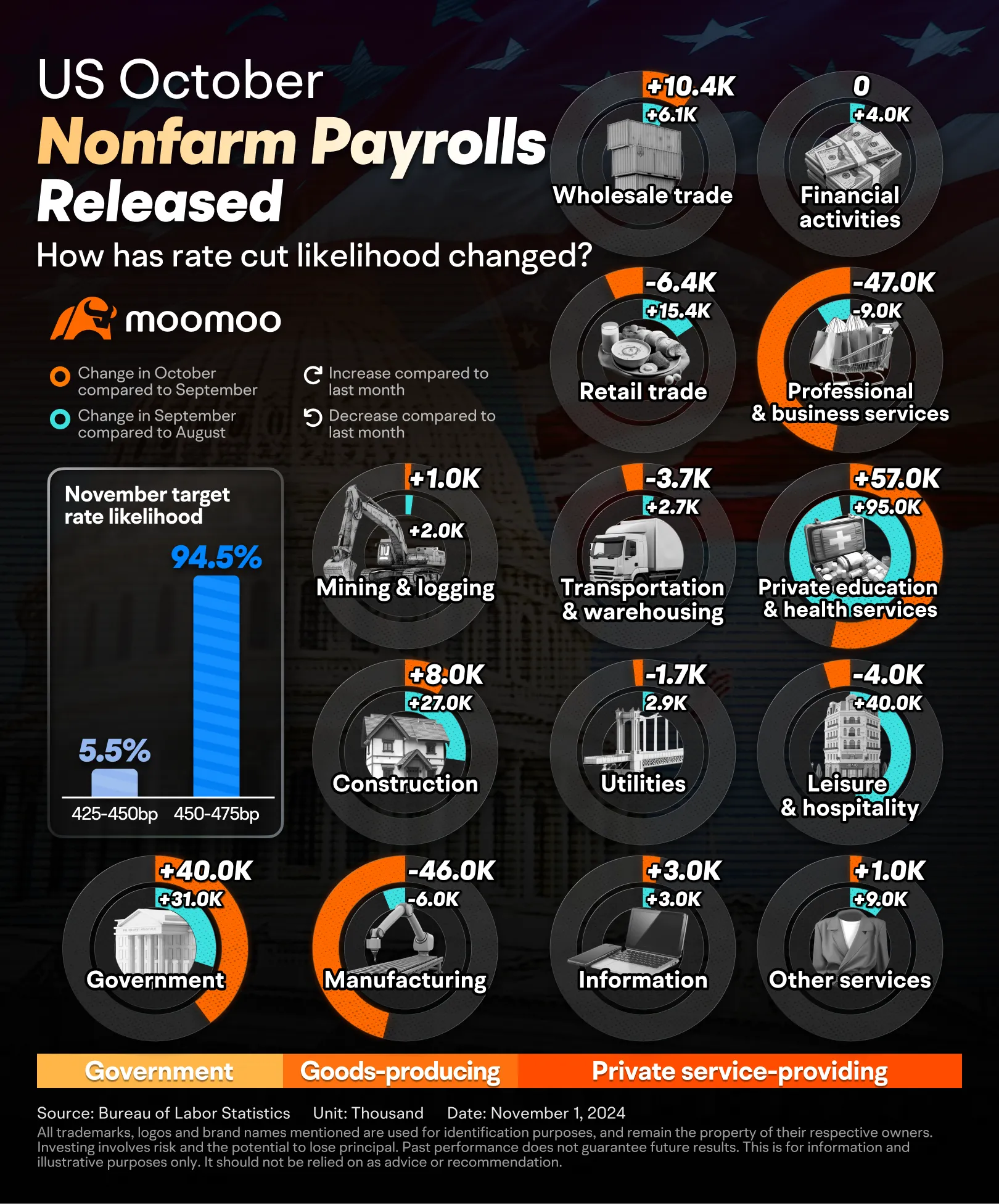

In October 2024, the US economy saw the addition of only 12,000 jobs, a sharp decline from the 223,000 jobs added in September, which itself was a downward revision. This figure was also significantly below the anticipated 113,000 jobs, marking the lowest growth since December 2020.

Additionally, hurricanes may have impacted job numbers in certain industries, although the Bureau of Labor Statistics was unab...

Additionally, hurricanes may have impacted job numbers in certain industries, although the Bureau of Labor Statistics was unab...

72

27

32

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)