豊国物産(米金融動向)

liked

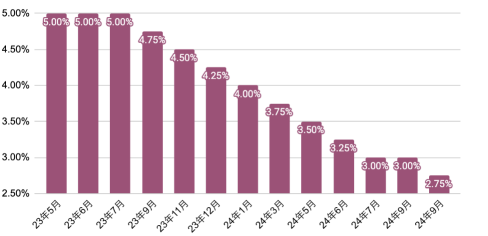

This week in the Japanese stock market, Results of the House of Representatives electionYaBOJ meeting、Many economic indicators in the USA、US mega-cap tech stocks earnings reportsIt seems that the development will be tumultuous due to various US economic indicators. Market participants are paying attention to whether the ruling party, Liberal Democratic Party and Komeito, can maintain a majority. In case of a majority loss, there is a possibility that the political uncertainty may increase and sell pressure on Japanese stocks could intensify. Moreover, Japan's stable political situation that has lasted for over 10 years may suddenly become fluid, potentially constraining the Bank of Japan's timing in seeking additional interest rate hikes. On the other hand, in the Bank of Japan's monetary policy decision-making meeting scheduled for the 31st, financial easing is expected, however, amid the continued depreciation of the yen, whether hawkish statements will be made remains to be seen.maintaining the current situationfinancial easingwhether hawkish statements will be made, and Views on the macro economy are attracting attention.。

This week in the US stock market, the market's direction could be significantly influenced by the release of important economic indicators and corporate earnings reports, leading to increased volatility. As for corporate earnings, the top technology giants dubbed the "Magnificent Seven (M7)" Magnificent Seven (American mega-cap stocks "M7")and $Alphabet-A (GOOGL.US)$、���������...

Translated

54

豊国物産(米金融動向)

liked

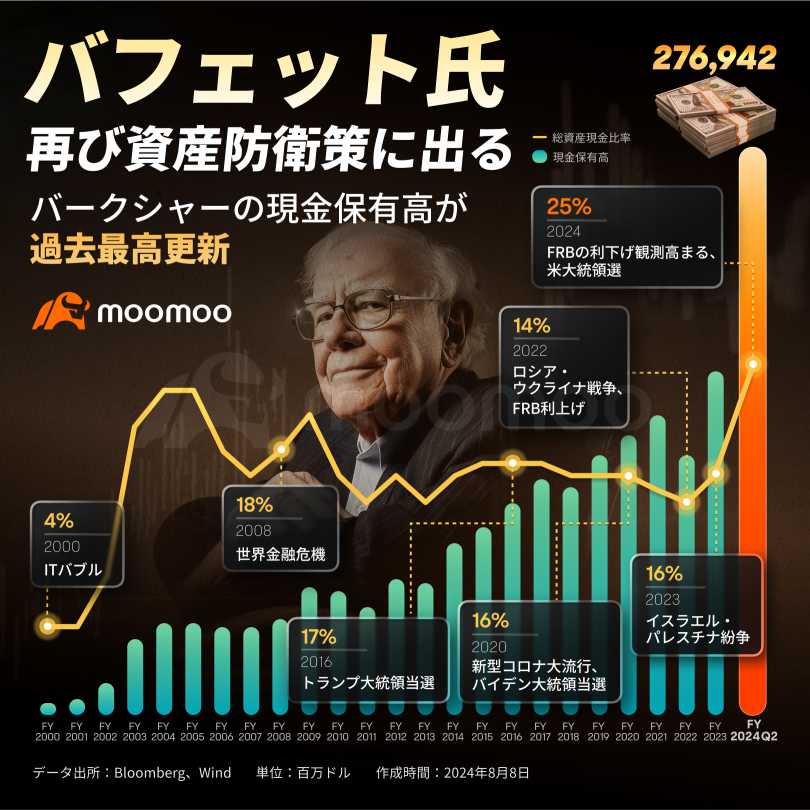

In the previous quarter, Mr. Buffett significantly reduced the ownership ratio of many US stocks, including $Apple (AAPL.US)$and has been selling for 7 consecutive quarters, accelerating in the second quarter of this year,The total amount of stock sales reached $75 billion..

In addition, $Berkshire Hathaway-A (BRK.A.US)$According to the financial statements, the company held $234.6 billion in US short-term Treasury bonds as of the end of the second quarter, as well as more than $42 billion in cash and cash equivalents.The current cash on hand is a record high of $276.9 billion.is turning out to be.

In contrast, the Federal Reserve Bank (FRB) held less than $195.3 billion of US Treasuries with a maturity of less than one year as of July 31. This means that Berkshire significantly surpasses the FRB in its position in US short-term bonds.This means that Berkshire significantly surpasses the FRB in its position in US short-term bonds.This means that Berkshire significantly surpasses the FRB in its position in US short-term bonds.

![]() As US stocks languish, 'the god of investment' sends a bearish signal.

As US stocks languish, 'the god of investment' sends a bearish signal.

Warren Buffett has announced that he will purchase short-term government bonds through US Treasury auctions during an economic crisis.in the report.

Normally, the return on short-term government bonds is not as high as that of risky investments such as stocks...

In addition, $Berkshire Hathaway-A (BRK.A.US)$According to the financial statements, the company held $234.6 billion in US short-term Treasury bonds as of the end of the second quarter, as well as more than $42 billion in cash and cash equivalents.The current cash on hand is a record high of $276.9 billion.is turning out to be.

In contrast, the Federal Reserve Bank (FRB) held less than $195.3 billion of US Treasuries with a maturity of less than one year as of July 31. This means that Berkshire significantly surpasses the FRB in its position in US short-term bonds.This means that Berkshire significantly surpasses the FRB in its position in US short-term bonds.This means that Berkshire significantly surpasses the FRB in its position in US short-term bonds.

Warren Buffett has announced that he will purchase short-term government bonds through US Treasury auctions during an economic crisis.in the report.

Normally, the return on short-term government bonds is not as high as that of risky investments such as stocks...

Translated

95

4

豊国物産(米金融動向)

reacted to

The Dow average rebounded for the first time in 4 weeks in the US stock market until 10/12, and both the S&P 500 and NASDAQ continued to grow. In the US stock market on the 11th, all 3 major indices continued to grow for 4 days. In response to heightened geopolitical risks surrounding the Palestinian conflict, US 10-year bond yields fell sharply to 4.62% at one point on the 10th. The decline in long-term US interest rates was well received, and major US tech companies led the rise in market prices, and public utility related stocks with high defensibility were also reviewed and bought, boosting the recovery trend in the US stock market. In the interest rate futures market, the Fed Vice Chairman's comments on the direction of monetary tightening “through an increase in bond yields instead of implementing additional interest rate increases” also improved market sentiment while many people were forecasting the FF rate unchanged at both the November meeting and the December meeting. In response to the fact that the rate of increase in US September CPI announced on the morning of the 12th exceeded market expectations, US 10-year bond yields began to rise. Both of the three major indices were pushed by profit-making sales, and fell for the first time in 5 days. The 11 major S&P 500 sectors are generally higher than last week. The public utility sector was at the top of price increases of 2.49%, and the real estate sector was 2.30%...

Translated

6

豊国物産(米金融動向)

reacted to

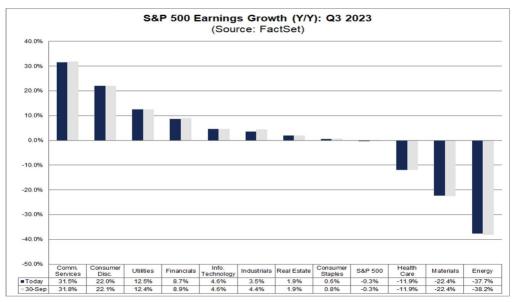

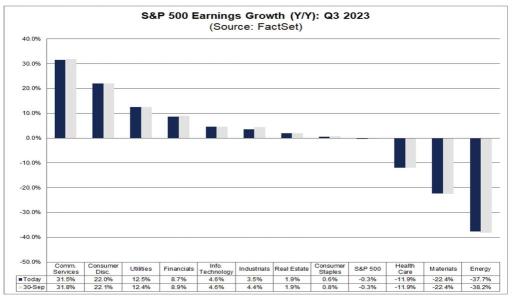

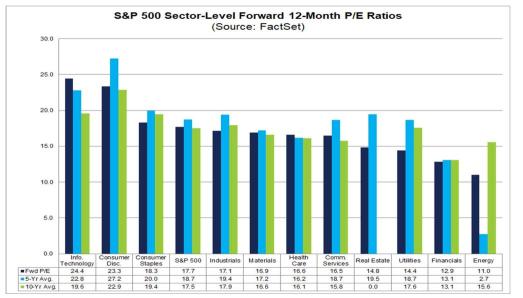

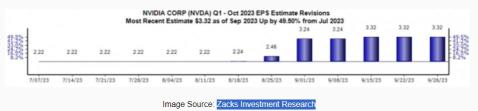

Major US companies to confirm bottoming out in '23 3Q financial results

Weekend 13, $JPMorgan (JPM.US)$ 、 $Wells Fargo & Co (WFC.US)$ Starting with the 3Q earnings announcement, major S&P 500 companies will enter the 3Q earnings season. According to the factset summary (as of 10/6), it was shown that the predicted EPS for the S&P 500 type 23 3Q fell 0.3% from the same period last year, and that profit would decline for the fourth consecutive quarter. Looking at performance momentum, it is likely that the 2Q fiscal year 23 will be the bottom, with profit falling 5.4% in the 22/4th quarter, the same 3.4% decrease in profit in the 23rd quarter, and the same 7.1% decrease in profit in 2'23. Currently, upward revisions to EPS predictions have been made one after another, mainly by major US tech companies. Since the predicted EPS of the US IT sector has only increased by 4.6%, along with the announcement of profit increase financial results by major US tech companies, there is also a possibility that the 23-quarter results of major US S&P 500 companies will turn into a positive zone for the first time in 4 quarters. Incidentally, according to the EPS forecast for 23/4Q and onwards, profit increased 7.8% for 23-4Q, and 2.4% for the full year of '23...

Weekend 13, $JPMorgan (JPM.US)$ 、 $Wells Fargo & Co (WFC.US)$ Starting with the 3Q earnings announcement, major S&P 500 companies will enter the 3Q earnings season. According to the factset summary (as of 10/6), it was shown that the predicted EPS for the S&P 500 type 23 3Q fell 0.3% from the same period last year, and that profit would decline for the fourth consecutive quarter. Looking at performance momentum, it is likely that the 2Q fiscal year 23 will be the bottom, with profit falling 5.4% in the 22/4th quarter, the same 3.4% decrease in profit in the 23rd quarter, and the same 7.1% decrease in profit in 2'23. Currently, upward revisions to EPS predictions have been made one after another, mainly by major US tech companies. Since the predicted EPS of the US IT sector has only increased by 4.6%, along with the announcement of profit increase financial results by major US tech companies, there is also a possibility that the 23-quarter results of major US S&P 500 companies will turn into a positive zone for the first time in 4 quarters. Incidentally, according to the EPS forecast for 23/4Q and onwards, profit increased 7.8% for 23-4Q, and 2.4% for the full year of '23...

Translated

6

豊国物産(米金融動向)

reacted to

Heightened geopolitical risks in the Middle East that blew away uncertainty about the Fed's monetary policy

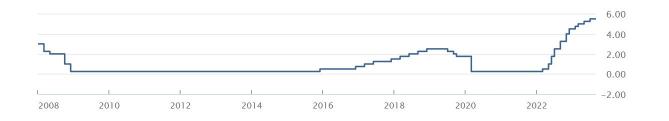

With the outbreak of the Palestinian crisis on the 7th of the weekend, there is a high possibility that the uncertainty surrounding the Fed's monetary policy will be put to an end for the time being. Along with the US interest rate hike cycle that began in 2022/3, the Fed's monetary policy has always been accompanied by three uncertainties: 1. The presence or absence of further interest rate hikes (25 bp), 2. Whether there is a final interest rate hike declaration, and 3. When to cut interest rates, Mr. Powell has faced it with a stance that all of monetary policy is “dependent on data” and does not clearly answer any of them. Even at the Jackson Hole Conference held in August, Mr. Powell persevered through his ambiguous position. Three points were taken up, such as uncertainty about an appropriate interest rate level, uncertainty about the time lag in monetary policy effects, and uncertainty in the US labor market that could be inflationary pressure, etc., and Mr. Powell pointed out the three uncertainties in making monetary policy decisions. In preparation for the soft landing of the US economy, it was seen that Mr. Powell was struggling with dialogue with the market through references to various uncertainties, but he witnessed a heightened “geopolitical risk in the Middle East” due to the rekindling of the Palestine conflict, and...

With the outbreak of the Palestinian crisis on the 7th of the weekend, there is a high possibility that the uncertainty surrounding the Fed's monetary policy will be put to an end for the time being. Along with the US interest rate hike cycle that began in 2022/3, the Fed's monetary policy has always been accompanied by three uncertainties: 1. The presence or absence of further interest rate hikes (25 bp), 2. Whether there is a final interest rate hike declaration, and 3. When to cut interest rates, Mr. Powell has faced it with a stance that all of monetary policy is “dependent on data” and does not clearly answer any of them. Even at the Jackson Hole Conference held in August, Mr. Powell persevered through his ambiguous position. Three points were taken up, such as uncertainty about an appropriate interest rate level, uncertainty about the time lag in monetary policy effects, and uncertainty in the US labor market that could be inflationary pressure, etc., and Mr. Powell pointed out the three uncertainties in making monetary policy decisions. In preparation for the soft landing of the US economy, it was seen that Mr. Powell was struggling with dialogue with the market through references to various uncertainties, but he witnessed a heightened “geopolitical risk in the Middle East” due to the rekindling of the Palestine conflict, and...

Translated

+2

11

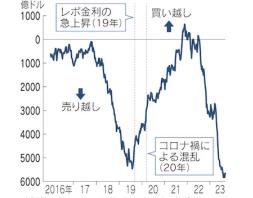

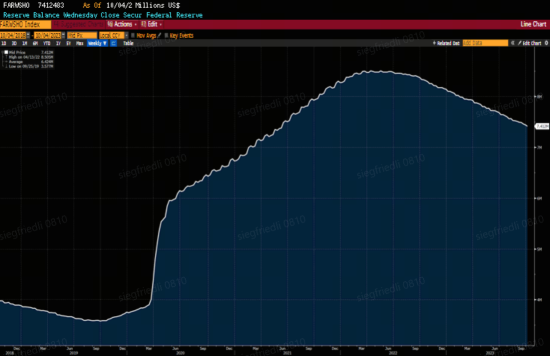

US employment statistics (September) were solid, but within the range of the Federal Reserve's expectations and not numbers that could change monetary policy. As student loan repayments resume and excess deposits are depleted, the market is starting to feel the impact of quantitative tightening (QT), and there are also views that US stocks will not rise in the future.

Despite the current situation with inflation and wages peaking, the labor market remains strong, and the difference in monetary policy lies in whether to deal with it through (1) interest rate hikes (Volcker's approach) or (2) stopping interest rate hikes and dealing with it at current levels for an extended period (Powell's approach). Chairman Powell has already chosen the latter, which involves dealing with it over a long period of time, but the market is concerned that strong economic indicators could lead to a change in interest rate policy. That is why long-term bonds are being sold.

The press conference after the FOMC meeting in July, where Chairman Powell left room for further rate hikes depending on future data, is considered a mistake. The IMF annual meeting will be held in Morocco from this week (October 9th to 15th). Over the past two years, there have been clear changes in US monetary policy during discussions between Japan, the US, and Europe. Subsequent FOMC meetings have confirmed changes in monetary policy.

This year...

Despite the current situation with inflation and wages peaking, the labor market remains strong, and the difference in monetary policy lies in whether to deal with it through (1) interest rate hikes (Volcker's approach) or (2) stopping interest rate hikes and dealing with it at current levels for an extended period (Powell's approach). Chairman Powell has already chosen the latter, which involves dealing with it over a long period of time, but the market is concerned that strong economic indicators could lead to a change in interest rate policy. That is why long-term bonds are being sold.

The press conference after the FOMC meeting in July, where Chairman Powell left room for further rate hikes depending on future data, is considered a mistake. The IMF annual meeting will be held in Morocco from this week (October 9th to 15th). Over the past two years, there have been clear changes in US monetary policy during discussions between Japan, the US, and Europe. Subsequent FOMC meetings have confirmed changes in monetary policy.

This year...

Translated

6

豊国物産(米金融動向)

liked

The Dow average continued to fall for 3 weeks in the US stock market until 10/5, and the S&P 500 continued to fall for 5 weeks. The NASDAQ continued to grow slightly while remaining flat. Assuming that the number of job offers for the US August (JOLTS US Employment Dynamics Survey) announced on the 3rd was 9.61 million, which greatly exceeded market expectations (8.8 million cases), and a tightening of US labor supply and demand was shown, observations of prolonged financial tightening by the Fed intensified. The 10-year US bond yield hit a high level of 4.81% every day for the first time in about 16 years, and the Dow average showed a decline of over 500 dollars at one point, and continued to fall drastically for 3 days. The US IT sector, which has a high PER, was sold, and the NASDAQ fell for the first time in 5 business days. Market sentiment also worsened due to a succession of hawkish statements by US Fed members, such as support for additional interest rate hikes at the November meeting and maintaining high level FF rates for a long period of time. The number of US ADP employed people in September, which was announced on the 4th, fell far short of market expectations, and the ISM non-manufacturing business confidence index in September showed a deceleration, so buyback was entered into US bonds, the rise in long-term US interest rates came to a standstill, and the three major indices all rebounded. Ahead of the announcement of US employment statistics for September on the 6th, the 3 major US indices fell slightly on the 5th, but were almost different from the day before...

Translated

3

豊国物産(米金融動向)

liked

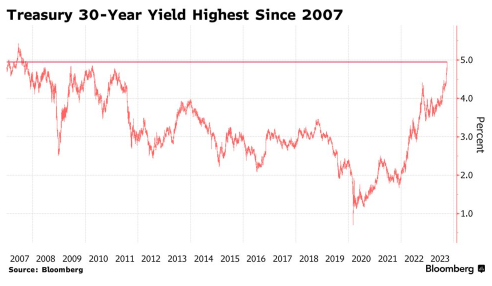

The August US Employment Dynamics Survey that triggered the rapid increase in long-term US interest rates

In the US bond market on 10/3, 10-year bond yields and 30-year bond yields all skyrocketed (bond prices fell). The 10-year bond yield, which is an indicator of long-term US interest rates, temporarily reached 4.806%, and the 30-year bond yield temporarily reached 4.950%, both of which set a high level for the first time in 16 years since 2007. The reason for the rapid increase in long-term interest rates in the US was an unexpected rapid increase in the number of US JOLTS (Employment Dynamics Survey) jobs for August announced on 10/3. The number of JOLTS jobs in August was 9.61 million, an increase of 690,000 cases compared to the 8.8 million cases predicted by the market, showing a high increase for the first time in about 2 years. The number of job offers in July was revised upward from 8.827 million to 8.92 million. Assuming that the tight US employment situation was shown, it seems that caution against additional interest rate hikes by the Fed led to a rapid increase in long-term interest rates at the November meeting. In response to the August JOLTS announcement, in the FF interest rate futures market, while the probability of leaving interest rates unchanged fell from 72.8% to 67.8% at the November meeting, the probability of a 25 bp interest rate hike rose from 27.2% to 32.4%.

What is the feeling that supply and demand in US labor are tight...

In the US bond market on 10/3, 10-year bond yields and 30-year bond yields all skyrocketed (bond prices fell). The 10-year bond yield, which is an indicator of long-term US interest rates, temporarily reached 4.806%, and the 30-year bond yield temporarily reached 4.950%, both of which set a high level for the first time in 16 years since 2007. The reason for the rapid increase in long-term interest rates in the US was an unexpected rapid increase in the number of US JOLTS (Employment Dynamics Survey) jobs for August announced on 10/3. The number of JOLTS jobs in August was 9.61 million, an increase of 690,000 cases compared to the 8.8 million cases predicted by the market, showing a high increase for the first time in about 2 years. The number of job offers in July was revised upward from 8.827 million to 8.92 million. Assuming that the tight US employment situation was shown, it seems that caution against additional interest rate hikes by the Fed led to a rapid increase in long-term interest rates at the November meeting. In response to the August JOLTS announcement, in the FF interest rate futures market, while the probability of leaving interest rates unchanged fell from 72.8% to 67.8% at the November meeting, the probability of a 25 bp interest rate hike rose from 27.2% to 32.4%.

What is the feeling that supply and demand in US labor are tight...

Translated

9

US long-term bonds continue to decline, with long-term interest rates rising. Stocks are also being sold. The JOLTS job openings were a trigger for selling at 9.61 million, but compared to the number of unemployed at 1.51 times, it is lower than the previous month's 1.53. Also, it is definitely lower than the maximum of 2 times, so it is not the true cause.

The market is feeling fear due to the continuation of a strong economy and high inflation (crude oil, rent, wages), as well as the maintenance of further interest rate hikes and long-term high interest rate policies. There is also anxiety about the deterioration of bond supply and demand due to the change in macro policy for corporate capital investment to be done with government subsidies instead of borrowing.

In addition, the recent rise in long-term interest rates (fall in long-term bonds) is affecting the approaching deadline of the trader's and hedge fund's bonus calculation period at the end of October (effectively the end of the period). Adjustments to positions must be made before the end of the period. Especially this Friday, which is a unique day for flash crashes where significant market fluctuations are more likely to occur. This is because it is the day before a 3-day weekend in the US and Japan and coincides with the holiday in China, resulting in a sudden reduction in liquidity.

Downgrades, government shutdowns, and concerns about supply and demand have expanded the unwind positions in US bond futures.

The market is feeling fear due to the continuation of a strong economy and high inflation (crude oil, rent, wages), as well as the maintenance of further interest rate hikes and long-term high interest rate policies. There is also anxiety about the deterioration of bond supply and demand due to the change in macro policy for corporate capital investment to be done with government subsidies instead of borrowing.

In addition, the recent rise in long-term interest rates (fall in long-term bonds) is affecting the approaching deadline of the trader's and hedge fund's bonus calculation period at the end of October (effectively the end of the period). Adjustments to positions must be made before the end of the period. Especially this Friday, which is a unique day for flash crashes where significant market fluctuations are more likely to occur. This is because it is the day before a 3-day weekend in the US and Japan and coincides with the holiday in China, resulting in a sudden reduction in liquidity.

Downgrades, government shutdowns, and concerns about supply and demand have expanded the unwind positions in US bond futures.

Translated

7

Since the government shutdown was avoided, the movement to buy risk assets by selling safe assets has intensified. As a result, long-term interest rates have risen. Uncertainty factors overlap, such as the postponement of government shutdowns, the UAW strike, and the resumption of student loan payments. In this situation, opinions are divided even among Fed directors. Just yesterday, while Director Bowman of the hawk faction insisted on multiple interest rate hikes by the end of the year even if PCE settles down, Vice Chairman Barr (in charge of financial supervision) acknowledged that issues have already shifted to a period of maintaining high interest rates, and interest rate hikes are in the final phase. In the end, Chairman Powell will decide, and it seems that Chairman Powell will agree with Vice Chairman Barr.

The difference in judgment between Director Bowman and Vice Chairman Barr is how much emphasis is placed on financial stability in monetary policy purposes. Vice Chairman Barr said that financial stability has been the biggest concern since the birth of the Fed system in 1913, and he is afraid that raising interest rates too much will destabilize the financial system. In order to achieve the three policy goals of price stability, economic stability, and financial stability with a single policy instrument (interest rate), it is necessary for the Fed to make comprehensive judgments based on exquisite technology. Ba...

The difference in judgment between Director Bowman and Vice Chairman Barr is how much emphasis is placed on financial stability in monetary policy purposes. Vice Chairman Barr said that financial stability has been the biggest concern since the birth of the Fed system in 1913, and he is afraid that raising interest rates too much will destabilize the financial system. In order to achieve the three policy goals of price stability, economic stability, and financial stability with a single policy instrument (interest rate), it is necessary for the Fed to make comprehensive judgments based on exquisite technology. Ba...

Translated

8

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)