路人辛酉

voted

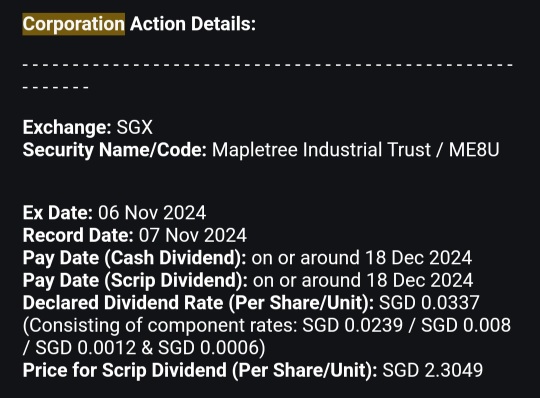

Today marks the date where shareholders need to respond to Moomoo if they would like to receive scrip instead of cash dividend for $Mapletree Ind Tr (ME8U.SG)$ . The price range by mid morning is between 2.33 and 2.28. By 2pm, the range is between 2.24 and 2.28.![]()

Would the avoidance of trading fee impact your decision? Or would the increase in holdings be your objective? Do comment and share your views![]()

Would the avoidance of trading fee impact your decision? Or would the increase in holdings be your objective? Do comment and share your views

1

1

路人辛酉

commented on

$Mapletree PanAsia Com Tr (N2IU.SG)$ For this dividend, do we have a choice of Scrip / Cash? just like MLT and MIT? Thanks

1

7

路人辛酉

liked

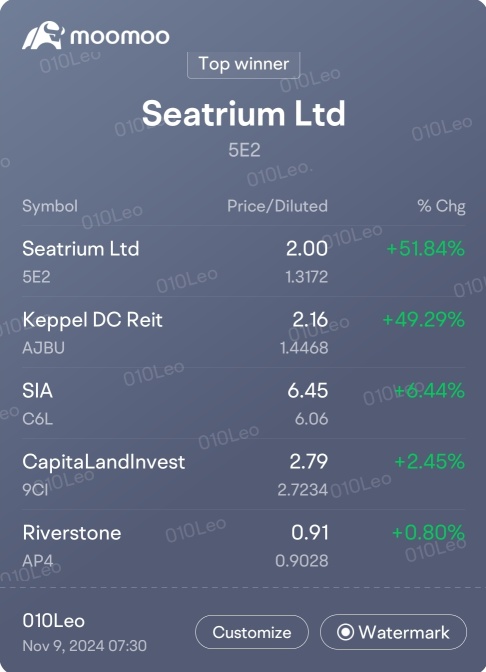

volatile week.

here's my top 5 winners and losers.

plan? continue to dca the strongest sreits. sadly not much bullet left.

glad $XPENG-W (09868.HK)$ returning to former glory.

here's my top 5 winners and losers.

plan? continue to dca the strongest sreits. sadly not much bullet left.

glad $XPENG-W (09868.HK)$ returning to former glory.

20

3

路人辛酉

voted

Hi mooers! ![]()

The Federal Reserve is scheduled hold FOMC meeting and press conference on November 7. This is crucial for the future trajectory of the U.S. and global economy.

The Commerce Department's personal consumption expenditures (PCE) price index, closely watched by the Federal Reserve, increased 0.2% month-over-month in September. Excluding food and energy, the September PCE price index rose 0.3% MoM and 2.7% YoY. On ...

The Federal Reserve is scheduled hold FOMC meeting and press conference on November 7. This is crucial for the future trajectory of the U.S. and global economy.

The Commerce Department's personal consumption expenditures (PCE) price index, closely watched by the Federal Reserve, increased 0.2% month-over-month in September. Excluding food and energy, the September PCE price index rose 0.3% MoM and 2.7% YoY. On ...

89

101

8

$AIMS APAC Reit (O5RU.SG)$

$Mapletree Log Tr (M44U.SG)$

$Mapletree Ind Tr (ME8U.SG)$ $FRASERS CENTREPOINT TRUST (J69U.SG)$ $Mapletree PanAsia Com Tr (N2IU.SG)$

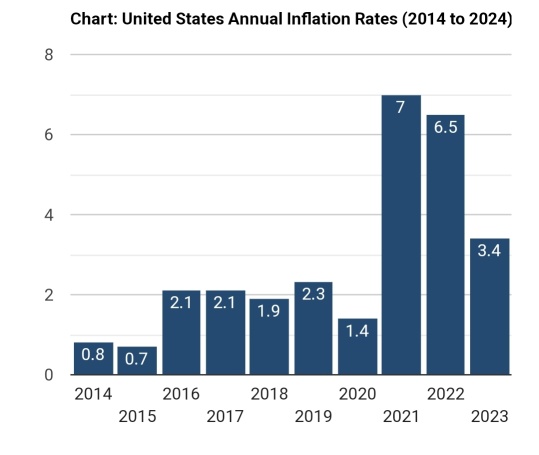

With recents bad financial results for some of the reits and US 10 year treasury yield picking up. S reits are heavily hammered again.

Market is pricing in US inflation will be going up again if Donald Trump wins the upcoming US presidential election evidently thru the 10 year US treasury yield is back to above 4%.

If you look ...

$Mapletree Log Tr (M44U.SG)$

$Mapletree Ind Tr (ME8U.SG)$ $FRASERS CENTREPOINT TRUST (J69U.SG)$ $Mapletree PanAsia Com Tr (N2IU.SG)$

With recents bad financial results for some of the reits and US 10 year treasury yield picking up. S reits are heavily hammered again.

Market is pricing in US inflation will be going up again if Donald Trump wins the upcoming US presidential election evidently thru the 10 year US treasury yield is back to above 4%.

If you look ...

1

7

路人辛酉

liked

Time for another look at the SREITs sector. I examine the challenging environment and explore why we are facing down side pressure. I reiterated on the importance of being selective when it comes SREITs.

iEdge S-Reit Index Weekly Review 28 Oct 24 - Dividends Pay For My Kopi

In the companion podcast we dive into:

• Why is the interest rate cut not helping

• Accepting the challenging situation

• Being selective in SREITs may help

• Why some SREITs are doing well

• Why some SREITs are not doin...

iEdge S-Reit Index Weekly Review 28 Oct 24 - Dividends Pay For My Kopi

In the companion podcast we dive into:

• Why is the interest rate cut not helping

• Accepting the challenging situation

• Being selective in SREITs may help

• Why some SREITs are doing well

• Why some SREITs are not doin...

26

1

路人辛酉

liked and commented on

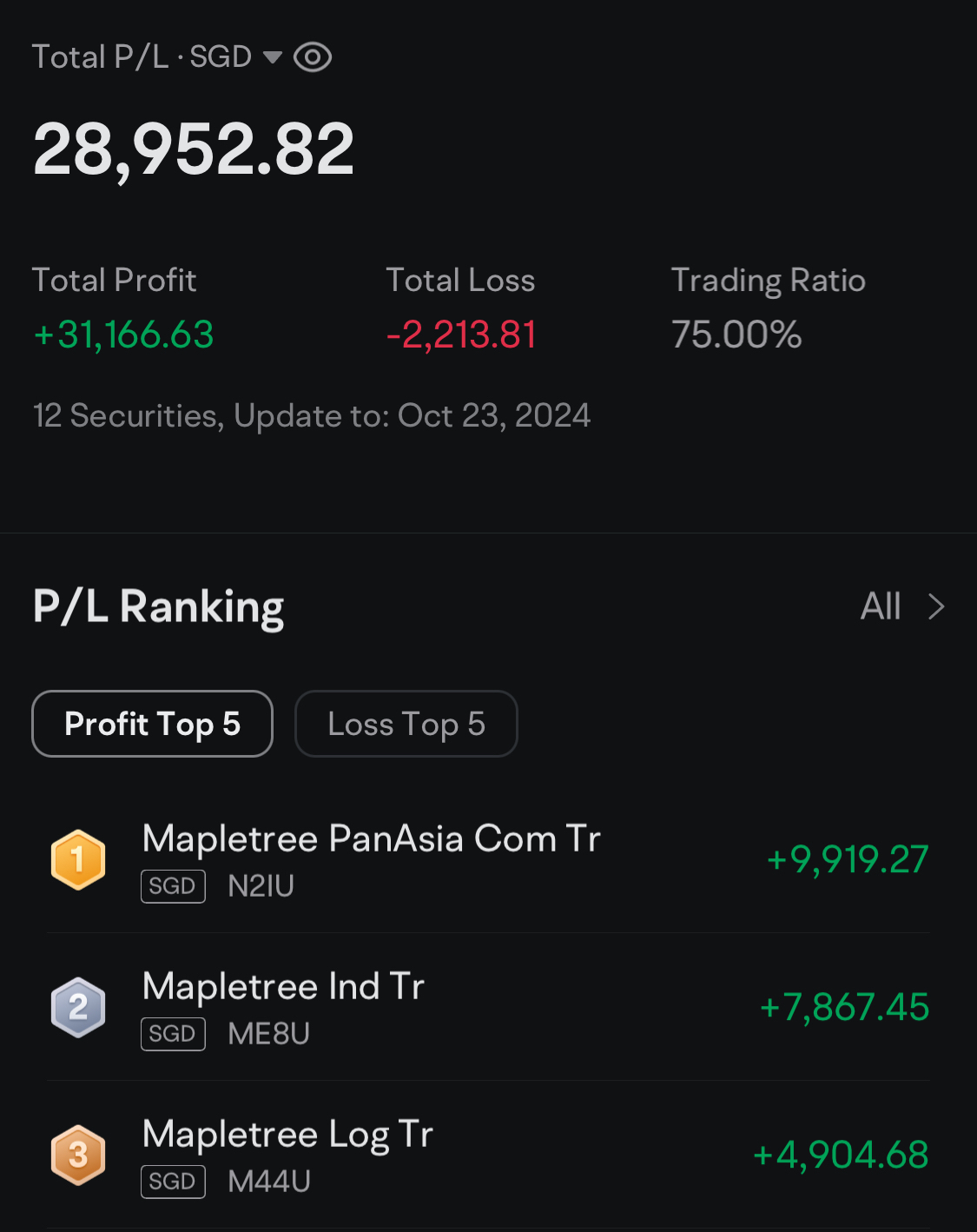

Dear friends,

For transparency sake, I would like to share that I’ve sold all my REITs position. I had initially wanted to hold the REITs for long but the large property holdings of MLT and MPACT in China is a real drag on the two REITs. And I feel it will take at least several years before the property situation in China recovers. MIT is the only one that gives me confidence but I’ve sold it as well because I believe the poor results of MPACT and MLT will sour sentiments and d...

For transparency sake, I would like to share that I’ve sold all my REITs position. I had initially wanted to hold the REITs for long but the large property holdings of MLT and MPACT in China is a real drag on the two REITs. And I feel it will take at least several years before the property situation in China recovers. MIT is the only one that gives me confidence but I’ve sold it as well because I believe the poor results of MPACT and MLT will sour sentiments and d...

31

32

1

路人辛酉

commented on

Reits' risk level has heighten with current geopolitical issue. Pricing in continous interest rate cut is quite risky.

Rate cut is a need but U.S. are being pulled back by Israel issue. Israel cannot wait for U.S. aid. Can U.S. give up on Israel and focus on its Election and win back its investors?

Please be careful with reits investing. We are currently in between financial war (rate cut), physical war, U.S. election.

30 days no war order has been give...

Rate cut is a need but U.S. are being pulled back by Israel issue. Israel cannot wait for U.S. aid. Can U.S. give up on Israel and focus on its Election and win back its investors?

Please be careful with reits investing. We are currently in between financial war (rate cut), physical war, U.S. election.

30 days no war order has been give...

6

15

路人辛酉

liked

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)