First write the password, Hong Kong stocks, with 3800, having the courage to either succeed or perish. $GCL TECH (03800.HK)$ , 3800, has the courage to either succeed or perish.

Logic: Highneck Capital leads a 2.4 billion investment.

Whether experts are bullish is not important. What matters most is when those not from the industry bring real money and silver into play.

The historical track record of high-capital is impressive:

Silicon material leader tongwei co.,ltd, subscribed for 0.5 billion yuan in high-level recognition, corresponding to a stock price of 28 yuan/share; currently 44.

Power inverter leader sungrow power supply, subscribed for 0.517 billion yuan, corresponding to a stock price of 57.5 yuan/share; currently 140.

Component integration leader longi green energy technology co., ltd., subscribed for 15.8 billion yuan, corresponding to a stock price of 70 yuan/share. Currently 80.

It can be said that high-level capital has not failed in taking the photovoltaic leader. Their industry awareness is top-notch.

In February this year, Jiangsu Zhongneng and $TCL Zhonghuan Renewable Energy Technology (002129.SZ)$ 、 $LONGi Green Energy Technology (601012.SH)$ respectively signed long-term sales contracts for 0.35 million tons and 0.914 million tons of polycrystalline silicon. Among them, Jiangsu Zhongneng is the key project after this round of Poly-Cunxin's rights issue fundraising.

In the first half of this year, Poly Xin also saw a rebound in performance, with the company's revenue reaching 8.779 billion RMB and a net income of about 2.407 billion RMB for the mother company.

Based on the current valuation and performance expectations, Poly Xin's PE ratio for next year's annual report period is only around 10. It is considered severely undervalued in the photovoltaic industry.

Regarding Tongwei Co., Ltd., the company's revenue and net income have soared in the first three quarters this year.

Logic: Highneck Capital leads a 2.4 billion investment.

Whether experts are bullish is not important. What matters most is when those not from the industry bring real money and silver into play.

The historical track record of high-capital is impressive:

Silicon material leader tongwei co.,ltd, subscribed for 0.5 billion yuan in high-level recognition, corresponding to a stock price of 28 yuan/share; currently 44.

Power inverter leader sungrow power supply, subscribed for 0.517 billion yuan, corresponding to a stock price of 57.5 yuan/share; currently 140.

Component integration leader longi green energy technology co., ltd., subscribed for 15.8 billion yuan, corresponding to a stock price of 70 yuan/share. Currently 80.

It can be said that high-level capital has not failed in taking the photovoltaic leader. Their industry awareness is top-notch.

In February this year, Jiangsu Zhongneng and $TCL Zhonghuan Renewable Energy Technology (002129.SZ)$ 、 $LONGi Green Energy Technology (601012.SH)$ respectively signed long-term sales contracts for 0.35 million tons and 0.914 million tons of polycrystalline silicon. Among them, Jiangsu Zhongneng is the key project after this round of Poly-Cunxin's rights issue fundraising.

In the first half of this year, Poly Xin also saw a rebound in performance, with the company's revenue reaching 8.779 billion RMB and a net income of about 2.407 billion RMB for the mother company.

Based on the current valuation and performance expectations, Poly Xin's PE ratio for next year's annual report period is only around 10. It is considered severely undervalued in the photovoltaic industry.

Regarding Tongwei Co., Ltd., the company's revenue and net income have soared in the first three quarters this year.

Translated

2

1

1

邱秋球

liked

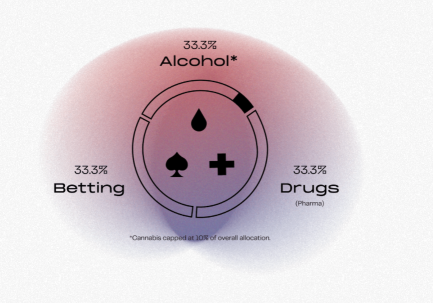

Yesterday, The BAD Investment Company announced the launch of the $B.A.D. ETF (BAD.US)$. The indexed large-cap fund is designed to offer investors equally weighted exposure to the "BAD" market segments — betting (casinos, gaming, and online gaming operations), alcohol/cannabis (alcoholic beverage manufacturing and distribution and/or cannabis cultivation and sales), and drugs (pharmaceutical and biotechnology product development and manufacturing) — by providing investment results that closely track the performance, before fees and expenses, of the EQM BAD Index (BADIDX).

With the proliferation of whitewashed ESG products and market sub-segments like sports betting and cannabis becoming more widely accepted socially and legally, we saw an opportunity to fill what we perceived as a gap in the marketplace. We came to that conclusion primarily by listening and watching this newly energized retail crowd over the past year.”

--- said Tommy Mancuso, president and founder of the BAD Investment Company, which owns the EQM BAD Index that BAD will track.

“We believe they want investment products rooted in transparency and quality that they may also be able to understand and relate to as consumers whether that is in health, wellbeing, or entertainment.”

--- Tommy Mancuso added.

The fund's launch comes amid a frenzy of ESG-fund debuts. In December alone, $Goldman Sachs (GS.US)$, $Bank of New York Mellon (BK.US)$, $JPMorgan (JPM.US)$ and Cathie Woods Ark Investment Management have introduced ETFs with sustainable tilts. (ESG ETF![]() : $GOLDMAN SACHS FUTURE PLANET EQUITY ETF (GSFP.US)$, $BNY Mellon Sustainable International Equity ETF (BKIS.US)$ , $JPMORGAN CLIMATE CHANGE SOLUTIONS ETF (TEMP.US)$, $ARK TRANSPARENCY ETF (CTRU.US)$ )

: $GOLDMAN SACHS FUTURE PLANET EQUITY ETF (GSFP.US)$, $BNY Mellon Sustainable International Equity ETF (BKIS.US)$ , $JPMORGAN CLIMATE CHANGE SOLUTIONS ETF (TEMP.US)$, $ARK TRANSPARENCY ETF (CTRU.US)$ )

Top 15 Holdings of BAD

Our mission is to position ourselves in a unique manner compared to most fund management companies. It's our opinion that we don't think or dress like the typical 'suit,' but are fully capable of harnessing the expertise and insights of Wall Street to provide strategically designed investment products.”

--- Tommy Mancuso said.

The expense ratio of BAD will be 0.75%.

Do you perfer ESG ETF or this anti-ESG ETF?

Source: The BAD Investment, Businesswire, Bloomberg

With the proliferation of whitewashed ESG products and market sub-segments like sports betting and cannabis becoming more widely accepted socially and legally, we saw an opportunity to fill what we perceived as a gap in the marketplace. We came to that conclusion primarily by listening and watching this newly energized retail crowd over the past year.”

--- said Tommy Mancuso, president and founder of the BAD Investment Company, which owns the EQM BAD Index that BAD will track.

“We believe they want investment products rooted in transparency and quality that they may also be able to understand and relate to as consumers whether that is in health, wellbeing, or entertainment.”

--- Tommy Mancuso added.

The fund's launch comes amid a frenzy of ESG-fund debuts. In December alone, $Goldman Sachs (GS.US)$, $Bank of New York Mellon (BK.US)$, $JPMorgan (JPM.US)$ and Cathie Woods Ark Investment Management have introduced ETFs with sustainable tilts. (ESG ETF

Top 15 Holdings of BAD

Our mission is to position ourselves in a unique manner compared to most fund management companies. It's our opinion that we don't think or dress like the typical 'suit,' but are fully capable of harnessing the expertise and insights of Wall Street to provide strategically designed investment products.”

--- Tommy Mancuso said.

The expense ratio of BAD will be 0.75%.

Do you perfer ESG ETF or this anti-ESG ETF?

Source: The BAD Investment, Businesswire, Bloomberg

28

1

6

邱秋球

commented on

The sudden outbreak of the Omicron variant has turned the world into chaos. Almost without anyone noticing, 2021 is quietly coming to an end.

In the past year, we've been through a lot, good and bad. Biden was elected president of the United States, and Merkel stepped down. The postponed 2020 Tokyo Olympic Games were finally held this year. 2021 also marks the 20th anniversary of "9·11"... Elon Musk surpassed Bezos twice to become the wealthiest person on this planet. S&P 500 hit the record-high earlier this year. And as we've put it before, Omicron – a variant of COVID-19 – suddenly broke out...

What a year! For every moment, we are all witnessing history. In fact, we ourselves become part of history. Perhaps a quote can somehow describe how we feel at this moment, "There is only one kind of heroism in the world, that is, after recognizing the essence of life, you still love it." Cheers to all!

Likewise, it is also a remarkable year for moomoo. Having brought a bundle of new blockbuster features to mooers (e.g., Bracket Order, Multiple Exchanges Data of LV2 Quotes for US Stock, Star Institution, etc.), moomoo will continue to polish our products and listen to feedback from users. Click here to view Features of the Year 2021. Moomoo has taken quite a step forward in the past year, yet we still value your voice. As Christmas is approaching, now we've got Santa moo in the town! Yessss! We sincerely invite all mooers to join us, make #My Christmas Wishlist for 2022 together, and just leave the rest to Santa moo!![]()

![]()

![]()

![]() What is the moomoo Christmas Wishlist for?

What is the moomoo Christmas Wishlist for?

Christmas Wishlist is our tradition to celebrate Christmas and make good wishes together for the upcoming new year. It's an excellent opportunity for us to listen to our mooers and continue to improve ourselves to become the intuitive and powerful investing platform for all. At this moment, any constructive ideas are warmly welcome!

![]() What's on your Christmas Wishlist for 2022?

What's on your Christmas Wishlist for 2022?

Don't hesitate to tell us what NEW FEATURES or SERVICES you want the most from moomoo and how we can improve in the future. The reasons and details of your wishes are highly appreciated. They are vital for us to understand the needs of our mooers better. Our team will deliver new features and services accordingly by considering what mooers need and want the most in the upcoming 2022.

You can like the wishlists posted by other mooers to support them as well.

![]() Rewards:

Rewards:

1. 20 FREE STOCKS!!!![]()

![]()

![]()

Based on the number of LIKEs. Each of the 20 most liked posts will be given 1 free stock (value: $5 – $50).

2. 10 moomoo EXCLUSIVE MERCHANDISE!!!![]()

![]()

![]()

Based on selection. We will select 10 constructive ideas about new features or services, then reward each with 1 moomoo Exclusive Merchandise.

3. POINTS!!!![]()

![]()

![]()

The rest of the participants will be rewarded with 100 points.

*Only those who wrote a minimum of 20 words and added the topic #My Christmas Wishlist for 2022 to their posts are eligible for our rewards. Please post relevant content under the topic.

![]() Duration:

Duration:

Now - 23:59 Dec. 31st (ET)

The winning lists will be announced on Jan. 12th, 2022.

![]() Notes:

Notes:

1. If some of you come up with the same idea, we will count the first one. First come, first served.

2. Reward 1 and 2 are not exclusive to each other. You can win both!

3. Write your original ideas: Plagiarism or cheating is not acceptable in any activities of Moo. Please "report" the suspicious posts if you find any. Once confirmed, the user committed shall be disqualified from the activities.

So, what's your wish for 2022?

In the past year, we've been through a lot, good and bad. Biden was elected president of the United States, and Merkel stepped down. The postponed 2020 Tokyo Olympic Games were finally held this year. 2021 also marks the 20th anniversary of "9·11"... Elon Musk surpassed Bezos twice to become the wealthiest person on this planet. S&P 500 hit the record-high earlier this year. And as we've put it before, Omicron – a variant of COVID-19 – suddenly broke out...

What a year! For every moment, we are all witnessing history. In fact, we ourselves become part of history. Perhaps a quote can somehow describe how we feel at this moment, "There is only one kind of heroism in the world, that is, after recognizing the essence of life, you still love it." Cheers to all!

Likewise, it is also a remarkable year for moomoo. Having brought a bundle of new blockbuster features to mooers (e.g., Bracket Order, Multiple Exchanges Data of LV2 Quotes for US Stock, Star Institution, etc.), moomoo will continue to polish our products and listen to feedback from users. Click here to view Features of the Year 2021. Moomoo has taken quite a step forward in the past year, yet we still value your voice. As Christmas is approaching, now we've got Santa moo in the town! Yessss! We sincerely invite all mooers to join us, make #My Christmas Wishlist for 2022 together, and just leave the rest to Santa moo!

Christmas Wishlist is our tradition to celebrate Christmas and make good wishes together for the upcoming new year. It's an excellent opportunity for us to listen to our mooers and continue to improve ourselves to become the intuitive and powerful investing platform for all. At this moment, any constructive ideas are warmly welcome!

Don't hesitate to tell us what NEW FEATURES or SERVICES you want the most from moomoo and how we can improve in the future. The reasons and details of your wishes are highly appreciated. They are vital for us to understand the needs of our mooers better. Our team will deliver new features and services accordingly by considering what mooers need and want the most in the upcoming 2022.

You can like the wishlists posted by other mooers to support them as well.

1. 20 FREE STOCKS!!!

Based on the number of LIKEs. Each of the 20 most liked posts will be given 1 free stock (value: $5 – $50).

2. 10 moomoo EXCLUSIVE MERCHANDISE!!!

Based on selection. We will select 10 constructive ideas about new features or services, then reward each with 1 moomoo Exclusive Merchandise.

3. POINTS!!!

The rest of the participants will be rewarded with 100 points.

*Only those who wrote a minimum of 20 words and added the topic #My Christmas Wishlist for 2022 to their posts are eligible for our rewards. Please post relevant content under the topic.

Now - 23:59 Dec. 31st (ET)

The winning lists will be announced on Jan. 12th, 2022.

1. If some of you come up with the same idea, we will count the first one. First come, first served.

2. Reward 1 and 2 are not exclusive to each other. You can win both!

3. Write your original ideas: Plagiarism or cheating is not acceptable in any activities of Moo. Please "report" the suspicious posts if you find any. Once confirmed, the user committed shall be disqualified from the activities.

So, what's your wish for 2022?

+2

564

482

49

邱秋球

commented on

Today's stock market adjustment is not news anymore, Weya's tax payment is the big news. The national dilemma reflected by Weya's tax payment is the most important.

Actually, it's just four words, financial tightness.

The tax avoidance method used by Weya is the mainstream tax avoidance method nowadays, including how Fan Bingbing was taxed back then. If you are familiar with tax planning, you should know that it is done by setting up a shell company to convert high income into assessed tax. With such an operation, the final profit of 100 million yuan may only be subject to a tax of 5 points. In contrast, if it is reported honestly, corporate income tax and personal income tax will be about 45 points.

Who has a bad relationship with money? Normal people would not go through the hassle of filing 45 tax points. Apart from the salaries of corporate executives on the surface. The reason why there were no issues before but now there are problems is because the country is implementing the policy of common prosperity, trying to reclaim the tax avoidance money from the high-income groups.

Do you think Viya broke the law? Certainly, she did break the law, but before it was just brushed off as a minor issue, with no one reporting and no officials investigating. But things are different now, as there is the will to target the wealthy, especially those in the influential fields like livestreaming. It used to be movie stars, now it's live streaming influencers. With the society, both domestically and internationally, cracking down on the wealthy, even though the poor may not benefit monetarily, they are very happy to watch the drama unfold.

So, how does this common prosperity relate to stock market investments? The connection is significant. You need to see the country's determination for common prosperity, what are they emphasizing?

Fairness! Fairness! Damn fairness!

So in the future, there are many industries whose prospects have been cut down by the national policy of fairness. Especially internet-platform companies that have used traffic to generate wealth, such as Alibaba, Douyin Toutiao, and Meituan.

Among these platforms, who is the smartest? It's the Douyin Toutiao system.

I'll explain so you understand. If you haven't watched Douyin videos, you might have heard of this account, Zhang. In just a few months, he has gained tens of millions of fans by filming rural life. Even the People's Daily has made a special comment on it. Some say it's because of his professional filming techniques, while others say that people are tired of the glamorous city life and long for the countryside.

You're all wrong.

This is the most obvious case under the national strategy of common prosperity. The goal is to create opportunities for the grassroots. Only when the grassroots have opportunities, can they represent the majority of ordinary people and have the chance to become the next Zhang. Douyin really understands the national policies, supporting poverty alleviation, rural assistance, and grassroots short video entrepreneurship. In the future, there will be a large number of Zhang-type entrepreneurs supported, showcasing various opportunities and lives in rural areas with tremendous traffic. If you happen to be a short video entrepreneur or live-streaming e-commerce, you should see this trend. This is the policy orientation conveyed by the will of the nation. It is the best trend to start a business in rural areas in the future. Whether it is rural e-commerce or ecological tourism, these are all good directions for the future.

But the will of the nation also requires banks to reduce the yield of fixed-income products and promote comprehensive popularization of equity assets. This is also a method of common prosperity. Only when ordinary people have the opportunity for wealth growth, can this society be healthy. It's not about the rich getting richer through stock market investments, while ordinary people cannot see opportunities.

To grasp the opportunities that belong to you in the next 20 years, one must have a deep understanding of the national policy of common prosperity. At the same time, one must also consider: is it reasonable that Viya's income is in the tens of billions, yet her tax burden ratio is lower than people earning a few thousand in salary?

Is this reasonable?

Okay, let's briefly discuss these topics. If you're interested, we can talk about how the policies of the same world, the capital, and the country can bring us change in the future. $TENCENT (00700.HK)$ $BABA-W (09988.HK)$ $MEITUAN-W (03690.HK)$

Actually, it's just four words, financial tightness.

The tax avoidance method used by Weya is the mainstream tax avoidance method nowadays, including how Fan Bingbing was taxed back then. If you are familiar with tax planning, you should know that it is done by setting up a shell company to convert high income into assessed tax. With such an operation, the final profit of 100 million yuan may only be subject to a tax of 5 points. In contrast, if it is reported honestly, corporate income tax and personal income tax will be about 45 points.

Who has a bad relationship with money? Normal people would not go through the hassle of filing 45 tax points. Apart from the salaries of corporate executives on the surface. The reason why there were no issues before but now there are problems is because the country is implementing the policy of common prosperity, trying to reclaim the tax avoidance money from the high-income groups.

Do you think Viya broke the law? Certainly, she did break the law, but before it was just brushed off as a minor issue, with no one reporting and no officials investigating. But things are different now, as there is the will to target the wealthy, especially those in the influential fields like livestreaming. It used to be movie stars, now it's live streaming influencers. With the society, both domestically and internationally, cracking down on the wealthy, even though the poor may not benefit monetarily, they are very happy to watch the drama unfold.

So, how does this common prosperity relate to stock market investments? The connection is significant. You need to see the country's determination for common prosperity, what are they emphasizing?

Fairness! Fairness! Damn fairness!

So in the future, there are many industries whose prospects have been cut down by the national policy of fairness. Especially internet-platform companies that have used traffic to generate wealth, such as Alibaba, Douyin Toutiao, and Meituan.

Among these platforms, who is the smartest? It's the Douyin Toutiao system.

I'll explain so you understand. If you haven't watched Douyin videos, you might have heard of this account, Zhang. In just a few months, he has gained tens of millions of fans by filming rural life. Even the People's Daily has made a special comment on it. Some say it's because of his professional filming techniques, while others say that people are tired of the glamorous city life and long for the countryside.

You're all wrong.

This is the most obvious case under the national strategy of common prosperity. The goal is to create opportunities for the grassroots. Only when the grassroots have opportunities, can they represent the majority of ordinary people and have the chance to become the next Zhang. Douyin really understands the national policies, supporting poverty alleviation, rural assistance, and grassroots short video entrepreneurship. In the future, there will be a large number of Zhang-type entrepreneurs supported, showcasing various opportunities and lives in rural areas with tremendous traffic. If you happen to be a short video entrepreneur or live-streaming e-commerce, you should see this trend. This is the policy orientation conveyed by the will of the nation. It is the best trend to start a business in rural areas in the future. Whether it is rural e-commerce or ecological tourism, these are all good directions for the future.

But the will of the nation also requires banks to reduce the yield of fixed-income products and promote comprehensive popularization of equity assets. This is also a method of common prosperity. Only when ordinary people have the opportunity for wealth growth, can this society be healthy. It's not about the rich getting richer through stock market investments, while ordinary people cannot see opportunities.

To grasp the opportunities that belong to you in the next 20 years, one must have a deep understanding of the national policy of common prosperity. At the same time, one must also consider: is it reasonable that Viya's income is in the tens of billions, yet her tax burden ratio is lower than people earning a few thousand in salary?

Is this reasonable?

Okay, let's briefly discuss these topics. If you're interested, we can talk about how the policies of the same world, the capital, and the country can bring us change in the future. $TENCENT (00700.HK)$ $BABA-W (09988.HK)$ $MEITUAN-W (03690.HK)$

Translated

60

6

3

邱秋球

liked

did u get her 9th etf?? $ARK TRANSPARENCY ETF (CTRU.US)$ luv her logical reasoning, never affected by Short term flux!!!! esp she shared on how fund mgrs usually will wanna match close to the index and start to sell off related to her fund’ stks which r usually not in those index(or a small% only)

https://youtu.be/LgJ5WVruHzw

i just love her although i do not have the cash to hold any longer

$ARK Innovation ETF (ARKK.US)$ $ARK Fintech Innovation ETF (ARKF.US)$

https://youtu.be/LgJ5WVruHzw

i just love her although i do not have the cash to hold any longer

$ARK Innovation ETF (ARKK.US)$ $ARK Fintech Innovation ETF (ARKF.US)$

19

2

邱秋球

liked

Tencent Resumes of some apps after ChinaMiit's Relaxation Guidance Measures; QQ Music Guidance 11.0.5 version (IOS) in App Store.

Tencent's app has begun to resume updates, and QQ Music iOS version 11.0.5 was first released. This is also Tencent's first Tencent product update since the Ministry of Industry and Information Technology adopted transitional administrative guidance measures on November 24 this year. (IT House)

$TENCENT (00700.HK)$

$Tencent (TCEHY.US)$

Tencent's app has begun to resume updates, and QQ Music iOS version 11.0.5 was first released. This is also Tencent's first Tencent product update since the Ministry of Industry and Information Technology adopted transitional administrative guidance measures on November 24 this year. (IT House)

$TENCENT (00700.HK)$

$Tencent (TCEHY.US)$

Translated

30

邱秋球

liked

$Alibaba (BABA.US)$ Holding still for the long term. Not giving up in my case.

3

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)