This wave of violent rebound in large technology stocks is almost over. Even if it continues to rise, it will not be too short. The probability of shock and correction in this position is very high. Nvidia was obviously weak last night. Let’s see if Tesla can follow in the past two days. Call back too. The probability of a pullback at this position is greater than the probability of a sideways move, and the short-term burst, the game between bulls and bears will be very intense $Tesla(TSLA.US$ ���������...

1

1

Hong Kong stock liquidity now awkward to dig a hole to put yourself in. Although it was not very high in the past, at least it rose a lot last year, which was acceptable. Now, on the contrary, the market has been tightened and tightened, with funds from inside reluctant to come out and those from outside trying to come in but afraid to come in.

Hong Kong stocks can also have a look, I wrote a post before, the game within the Unite...

Hong Kong stocks can also have a look, I wrote a post before, the game within the Unite...

2

2

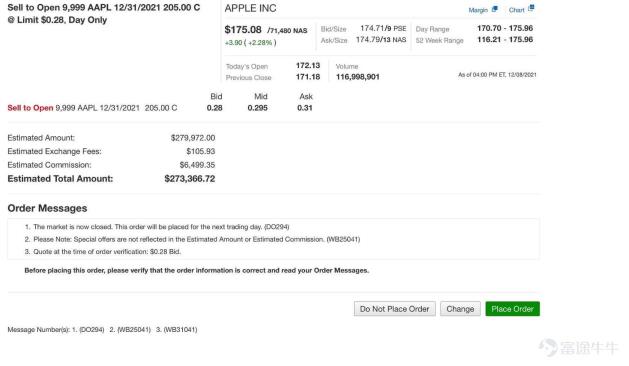

Following the sale of Pinduoduo Put and New Oriental Put, Mr. Duan made another covered call combination today. Although he is selling calls, he has stock in his hands, so he formed a group.

This is the order details. No transactions have been made yet. The order was placed to sell 9999 Apple Call cards due on December 31, 2021 (exercise price 205). The price limit is 0.28, and the total amount is 27.3W US dollars. I'm guessing this order will probably be sold tonight after fermentation during the day. This option traded 4,155 lots last night.

Next, let's talk about what a covered call is. This combination is usually made because they are worried that the stock price will not rise to a certain price, so they earn a portion of the premium by selling the call. Take the example of Teacher Bian Duan.

If the price of Apple is less than or equal to 205 US dollars before December 31st,Then Mr. Duan will be able to earn a steady income of 27.3w (so I doubt that Apple will pay 200 US dollars this month; otherwise, the pressure level of 200 US dollars is high enough. It is also a relatively stable price, and the premium is higher, but Mr. Duan chose 205, which actually had some considerations). At this point, the person who buys the call will lose all of the premium.

If the price of Apple is higher than 205 US dollars on the expiration dateThe person who bought this call will definitely ask to exercise the right. The buyer has the right to buy 99.99w Apple shares at a price of 205 US dollars. The buyer's earnings were (price at maturity - 205-0.28). Only when the expiration price is higher than 205.38 US dollars will the person who bought the call have a chance to make a profit. The closing price of Apple yesterday was 175.08, with a 17% premium. It is very difficult to make a profit.

One characteristic of the covered call combination is that once the strategy is used, the maximum potential return is limited. Once the stock price exceeds the exercise price, it has nothing to do with the shareholder.

Covered calls are more suitable for fluctuating ranges or short-term increases that are too large and are worried that they will not be able to raise the price you want, and earn a portion of the premium in advance through sell calls.

5% of the capital was used to sell the put. Yesterday, Pinduoduo and New Oriental received a premium of 3.6 million US dollars. If leverage is not calculated, the corresponding security deposit should be around 3,600 million US dollars. If there are only these two puts, then this account is estimated to be over 700 million US dollars in capital. But the point is, he probably sold more than just these two puts, so the funds in this account may have all started at 1 billion US dollars. That's a huge amount of funding.

To sum it up, I feel like Teacher Duan is optimistic about Apple's $200 this month (supervisor speculates). After all, Pinduoduo is also selling infinitely close to the lowest price. After all, Apple is currently experiencing a boom in the market, so please cherish the apple that is booming. In the last month or so, Tesla was the main star, then Nvidia, and now it's Apple. There is nothing like this. However, you still have to work hard on your own to make a deal; the masters are probably just having fun. $Apple(AAPL.US$ $Tesla(TSLA.US$ $NVIDIA(NVDA.US$

This is the order details. No transactions have been made yet. The order was placed to sell 9999 Apple Call cards due on December 31, 2021 (exercise price 205). The price limit is 0.28, and the total amount is 27.3W US dollars. I'm guessing this order will probably be sold tonight after fermentation during the day. This option traded 4,155 lots last night.

Next, let's talk about what a covered call is. This combination is usually made because they are worried that the stock price will not rise to a certain price, so they earn a portion of the premium by selling the call. Take the example of Teacher Bian Duan.

If the price of Apple is less than or equal to 205 US dollars before December 31st,Then Mr. Duan will be able to earn a steady income of 27.3w (so I doubt that Apple will pay 200 US dollars this month; otherwise, the pressure level of 200 US dollars is high enough. It is also a relatively stable price, and the premium is higher, but Mr. Duan chose 205, which actually had some considerations). At this point, the person who buys the call will lose all of the premium.

If the price of Apple is higher than 205 US dollars on the expiration dateThe person who bought this call will definitely ask to exercise the right. The buyer has the right to buy 99.99w Apple shares at a price of 205 US dollars. The buyer's earnings were (price at maturity - 205-0.28). Only when the expiration price is higher than 205.38 US dollars will the person who bought the call have a chance to make a profit. The closing price of Apple yesterday was 175.08, with a 17% premium. It is very difficult to make a profit.

One characteristic of the covered call combination is that once the strategy is used, the maximum potential return is limited. Once the stock price exceeds the exercise price, it has nothing to do with the shareholder.

Covered calls are more suitable for fluctuating ranges or short-term increases that are too large and are worried that they will not be able to raise the price you want, and earn a portion of the premium in advance through sell calls.

5% of the capital was used to sell the put. Yesterday, Pinduoduo and New Oriental received a premium of 3.6 million US dollars. If leverage is not calculated, the corresponding security deposit should be around 3,600 million US dollars. If there are only these two puts, then this account is estimated to be over 700 million US dollars in capital. But the point is, he probably sold more than just these two puts, so the funds in this account may have all started at 1 billion US dollars. That's a huge amount of funding.

To sum it up, I feel like Teacher Duan is optimistic about Apple's $200 this month (supervisor speculates). After all, Pinduoduo is also selling infinitely close to the lowest price. After all, Apple is currently experiencing a boom in the market, so please cherish the apple that is booming. In the last month or so, Tesla was the main star, then Nvidia, and now it's Apple. There is nothing like this. However, you still have to work hard on your own to make a deal; the masters are probably just having fun. $Apple(AAPL.US$ $Tesla(TSLA.US$ $NVIDIA(NVDA.US$

Translated

+2

8

6

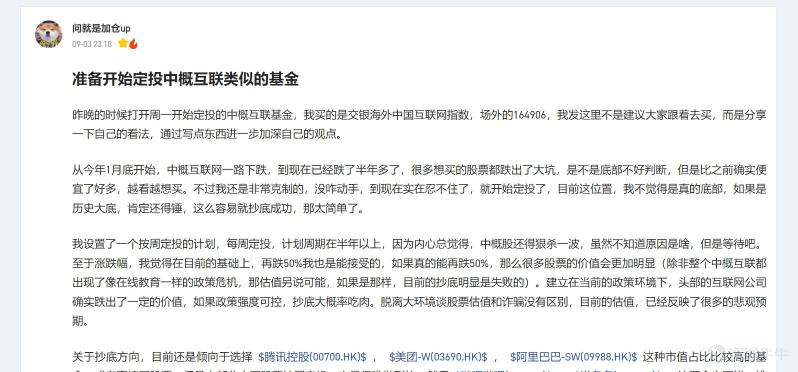

China Securities once again plummeted last night. Although the decline was not as large as before, this time there was no difference in damage. If I had to say, the current decline in China Securities was clearly calculated based on the fall. Just look for Chinese securities. Last night they were all close to 10 points. Moreover, it had already dropped a wave the night before yesterday. As for the decline in many stocks this year, it's really unbearable.

Since I started writing about the sharp decline in China's securities market share, my opinion is quite clear.The Chinese securities market continues to fall. Are they falling to the bottom or are they afraid of the market?I wrote this when it plummeted at the end of March. Since then, I've written many articles along the way. Basically, I didn't copy the bottom. The only post that copied the bottom was posted in September, but the amount control is OK. Now it's -15%, and I make a fixed investment every day, and I bought it for about 6,000 yuan. As for the possibility that it may drop by another 50% on this basis, that is really a coincidence. It was just a matter of caution at the time, but judging from the current trend, this is not an impossible thing.

Apart from killing valuations, another important factor is the foreign company accountability law that the US just passed yesterday. This was also the trigger for the decline in the first half of the year. The recent passage of this bill is considered a negative and complete implementation. We will wait and see how it will actually be implemented in the future.

What are the risk points

At this point in time, let's sort out China Securities once again. Earlier, I said that China Securities have two risks: policy risk and valuation risk.Currently, valuation risks are basically negligible, but policy risks are still huge. There are many policy impacts. There are many sources. Currently, it seems that policies in some fields have continued to be implemented, but more policies may still be on the way. Currently, valuation risks are not great, but the emotional impact brought about by the policy still requires caution.

Since last year, China's securities have skyrocketed. There are countless stocks that are ten times larger in a year, but the sharp decline since the beginning of the year has almost smoothed out this rise, and even continued to decline. The current decline can no longer be explained by fundamentals, but companies with good fundamentals may be more resistant to falling. However, since stocks with good fundamentals will have more overseas investors, the selling pressure from these people will offset the strong fundamentals, so it is reflected in stock price trends, where it is falling indiscriminately.

Can you copy the bottom

From a prudent point of view, don't go to the bottom. Even after falling so much, I think bottoming out is still an extremely uneconomical profit/loss ratio. This is the first time I've experienced this kind of thing in so many years when trading stocks. There is too much uncertainty about how it will evolve and how policies will be coordinated in the future. The only thing that is certain is that some companies are really good, but never let the collapse brought about by overcrowding emotions. It's already happened once before, and yesterday can be counted as another time. Whether they will come again in the future is really hard to say.Until all the great uncertainties come to fruition, watching is always the most elegant choice.

How to copy the bottom

Currently, the Internet section in China isThe best growth is the three idiots of new energyThis one is my personal favorite right now. Although it's a pretty tough kill, if I go to the bottom in the future, I'll probably start from here. The growth logic of the entire Internet sector is gradually being falsified. Although there are still quite a few companies growing, the growth rate is slowing down.If you can go out to sea to harvest all over the world, then this is a new story. Currently, it's more like a cold winter on the internet, and the cold tide has only just begun.Although many internet companies have laid off employees before, I was shocked until I saw iQiyi say they wanted to cut 20% to 40% of their employees. But it's also normal. After all, it's always been

Policy risk is definitely the biggest risk. Many companies' moats are based on policy stability. If policies begin to be continuously adjusted, the company's valuation and the level of the moat may all be broken. Companies that don't pay attention to social image and the direction of the country's development are likely to be eliminated. Even if they are not eliminated, they still have to be wary of the company's irrational operations.

What do you think of the future

If you're still habitually bottoming out after more than half a year of sharp decline in China Securities, then there really isn't much to talk about. Undercutting is never the best solution. You can buy discounted products, but discounted stocks are likely to have holes, especially stocks with a discount are likely to be huge pits.

What to do for fear of not being able to buy

People have been asking this question since March. Don't always think about buying at the bottom, but buying in the midst of an upward trend. If it actually reverses, even if it goes higher, it's far safer than it is now. If it were a reversal, then the increase would definitely not be 20 or 30 points; it would probably be several times the intense market. Never underestimate the power of emotions. It can skyrocket throughout the year. A bunch of people say it's not reasonable. Many people say it's underestimated this year. These people are probably in the same group. The value of stocks usually switches between excessive overestimation and undervaluation, and rationality is probably just an instantaneous thing. More stocks are switching between being very overvalued and very undervalued, such as China Securities.

To borrow a quote I saw elsewhere today, the current situation of China Securities is, if it is delisted from the US stock market, then why buy it, and if not delisted from the US stock market, then why buy it

Since I started writing about the sharp decline in China's securities market share, my opinion is quite clear.The Chinese securities market continues to fall. Are they falling to the bottom or are they afraid of the market?I wrote this when it plummeted at the end of March. Since then, I've written many articles along the way. Basically, I didn't copy the bottom. The only post that copied the bottom was posted in September, but the amount control is OK. Now it's -15%, and I make a fixed investment every day, and I bought it for about 6,000 yuan. As for the possibility that it may drop by another 50% on this basis, that is really a coincidence. It was just a matter of caution at the time, but judging from the current trend, this is not an impossible thing.

Apart from killing valuations, another important factor is the foreign company accountability law that the US just passed yesterday. This was also the trigger for the decline in the first half of the year. The recent passage of this bill is considered a negative and complete implementation. We will wait and see how it will actually be implemented in the future.

What are the risk points

At this point in time, let's sort out China Securities once again. Earlier, I said that China Securities have two risks: policy risk and valuation risk.Currently, valuation risks are basically negligible, but policy risks are still huge. There are many policy impacts. There are many sources. Currently, it seems that policies in some fields have continued to be implemented, but more policies may still be on the way. Currently, valuation risks are not great, but the emotional impact brought about by the policy still requires caution.

Since last year, China's securities have skyrocketed. There are countless stocks that are ten times larger in a year, but the sharp decline since the beginning of the year has almost smoothed out this rise, and even continued to decline. The current decline can no longer be explained by fundamentals, but companies with good fundamentals may be more resistant to falling. However, since stocks with good fundamentals will have more overseas investors, the selling pressure from these people will offset the strong fundamentals, so it is reflected in stock price trends, where it is falling indiscriminately.

Can you copy the bottom

From a prudent point of view, don't go to the bottom. Even after falling so much, I think bottoming out is still an extremely uneconomical profit/loss ratio. This is the first time I've experienced this kind of thing in so many years when trading stocks. There is too much uncertainty about how it will evolve and how policies will be coordinated in the future. The only thing that is certain is that some companies are really good, but never let the collapse brought about by overcrowding emotions. It's already happened once before, and yesterday can be counted as another time. Whether they will come again in the future is really hard to say.Until all the great uncertainties come to fruition, watching is always the most elegant choice.

How to copy the bottom

Currently, the Internet section in China isThe best growth is the three idiots of new energyThis one is my personal favorite right now. Although it's a pretty tough kill, if I go to the bottom in the future, I'll probably start from here. The growth logic of the entire Internet sector is gradually being falsified. Although there are still quite a few companies growing, the growth rate is slowing down.If you can go out to sea to harvest all over the world, then this is a new story. Currently, it's more like a cold winter on the internet, and the cold tide has only just begun.Although many internet companies have laid off employees before, I was shocked until I saw iQiyi say they wanted to cut 20% to 40% of their employees. But it's also normal. After all, it's always been

Policy risk is definitely the biggest risk. Many companies' moats are based on policy stability. If policies begin to be continuously adjusted, the company's valuation and the level of the moat may all be broken. Companies that don't pay attention to social image and the direction of the country's development are likely to be eliminated. Even if they are not eliminated, they still have to be wary of the company's irrational operations.

What do you think of the future

If you're still habitually bottoming out after more than half a year of sharp decline in China Securities, then there really isn't much to talk about. Undercutting is never the best solution. You can buy discounted products, but discounted stocks are likely to have holes, especially stocks with a discount are likely to be huge pits.

What to do for fear of not being able to buy

People have been asking this question since March. Don't always think about buying at the bottom, but buying in the midst of an upward trend. If it actually reverses, even if it goes higher, it's far safer than it is now. If it were a reversal, then the increase would definitely not be 20 or 30 points; it would probably be several times the intense market. Never underestimate the power of emotions. It can skyrocket throughout the year. A bunch of people say it's not reasonable. Many people say it's underestimated this year. These people are probably in the same group. The value of stocks usually switches between excessive overestimation and undervaluation, and rationality is probably just an instantaneous thing. More stocks are switching between being very overvalued and very undervalued, such as China Securities.

To borrow a quote I saw elsewhere today, the current situation of China Securities is, if it is delisted from the US stock market, then why buy it, and if not delisted from the US stock market, then why buy it

Translated

It's safe to say that options speculators are easy to use. In particular, in the short term, by going long and short by buying and putting, you can perfectly control risk and maximize profit.

Many people say why options are bad, and participation is very risky. This is true, because options come with their own leverage, and it is normal for them to fluctuate a lot.

Today, let's take a closer look at why intraday speculation on options is appropriate.

First, let's take a simple example, such as Apple's collapse to the bottom last night.

Last night, Apple plummeted to -3.5% in the market. At its lowest point, it was already very close to the 20-day line, with a difference of 1 yuan. However, as can be seen from the intraday market, after the trend pulls back to the intraday moving average, it is basically impossible to break down. If you want to get to the bottom of the market at this time, let's say buy apples. Since the market has been very weak recently and is all supported by apples, it is likely that apples are still the backbone of the recent market. So, if I start to cut the bottom when I find out I can't keep up, if I want to buy 100 shares of Apple, it would cost almost 16,000 US dollars without leverage. This is already difficult for many people to operate. They probably don't have that much money at all, but they still want to speculate. At this point, you can find that options are easy to use.

Let's take a look at Apple's options. I chose the one that expires on December 17, because the date is so exciting that I can't stand it.

This is an option that expires on December 17. You can see that the price difference between neighboring options was 2.5. Last night when Apple first started to raise the price, the price was about 160. At the time, I chose 165. The reason I didn't choose 162.5 was that the 165 option spread would be a little smaller. At the same time, the premium was only about 3 points, so it's not impossible to go up to the option within the price.

Let's take a look at 165call's trend last night. If the bottom rebounds again, it could probably earn double last night.

This place is not for show operations. We can look at a few points, why do we use options, and how to choose options

1. Choosing options can control risk very well. As an option buyer, the biggest loss is the principal amount. US stocks have fluctuated greatly in recent days. Many stocks have suddenly taken a dive, and accounts will fluctuate greatly. For example, if you wanted to buy 100 shares of Apple last night, you would get at least 1.6 watts of US dollars without leverage. If the underlying stock fluctuates by 1%, the account will fluctuate around 160 US dollars. Take Apple's fluctuation last night. The fluctuation of 2,300 US dollars is not a problem. It's acceptable to have an increase, but it's very uncomfortable to lose money. In particular, it has already dropped 3 points. The market has already dived all the way, and it's very uneconomical to spend so much money to get to the bottom. However, using options is not the same. At Apple -3%, an option was 220 dollars at the time (165 calls due 2021217). If you buy this option, your account will lose up to $220, and your profit isn't capped. Especially when Apple fell to support yesterday, it's still great to play with some money.

2. How to choose options for short-term games. It depends on a person's risk tolerance. The closer the expiration date and the closer the exercise price is to the current price, the greater the fluctuation, and the more intense the game. You can usually consider choosing an off-price option with an expiration date slightly farther away. It is usually best if the expiration date is within a week. If the expiration date is within a week, the game will be very serious (the advantage is that the time value is relatively small; the downside is that if you choose the wrong option, the remaining time value will be lost very quickly)

This one expires on December 3. The price of the Apple Call is 165. The fluctuation last night was even more intense, and at one point the intraday market came close to zero. Anyway, I usually choose shallow off-price options with about 2 weeks left to play. How to measure the previous stage mainly depends on the exercise price. For example, Apple's options, the premium of 3 points is already quite a bit, which can be considered a shallow price. If it's Tesla, 10 points is fine. It mainly depends on the size of the fluctuations of individual stocks themselves.

Alternatively, we can look at an indicator, delta. Try to choose a delta between 0.4-0.5. This option can improve stock price changes anyway. At the same time, it is best to make the delta value larger than the theta value, so that the time value does not decrease too quickly to offset the growth of delta.

For example, the price of this option. If the underlying stock rises by 1 US dollar, the option will increase by 0.35 US dollars. However, after a day, theta will cause options to be reduced by 0.7 US dollars. This option does not respond well to changes in the price of the underlying stock.

Of course, these indicators all change dynamically, and they all dynamically reflect the correlation between this option stock.

3. Never stud. An option usually represents 100 shares. For example, yesterday this option was bought for 200 US dollars. This represents a fluctuation in 100 Apple shares. The only benefit is that as long as you buy an option, the maximum risk is directly controlled within a certain range (this is an advantage of options over futures). You can calculate how high this leverage is. If you calculate an Apple share of 160 US dollars, 100 shares would be 16,000 US dollars. In other words, we leveraged 16,000 US dollars through 200 US dollars, and this leverage is almost 80 times. If you have a $2,000 account, you want to get into Stud, it's really similar to gambling.

4. The appeal of options is leverage, that is, they are small and large. More chips have been leveraged through very small positions. This is also why many people use small accounts to play options; they really only need a very small sum of money. The most important thing about playing options is to survive, not to earn money every time. As long as you can survive and keep improving yourself, you will experience explosive gains one day, but until this day arrives, you can't fall down. Be deterministic and don't always gamble.

5. An option is just a tool. Normally, many people will say how easy it is to lose money with options. Take yesterday's Apple underwriting, which is also buying 100 shares of Apple. If the stock exchange fails, you may lose even more. The recent market has fluctuated so much. Controlling losses is the key; controlling losses is the key; controlling retracement is the key to growth. Of course, many people may not be able to buy 100 shares of Apple at all if they don't participate in options (I am, for example). It's better to understand options correctly. Options are just an amplifier, so that the strengths and weaknesses of individual abilities can be shown very quickly. Therefore, when you don't have enough ability, just try to simulate the game, and do your basic skills. $Apple(AAPL.US$ $Tesla(TSLA.US$ $Microsoft(MSFT.US$ $NVIDIA(NVDA.US$

Many people say why options are bad, and participation is very risky. This is true, because options come with their own leverage, and it is normal for them to fluctuate a lot.

Today, let's take a closer look at why intraday speculation on options is appropriate.

First, let's take a simple example, such as Apple's collapse to the bottom last night.

Last night, Apple plummeted to -3.5% in the market. At its lowest point, it was already very close to the 20-day line, with a difference of 1 yuan. However, as can be seen from the intraday market, after the trend pulls back to the intraday moving average, it is basically impossible to break down. If you want to get to the bottom of the market at this time, let's say buy apples. Since the market has been very weak recently and is all supported by apples, it is likely that apples are still the backbone of the recent market. So, if I start to cut the bottom when I find out I can't keep up, if I want to buy 100 shares of Apple, it would cost almost 16,000 US dollars without leverage. This is already difficult for many people to operate. They probably don't have that much money at all, but they still want to speculate. At this point, you can find that options are easy to use.

Let's take a look at Apple's options. I chose the one that expires on December 17, because the date is so exciting that I can't stand it.

This is an option that expires on December 17. You can see that the price difference between neighboring options was 2.5. Last night when Apple first started to raise the price, the price was about 160. At the time, I chose 165. The reason I didn't choose 162.5 was that the 165 option spread would be a little smaller. At the same time, the premium was only about 3 points, so it's not impossible to go up to the option within the price.

Let's take a look at 165call's trend last night. If the bottom rebounds again, it could probably earn double last night.

This place is not for show operations. We can look at a few points, why do we use options, and how to choose options

1. Choosing options can control risk very well. As an option buyer, the biggest loss is the principal amount. US stocks have fluctuated greatly in recent days. Many stocks have suddenly taken a dive, and accounts will fluctuate greatly. For example, if you wanted to buy 100 shares of Apple last night, you would get at least 1.6 watts of US dollars without leverage. If the underlying stock fluctuates by 1%, the account will fluctuate around 160 US dollars. Take Apple's fluctuation last night. The fluctuation of 2,300 US dollars is not a problem. It's acceptable to have an increase, but it's very uncomfortable to lose money. In particular, it has already dropped 3 points. The market has already dived all the way, and it's very uneconomical to spend so much money to get to the bottom. However, using options is not the same. At Apple -3%, an option was 220 dollars at the time (165 calls due 2021217). If you buy this option, your account will lose up to $220, and your profit isn't capped. Especially when Apple fell to support yesterday, it's still great to play with some money.

2. How to choose options for short-term games. It depends on a person's risk tolerance. The closer the expiration date and the closer the exercise price is to the current price, the greater the fluctuation, and the more intense the game. You can usually consider choosing an off-price option with an expiration date slightly farther away. It is usually best if the expiration date is within a week. If the expiration date is within a week, the game will be very serious (the advantage is that the time value is relatively small; the downside is that if you choose the wrong option, the remaining time value will be lost very quickly)

This one expires on December 3. The price of the Apple Call is 165. The fluctuation last night was even more intense, and at one point the intraday market came close to zero. Anyway, I usually choose shallow off-price options with about 2 weeks left to play. How to measure the previous stage mainly depends on the exercise price. For example, Apple's options, the premium of 3 points is already quite a bit, which can be considered a shallow price. If it's Tesla, 10 points is fine. It mainly depends on the size of the fluctuations of individual stocks themselves.

Alternatively, we can look at an indicator, delta. Try to choose a delta between 0.4-0.5. This option can improve stock price changes anyway. At the same time, it is best to make the delta value larger than the theta value, so that the time value does not decrease too quickly to offset the growth of delta.

For example, the price of this option. If the underlying stock rises by 1 US dollar, the option will increase by 0.35 US dollars. However, after a day, theta will cause options to be reduced by 0.7 US dollars. This option does not respond well to changes in the price of the underlying stock.

Of course, these indicators all change dynamically, and they all dynamically reflect the correlation between this option stock.

3. Never stud. An option usually represents 100 shares. For example, yesterday this option was bought for 200 US dollars. This represents a fluctuation in 100 Apple shares. The only benefit is that as long as you buy an option, the maximum risk is directly controlled within a certain range (this is an advantage of options over futures). You can calculate how high this leverage is. If you calculate an Apple share of 160 US dollars, 100 shares would be 16,000 US dollars. In other words, we leveraged 16,000 US dollars through 200 US dollars, and this leverage is almost 80 times. If you have a $2,000 account, you want to get into Stud, it's really similar to gambling.

4. The appeal of options is leverage, that is, they are small and large. More chips have been leveraged through very small positions. This is also why many people use small accounts to play options; they really only need a very small sum of money. The most important thing about playing options is to survive, not to earn money every time. As long as you can survive and keep improving yourself, you will experience explosive gains one day, but until this day arrives, you can't fall down. Be deterministic and don't always gamble.

5. An option is just a tool. Normally, many people will say how easy it is to lose money with options. Take yesterday's Apple underwriting, which is also buying 100 shares of Apple. If the stock exchange fails, you may lose even more. The recent market has fluctuated so much. Controlling losses is the key; controlling losses is the key; controlling retracement is the key to growth. Of course, many people may not be able to buy 100 shares of Apple at all if they don't participate in options (I am, for example). It's better to understand options correctly. Options are just an amplifier, so that the strengths and weaknesses of individual abilities can be shown very quickly. Therefore, when you don't have enough ability, just try to simulate the game, and do your basic skills. $Apple(AAPL.US$ $Tesla(TSLA.US$ $Microsoft(MSFT.US$ $NVIDIA(NVDA.US$

Translated

+4

15

2

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)