電柱マン

voted

Good morning to all Moomoo users!![]() Here are the key points of the morning news.

Here are the key points of the morning news.

● [Tokyo stock market forecast range] 900,000-950,000 yen (closing price on the 4th: 977,314 yen)

● [Remarks by senior FRB officials] There is also a possibility of not implementing interest rate cuts this year - President Kashkari

● New York stocks experience the biggest decline of the year, with the prospect of interest rate cuts receding and risk aversion spreading

● If the certainty of achieving the 2% target increases, BOJ President Ueda will consider raising interest rates

● Brent crude oil in the North Sea rose to the 90 dollar range, the highest level since October last year, due to geopolitical risks

● Growing cash flow at Amazon, with expectations for shareholder returns - stock price approaches record high

Tesla rises, production of right-hand drive cars for export to India begins at the German factory.

- moomoo News Mark

Market Overview

In the US stock market on the 4th, the Dow Jones Industrial Average fell for the 4th consecutive day, down 530.16 points to 30,8596.98 dollars. The Nasdaq Composite Index was down 228.376 points to 16,049.082. On the 5th, the Tokyo stock market leaned heavily towards selling, especially in large-cap stocks, and the Nikkei Stock Average...

● [Tokyo stock market forecast range] 900,000-950,000 yen (closing price on the 4th: 977,314 yen)

● [Remarks by senior FRB officials] There is also a possibility of not implementing interest rate cuts this year - President Kashkari

● New York stocks experience the biggest decline of the year, with the prospect of interest rate cuts receding and risk aversion spreading

● If the certainty of achieving the 2% target increases, BOJ President Ueda will consider raising interest rates

● Brent crude oil in the North Sea rose to the 90 dollar range, the highest level since October last year, due to geopolitical risks

● Growing cash flow at Amazon, with expectations for shareholder returns - stock price approaches record high

Tesla rises, production of right-hand drive cars for export to India begins at the German factory.

- moomoo News Mark

Market Overview

In the US stock market on the 4th, the Dow Jones Industrial Average fell for the 4th consecutive day, down 530.16 points to 30,8596.98 dollars. The Nasdaq Composite Index was down 228.376 points to 16,049.082. On the 5th, the Tokyo stock market leaned heavily towards selling, especially in large-cap stocks, and the Nikkei Stock Average...

Translated

+1

28

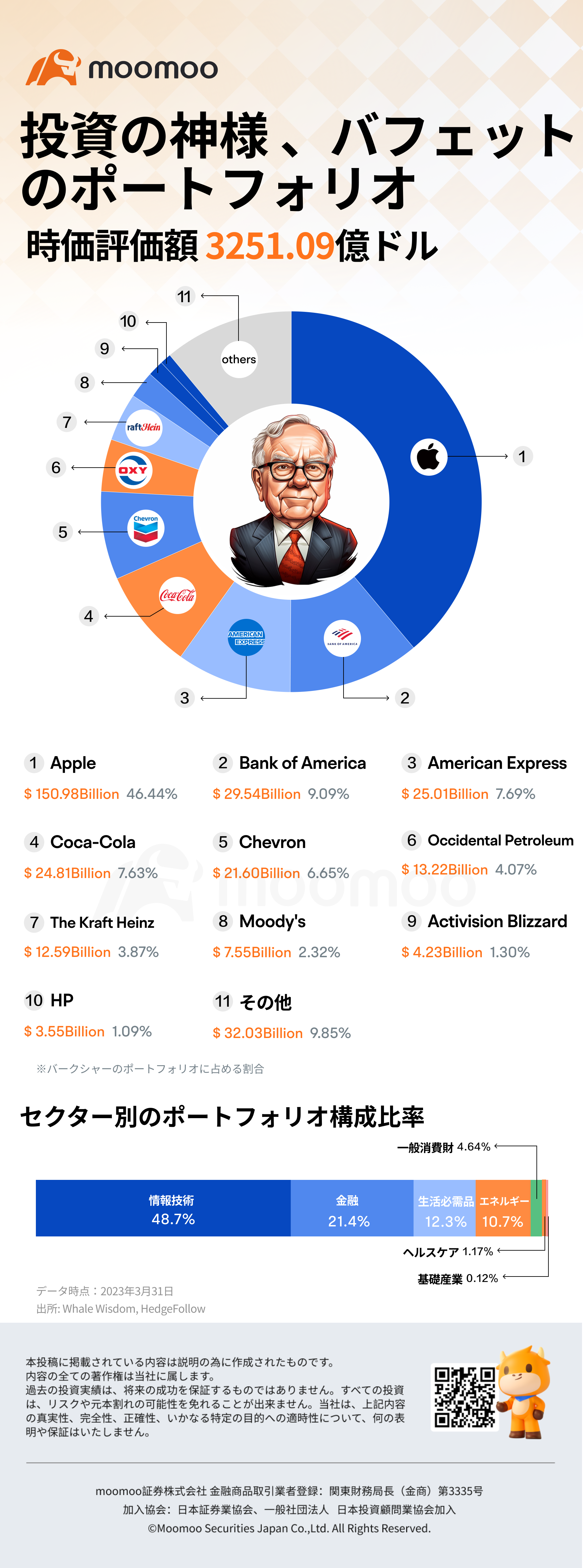

Publication of portfolio

Rate of return on investment

Number of shares purchased and amount per month, etc.

I want you to tell me.

Rate of return on investment

Number of shares purchased and amount per month, etc.

I want you to tell me.

Translated

18

電柱マン

reacted to

電柱マン

liked

This is Buffett Taro.

It has dropped 52% due to overtime transactions in response to reports that USBAC West Bank Corp (PACW below) is considering sell-off. Also, from the view that “the bank crisis is not over,” market participants anticipate that “there will be interest rate cuts as early as July,” but I think this is a mistake.

Like Silicon Valley Bank, Signature Bank, and First Republic Bank, which have already gone bankrupt, PACW is a regional bank based in California, and all of the current banking crises are concentrated on the west coast.

In other words, since it's not happening across the US, the Fed probably doesn't think that a banking crisis is imminent, and it's hard to think of moving to cut interest rates early. Even so, considering that there is a large gap with market participants in the outlook for policy interest rates, the FOMC after July could be a source of market turbulence.

In order to avoid this, it is expected that Chairman Powell will continue to send hawkish messages until market participants change their minds, so I think the upper price of the stock market will be heavy.

Good Luck.

It has dropped 52% due to overtime transactions in response to reports that USBAC West Bank Corp (PACW below) is considering sell-off. Also, from the view that “the bank crisis is not over,” market participants anticipate that “there will be interest rate cuts as early as July,” but I think this is a mistake.

Like Silicon Valley Bank, Signature Bank, and First Republic Bank, which have already gone bankrupt, PACW is a regional bank based in California, and all of the current banking crises are concentrated on the west coast.

In other words, since it's not happening across the US, the Fed probably doesn't think that a banking crisis is imminent, and it's hard to think of moving to cut interest rates early. Even so, considering that there is a large gap with market participants in the outlook for policy interest rates, the FOMC after July could be a source of market turbulence.

In order to avoid this, it is expected that Chairman Powell will continue to send hawkish messages until market participants change their minds, so I think the upper price of the stock market will be heavy.

Good Luck.

Translated

51

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)