$Hang Seng Index (800000.HK)$ $Direxion Daily FTSE China Bear 3X Shares ETF (YANG.US)$ $Direxion Daily FTSE China Bull 3X Shares ETF (YINN.US)$

The reason for the stock market's rise this time is the practice of converting equity into bonds, which is the first time in the history of human finance. Objectively reducing the number of stocks, similar to the concept of companies repurchasing stocks to raise stock prices, but in reality, the companies did not spend money to repurchase, instead they used stocks as collateral, leveraging commercial banks to handle the bonds, and the banks did not actually withhold money or bear risks because the bonds were issued by the central bank.

This perfectly solves the problem that the central bank issues bonds to inject liquidity into the market but cannot directly give money to companies. It also solves the problem that companies want to repurchase stocks to increase stock value but do not have the funds. By leveraging the entire stock market with minimal cost (500 billion yuan in national bonds) without violating financial rules.

If commercial banks hold onto stocks and do not release them, the number of stocks in the stock market will not increase, and appreciation is inevitable, rather than undergoing large-scale devaluation. Since Chinese commercial banks are state-owned, they can hold onto stocks without any cost.

This approach is the first of its kind for mankind, aimed at increasing the value of stocks that have lost value due to the sluggish stock market. The premise is that objectively, the A-share market in China is sluggish due to psychological factors, rather than a lack of actual economic investment, as the Chinese social savings amounts...

The reason for the stock market's rise this time is the practice of converting equity into bonds, which is the first time in the history of human finance. Objectively reducing the number of stocks, similar to the concept of companies repurchasing stocks to raise stock prices, but in reality, the companies did not spend money to repurchase, instead they used stocks as collateral, leveraging commercial banks to handle the bonds, and the banks did not actually withhold money or bear risks because the bonds were issued by the central bank.

This perfectly solves the problem that the central bank issues bonds to inject liquidity into the market but cannot directly give money to companies. It also solves the problem that companies want to repurchase stocks to increase stock value but do not have the funds. By leveraging the entire stock market with minimal cost (500 billion yuan in national bonds) without violating financial rules.

If commercial banks hold onto stocks and do not release them, the number of stocks in the stock market will not increase, and appreciation is inevitable, rather than undergoing large-scale devaluation. Since Chinese commercial banks are state-owned, they can hold onto stocks without any cost.

This approach is the first of its kind for mankind, aimed at increasing the value of stocks that have lost value due to the sluggish stock market. The premise is that objectively, the A-share market in China is sluggish due to psychological factors, rather than a lack of actual economic investment, as the Chinese social savings amounts...

Translated

35

12

25

$Direxion Daily FTSE China Bear 3X Shares ETF (YANG.US)$

**Yang** is a leveraged ETF that triples the short position on the Chinese market, specifically targeting the FTSE China 50 Index. Its price volatility is mainly influenced by the following factors:

### 1. **Performance of the Chinese Stock Market**

- **Hang Seng Index, Shanghai and Shenzhen Stock Markets**: Yang's performance is directly inversely related to the major stock markets in China. An increase in the Hang Seng Index or the Shanghai and Shenzhen stock markets usually leads to a decrease in the price of Yang, and vice versa. Therefore, when the Chinese stock market experiences a significant increase, the price of Yang will decrease significantly, as you have recently observed.

- **Policy Regulation**: The Chinese government's monetary policy, fiscal stimulus policies, or policies related to capital markets will all impact market performance. Especially when China introduces policies to support the economy (such as reserve requirement cuts, interest rate cuts, infrastructure investments, etc.), the stock market usually rebounds, which in turn has a negative impact on Yang.

### 2. **China's Macroeconomic Situation**

- **Economic Data**: Economic data released by China (such as GDP growth rate, PMI index, industrial production, import and export data, etc.) are important factors influencing the Chinese stock market. Positive economic data usually raise the stock market, thereby lowering the price of Yang; while weak economic data...

**Yang** is a leveraged ETF that triples the short position on the Chinese market, specifically targeting the FTSE China 50 Index. Its price volatility is mainly influenced by the following factors:

### 1. **Performance of the Chinese Stock Market**

- **Hang Seng Index, Shanghai and Shenzhen Stock Markets**: Yang's performance is directly inversely related to the major stock markets in China. An increase in the Hang Seng Index or the Shanghai and Shenzhen stock markets usually leads to a decrease in the price of Yang, and vice versa. Therefore, when the Chinese stock market experiences a significant increase, the price of Yang will decrease significantly, as you have recently observed.

- **Policy Regulation**: The Chinese government's monetary policy, fiscal stimulus policies, or policies related to capital markets will all impact market performance. Especially when China introduces policies to support the economy (such as reserve requirement cuts, interest rate cuts, infrastructure investments, etc.), the stock market usually rebounds, which in turn has a negative impact on Yang.

### 2. **China's Macroeconomic Situation**

- **Economic Data**: Economic data released by China (such as GDP growth rate, PMI index, industrial production, import and export data, etc.) are important factors influencing the Chinese stock market. Positive economic data usually raise the stock market, thereby lowering the price of Yang; while weak economic data...

Translated

12

1

2

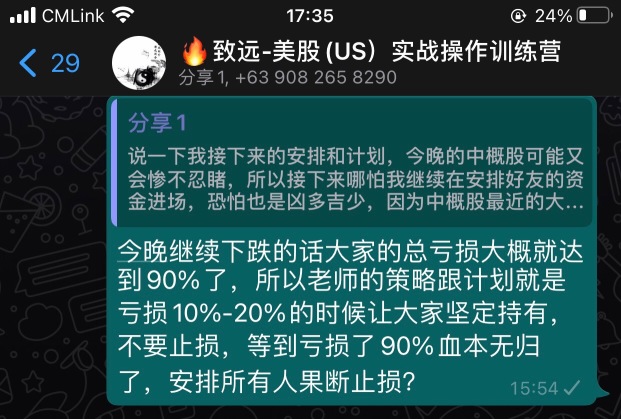

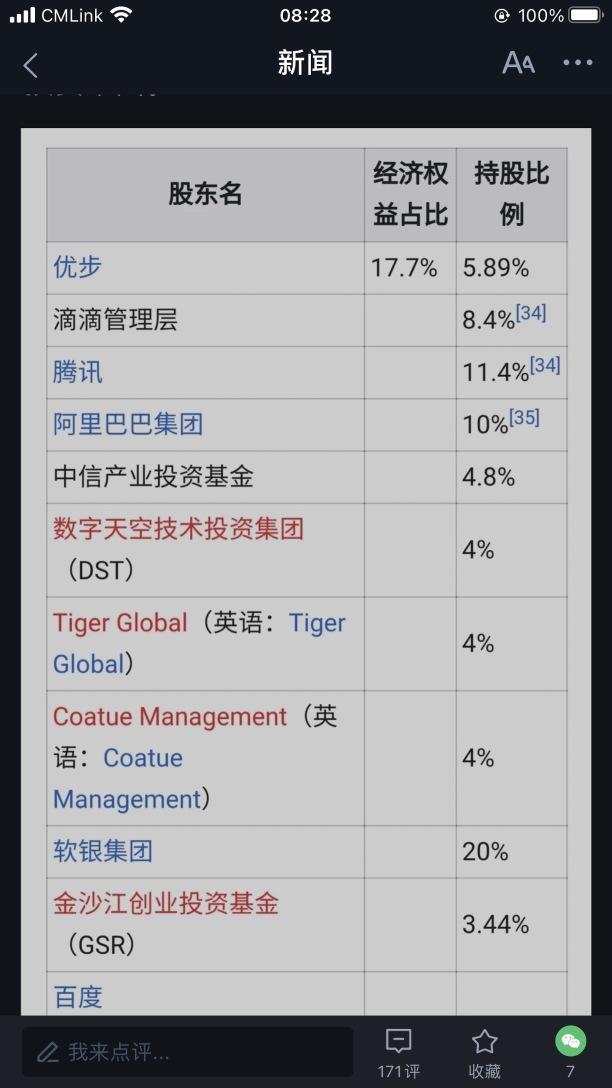

$DiDi Global (Delisted) (DIDI.US)$

DIDI fell 44%, the largest single-day decline since the company's IPO in the USA. Since the IPO, investors have suffered huge losses. Investor lawsuits are almost inevitable.

DIDI fell 44%, the largest single-day decline since the company's IPO in the USA. Since the IPO, investors have suffered huge losses. Investor lawsuits are almost inevitable.

Translated

2

$Sentage (SNTG.US)$

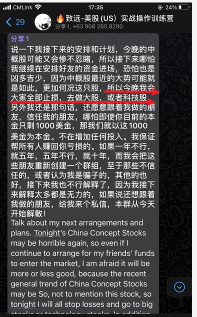

From when many retail investors were killed on 7.22 by several different groups of teachers to kill pigs, everyone must have had many sleepless nights. Many victims from Hong Kong, Taiwan, Singapore, the United States and other regions have reported this gang fraud to local law enforcement authorities. Although these actions may not help everyone recover their losses, they hope that the flames of the stars can be ignited. After being proud for a while, these people must not be proud. Skynet has been restored without omission. There will always be a day when they are condemned. Justice may be late, but it will never come.

What I want to say is that according to statistics, the fraud gang shorted about 2 million SNTG shares on 7.22, accounting for 40% of the total transaction volume of the day, so sooner or later they need to buy back these stocks to close their positions. If there are also so-called teachers who let you stop your losses today, then they still want to squeeze out the last drop of blood from retail investors. It has already dropped from 31 yuan to 5 yuan in the IPO price, and most victims have already lost more than 90%. What else is there to be fear. As long as everyone unites and stops selling their stocks, they can force the fraud group to buy back their stocks, the stock price will naturally A recovery.

The following screenshot shows the short sales data for 7.22. There are also some screenshots of the scammer teacher in my group who cheated until this afternoon, saying that everyone would stop losing money tonight. After being harshly questioned by me, they felt they couldn't keep up, so they immediately disbanded the group.

Currently...

From when many retail investors were killed on 7.22 by several different groups of teachers to kill pigs, everyone must have had many sleepless nights. Many victims from Hong Kong, Taiwan, Singapore, the United States and other regions have reported this gang fraud to local law enforcement authorities. Although these actions may not help everyone recover their losses, they hope that the flames of the stars can be ignited. After being proud for a while, these people must not be proud. Skynet has been restored without omission. There will always be a day when they are condemned. Justice may be late, but it will never come.

What I want to say is that according to statistics, the fraud gang shorted about 2 million SNTG shares on 7.22, accounting for 40% of the total transaction volume of the day, so sooner or later they need to buy back these stocks to close their positions. If there are also so-called teachers who let you stop your losses today, then they still want to squeeze out the last drop of blood from retail investors. It has already dropped from 31 yuan to 5 yuan in the IPO price, and most victims have already lost more than 90%. What else is there to be fear. As long as everyone unites and stops selling their stocks, they can force the fraud group to buy back their stocks, the stock price will naturally A recovery.

The following screenshot shows the short sales data for 7.22. There are also some screenshots of the scammer teacher in my group who cheated until this afternoon, saying that everyone would stop losing money tonight. After being harshly questioned by me, they felt they couldn't keep up, so they immediately disbanded the group.

Currently...

Translated

+1

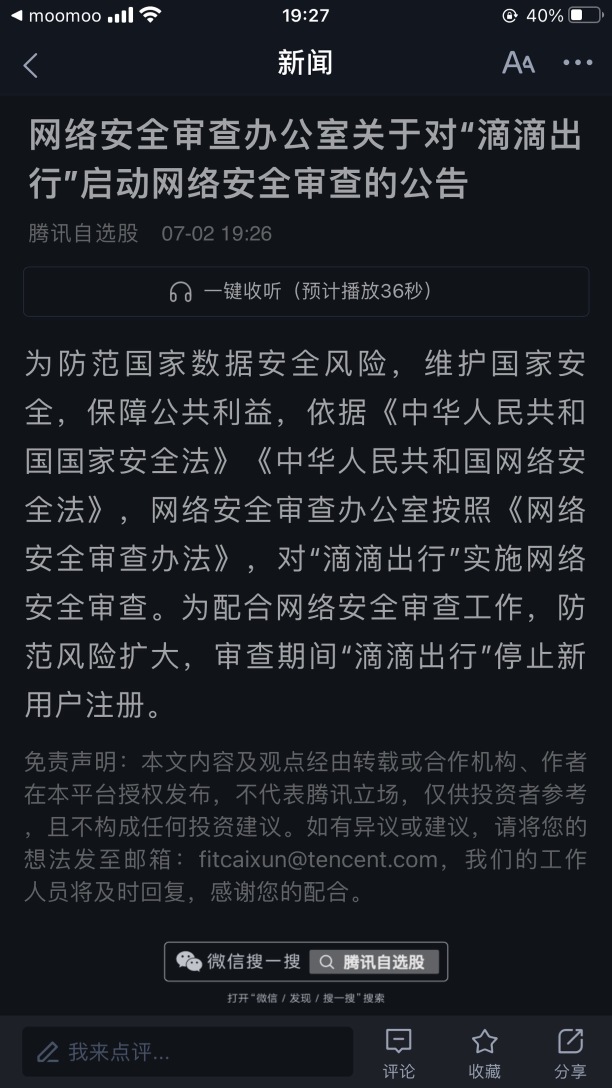

$DiDi Global (Delisted) (DIDI.US)$Just now, the Cyberspace Administration of China also announced that it will conduct network censorship on BOSS Zhipin. It has also stopped new user registrations. Since it is not only targeting Didi, it is a universal inspection, there is no need to panic.

Translated

2

1

$DiDi Global (Delisted) (DIDI.US)$

The news about the removal of the app is essentially the same as the prohibition of registering new users, with no substantial difference. It is just a different way of saying the old news. It has no substantial impact on DIDI's current operation. DIDI will still join the Russell Global Index on July 8th and will still join the Dow Jones S&P Index on July 12th. These are all bullish. If you panic and sell on Tuesday's opening, you are just giving the cheapest chips to conspiracy theorists.

The news about the removal of the app is essentially the same as the prohibition of registering new users, with no substantial difference. It is just a different way of saying the old news. It has no substantial impact on DIDI's current operation. DIDI will still join the Russell Global Index on July 8th and will still join the Dow Jones S&P Index on July 12th. These are all bullish. If you panic and sell on Tuesday's opening, you are just giving the cheapest chips to conspiracy theorists.

Translated

9

4

2

$Uxin (UXIN.US)$

Pre-market trading has an ask price of 3.72 at 211k. How panicked must one be to do this...![]()

Pre-market trading has an ask price of 3.72 at 211k. How panicked must one be to do this...

Translated

1

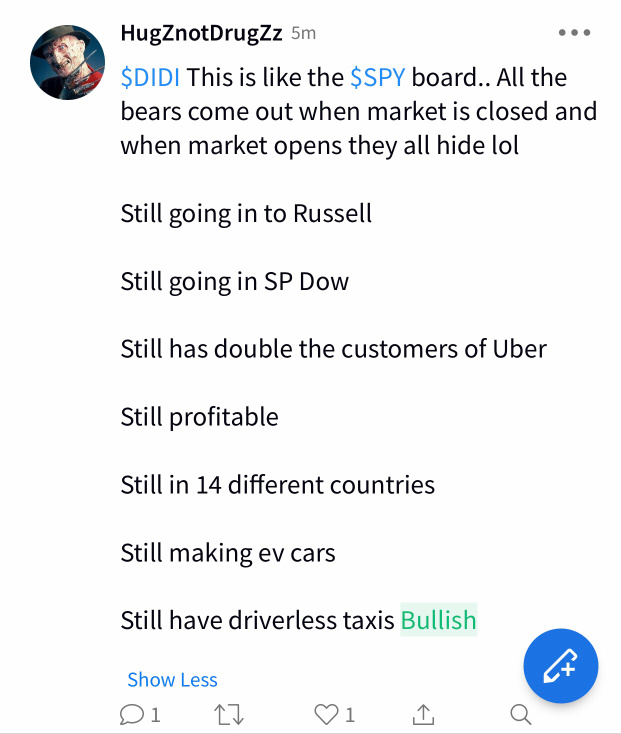

$Uxin (UXIN.US)$

Yesterday, everyone focused their attention on the benefits of NIO's 300 million investment. The bookmakers were so insidious. They deliberately covered up the huge disadvantages of 69 million US dollars in convertible stocks (the price was 1.03) being exercised yesterday, leading retail investors to take over and then sell in bulk before the market. Now it is estimated that it will fall back to fairy stocks...

Yesterday, everyone focused their attention on the benefits of NIO's 300 million investment. The bookmakers were so insidious. They deliberately covered up the huge disadvantages of 69 million US dollars in convertible stocks (the price was 1.03) being exercised yesterday, leading retail investors to take over and then sell in bulk before the market. Now it is estimated that it will fall back to fairy stocks...

Translated

2

1

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)