$Tesla (TSLA.US)$ $Amazon (AMZN.US)$ $Microsoft (MSFT.US)$ The subject is an army running out of water; value trends are an ironclad battle

Snowball column from Fourizi

Opening article sharing (based on messages from a few of my friends in the afternoon that the market rebounded and didn't make any money)

1: The index fluctuated and rebounded, and most people's feelings of being suppressed during the previous decline began to unleash. The market rotated rapidly, and the intraday period varied

There is a lot of movement, leading to too much excitement, too much chasing ups and downs, and being too impatient. As a result, it can even cause the index to rebound 200 points, myself

The account is not making any money. I also often encountered it when I first entered the market five years before entering the market.

A friend of mine doesn't have the same model as mine and hasn't made any money in the past few days.

The reason is that weak people don't want to buy, stable ones don't want to lurk, and they don't dare to buy leaders when invited in. The result is that they seem aggressive but they are not leading the way.

Unsteady, and impatient to hold shares.

A week and a month pass quickly. For most investors, it is necessary to calm down and pursue accuracy and steady compound interest

2: There are not many high-quality targets filtered through a comprehensive model, based on sector rotation, trends, market style, and dominance

The operating intentions of capital are different, and the timing of the explosion will vary. For most people, at least the value of the bullish trend

You still need to be patient to keep stocks above the 10/20 EMA.

If you don't have this patience, it means it's not reasonable for you to act in a proper manner...

Snowball column from Fourizi

Opening article sharing (based on messages from a few of my friends in the afternoon that the market rebounded and didn't make any money)

1: The index fluctuated and rebounded, and most people's feelings of being suppressed during the previous decline began to unleash. The market rotated rapidly, and the intraday period varied

There is a lot of movement, leading to too much excitement, too much chasing ups and downs, and being too impatient. As a result, it can even cause the index to rebound 200 points, myself

The account is not making any money. I also often encountered it when I first entered the market five years before entering the market.

A friend of mine doesn't have the same model as mine and hasn't made any money in the past few days.

The reason is that weak people don't want to buy, stable ones don't want to lurk, and they don't dare to buy leaders when invited in. The result is that they seem aggressive but they are not leading the way.

Unsteady, and impatient to hold shares.

A week and a month pass quickly. For most investors, it is necessary to calm down and pursue accuracy and steady compound interest

2: There are not many high-quality targets filtered through a comprehensive model, based on sector rotation, trends, market style, and dominance

The operating intentions of capital are different, and the timing of the explosion will vary. For most people, at least the value of the bullish trend

You still need to be patient to keep stocks above the 10/20 EMA.

If you don't have this patience, it means it's not reasonable for you to act in a proper manner...

Translated

2

鸽子

liked and commented on

In stock trading, if you don't chase highs and sell lows in the short term, you will be ahead of 50% of people.

If you operate in the medium to long term, reducing frequent trading, you will surpass 70% of people.

If you further use fundamental analysis to select stocks and choose excellent companies in sunrise industries, you will surpass 90% of people.

If you combine entering at the bottom of the monthly chart, you will surpass almost 95% of people.

If you further avoid monotony, diversify your positions, you will surpass almost 98% of people.

If you have idle money for stock trading, without using leverage, in the long run, you will definitely surpass over 99% of people...

Planning to adhere to the above points repeatedly, achieving financial freedom is just a matter of time. $Amazon (AMZN.US)$ $Tesla (TSLA.US)$ $Microsoft (MSFT.US)$

If you operate in the medium to long term, reducing frequent trading, you will surpass 70% of people.

If you further use fundamental analysis to select stocks and choose excellent companies in sunrise industries, you will surpass 90% of people.

If you combine entering at the bottom of the monthly chart, you will surpass almost 95% of people.

If you further avoid monotony, diversify your positions, you will surpass almost 98% of people.

If you have idle money for stock trading, without using leverage, in the long run, you will definitely surpass over 99% of people...

Planning to adhere to the above points repeatedly, achieving financial freedom is just a matter of time. $Amazon (AMZN.US)$ $Tesla (TSLA.US)$ $Microsoft (MSFT.US)$

Translated

10

1

鸽子

liked and commented on

** DAY TRADING RULES **

**1.** *ONLY ENTER SETUPS YOU KNOW CONSISTENTLY WORK*

These are the only strategies I use 👇

• 15min ORB strategy breakouts with VOLUME

• ABCD (always enter at C)

• breaks of support/resistances

• breakouts of key levels found from previous days on the 5min, 15min, 1hr, or 1Day chart

• Bearish or Bullish divergences (RSI, MACD, OBV)

• Candlesticks patterns= Pin bars, Engulfing, and inside days are the highest probability.

• 3rd touch of trendlines

**2.** Never en...

**1.** *ONLY ENTER SETUPS YOU KNOW CONSISTENTLY WORK*

These are the only strategies I use 👇

• 15min ORB strategy breakouts with VOLUME

• ABCD (always enter at C)

• breaks of support/resistances

• breakouts of key levels found from previous days on the 5min, 15min, 1hr, or 1Day chart

• Bearish or Bullish divergences (RSI, MACD, OBV)

• Candlesticks patterns= Pin bars, Engulfing, and inside days are the highest probability.

• 3rd touch of trendlines

**2.** Never en...

9

6

鸽子

liked

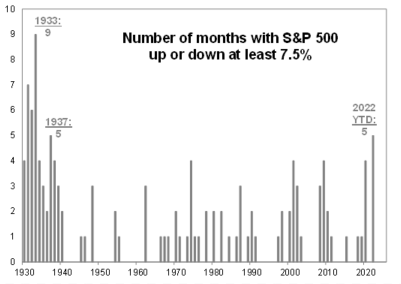

Have you wondered: what is the number of months in 2022 that the $S&P 500 Index (.SPX.US)$ has been UP or DOWN at least 7.5%?

5 times! Not much, a lot, an outlier ?

Well, that is the most (at par) since 1937! That is since pretty much everybody started investing & trading. One more occurrence in November/December and we have one for the history books in 2022 ... let that sink in!

Choppy market, trying to time it ?

$Tesla (TSLA.US)$ $Apple (AAPL.US)$

5 times! Not much, a lot, an outlier ?

Well, that is the most (at par) since 1937! That is since pretty much everybody started investing & trading. One more occurrence in November/December and we have one for the history books in 2022 ... let that sink in!

Choppy market, trying to time it ?

$Tesla (TSLA.US)$ $Apple (AAPL.US)$

4

1

鸽子

liked

$Tesla (TSLA.US)$ $SPDR S&P 500 ETF (SPY.US)$ $Apple (AAPL.US)$ 仓位

熊市我都是低仓位操作,昨天发站长线开始了,没想到今天直接爆拉。今天一早就发帖今天

买入,可惜起了个早,仓位太低,当然一直保持稳健获利也是这种思维,所以今年一直获利,

所以弊端也是存在的,再仔细考虑考虑。

目前市场预期美联储加息周期进入尾声,同时衰退从各类数据看并不严重,轻微衰退概率目

前较高,所以目前这个位置我考虑长线仓位进行配置,同时选定行业确定性高一点行业。

机会现在越来越明显,局部低估严重的品种,深套的投资者即将迎来春天,要做的就是等待。

个人目前开始精挑细选,今天加了部分仓位,现在长线仓位3%,盘中超短线偶尔加上,整

体每天运作资金一成左右。

慢慢做,在稳定收益的前提下,把长线仓位择机加到一成,盘中增加操作仓位,每天运作资

金提高到四成,两个账户底仓总共两成,进可攻退可守。

现在思路需要开始慢慢转变,迎接市场的触底。当然并不意味着触底后市场立马大涨,底部

盘整长则半年,短则两个月,投资者要做的就是在仓位配置的前提下,做好品种的甄...

熊市我都是低仓位操作,昨天发站长线开始了,没想到今天直接爆拉。今天一早就发帖今天

买入,可惜起了个早,仓位太低,当然一直保持稳健获利也是这种思维,所以今年一直获利,

所以弊端也是存在的,再仔细考虑考虑。

目前市场预期美联储加息周期进入尾声,同时衰退从各类数据看并不严重,轻微衰退概率目

前较高,所以目前这个位置我考虑长线仓位进行配置,同时选定行业确定性高一点行业。

机会现在越来越明显,局部低估严重的品种,深套的投资者即将迎来春天,要做的就是等待。

个人目前开始精挑细选,今天加了部分仓位,现在长线仓位3%,盘中超短线偶尔加上,整

体每天运作资金一成左右。

慢慢做,在稳定收益的前提下,把长线仓位择机加到一成,盘中增加操作仓位,每天运作资

金提高到四成,两个账户底仓总共两成,进可攻退可守。

现在思路需要开始慢慢转变,迎接市场的触底。当然并不意味着触底后市场立马大涨,底部

盘整长则半年,短则两个月,投资者要做的就是在仓位配置的前提下,做好品种的甄...

1

鸽子

liked

$Hang Seng Index (800000.HK)$ $Hang Seng TECH Index ETF (03032.HK)$ $MEITUAN-W (03690.HK)$一个人要想做好股票,必须具备这七大能力,长年的经验总结:

一、要有逆向思维,换位思考的能力,你要明白投资都是少数人挣钱;

二、独立思考,独立思考的能力是非常重要,大多数人都是借着消息人云亦云,特别是只看消息,不看股价的位置炒股的那帮人,很容易亏损;

三、要有纠错能力,就要学会止损,因为投资总有对总有错,没有人做到100%正确,不敬畏市场,你错了一次就将前功尽弃;

四、找到自己的正确的投资方式,有的人是闲钱投资,所以说他不用去理会外面风风雨雨,有的人做大盘股,有的人玩小盘股,有人做成长股,没有可比性。但是我们要知道最后大部分个股都是赔,少部分个股在赛跑,运动员上场的机会是非常少的,一只股票上涨的时间是非常有限,大部分时间都在下跌,所以说大家是要有自己的投资方法,不用学来学去学,要长期去试,长期去积累。

五、要学会控制情绪,很多人他就是往往失败在最后一次,因为他的仓位,资金来源啊不一样的,他的情绪控制是很难控制,有的人上班就一天就赚一两百,他...

一、要有逆向思维,换位思考的能力,你要明白投资都是少数人挣钱;

二、独立思考,独立思考的能力是非常重要,大多数人都是借着消息人云亦云,特别是只看消息,不看股价的位置炒股的那帮人,很容易亏损;

三、要有纠错能力,就要学会止损,因为投资总有对总有错,没有人做到100%正确,不敬畏市场,你错了一次就将前功尽弃;

四、找到自己的正确的投资方式,有的人是闲钱投资,所以说他不用去理会外面风风雨雨,有的人做大盘股,有的人玩小盘股,有人做成长股,没有可比性。但是我们要知道最后大部分个股都是赔,少部分个股在赛跑,运动员上场的机会是非常少的,一只股票上涨的时间是非常有限,大部分时间都在下跌,所以说大家是要有自己的投资方法,不用学来学去学,要长期去试,长期去积累。

五、要学会控制情绪,很多人他就是往往失败在最后一次,因为他的仓位,资金来源啊不一样的,他的情绪控制是很难控制,有的人上班就一天就赚一两百,他...

2

鸽子

voted

According to Singapore Minister for Health Ong Ye Kung, while Singapore and Hong Kong's companies and sectors compete, they also mutually benefit from each other to an even greater extent.

He also pointed out that supply chains, production capabilities and markets, as well as people relations are all "closely interwined" across the world and between cities. Singapore and Hong Kong realtions need to be seen from that prespective.

![]() Do you think Singapore...

Do you think Singapore...

He also pointed out that supply chains, production capabilities and markets, as well as people relations are all "closely interwined" across the world and between cities. Singapore and Hong Kong realtions need to be seen from that prespective.

13

3

鸽子

liked

In the stock market, if you don't chase highs and sell lows in the short term, you will be ahead of 50% of people.

If you trade in the medium and long term and reduce frequent transactions, you will profit from 70% of the people.

If you select stocks based on fundamentals and choose excellent companies in the sunrise industry, you will surpass 90% of the people.

If you combine entering at the bottom of the monthly chart, you will almost surpass 95% of the people.

To avoid monotony, diversify your positions, just like over 98% of people.

If you can invest in stocks with spare money, without leveraging, in the long run you will definitely surpass over 99% of people...

Plan to adhere to the above points, financial freedom is just a matter of time.

$Tesla (TSLA.US)$ $Amazon (AMZN.US)$ $SPDR S&P 500 ETF (SPY.US)$ This is my future plan, let's encourage each other!

If you trade in the medium and long term and reduce frequent transactions, you will profit from 70% of the people.

If you select stocks based on fundamentals and choose excellent companies in the sunrise industry, you will surpass 90% of the people.

If you combine entering at the bottom of the monthly chart, you will almost surpass 95% of the people.

To avoid monotony, diversify your positions, just like over 98% of people.

If you can invest in stocks with spare money, without leveraging, in the long run you will definitely surpass over 99% of people...

Plan to adhere to the above points, financial freedom is just a matter of time.

$Tesla (TSLA.US)$ $Amazon (AMZN.US)$ $SPDR S&P 500 ETF (SPY.US)$ This is my future plan, let's encourage each other!

Translated

8

1

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)