$Tesla (TSLA.US)$ $Amazon (AMZN.US)$ $Microsoft (MSFT.US)$ The subject is an army running out of water; value trends are an ironclad battle

Snowball column from Fourizi

Opening article sharing (based on messages from a few of my friends in the afternoon that the market rebounded and didn't make any money)

1: The index fluctuated and rebounded, and most people's feelings of being suppressed during the previous decline began to unleash. The market rotated rapidly, and the intraday period varied

There is a lot of movement, leading to too much excitement, too much chasing ups and downs, and being too impatient. As a result, it can even cause the index to rebound 200 points, myself

The account is not making any money. I also often encountered it when I first entered the market five years before entering the market.

A friend of mine doesn't have the same model as mine and hasn't made any money in the past few days.

The reason is that weak people don't want to buy, stable ones don't want to lurk, and they don't dare to buy leaders when invited in. The result is that they seem aggressive but they are not leading the way.

Unsteady, and impatient to hold shares.

A week and a month pass quickly. For most investors, it is necessary to calm down and pursue accuracy and steady compound interest

2: There are not many high-quality targets filtered through a comprehensive model, based on sector rotation, trends, market style, and dominance

The operating intentions of capital are different, and the timing of the explosion will vary. For most people, at least the value of the bullish trend

You still need to be patient to keep stocks above the 10/20 EMA.

If you don't have this patience, it means it's not reasonable for you to act in a proper manner...

Snowball column from Fourizi

Opening article sharing (based on messages from a few of my friends in the afternoon that the market rebounded and didn't make any money)

1: The index fluctuated and rebounded, and most people's feelings of being suppressed during the previous decline began to unleash. The market rotated rapidly, and the intraday period varied

There is a lot of movement, leading to too much excitement, too much chasing ups and downs, and being too impatient. As a result, it can even cause the index to rebound 200 points, myself

The account is not making any money. I also often encountered it when I first entered the market five years before entering the market.

A friend of mine doesn't have the same model as mine and hasn't made any money in the past few days.

The reason is that weak people don't want to buy, stable ones don't want to lurk, and they don't dare to buy leaders when invited in. The result is that they seem aggressive but they are not leading the way.

Unsteady, and impatient to hold shares.

A week and a month pass quickly. For most investors, it is necessary to calm down and pursue accuracy and steady compound interest

2: There are not many high-quality targets filtered through a comprehensive model, based on sector rotation, trends, market style, and dominance

The operating intentions of capital are different, and the timing of the explosion will vary. For most people, at least the value of the bullish trend

You still need to be patient to keep stocks above the 10/20 EMA.

If you don't have this patience, it means it's not reasonable for you to act in a proper manner...

Translated

2

鸽子

liked and commented on

In stock trading, if you don't chase highs and sell lows in the short term, you will be ahead of 50% of people.

If you operate in the medium to long term, reducing frequent trading, you will surpass 70% of people.

If you further use fundamental analysis to select stocks and choose excellent companies in sunrise industries, you will surpass 90% of people.

If you combine entering at the bottom of the monthly chart, you will surpass almost 95% of people.

If you further avoid monotony, diversify your positions, you will surpass almost 98% of people.

If you have idle money for stock trading, without using leverage, in the long run, you will definitely surpass over 99% of people...

Planning to adhere to the above points repeatedly, achieving financial freedom is just a matter of time. $Amazon (AMZN.US)$ $Tesla (TSLA.US)$ $Microsoft (MSFT.US)$

If you operate in the medium to long term, reducing frequent trading, you will surpass 70% of people.

If you further use fundamental analysis to select stocks and choose excellent companies in sunrise industries, you will surpass 90% of people.

If you combine entering at the bottom of the monthly chart, you will surpass almost 95% of people.

If you further avoid monotony, diversify your positions, you will surpass almost 98% of people.

If you have idle money for stock trading, without using leverage, in the long run, you will definitely surpass over 99% of people...

Planning to adhere to the above points repeatedly, achieving financial freedom is just a matter of time. $Amazon (AMZN.US)$ $Tesla (TSLA.US)$ $Microsoft (MSFT.US)$

Translated

10

1

鸽子

liked and commented on

** DAY TRADING RULES **

**1.** *ONLY ENTER SETUPS YOU KNOW CONSISTENTLY WORK*

These are the only strategies I use 👇

• 15min ORB strategy breakouts with VOLUME

• ABCD (always enter at C)

• breaks of support/resistances

• breakouts of key levels found from previous days on the 5min, 15min, 1hr, or 1Day chart

• Bearish or Bullish divergences (RSI, MACD, OBV)

• Candlesticks patterns= Pin bars, Engulfing, and inside days are the highest probability.

• 3rd touch of trendlines

**2.** Never en...

**1.** *ONLY ENTER SETUPS YOU KNOW CONSISTENTLY WORK*

These are the only strategies I use 👇

• 15min ORB strategy breakouts with VOLUME

• ABCD (always enter at C)

• breaks of support/resistances

• breakouts of key levels found from previous days on the 5min, 15min, 1hr, or 1Day chart

• Bearish or Bullish divergences (RSI, MACD, OBV)

• Candlesticks patterns= Pin bars, Engulfing, and inside days are the highest probability.

• 3rd touch of trendlines

**2.** Never en...

9

6

鸽子

liked

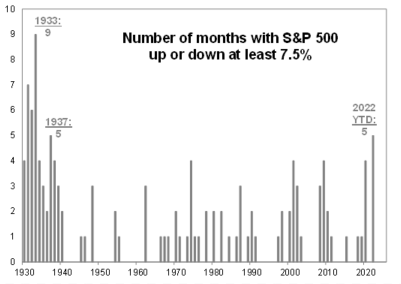

Have you wondered: what is the number of months in 2022 that the $S&P 500 Index (.SPX.US)$ has been UP or DOWN at least 7.5%?

5 times! Not much, a lot, an outlier ?

Well, that is the most (at par) since 1937! That is since pretty much everybody started investing & trading. One more occurrence in November/December and we have one for the history books in 2022 ... let that sink in!

Choppy market, trying to time it ?

$Tesla (TSLA.US)$ $Apple (AAPL.US)$

5 times! Not much, a lot, an outlier ?

Well, that is the most (at par) since 1937! That is since pretty much everybody started investing & trading. One more occurrence in November/December and we have one for the history books in 2022 ... let that sink in!

Choppy market, trying to time it ?

$Tesla (TSLA.US)$ $Apple (AAPL.US)$

4

1

鸽子

liked

$Tesla (TSLA.US)$ $SPDR S&P 500 ETF (SPY.US)$ $Apple (AAPL.US)$ Positions

In bear markets, I always operate with low positions. The Webmaster Line started yesterday, and I didn't expect it to explode directly today. Posted early this morning today

The purchase, unfortunately, started early, and the position was too low. Of course, maintaining steady profits is also this way of thinking, so it has been profitable this year.

Therefore, there are disadvantages, so consider them carefully.

Currently, the market expects the Fed's interest rate hike cycle to come to an end. At the same time, judging from various data, the recession is not serious. The probability of a slight recession is expected.

The previous one was higher, so I'm considering long-term positions for this position, and at the same time choosing an industry with a higher degree of certainty.

Opportunities are now becoming more and more obvious. Some are underestimating serious varieties. Deep investors are about to usher in spring; all they have to do is wait.

Individuals are now beginning to carefully select. Some positions have been added today. Currently, long-term positions are 3%, and intraday ultra-short-term positions are added occasionally.

The operating capital of the system is about 10% per day.

Do it slowly. Under the premise of stable earnings, take the opportunity to add long-term positions to 10%, increase operating positions in the intraday period, and operate capital every day

Gold was raised to 40%, and the bottom positions of the two accounts totaled 20%, so offensively and retractable, they can be defended.

Now we need to start to slowly shift our thinking to meet the bottom of the market. Of course, this does not mean that after hitting the bottom, the market will immediately rise sharply, the bottom

The consolidation takes half a year, and the short one is two months. All investors need to do is to do a good job of variety under the premise of position allocation...

In bear markets, I always operate with low positions. The Webmaster Line started yesterday, and I didn't expect it to explode directly today. Posted early this morning today

The purchase, unfortunately, started early, and the position was too low. Of course, maintaining steady profits is also this way of thinking, so it has been profitable this year.

Therefore, there are disadvantages, so consider them carefully.

Currently, the market expects the Fed's interest rate hike cycle to come to an end. At the same time, judging from various data, the recession is not serious. The probability of a slight recession is expected.

The previous one was higher, so I'm considering long-term positions for this position, and at the same time choosing an industry with a higher degree of certainty.

Opportunities are now becoming more and more obvious. Some are underestimating serious varieties. Deep investors are about to usher in spring; all they have to do is wait.

Individuals are now beginning to carefully select. Some positions have been added today. Currently, long-term positions are 3%, and intraday ultra-short-term positions are added occasionally.

The operating capital of the system is about 10% per day.

Do it slowly. Under the premise of stable earnings, take the opportunity to add long-term positions to 10%, increase operating positions in the intraday period, and operate capital every day

Gold was raised to 40%, and the bottom positions of the two accounts totaled 20%, so offensively and retractable, they can be defended.

Now we need to start to slowly shift our thinking to meet the bottom of the market. Of course, this does not mean that after hitting the bottom, the market will immediately rise sharply, the bottom

The consolidation takes half a year, and the short one is two months. All investors need to do is to do a good job of variety under the premise of position allocation...

Translated

1

鸽子

liked

$Hang Seng Index (800000.HK)$ $Hang Seng TECH Index ETF (03032.HK)$ $MEITUAN-W (03690.HK)$To succeed in stocks, one must possess these seven major abilities, summarized from years of experience:

First, you need to have the ability of reverse thinking and empathetic thinking. You need to understand that investment is where only a few people make money;

Second, independent thinking is crucial. Most people just follow the crowd based on rumors without considering stock prices. Especially those who only look at news and not the stock price location when trading stocks are prone to losses;

Third, to have the ability to correct mistakes, you need to learn to cut losses, because there are always right and wrong in investment, no one can be 100% correct. Without respecting the market, making a mistake once will undo all previous efforts.

Fourth, find your own correct investment method. Some people invest idle funds, so they do not need to pay attention to the ups and downs outside. Some people invest in large cap stocks, some people play small cap stocks, some invest in growth stocks. There is no comparability. But we must know that in the end, most stocks lose, a few stocks are in a race. The chance for athletes to go on stage is very rare, and the time for a stock to rise is very limited. Most of the time it is falling. Therefore, everyone should have their own investment method, not learning back and forth, but trying for the long term and accumulating over time.

Fifth, you need to learn to control your emotions. Many people often fail in the last round because of their position, funding sources, and different emotions. It is very difficult to control their emotions. Some people can earn one or two hundred in a day at work...

First, you need to have the ability of reverse thinking and empathetic thinking. You need to understand that investment is where only a few people make money;

Second, independent thinking is crucial. Most people just follow the crowd based on rumors without considering stock prices. Especially those who only look at news and not the stock price location when trading stocks are prone to losses;

Third, to have the ability to correct mistakes, you need to learn to cut losses, because there are always right and wrong in investment, no one can be 100% correct. Without respecting the market, making a mistake once will undo all previous efforts.

Fourth, find your own correct investment method. Some people invest idle funds, so they do not need to pay attention to the ups and downs outside. Some people invest in large cap stocks, some people play small cap stocks, some invest in growth stocks. There is no comparability. But we must know that in the end, most stocks lose, a few stocks are in a race. The chance for athletes to go on stage is very rare, and the time for a stock to rise is very limited. Most of the time it is falling. Therefore, everyone should have their own investment method, not learning back and forth, but trying for the long term and accumulating over time.

Fifth, you need to learn to control your emotions. Many people often fail in the last round because of their position, funding sources, and different emotions. It is very difficult to control their emotions. Some people can earn one or two hundred in a day at work...

Translated

2

鸽子

voted

According to Singapore Minister for Health Ong Ye Kung, while Singapore and Hong Kong's companies and sectors compete, they also mutually benefit from each other to an even greater extent.

He also pointed out that supply chains, production capabilities and markets, as well as people relations are all "closely interwined" across the world and between cities. Singapore and Hong Kong realtions need to be seen from that prespective.

![]() Do you think Singapore...

Do you think Singapore...

He also pointed out that supply chains, production capabilities and markets, as well as people relations are all "closely interwined" across the world and between cities. Singapore and Hong Kong realtions need to be seen from that prespective.

13

3

鸽子

liked

In the stock market, if you don't chase highs and sell lows in the short term, you will be ahead of 50% of people.

If you trade in the medium and long term and reduce frequent transactions, you will profit from 70% of the people.

If you select stocks based on fundamentals and choose excellent companies in the sunrise industry, you will surpass 90% of the people.

If you combine entering at the bottom of the monthly chart, you will almost surpass 95% of the people.

To avoid monotony, diversify your positions, just like over 98% of people.

If you can invest in stocks with spare money, without leveraging, in the long run you will definitely surpass over 99% of people...

Plan to adhere to the above points, financial freedom is just a matter of time.

$Tesla (TSLA.US)$ $Amazon (AMZN.US)$ $SPDR S&P 500 ETF (SPY.US)$ This is my future plan, let's encourage each other!

If you trade in the medium and long term and reduce frequent transactions, you will profit from 70% of the people.

If you select stocks based on fundamentals and choose excellent companies in the sunrise industry, you will surpass 90% of the people.

If you combine entering at the bottom of the monthly chart, you will almost surpass 95% of the people.

To avoid monotony, diversify your positions, just like over 98% of people.

If you can invest in stocks with spare money, without leveraging, in the long run you will definitely surpass over 99% of people...

Plan to adhere to the above points, financial freedom is just a matter of time.

$Tesla (TSLA.US)$ $Amazon (AMZN.US)$ $SPDR S&P 500 ETF (SPY.US)$ This is my future plan, let's encourage each other!

Translated

8

1

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)