love the moomoo fund reports. there is a lot of information and pretty updated. there's fund comparison. now even better with charts showing my daily returns.

love love the 7day 6% Fund voucher, hope to see their return.

thanks to moomoo 6.8% promo I started my journey with money market funds. yes I park my money there while waiting for opportunities to purchase more stocks. good returns too beating even the t-bills.

with mag7 rise, I started on technology funds and witnessed the volatility. But...

love love the 7day 6% Fund voucher, hope to see their return.

thanks to moomoo 6.8% promo I started my journey with money market funds. yes I park my money there while waiting for opportunities to purchase more stocks. good returns too beating even the t-bills.

with mag7 rise, I started on technology funds and witnessed the volatility. But...

28

stocks slip into the red...

sreits still not doing well... more dca to narrow the losses... hope dividends will be better.

overall not a bad year.

good learning experience with moomoo communities and newfound friends. wishing everyone a better year ahead.

slowly but surely time to say goodbye to the losers.

sreits still not doing well... more dca to narrow the losses... hope dividends will be better.

overall not a bad year.

good learning experience with moomoo communities and newfound friends. wishing everyone a better year ahead.

slowly but surely time to say goodbye to the losers.

6

010Leo

voted

Hi, mooers!

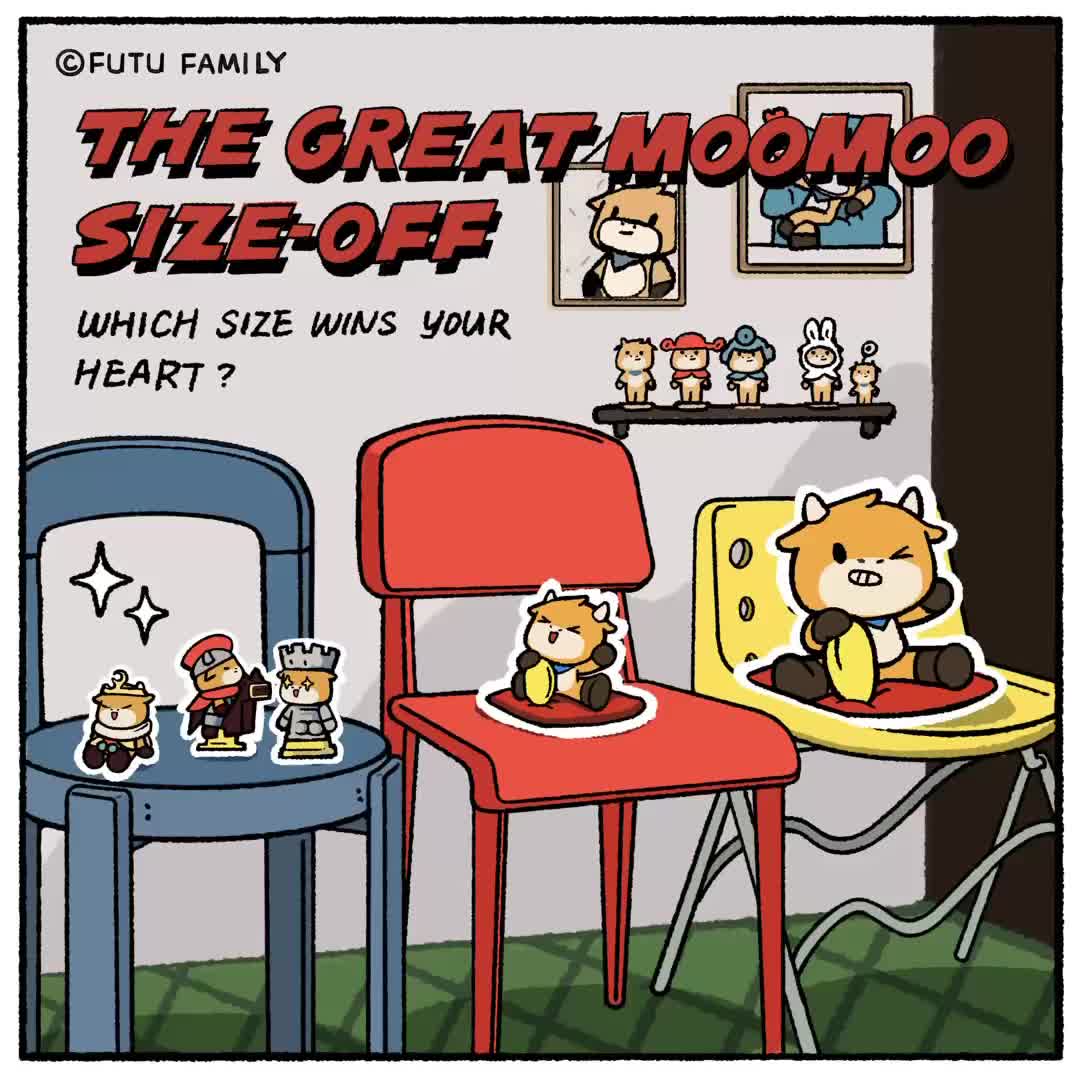

Are you ready to jump into 2025 with excitement? We're delighted to lead the way by introducing our first collectible of the year—the Lively Moo!

As you've just seen, the Lively Moo isn't just any collectible; it embodies joy and creativity for the upcoming year. Plus, we've crafted special red envelopes for the Lunar New Year. 🧧

Join us as we delve into the charm and features of these exciting new items! 👀

🚨 Heart-melter alert! 🚨...

Are you ready to jump into 2025 with excitement? We're delighted to lead the way by introducing our first collectible of the year—the Lively Moo!

As you've just seen, the Lively Moo isn't just any collectible; it embodies joy and creativity for the upcoming year. Plus, we've crafted special red envelopes for the Lunar New Year. 🧧

Join us as we delve into the charm and features of these exciting new items! 👀

🚨 Heart-melter alert! 🚨...

54

16

3

010Leo

reacted to

As we say goodbye to 2024, we also close another chapter of our "Guess the Fund" series. This year, we've been thrilled to have over 5,000 of you join us, with many contributing their strategic insights. Thanks for your overwhelming support and engagement!

In the past nine months, we navigated through five key themes: AI, commodities, European markets, balanced-asset dividends, and Asian markets. Your enthusiasm and insights...

+3

161

88

8

little notes from my girls reflecting on the past year.

my girls spending time to go shopping and then making a simple meal.

browsing moomoo chat daily to get tips, special deals and simply friendship.

my girls spending time to go shopping and then making a simple meal.

browsing moomoo chat daily to get tips, special deals and simply friendship.

1

010Leo

voted

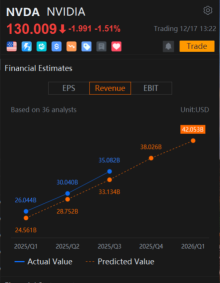

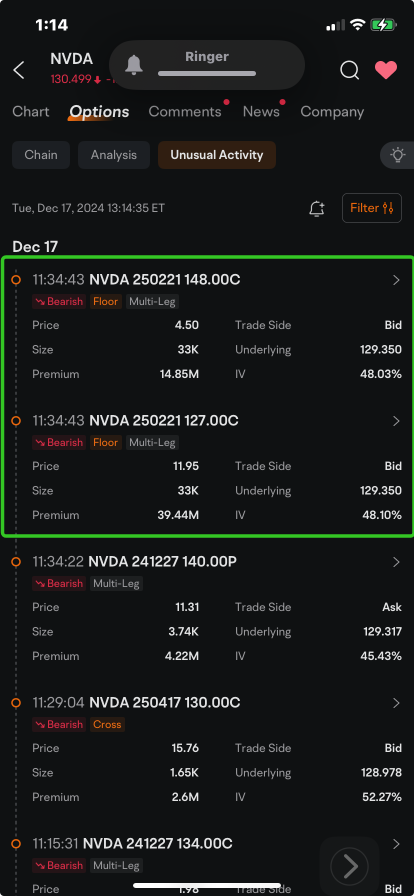

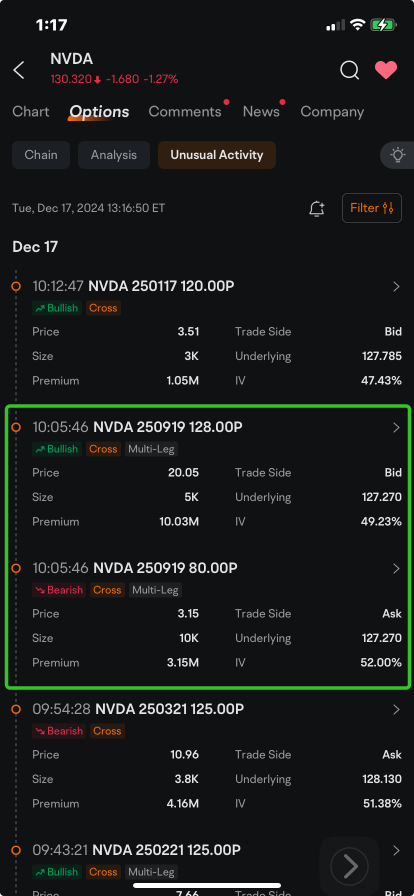

$NVIDIA (NVDA.US)$ bears are selling millions of dollars in call options that could be profitable if the stock stays on a downward trajectory through early 2025.

On Monday, Nvidia logged its seventh decline in eight sessions, taking its losses from a record close to more than 10%. That meets the technical definition of a correction. The market leader in chips that power artificial intelligence applications (AI) extended its losses,...

On Monday, Nvidia logged its seventh decline in eight sessions, taking its losses from a record close to more than 10%. That meets the technical definition of a correction. The market leader in chips that power artificial intelligence applications (AI) extended its losses,...

44

23

57

010Leo

commented on

Hi, mooers!

Welcome to our 2024 Recap: Mooers of the Year! 🎉

What a dynamic year it's been! We've seen an influx of fresh talent and heard louder calls from seasoned voices. Our community has grown into a focal point of engaging conversations and strong friendships. Let's spotlight the mooers who have sparked significant change this year!

*Heads up: We've tweaked the lineup to highlight more mooers and rotate previous stars. To be featured, members must have posted ...

Welcome to our 2024 Recap: Mooers of the Year! 🎉

What a dynamic year it's been! We've seen an influx of fresh talent and heard louder calls from seasoned voices. Our community has grown into a focal point of engaging conversations and strong friendships. Let's spotlight the mooers who have sparked significant change this year!

*Heads up: We've tweaked the lineup to highlight more mooers and rotate previous stars. To be featured, members must have posted ...

+1

132

123

25

010Leo

voted

Happy weekend investors! Welcome back to Weekly Buzz where we talk about the top ten buzzing stocks on moomoo this week! Comment below to answer the Weekly Topic question for a chance to win an award!

Make Your Choice

Weekly Buzz

The market finished the week with all-time records for tech stocks, yet again. Prices were muted until CPI numbers came out Wednesday, high enough above expectations to secure hope for further rate cuts at the FOMC meet...

Make Your Choice

Weekly Buzz

The market finished the week with all-time records for tech stocks, yet again. Prices were muted until CPI numbers came out Wednesday, high enough above expectations to secure hope for further rate cuts at the FOMC meet...

+9

46

18

13

010Leo

voted

Greetings, mooers!

Can you believe it's already mid-December? As 2024 comes to a close, we're overwhelmed with gratitude for a year filled with joy and delightful surprises.

At Futu Family, we take great joy in welcoming new members to our moo-velous family. We love every part of the journey, from the first sketches to the final figurines. It's been fantastic to watch them find their way to you.

🤗 Let's look back at our new friends.

🧡 New chara...

Can you believe it's already mid-December? As 2024 comes to a close, we're overwhelmed with gratitude for a year filled with joy and delightful surprises.

At Futu Family, we take great joy in welcoming new members to our moo-velous family. We love every part of the journey, from the first sketches to the final figurines. It's been fantastic to watch them find their way to you.

🤗 Let's look back at our new friends.

🧡 New chara...

29

7

3

events.

events.![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)