0137817348 Armqn

voted

Hi, mooers!

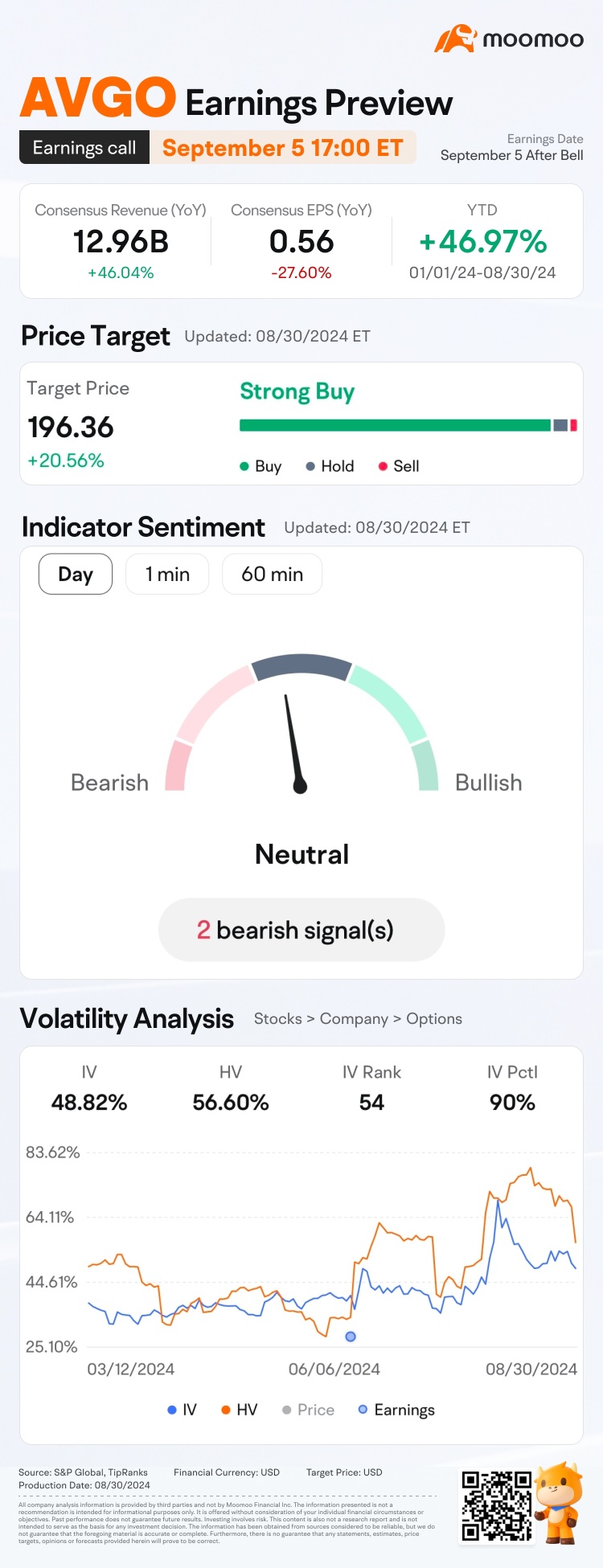

$Broadcom (AVGO.US)$ is releasing its Q3 earnings on September 5 after the bell. Unlock insights with AVGO Earnings Hub>>

For the details of indicator sentiment, please tap the link and check.

Since its Q2 earnings release, shares of $Broadcom (AVGO.US)$ have seen an increase of 9.22%. How will the market react to the upcoming results? Make your guess now!

Rewards

● An equal share of 5,000 points: For mooers who corr...

$Broadcom (AVGO.US)$ is releasing its Q3 earnings on September 5 after the bell. Unlock insights with AVGO Earnings Hub>>

For the details of indicator sentiment, please tap the link and check.

Since its Q2 earnings release, shares of $Broadcom (AVGO.US)$ have seen an increase of 9.22%. How will the market react to the upcoming results? Make your guess now!

Rewards

● An equal share of 5,000 points: For mooers who corr...

Expand

Expand 80

114

0137817348 Armqn

voted

And once again we are near the end of August so it is time to do a recap for the month!![]()

Wake me up when September ends![]()

Apple doing well with anticipation of their generative AI phone services, took some profit here and here![]()

Traded some securities to utilize the I also can stock cash coupons![]()

Nothing crazy just boring slow steady gains from money market funds with some extra boost thanks to moomoo![]()

In lieu of interest rate cuts I have also been moving...

Wake me up when September ends

Apple doing well with anticipation of their generative AI phone services, took some profit here and here

Traded some securities to utilize the I also can stock cash coupons

Nothing crazy just boring slow steady gains from money market funds with some extra boost thanks to moomoo

In lieu of interest rate cuts I have also been moving...

+4

39

7

0137817348 Armqn

commented on and voted

Hey, mooers!

Did you catch our quick rundown on ETFs in the last post, including the different types you can choose from? If not, take a look here: For Beginners | ETF essentials: Launching your investment journey>>

ETFs are popular for their asset variety, risk spread, and trading simplicity. However, picking the right one can be tough with all the choices out there. In this post, we're going to show you how to search for and ...

Did you catch our quick rundown on ETFs in the last post, including the different types you can choose from? If not, take a look here: For Beginners | ETF essentials: Launching your investment journey>>

ETFs are popular for their asset variety, risk spread, and trading simplicity. However, picking the right one can be tough with all the choices out there. In this post, we're going to show you how to search for and ...

+3

60

35

0137817348 Armqn

liked and commented on

Columns Capital trend: Foreign net buy 1.5 billion Malaysian shares, the largest net buy in 8 years.

As the performance of the banking industry shines, foreign investors have been actively buying Malaysian shares for the third consecutive week, with a net purchase of up to 1.5 billion Malaysian ringgit, the highest net purchase since March 18, 2016.

According to the MIDF research on capital trends, foreign investors continued to flow into Malaysian shares significantly last week. The three favored sectors were financial services (1.3 billion Malaysian ringgit), utilities (0.2 billion 59.7 million Malaysian ringgit), and construction (88.7 million Malaysian ringgit).

At the same time, the three sectors with the net selling by foreign investors were technology (-60.4 million Malaysian ringgit), transportation and logistics (-57.2 million Malaysian ringgit), and industrial products and services (-41 million Malaysian ringgit).

Local institutions sold Malaysian shares throughout the week, with a net selling total of 1.2 billion 60 million Malaysian ringgit, the largest net selling since March 4, 2022. Local institutions net bought 13.9 million Malaysian ringgit of shares on Monday, but they were net sellers from Tuesday to Friday.

As for retail investors, except for buying on Thursday, they were selling on other trading days, with a total net selling of 0.2 billion 45.4 million Malaysian ringgit of shares.

As for the level of participation, all three parties experienced growth. Among them, foreign investors were the most active in trading, with the average daily trading volume (ADTV) increasing by 49.9%, while local institutions and retail investors decreased by 0.4% and 2.8% respectively.

Foreign funds net bought stocks last week.

$PBBANK (1295.MY)$

$MAYBANK (1155.MY)$

$RHBBANK (1066.MY)$

$CIMB (1023.MY)$

���������...

According to the MIDF research on capital trends, foreign investors continued to flow into Malaysian shares significantly last week. The three favored sectors were financial services (1.3 billion Malaysian ringgit), utilities (0.2 billion 59.7 million Malaysian ringgit), and construction (88.7 million Malaysian ringgit).

At the same time, the three sectors with the net selling by foreign investors were technology (-60.4 million Malaysian ringgit), transportation and logistics (-57.2 million Malaysian ringgit), and industrial products and services (-41 million Malaysian ringgit).

Local institutions sold Malaysian shares throughout the week, with a net selling total of 1.2 billion 60 million Malaysian ringgit, the largest net selling since March 4, 2022. Local institutions net bought 13.9 million Malaysian ringgit of shares on Monday, but they were net sellers from Tuesday to Friday.

As for retail investors, except for buying on Thursday, they were selling on other trading days, with a total net selling of 0.2 billion 45.4 million Malaysian ringgit of shares.

As for the level of participation, all three parties experienced growth. Among them, foreign investors were the most active in trading, with the average daily trading volume (ADTV) increasing by 49.9%, while local institutions and retail investors decreased by 0.4% and 2.8% respectively.

Foreign funds net bought stocks last week.

$PBBANK (1295.MY)$

$MAYBANK (1155.MY)$

$RHBBANK (1066.MY)$

$CIMB (1023.MY)$

���������...

Translated

28

1

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)