102063946 wolfcheeta

liked

Singapore stocks advanced at the opening bell on Wednesday (Mar 27) morning, following higher-than-expected growth in the city-state’s February factory output.

Data released by the Economic Development Board on Tuesday showed that Singapore’s factory output grew 3.8 per cent in February, exceeding private-sector economist estimates of 0.5 per cent.

$FTSE Singapore Straits Time Index (.STI.SG)$gained 15.37 points or 0.5 per cent to 3...

Data released by the Economic Development Board on Tuesday showed that Singapore’s factory output grew 3.8 per cent in February, exceeding private-sector economist estimates of 0.5 per cent.

$FTSE Singapore Straits Time Index (.STI.SG)$gained 15.37 points or 0.5 per cent to 3...

4

1

102063946 wolfcheeta

voted

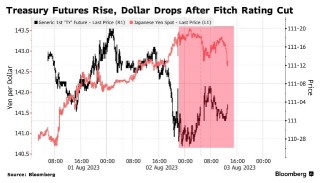

On August 1, 2023, Fitch Ratings downgraded the United States' long-term foreign-currency Issuer default rating (IDR) to AA+ from AAA. The last time an international rating agency did so was 12 years ago when Standard & Poor's cut the U.S. credit rating from AAA to AA+ in 2011.

![]() Why downgrade?

Why downgrade?

Fitch attributed the downgrade of the U.S. to several factors, including weakened governance, rising general government deficits and debt, medium-...

Fitch attributed the downgrade of the U.S. to several factors, including weakened governance, rising general government deficits and debt, medium-...

32

15

41

102063946 wolfcheeta

voted

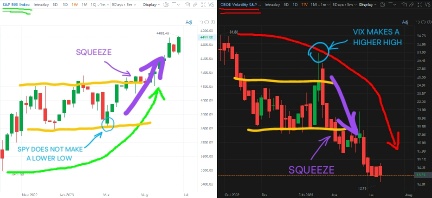

The Inverse Correlation

Vix will increase in value when investors turn bearish for any reason. Whether it be rate hike fears, a small banking collapse, war, runaway inflation, or just weakening economic data. Conversely, the VIX's value will fall when traders are getting more bullish on the market.

In either of these instances, the price of the S&P 500 and the VIX will travel in opposite directions. This is the inverse correlation between the two indic...

Vix will increase in value when investors turn bearish for any reason. Whether it be rate hike fears, a small banking collapse, war, runaway inflation, or just weakening economic data. Conversely, the VIX's value will fall when traders are getting more bullish on the market.

In either of these instances, the price of the S&P 500 and the VIX will travel in opposite directions. This is the inverse correlation between the two indic...

7

3

102063946 wolfcheeta

voted

Addiction is the inability to stop consuming a chemical or pursuing an activity despite causing harm.

Very much the same happens to people who trade.

Here are some signs of addiction:

![]() You spend far too much of your free time trading

You spend far too much of your free time trading

![]() You are trading stocks at work (and it isn’t your job)

You are trading stocks at work (and it isn’t your job)

![]() The “high” of trying to find the next “moonshot” is the focus of attention

The “high” of trying to find the next “moonshot” is the focus of attention

![]() You have feelings for frustration, aggression or attempt to surpress other personal problems...

You have feelings for frustration, aggression or attempt to surpress other personal problems...

Very much the same happens to people who trade.

Here are some signs of addiction:

21

2

3

102063946 wolfcheeta

voted

Investing can be risky

Stocks can go up one day and down the next. These changes could result in a significant loss of value.

And why do people still risk their hard-earned money on it? Would you guys tell me about your reason?

Stocks can go up one day and down the next. These changes could result in a significant loss of value.

And why do people still risk their hard-earned money on it? Would you guys tell me about your reason?

45

4

4

102063946 wolfcheeta

voted

$PayPal (PYPL.US)$ Who are the best fintech companies to invest in?

$Block (SQ.US)$ $Upstart (UPST.US)$ $Affirm Holdings (AFRM.US)$ $SoFi Technologies (SOFI.US)$ $SPDR S&P 500 ETF (SPY.US)$

$Block (SQ.US)$ $Upstart (UPST.US)$ $Affirm Holdings (AFRM.US)$ $SoFi Technologies (SOFI.US)$ $SPDR S&P 500 ETF (SPY.US)$

5

1

102063946 wolfcheeta

liked

$Grab Holdings (GRAB.US)$ I thought i was viewing SGX….up down within penny whole day. truly carrying sg spirit 🤣

12

7

102063946 wolfcheeta

liked

$The Health Care Select Sector SPDR® Fund (XLV.US)$

This is the major healthcare ETF

A look at the top chart and you can see the nearly 5 months of consolidation and a breakout to the upside

The second MACD (used here as a momentum trend indicator) shows the red/green trend bars, (notice how the trend lines are in line with the bars). Now look back to the start of the indicator and you can see how the trend lines up with the price rise (the current indicator is much much stronger). Indicators lag by design (if they could predict future movement that would be a crystal ball) but they show us this has been set up to explode higher.

Now the DMA (Displaced Moving Average used to spot trend reversals) on the bottom. The middle of the 3 horizontal lines is the trend, notice the break out (or up)! The blue line is the Moving Average and gives no indication it only tells you what is. The yellow is a forward shifted indicator (magic crystal ball). Notice once again a breakout!

Now why is it breaking out? The majors in healthcare have NEVER had more money (I will avoid the why's just know they do). Now inflation is here and cash loses value everyday you hold it, but you know what doesn't??? Drugs!... tell me are your healthcare costs going down!? So now these companies have hundreds of billions of dollars losing value the longer they hold it (not to mention the tax man cometh). At this very same time we have the most drugs EVER trying to get approval/trials but the costs are going up and their limited cash on hand is losing value, see where this is going??? Mergers acquisitions and product agreements on a level NEVER seen before!

Why am I writing this on a cold Saturday? Well you could buy this ETF (and limit your risk by its shear volume of assets BUT also limiting your possible gains in the right individual stocks) and make a lot of gains!... Or you could see this as a big ol' buy signal 🚀🚀🚀 for individual stocks in the healthcare sector. Some of my picks are

$Deciphera Pharmaceuticals (DCPH.US)$

$ChemoCentryx (CCXI.US)$

$Cortexyme (CRTX.US)$

$180 Life Sciences (ATNF.US)$

$CorMedix (CRMD.US)$

$Aurinia Pharmaceuticals (AUPH.US)$

$Citius Pharmaceuticals (CTXR.US)$

$Coherus BioSciences (CHRS.US)$

edit

oh hahaha I forgot $Biofrontera (BFRI.US)$ I keep thinking of it as more of a meme and less as a pharma play😄

This is the major healthcare ETF

A look at the top chart and you can see the nearly 5 months of consolidation and a breakout to the upside

The second MACD (used here as a momentum trend indicator) shows the red/green trend bars, (notice how the trend lines are in line with the bars). Now look back to the start of the indicator and you can see how the trend lines up with the price rise (the current indicator is much much stronger). Indicators lag by design (if they could predict future movement that would be a crystal ball) but they show us this has been set up to explode higher.

Now the DMA (Displaced Moving Average used to spot trend reversals) on the bottom. The middle of the 3 horizontal lines is the trend, notice the break out (or up)! The blue line is the Moving Average and gives no indication it only tells you what is. The yellow is a forward shifted indicator (magic crystal ball). Notice once again a breakout!

Now why is it breaking out? The majors in healthcare have NEVER had more money (I will avoid the why's just know they do). Now inflation is here and cash loses value everyday you hold it, but you know what doesn't??? Drugs!... tell me are your healthcare costs going down!? So now these companies have hundreds of billions of dollars losing value the longer they hold it (not to mention the tax man cometh). At this very same time we have the most drugs EVER trying to get approval/trials but the costs are going up and their limited cash on hand is losing value, see where this is going??? Mergers acquisitions and product agreements on a level NEVER seen before!

Why am I writing this on a cold Saturday? Well you could buy this ETF (and limit your risk by its shear volume of assets BUT also limiting your possible gains in the right individual stocks) and make a lot of gains!... Or you could see this as a big ol' buy signal 🚀🚀🚀 for individual stocks in the healthcare sector. Some of my picks are

$Deciphera Pharmaceuticals (DCPH.US)$

$ChemoCentryx (CCXI.US)$

$Cortexyme (CRTX.US)$

$180 Life Sciences (ATNF.US)$

$CorMedix (CRMD.US)$

$Aurinia Pharmaceuticals (AUPH.US)$

$Citius Pharmaceuticals (CTXR.US)$

$Coherus BioSciences (CHRS.US)$

edit

oh hahaha I forgot $Biofrontera (BFRI.US)$ I keep thinking of it as more of a meme and less as a pharma play😄

26

2

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)