102162150Karen

liked

In the early hours of November 6, U.S. local time, Republican presidential candidate Donald Trump announced his victory in the 2024 presidential election. In response to the election outcome, the "Trump Trade" swept across major asset classes, with S&P 500 index futures rising by 2%, the dollar and U.S. Treasury yields increasing, and Bitcoin briefly surpassing $75,000, hitting a historic high!

Trump's policy positions clearly reflect a cons...

Trump's policy positions clearly reflect a cons...

378

118

102162150Karen

liked

Hi, mooers! ![]()

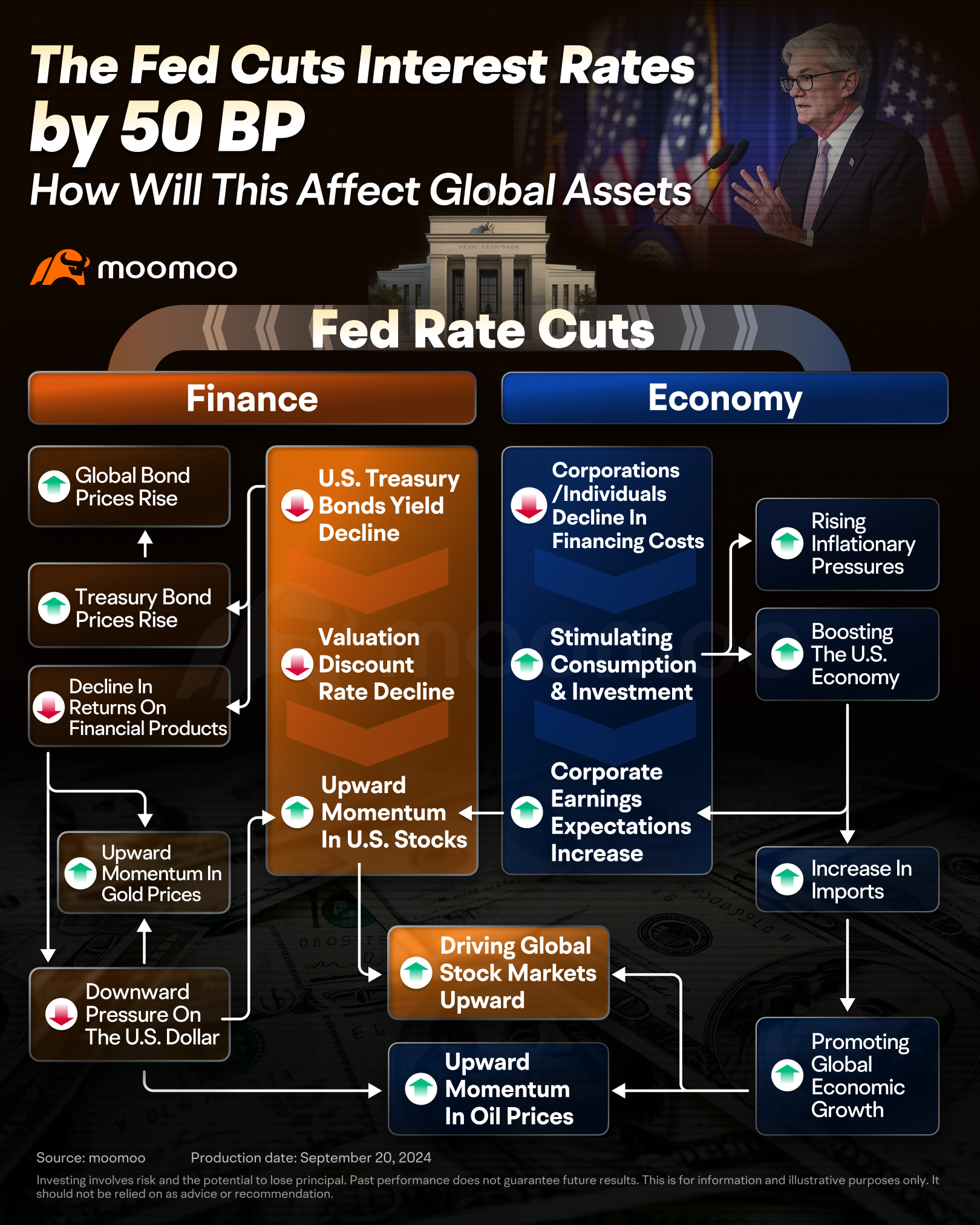

Time has swiftly passed, bringing us to the final quarter of 2024.

When we reflect on the last few months, the standout theme has certainly been the interest rate cut. Which markets have thrived since the Fed's decision? How have your investments adapted to the decreasing interest rates, and what are your strategies moving forward?![]()

Let's dive into your fellow mooers' investment strategies and earnings insights!

Most investors remain s...

Time has swiftly passed, bringing us to the final quarter of 2024.

When we reflect on the last few months, the standout theme has certainly been the interest rate cut. Which markets have thrived since the Fed's decision? How have your investments adapted to the decreasing interest rates, and what are your strategies moving forward?

Let's dive into your fellow mooers' investment strategies and earnings insights!

Most investors remain s...

+5

126

56

102162150Karen

liked

On 24th September, the People's Bank of China rolled out a series of policy measures that sparked a frenzy among investors. This led to a "Super Tuesday" for Chinese assets.![]()

The Hang Seng Index $Hang Seng Index (800000.HK)$ has risen by 32.42% from 9.Sep to 7.Oct, outperforming the $S&P 500 Index (.SPX.US)$ 's 5.32% gain. Is the rally in Chinese assets here to stay? Can we take advantage of it?

![]() Good news! moomoo n...

Good news! moomoo n...

The Hang Seng Index $Hang Seng Index (800000.HK)$ has risen by 32.42% from 9.Sep to 7.Oct, outperforming the $S&P 500 Index (.SPX.US)$ 's 5.32% gain. Is the rally in Chinese assets here to stay? Can we take advantage of it?

258

68

102162150Karen

liked

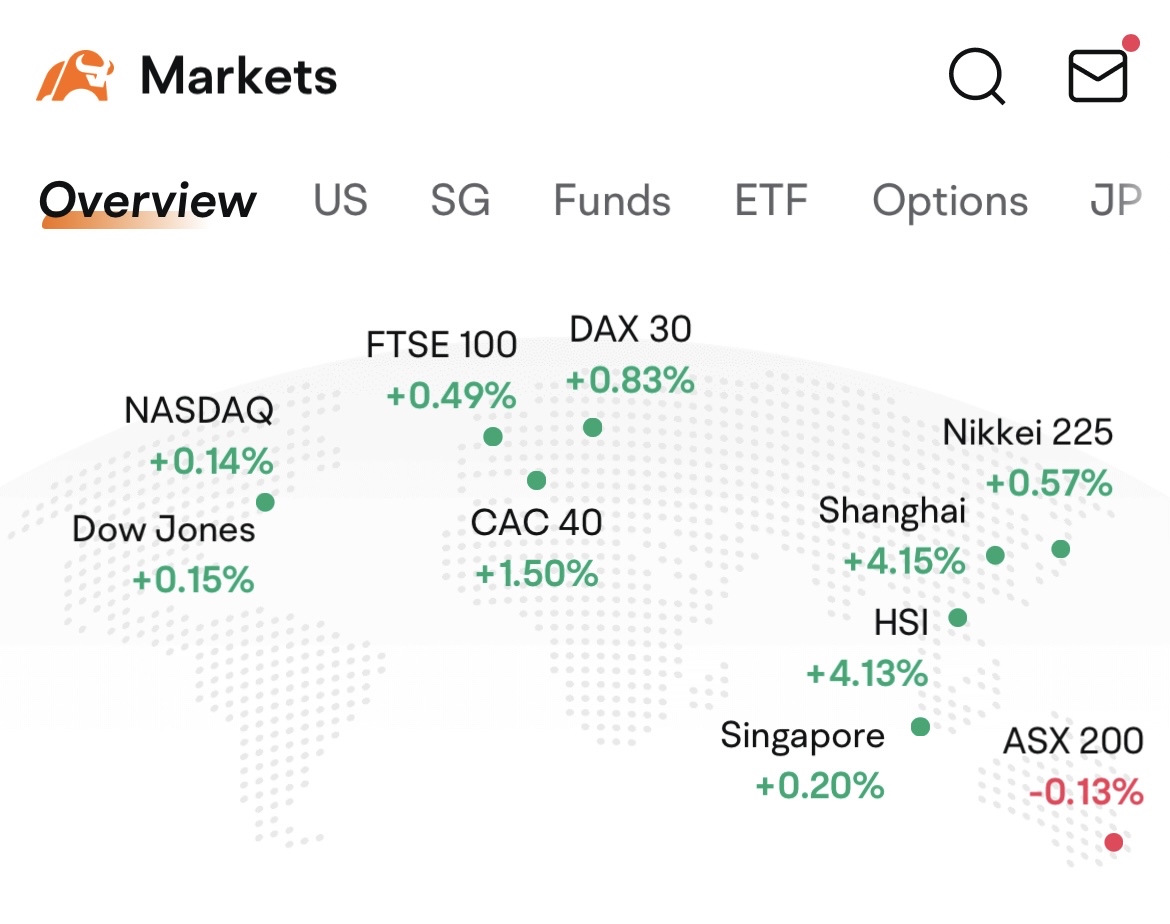

The US Federal Reserve initiated its easing cycle with 50 basis points rate cut last week. This week, Chinese markets joined the trend on Tuesday by cutting the rate by 50 basis points. This decision sparked a rally, with the $Hang Seng Index (800000.HK)$ and $SSE Composite Index (000001.SH)$ rising more than 4% in a single day. On the same day, the Reserve Bank of Australia left its cash rate unchanged at 4.35%. Howe...

+2

350

146

102162150Karen

Set a live reminder

Missed the live? Watch the replay now and join Justin, Michael and Jessica as they dives deep into US rate cuts!

701

1018

102162150Karen

liked

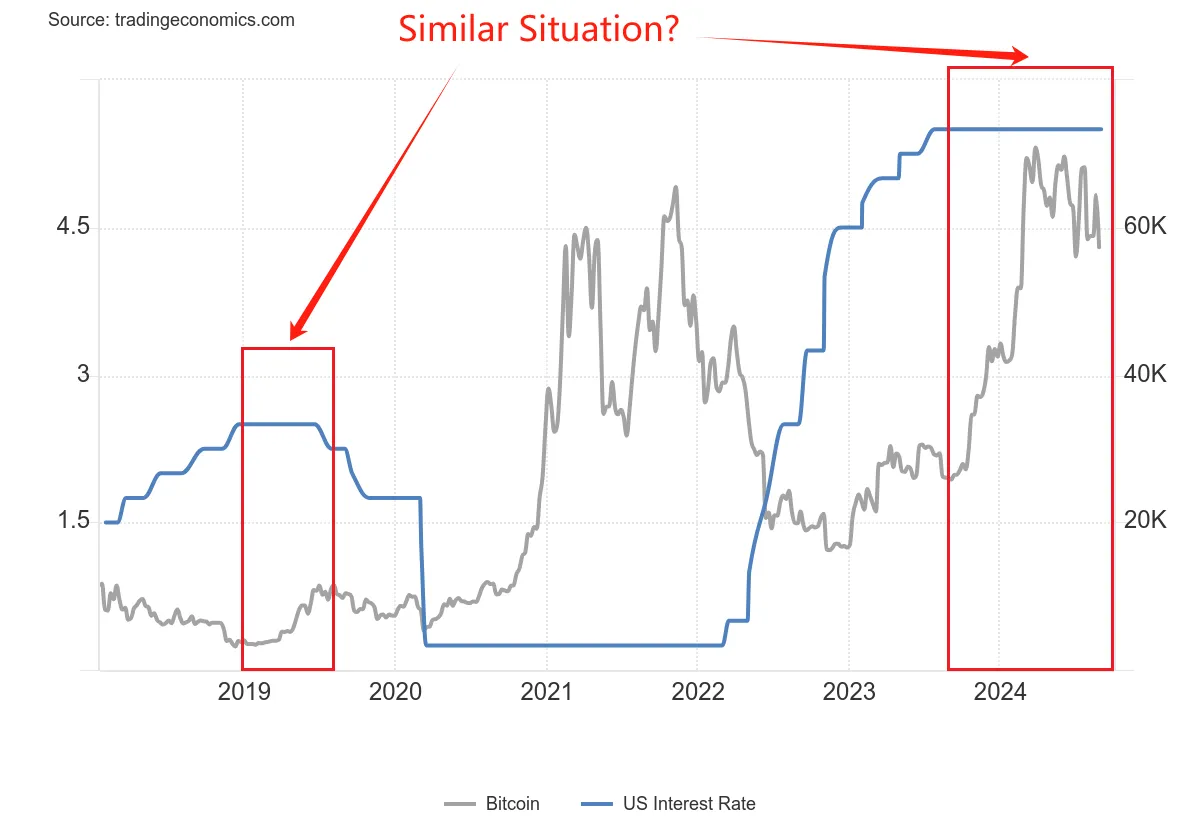

There's a common belief that Federal Reserve rate cuts may boost Bitcoin's price. While this idea has merit, it's too simplistic. With rate cuts now happening, let's delve deeper:

- Why do rate cuts affect Bitcoin's price?

- Does Bitcoin always rise immediately after a rate cut?

- How much can rate cuts boost Bitcoin's price?

These questions are crucial for our investment strategy. Let's explore them in this article.

Rate cuts: Boosting liquidity and ...

- Why do rate cuts affect Bitcoin's price?

- Does Bitcoin always rise immediately after a rate cut?

- How much can rate cuts boost Bitcoin's price?

These questions are crucial for our investment strategy. Let's explore them in this article.

Rate cuts: Boosting liquidity and ...

+2

355

104

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)