102426083Moomoo

voted

Spoiler:

At the end of this post, there is a chance for you to win points!

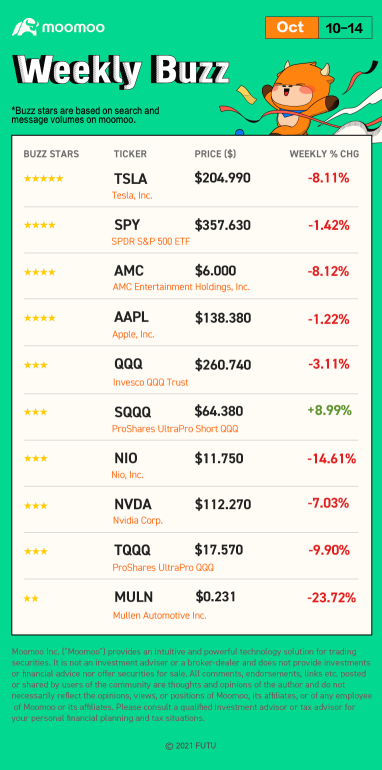

Happy Monday, mooers! Welcome back to Weekly Buzz, where we review the news, performance, and community sentiment of the selected buzzing stocks on moomoo platform based on search and message volumes of last week! (Nano caps are excluded.)

Make Your Choices

Buzzing Stocks List & Mooers Comments

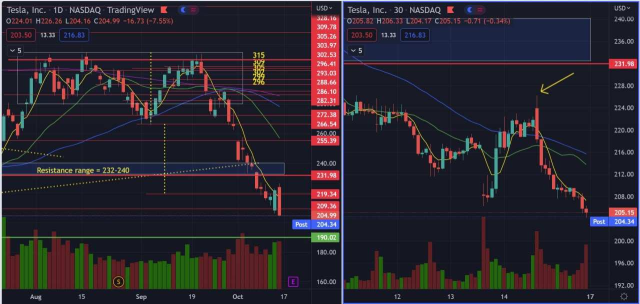

What a volatile week we had! Inflation jumped by 8.2% in September vers...

At the end of this post, there is a chance for you to win points!

Happy Monday, mooers! Welcome back to Weekly Buzz, where we review the news, performance, and community sentiment of the selected buzzing stocks on moomoo platform based on search and message volumes of last week! (Nano caps are excluded.)

Make Your Choices

Buzzing Stocks List & Mooers Comments

What a volatile week we had! Inflation jumped by 8.2% in September vers...

+2

45

41

$ABF SG BOND ETF (A35.SG)$ will it drop until zero?

2

1

102426083Moomoo

voted

102426083Moomoo

voted

Hey, mooers! At the end of this post, there is a chance for you to win points!![]()

Welcome to REITs 101, which will level up your REITs investment knowledge with our full educational REIT Investment.

The 1800s

In the 1800s, the wealthy in the US used trust structures (known as the Massachusetts Trust) to avoid double taxation. As trusts were not corporates, they did not attract corporate taxes as long as the income derived was distributed to their beneficiaries...

Welcome to REITs 101, which will level up your REITs investment knowledge with our full educational REIT Investment.

The 1800s

In the 1800s, the wealthy in the US used trust structures (known as the Massachusetts Trust) to avoid double taxation. As trusts were not corporates, they did not attract corporate taxes as long as the income derived was distributed to their beneficiaries...

24

10

102426083Moomoo

liked

2021 is awesome because I started my investment journey... I selected Moo Moo as my desired investment platform due to several reasons, 1) Moo Moo offers user friendly interface, 2) lots of news, short quick articles and videos to level up my investment knowledge, 3) low charge fees for trading, and 4) offers free stocks! The journey so far using Moo Moo has been exceptionally pleasant.

For my investment portfolio, I diversify on several fronts.

I actively invest in Bank stocks including $OCBC Bank (O39.SG)$, $DBS Group Holdings (D05.SG)$, $UOB (U11.SG)$, which provide for great gains and dividends.

For Reits, I would recommend $CapLand IntCom T (C38U.SG)$, $CapLand Ascendas REIT (A17U.SG)$, $Suntec Reit (T82U.SG)$ and $Keppel DC Reit (AJBU.SG)$. Good source of high dividends.

Other SG stocks include $ST Engineering (S63.SG)$ and $SGX (S68.SG)$ are worth considering.

For US stocks, $Apple (AAPL.US)$ is definitely a good stock to invest in. I would expect the stock to rise further with the excitement over the release of the Apple Car in the near future. In the upcoming hype of the electric cars, stocks such as $NIO Inc (NIO.US)$, $Lucid Group (LCID.US)$ would probably gain traction over time. I previously bought NIO with the believe that the stock would soar in time.

For the HK market, $BABA-W (09988.HK)$ and $ICBC (01398.HK)$ are my targets. Alibaba is currently very much undervalued, thus expecting it to increase soon after recovery from its nosedive for a period.

All of the above stocks, I am adopting the long term investment mentality to gradually increase the volume for high dividend returns.

Patience and diligence is what I learnt through the process as I spent many days observing the stock trends to determine when would be the best time to enter the market.

With uncertainty over news of the Omicron variant, stocks seem to be bearish during this time, I see it as an opportunity to buy more during the dip. So far, I am happy with the performance of all my investment, laying the foundation for growth as the economy gradually recovers.

One cool thing I did was to sell the Twitter stock and use whatever funds to buy a biotech stock, $Longeveron (LGVN.US)$. This was the only one off instance that I traded based on luck with the strike lottery mindset. As in times of covid, biotech stocks tend to be rocketing high dynamically within a day. I made a decent profit out of it when the stock shot up. This was quite an experience.

Hope for all to invest well and into a Great 2022 ahead!

For my investment portfolio, I diversify on several fronts.

I actively invest in Bank stocks including $OCBC Bank (O39.SG)$, $DBS Group Holdings (D05.SG)$, $UOB (U11.SG)$, which provide for great gains and dividends.

For Reits, I would recommend $CapLand IntCom T (C38U.SG)$, $CapLand Ascendas REIT (A17U.SG)$, $Suntec Reit (T82U.SG)$ and $Keppel DC Reit (AJBU.SG)$. Good source of high dividends.

Other SG stocks include $ST Engineering (S63.SG)$ and $SGX (S68.SG)$ are worth considering.

For US stocks, $Apple (AAPL.US)$ is definitely a good stock to invest in. I would expect the stock to rise further with the excitement over the release of the Apple Car in the near future. In the upcoming hype of the electric cars, stocks such as $NIO Inc (NIO.US)$, $Lucid Group (LCID.US)$ would probably gain traction over time. I previously bought NIO with the believe that the stock would soar in time.

For the HK market, $BABA-W (09988.HK)$ and $ICBC (01398.HK)$ are my targets. Alibaba is currently very much undervalued, thus expecting it to increase soon after recovery from its nosedive for a period.

All of the above stocks, I am adopting the long term investment mentality to gradually increase the volume for high dividend returns.

Patience and diligence is what I learnt through the process as I spent many days observing the stock trends to determine when would be the best time to enter the market.

With uncertainty over news of the Omicron variant, stocks seem to be bearish during this time, I see it as an opportunity to buy more during the dip. So far, I am happy with the performance of all my investment, laying the foundation for growth as the economy gradually recovers.

One cool thing I did was to sell the Twitter stock and use whatever funds to buy a biotech stock, $Longeveron (LGVN.US)$. This was the only one off instance that I traded based on luck with the strike lottery mindset. As in times of covid, biotech stocks tend to be rocketing high dynamically within a day. I made a decent profit out of it when the stock shot up. This was quite an experience.

Hope for all to invest well and into a Great 2022 ahead!

238

11

102426083Moomoo

liked

If you're in high growth (AKA: names such as ZM $Zoom Video Communications (ZM.US)$ , DKNG $DraftKings (DKNG.US)$ , SOFI $SoFi Technologies (SOFI.US)$ , etc), this was not done the easy way. The easy way would've been for everything to get wiped out in mid-February-March and be done with it, instead, parts of tech stayed relatively strong or at least wasn't hit as hard, and the Nasdaq was able to rebound.

It's led to the process of finding the bottom being dragged out here. Until one of the following happens:

The Nasdaq sells off and these stocks show relative strength.

A harder correction at the surface by the Nasdaq.

It's still going on.

And many names may not rebound (does ZM ever trade $440 again?).![]()

![]()

It's led to the process of finding the bottom being dragged out here. Until one of the following happens:

The Nasdaq sells off and these stocks show relative strength.

A harder correction at the surface by the Nasdaq.

It's still going on.

And many names may not rebound (does ZM ever trade $440 again?).

10

2

102426083Moomoo

liked

$EVERGRANDE (03333.HK)$ will try restructuring on Monday to reign in its default. They admitted Friday they cant pay Mondays loan due. One risk is that Beijing may not have a full picture of how indebted Evergrande and its peers have become. The Shenzhen-based developer indicated in its exchange filing on Friday that it may not be able to fulfill its pledge to guarantee payment on a $260 million note issued by joint venture Jumbo Fortune Enterprises, an obligation that many Evergrande investors didn’t even know existed until a few months ago.

Bond investors have been anticipating an Evergrande restructuring for months, with the company’s 2025 dollar notes trading below 30 cents since the end of September.

Money managers are bracing for a potential default by $KAISA GROUP (01638.HK)$, which faces a $400 million bond maturity on Tuesday after failing to swap the notes for new ones due 18 months later.

Bond investors have been anticipating an Evergrande restructuring for months, with the company’s 2025 dollar notes trading below 30 cents since the end of September.

Money managers are bracing for a potential default by $KAISA GROUP (01638.HK)$, which faces a $400 million bond maturity on Tuesday after failing to swap the notes for new ones due 18 months later.

45

34

102426083Moomoo

liked

Hello, mooers!

This week the stock market blew out possible again with rapid slash and rally.After a week full of excitement, it's time to discover some famous companies with the market attention!

Rule: Look at the charts below and tell the name of corresponding stocks. (i.e. Tesla, Apple, AMC)

Validity period: Please leave your comments by Monday Dec. 6, 9:00 AM ET / 10:00 PM SGT.

Rewards:

The first and the last mooer who give correct answers within the validity period will win 800 points each!

Miss the first place? Feel free to leave your comment about any of the stocks below, and 3 mooers will win extra 800 points each! (Based on quality and originality)

Comment now to win!

Chart 1:

Changing the world through digital experiences, the company has an ROE of 44.21% and delivered a 2171% return in the past 10 years.

Chart 2:

The 4th Largest semiconductor company in the world, and the only remaining US maker of DRAM, the short-term memory chips found in computers and smartphones.

Chart 3:

A global consumer internet company founded in Singapore and is expanding to the world.

This week the stock market blew out possible again with rapid slash and rally.After a week full of excitement, it's time to discover some famous companies with the market attention!

Rule: Look at the charts below and tell the name of corresponding stocks. (i.e. Tesla, Apple, AMC)

Validity period: Please leave your comments by Monday Dec. 6, 9:00 AM ET / 10:00 PM SGT.

Rewards:

The first and the last mooer who give correct answers within the validity period will win 800 points each!

Miss the first place? Feel free to leave your comment about any of the stocks below, and 3 mooers will win extra 800 points each! (Based on quality and originality)

Comment now to win!

Chart 1:

Changing the world through digital experiences, the company has an ROE of 44.21% and delivered a 2171% return in the past 10 years.

Chart 2:

The 4th Largest semiconductor company in the world, and the only remaining US maker of DRAM, the short-term memory chips found in computers and smartphones.

Chart 3:

A global consumer internet company founded in Singapore and is expanding to the world.

161

124

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)