102617252心

liked

21

20

102617252心

liked

Donald Trump's new company, Trump Media & Technology Group (TMTG), recently announced its plans to merge with special-purpose acquisition company (SPAC) $Digital World Acquisition Corp (DWAC.US)$. DWAC soared as much as 400% the following day. Interestingly, penny stocks connected to the merger are also doing well.

Essentially, SPACs are blank check companies that are investment vehicles looking for startups to take public. With limited paperwork and financial requirements, it is a less taxing way to list shares.

Under the merger announcement, related penny stocks in social media and tech are surging. Some of them are relatively new players, and others are established enterprises. These penny stocks look poised for quick gains from the merger:

$Salem Media Group (SALM.US)$

$Grom Social Enterprises (GROM.US)$

$Phunware (PHUN.US)$

$Creatd (CRTD.US)$

$IZEA Worldwide (IZEA.US)$

$Greenpro Capital (GRNQ.US)$

$NextPlay Technologies (NXTP.US)$

Part of the content is taken from Yahoo! Fiance.

Essentially, SPACs are blank check companies that are investment vehicles looking for startups to take public. With limited paperwork and financial requirements, it is a less taxing way to list shares.

Under the merger announcement, related penny stocks in social media and tech are surging. Some of them are relatively new players, and others are established enterprises. These penny stocks look poised for quick gains from the merger:

$Salem Media Group (SALM.US)$

$Grom Social Enterprises (GROM.US)$

$Phunware (PHUN.US)$

$Creatd (CRTD.US)$

$IZEA Worldwide (IZEA.US)$

$Greenpro Capital (GRNQ.US)$

$NextPlay Technologies (NXTP.US)$

Part of the content is taken from Yahoo! Fiance.

20

1

102617252心

liked

$Range Resources (RRC.US)$and other natural gas-focused producers ripped to 52-week highs today as U.S. front-month natural gas soared to its largest one-day percentage gain since September a year ago, closing +12% to $5.898/MMBtu $United States Natural Gas (UNG.US)$.

Yesterday's settlement is the second highest this year, after the front-month contract hit $6.312 on October 5.

Reaching 52-week highs today: $Chesapeake Energy (CHK.US)$+9.1%, $Range Resources (RRC.US)$+6.3%, $Antero Resources (AR.US)$+5.7%.

Also scoring big gains: $Comstock Resources (CRK.US)$+9%, $Southwestern Energy (SWN.US)$+7.4%, $Coterra Energy (CTRA.US)$+5.9%, $EQT Corp (EQT.US)$+5.2%.

After nearly a month of above-normal temperatures, the National Oceanic and Atmospheric Administration predicts cooler than normal conditions for most of the U.S. southeast and midwest during the first week of November, which should lift domestic heating demand over the period, Schneider Electric's Christin Redmond tells MarketWatch.

NatGasWeather.com says these are not frigid systems to start November, "and the pattern isn't bullish, it's just better than it's been the past five weeks for more seasonal national demand."

Citing strong natural gas fundamentals, Stifel analysts recently upgraded Range Resources to a Buy rating.

Yesterday's settlement is the second highest this year, after the front-month contract hit $6.312 on October 5.

Reaching 52-week highs today: $Chesapeake Energy (CHK.US)$+9.1%, $Range Resources (RRC.US)$+6.3%, $Antero Resources (AR.US)$+5.7%.

Also scoring big gains: $Comstock Resources (CRK.US)$+9%, $Southwestern Energy (SWN.US)$+7.4%, $Coterra Energy (CTRA.US)$+5.9%, $EQT Corp (EQT.US)$+5.2%.

After nearly a month of above-normal temperatures, the National Oceanic and Atmospheric Administration predicts cooler than normal conditions for most of the U.S. southeast and midwest during the first week of November, which should lift domestic heating demand over the period, Schneider Electric's Christin Redmond tells MarketWatch.

NatGasWeather.com says these are not frigid systems to start November, "and the pattern isn't bullish, it's just better than it's been the past five weeks for more seasonal national demand."

Citing strong natural gas fundamentals, Stifel analysts recently upgraded Range Resources to a Buy rating.

19

1

102617252心

liked

In 2021, moomoo became the place where investors could share their opinions and communicate freely with each other. The frequent interactions between the enthusiastic mooers have positively impacted the community.![]()

![]()

![]() Mooers are moving in the same direction: making profits and improving themselves. It would take a long time and great effort for our dear mooers to achieve these goals. Why don't we take a look at ten of the year's valuable market insights and investing tips?

Mooers are moving in the same direction: making profits and improving themselves. It would take a long time and great effort for our dear mooers to achieve these goals. Why don't we take a look at ten of the year's valuable market insights and investing tips?

Spoiler: There's a chance to get points if you read till the end.

*The selected articles are listed randomly.

![]() ONE: Is investing in Trump's new merger a good idea?

ONE: Is investing in Trump's new merger a good idea?

@HuatLadywrote about his concerns on the merger of Trump's company and a SPAC called the Digital World Acquisition Corp. We have to admit that he has a point!

"Forgive me for predicting that most likely his company's stock will not be viable for long term investment goal."

View more: Will Donald be able to deal his Trump Card?

![]() TWO: What do you think of meme stocks?

TWO: What do you think of meme stocks?

@Machiavellis3rdEyeused vivid language to call for rational investing and remind mooers to watch out for media manipulations. Do you agree with him?

"You ARE ALL MY ALLIES, regardless of your investment choices, politics, religions, colors, sex, or anything else! I say we start learning and adapting to their constantly evolving illegal games (media manipulation, PFOF, CB's) together. Then we will all figure out how to take that cheese - without getting TRAPPED."

View more: When will we get off this bus to CRAZYTOWN?

![]() THREE: What can we learn from the big picture?

THREE: What can we learn from the big picture?

@WYCKOFFPROanalyzed the trend of the Russell 2020 with technical tools. Has the market proved his assumptions?

"The breakout of the Russell 2000 gives the first confirmation of the scenario of possible rotation from big cap stocks to small cap stocks."

View more: A Bargain you can't Ignore — This Laggard Breaks All Time High Last Week

![]() FOUR: Will the strong momentum of recovery stocks fade?

FOUR: Will the strong momentum of recovery stocks fade?

On Nov 5, Pfizer introduced a new COVID-19 antiviral pill that is expected to treat 89% of acutely hospitalized patients and thus reduce the risk of death. @HuatEveranticipated that Pfizer's share price would continue to climb once the FDA approved the new antiviral pill. What do you think?

"They hold the promise of cutting down the risk of severe Covid 19 ailments, hospitalisation stays and even deaths, and if being taken at the early onsets of infection. "

View more: A Breakthrough in Covid 19 Antiviral Pills

![]()

![]() FIVE: EV stocks skyrocketing: Good buy or goodbye?

FIVE: EV stocks skyrocketing: Good buy or goodbye?

@Deviltonconducted an in-depth analysis on one of the most popular stocks, $Rivian, and pointed out that patience is a virtue in trading.

"Human are always impatient, we will always have FOMO if we sit and wait till Friday, scared that it stops falling and starts to rise again. Yet buying all tomo may not allow you to buy at the best price." View more here.

![]() SIX: How do you decide when to buy/sell?

SIX: How do you decide when to buy/sell?

@HopeAlwayssaid that there is no best way to determine when to buy and when to sell the stocks of indexes. The timings depend on investing goals, philosophies, and personal preferences.

"The three main risks are company, valuation and earnings risks. Once we are able to find a stock that that signals low risk based on these three conditions, it is time to buy. Whenever a negative change happens to any of the three conditions, it is time to sell."

View more: Buying and Selling Stocks

![]() SEVEN: How do you know when to stop loss / take profit?

SEVEN: How do you know when to stop loss / take profit?

@Powerhousehas three underlying principles in stopping losses and taking profits. All investors should stay informed and closely observe trends to set price targets.

"For micro, there is a need to determine your present financial risk appetite figuratively. On the macro level, situations may have changed. Determining when is the most precise time to stop loss or take profit of a stock and milk the most out of it is extremely difficult."

View more: Stop the pain, take the happiness

![]() EIGHT: What urges you to press the "trade" button?

EIGHT: What urges you to press the "trade" button?

@Panda2102has done macro research to sort out a list of companies and ranks them from different dimensions.

"The mission statement, the moat, the network effect, the switching cost, low cost advantage, optionality, the ratio for PE, PEG, Cash, Debt, Free Cash flow and the ownership of the company."

View more: Best time to press the trade button

![]() NINE: How to build a portfolio with a windfall of $1 million?

NINE: How to build a portfolio with a windfall of $1 million?

@Mars Mooothinks that the Squid Game Multi-Portfolio comprises four parts: player 456, player 218, player 067, and a liquid one.

"The first portfolio is aimed at potential sectors for diversification and profits. The second is designed to high risk lead high returns. The next one intent on helping on thr way. While the last one shows that cash is king."

View more: The Squid Game Multi-Portfolios Portfolio

![]() TEN: How to profit from short-selling?

TEN: How to profit from short-selling?

@Mcsnacks H Tupackshared that short-selling is highly popular on Wall Street and often carried out by aggressive hedge funds.

"Hedge funds acting through collaborating market makers can create huge numbers of counterfeit shares that can overwhelm buying demand. They have turned it into a casino and everyone knows the house always wins in that scenario."

View more: The only way for short selling to be profitable is by cheating

This recap takes a deep dive into the market insights and investing tips that inspire us to become better investors. Did you find anything interesting or helpful?

![]() Bonus

Bonus![]()

Please Leave your comments below and @ the mooer whose opinions impress you the most, and explain why they are attractive. The 1st, 10th, 20th, 30th, 40th...(multiples of 10) mooers will be rewarded with 88 points each!

Duration: Now- Dec 28, 2021 11:59 PM SGT

moomoo annual ceremony is happening right now! Check it out here: 2021 in Review: Grow Together to the Moon!

Spoiler: There's a chance to get points if you read till the end.

*The selected articles are listed randomly.

@HuatLadywrote about his concerns on the merger of Trump's company and a SPAC called the Digital World Acquisition Corp. We have to admit that he has a point!

"Forgive me for predicting that most likely his company's stock will not be viable for long term investment goal."

View more: Will Donald be able to deal his Trump Card?

@Machiavellis3rdEyeused vivid language to call for rational investing and remind mooers to watch out for media manipulations. Do you agree with him?

"You ARE ALL MY ALLIES, regardless of your investment choices, politics, religions, colors, sex, or anything else! I say we start learning and adapting to their constantly evolving illegal games (media manipulation, PFOF, CB's) together. Then we will all figure out how to take that cheese - without getting TRAPPED."

View more: When will we get off this bus to CRAZYTOWN?

@WYCKOFFPROanalyzed the trend of the Russell 2020 with technical tools. Has the market proved his assumptions?

"The breakout of the Russell 2000 gives the first confirmation of the scenario of possible rotation from big cap stocks to small cap stocks."

View more: A Bargain you can't Ignore — This Laggard Breaks All Time High Last Week

On Nov 5, Pfizer introduced a new COVID-19 antiviral pill that is expected to treat 89% of acutely hospitalized patients and thus reduce the risk of death. @HuatEveranticipated that Pfizer's share price would continue to climb once the FDA approved the new antiviral pill. What do you think?

"They hold the promise of cutting down the risk of severe Covid 19 ailments, hospitalisation stays and even deaths, and if being taken at the early onsets of infection. "

View more: A Breakthrough in Covid 19 Antiviral Pills

@Deviltonconducted an in-depth analysis on one of the most popular stocks, $Rivian, and pointed out that patience is a virtue in trading.

"Human are always impatient, we will always have FOMO if we sit and wait till Friday, scared that it stops falling and starts to rise again. Yet buying all tomo may not allow you to buy at the best price." View more here.

@HopeAlwayssaid that there is no best way to determine when to buy and when to sell the stocks of indexes. The timings depend on investing goals, philosophies, and personal preferences.

"The three main risks are company, valuation and earnings risks. Once we are able to find a stock that that signals low risk based on these three conditions, it is time to buy. Whenever a negative change happens to any of the three conditions, it is time to sell."

View more: Buying and Selling Stocks

@Powerhousehas three underlying principles in stopping losses and taking profits. All investors should stay informed and closely observe trends to set price targets.

"For micro, there is a need to determine your present financial risk appetite figuratively. On the macro level, situations may have changed. Determining when is the most precise time to stop loss or take profit of a stock and milk the most out of it is extremely difficult."

View more: Stop the pain, take the happiness

@Panda2102has done macro research to sort out a list of companies and ranks them from different dimensions.

"The mission statement, the moat, the network effect, the switching cost, low cost advantage, optionality, the ratio for PE, PEG, Cash, Debt, Free Cash flow and the ownership of the company."

View more: Best time to press the trade button

@Mars Mooothinks that the Squid Game Multi-Portfolio comprises four parts: player 456, player 218, player 067, and a liquid one.

"The first portfolio is aimed at potential sectors for diversification and profits. The second is designed to high risk lead high returns. The next one intent on helping on thr way. While the last one shows that cash is king."

View more: The Squid Game Multi-Portfolios Portfolio

@Mcsnacks H Tupackshared that short-selling is highly popular on Wall Street and often carried out by aggressive hedge funds.

"Hedge funds acting through collaborating market makers can create huge numbers of counterfeit shares that can overwhelm buying demand. They have turned it into a casino and everyone knows the house always wins in that scenario."

View more: The only way for short selling to be profitable is by cheating

This recap takes a deep dive into the market insights and investing tips that inspire us to become better investors. Did you find anything interesting or helpful?

Please Leave your comments below and @ the mooer whose opinions impress you the most, and explain why they are attractive. The 1st, 10th, 20th, 30th, 40th...(multiples of 10) mooers will be rewarded with 88 points each!

Duration: Now- Dec 28, 2021 11:59 PM SGT

moomoo annual ceremony is happening right now! Check it out here: 2021 in Review: Grow Together to the Moon!

445

39

102617252心

liked

$Ocugen (OCGN.US)$ today premarket so calm.. something is brewing..

4

102617252心

liked

102617252心

liked

$NextPlay Technologies (NXTP.US)$ hope it will hit $1.5 today

12

102617252心

liked

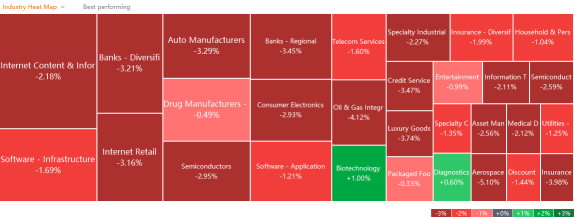

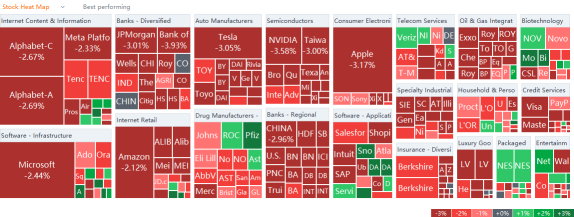

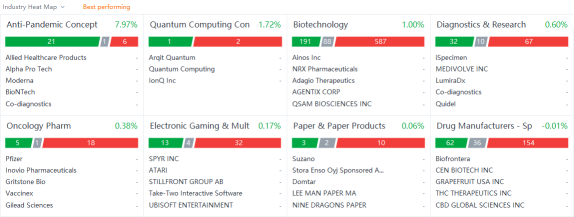

Hey mooers, check out today's hot sectors and hot stocks here!

$S&P 500 Index (.SPX.US)$ $Palantir (PLTR.US)$ $Netflix (NFLX.US)$

$S&P 500 Index (.SPX.US)$ $Palantir (PLTR.US)$ $Netflix (NFLX.US)$

+1

46

4

102617252心

liked

$Netflix (NFLX.US)$ $Apple (AAPL.US)$ Following the popularity of "Squid Game" launched by Netflix (NFLX.O), Apple (AAPL.O) launched its first Korean original TV series "Doctor Mind" this month to complement its Apple TV+ streaming in Korea. service. It is understood that Apple launched Apple TV+ in South Korea on November 4. On the same day, "Dr. Mind" debuted on the streaming service. However, Apple TV+ is currently far behind its South Korean rival Netflix. Netflix has been providing authorized and original Korean content for many years.

Article excerpted from the US Stock Research Agency

Article excerpted from the US Stock Research Agency

27

3

102617252心

liked

November has been an eventful month so far. Have you reviewed your trading performance yet? A kind reminder is that there are only two weeks left to win free stocks and points by joining topic discussion #Review Your Trades to Win Free Stocks. Now let's take a look at what has been going on this month!

![]()

![]() Fundamentals:

Fundamentals:

The U.S. stock market hit multiple all-time highs at an extraordinary run during the pandemic. It fell back from record levels on Tuesday (Nov 9), breaking an eight-day winning streak for the $S&P 500 Index (.SPX.US)$ .

Some investors view Tuesday's pullback as a breather after the rally. Propelled by third-quarter solid earnings, stocks have continued to trend upward, bolstering investors' confidence in the economic recovery.

![]() What do you think are the risks for economic growth? Under the circumstance of a winter spike of Covid-19 cases, do you think Fed will reimpose financial restrictions and push up interest rates to quell inflation? How would that affect the stocks you are holding?

What do you think are the risks for economic growth? Under the circumstance of a winter spike of Covid-19 cases, do you think Fed will reimpose financial restrictions and push up interest rates to quell inflation? How would that affect the stocks you are holding? ![]() Share your insights at #Review Your Trades to Win Free Stocks now.

Share your insights at #Review Your Trades to Win Free Stocks now.

![]()

![]() Trending:

Trending:

1. In an online poll, Twitter users say 'yes' to Tesla Inc. $Tesla (TSLA.US)$ CEO Elon Musk to sell 10% of his stock—valued at around $21 billion on Friday—which resulted in a drop of $TSLA$ share price. Tesla's shares fell $139.44, or 12%, to $1,023.50 on Nov 9.

Did you buy, hold or sell Tesla? Did you buy $Rivian Automotive (RIVN.US)$ ? How's the trading performance? Join the topic discussion and review now at #Review Your Trades to Win Free Stocks.

2. After some detailed research, the Federal Reserve said on Monday that it is beginning to worry that the recent and unprecedented volatility in meme stocks like $GameStop (GME.US)$ and $AMC Entertainment (AMC.US)$ are creating pockets of risk in the market that could create real problems for the entire U.S. financial system.

$AMC Entertainment (AMC.US)$ share prices have been at the center of this year's meme stock craze, skyrocketing more than 2,025% in 2021. Despite earnings better than expected, shares of AMC, popular among individual traders, fell $5.13, or 11%, to $39.93 (Nov 9).

![]() Would you HODL in the face of potential regulations on meme stocks? How's your trading during such volatility?

Would you HODL in the face of potential regulations on meme stocks? How's your trading during such volatility?![]() Share your views here at #Review Your Trades to Win Free Stocks.

Share your views here at #Review Your Trades to Win Free Stocks.

The U.S. stock market hit multiple all-time highs at an extraordinary run during the pandemic. It fell back from record levels on Tuesday (Nov 9), breaking an eight-day winning streak for the $S&P 500 Index (.SPX.US)$ .

Some investors view Tuesday's pullback as a breather after the rally. Propelled by third-quarter solid earnings, stocks have continued to trend upward, bolstering investors' confidence in the economic recovery.

1. In an online poll, Twitter users say 'yes' to Tesla Inc. $Tesla (TSLA.US)$ CEO Elon Musk to sell 10% of his stock—valued at around $21 billion on Friday—which resulted in a drop of $TSLA$ share price. Tesla's shares fell $139.44, or 12%, to $1,023.50 on Nov 9.

Did you buy, hold or sell Tesla? Did you buy $Rivian Automotive (RIVN.US)$ ? How's the trading performance? Join the topic discussion and review now at #Review Your Trades to Win Free Stocks.

2. After some detailed research, the Federal Reserve said on Monday that it is beginning to worry that the recent and unprecedented volatility in meme stocks like $GameStop (GME.US)$ and $AMC Entertainment (AMC.US)$ are creating pockets of risk in the market that could create real problems for the entire U.S. financial system.

$AMC Entertainment (AMC.US)$ share prices have been at the center of this year's meme stock craze, skyrocketing more than 2,025% in 2021. Despite earnings better than expected, shares of AMC, popular among individual traders, fell $5.13, or 11%, to $39.93 (Nov 9).

112

4

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)