102809501_顺风顺水

reacted to

🎉 Glad to inform SG mooers 🎉

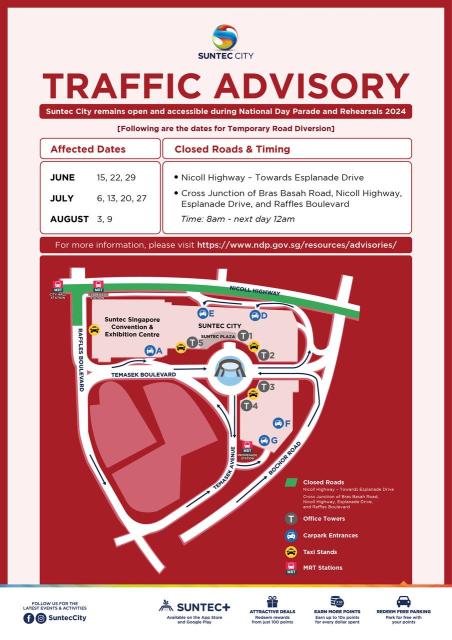

The wait is almost over—just the last day to go until MooFest 2024!

>> Grab the last chance to joun us<<

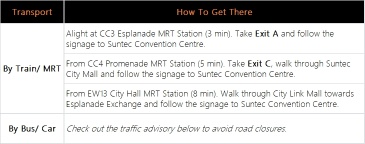

We’re excited that you’ll be joining us for MooFest 2024, happening TOMORROW! We’ve planned an incredible day filled with activities for you to have fun and learn more about investing. To make sure that you're ready for a fantastic time, here is some important information you need.

📅 Date: 6 July 2024 (Tomorrow)

⏰ Time: 9am - 6pm...

The wait is almost over—just the last day to go until MooFest 2024!

>> Grab the last chance to joun us<<

We’re excited that you’ll be joining us for MooFest 2024, happening TOMORROW! We’ve planned an incredible day filled with activities for you to have fun and learn more about investing. To make sure that you're ready for a fantastic time, here is some important information you need.

📅 Date: 6 July 2024 (Tomorrow)

⏰ Time: 9am - 6pm...

+4

163

109

102809501_顺风顺水

voted

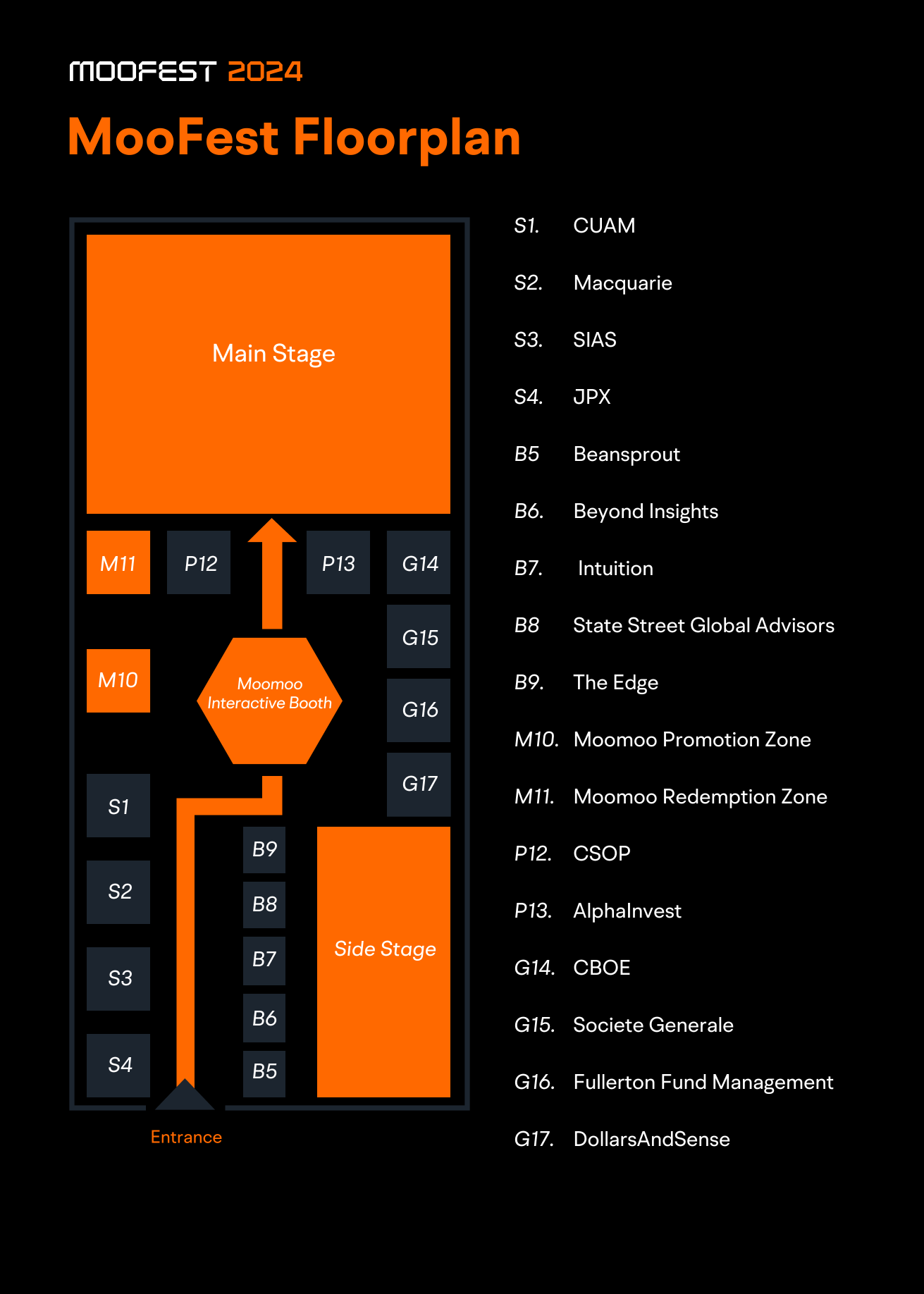

Tesla is releasing its Q4 2023 earnings on January 24, after the U.S. stock market close. How will the market react to the company's quarterly results? Vote your answer to participate!

Rewards

● An equal share of 1,000 points: For mooers who correctly guess the price range of $Tesla (TSLA.US)$'s opening price at 9:30 AM ET Jan 25 (e.g., If 50 mooers make a correct guess, each of them will get 20 points.)

(Vote will ...

Rewards

● An equal share of 1,000 points: For mooers who correctly guess the price range of $Tesla (TSLA.US)$'s opening price at 9:30 AM ET Jan 25 (e.g., If 50 mooers make a correct guess, each of them will get 20 points.)

(Vote will ...

106

130

102809501_顺风顺水

reacted to

The past week has been a dark period in the history of crypto, with the total market capitalization of this industry dipping as low as $1.2 trillion for the first time since July 2021. ![]()

![]()

![]() The turmoil, in large part, has been due to the real-time disintegration of $Terra (LUNA.CC)$.

The turmoil, in large part, has been due to the real-time disintegration of $Terra (LUNA.CC)$.

Last week, Terra has officially stopped block production as the blockchain's native token hit a low of $0.0003, near zero.![]()

![]()

![]()

In a tumble start...

Last week, Terra has officially stopped block production as the blockchain's native token hit a low of $0.0003, near zero.

In a tumble start...

1093

961

102809501_顺风顺水

liked

Ladies and gentlemen, it is your friendly neighbourhood 股神 again.

It has been quite awhile since I last posted. Much has happened lately with the fed's tapering, upcoming interest rate hike, omicron variant, etc.

At this current juncture of market volatility and massive sell-offs, growth stocks have entered deep value territory, while large capitalization stocks have entered a bubble. In the upcoming weeks, I foresee a rotation of funds from large capitalization stocks to growth stocks amidst the upcoming progressive interest rate hike of 0.25% to 0.75% by 2022 year end. The interest rate hike should remain as projected and not be increased, to cushion the impact of the omicron variant on the economy.

Many feared the uncertainty which the omicron variant brings to the stock market, but I view it as an opportunity of a lifetime. With the current data from South Africa, Europe and the world, it is preliminarily conclusive that the omicron variant is indeed much more transmissive. In fact, it is found that the omicron variant is at least 5 times more transmissive than the delta variant. However, it appears that the omicron variant is much milder in terms of severity. With a tremendous number of people in the millions contracting the omicron variant, only a very very small percentage of people are hospitalised and slightly more than a dozen dead. I believe that this variant will be unstoppable, but humans will evolve and thrive. It will indeed be the survival of the fittest. The recovery will be very swift as herd immunity will be achieved in a very short period of time. Finally, either the omicron variant or the next will bring the virus to common cold level of severity and be truly endemic in the world.

So, what stocks do we hold in such market conditions? Well, we should hold those which are covid-proof - those which can grow and thrive in an uncertain world economy and order. To reveal, I am currently holding stocks of $ChargePoint (CHPT.US)$ $Opendoor Technologies (OPEN.US)$ $Palantir (PLTR.US)$ $Skillz (SKLZ.US)$ and $SoFi Technologies (SOFI.US)$. One does not need a massive diversification, for diversification is a protection against ignorance. Holding 5 to 15 stocks is more than diversified for the informed investor. Lastly, to balance between asset class, I am holding stocks of $Hut 8 (HUT.US)$, which have lower correlation to the general stock market.

On a side note, Chinese stocks are no longer worth holding from now to the near future with the recent turn of events - forced delisting of Chinese stocks, blacklisting of Chinese companies, heightened escalation of US-China tensions, evergrande default, etc. I have sold out my positions and took some losses in $Futu Holdings Ltd (FUTU.US)$ and $UP Fintech (TIGR.US)$. This rebalance of portfolio is vital, considering opportunity costs.

To conclude, I wish you all all the best in your investment journey. Merry Christmas and a Happy New Year. To a brighter future. Cheers!!

It has been quite awhile since I last posted. Much has happened lately with the fed's tapering, upcoming interest rate hike, omicron variant, etc.

At this current juncture of market volatility and massive sell-offs, growth stocks have entered deep value territory, while large capitalization stocks have entered a bubble. In the upcoming weeks, I foresee a rotation of funds from large capitalization stocks to growth stocks amidst the upcoming progressive interest rate hike of 0.25% to 0.75% by 2022 year end. The interest rate hike should remain as projected and not be increased, to cushion the impact of the omicron variant on the economy.

Many feared the uncertainty which the omicron variant brings to the stock market, but I view it as an opportunity of a lifetime. With the current data from South Africa, Europe and the world, it is preliminarily conclusive that the omicron variant is indeed much more transmissive. In fact, it is found that the omicron variant is at least 5 times more transmissive than the delta variant. However, it appears that the omicron variant is much milder in terms of severity. With a tremendous number of people in the millions contracting the omicron variant, only a very very small percentage of people are hospitalised and slightly more than a dozen dead. I believe that this variant will be unstoppable, but humans will evolve and thrive. It will indeed be the survival of the fittest. The recovery will be very swift as herd immunity will be achieved in a very short period of time. Finally, either the omicron variant or the next will bring the virus to common cold level of severity and be truly endemic in the world.

So, what stocks do we hold in such market conditions? Well, we should hold those which are covid-proof - those which can grow and thrive in an uncertain world economy and order. To reveal, I am currently holding stocks of $ChargePoint (CHPT.US)$ $Opendoor Technologies (OPEN.US)$ $Palantir (PLTR.US)$ $Skillz (SKLZ.US)$ and $SoFi Technologies (SOFI.US)$. One does not need a massive diversification, for diversification is a protection against ignorance. Holding 5 to 15 stocks is more than diversified for the informed investor. Lastly, to balance between asset class, I am holding stocks of $Hut 8 (HUT.US)$, which have lower correlation to the general stock market.

On a side note, Chinese stocks are no longer worth holding from now to the near future with the recent turn of events - forced delisting of Chinese stocks, blacklisting of Chinese companies, heightened escalation of US-China tensions, evergrande default, etc. I have sold out my positions and took some losses in $Futu Holdings Ltd (FUTU.US)$ and $UP Fintech (TIGR.US)$. This rebalance of portfolio is vital, considering opportunity costs.

To conclude, I wish you all all the best in your investment journey. Merry Christmas and a Happy New Year. To a brighter future. Cheers!!

56

17

102809501_顺风顺水

liked

My biggest mistake was to follow others advice without doing my own research. If we were to follow others blindly, we could be buying on speculation that the price will keep going up. Always do our own research first before we make any decision.

3

102809501_顺风顺水

liked

$SIA (C6L.SG)$ : The fear of Omicron grounding all aircraft worldwide in the coming months ahead had again dampen the spirit of many. The strange news is that SIA is trying to bring A380 back to life where no others do. What does that mean ? Does SIA management team see something which others don't see ? Preparing for the next big move ??? Guess ! ! !

18

4

102809501_顺风顺水

liked

Shipping company reinstates 2022 earnings guidance, adds $5 billion share buyback program.

$FedEx (FDX.US)$ topped analyst expectations with its latest financial report, sending shares of the shipping company higher in after-hours trading on Thursday.

The three-month period that ended Nov. 30 brought in revenue of $23.5 billion and adjusted net income of $1.3 billion. Adjusted earnings came in at $4.55 per share — down from $4.83 last year but above analyst expectations of $4.28 for the Memphis-based delivery company

Revenue also surpassed analyst expectations of $22.414 billion.

"FedEx operating income grew in our second quarter, driven by strong revenue growth and effective management of our cost and expected labor availability challenges," Michael C. Lenz, FedEx Corp. executive vice president and chief financial officer, said in a press statement.

In light of the strong earrings, FedEx reinstated its original 2022 EPS outlook to between $20.50 to $21.50 after lowering it to a range of $19.75 to $21 amid declining numbers in September. The company also announced a $5 billion share buyback program in addition to the 2.3 million shares authorized in its previous plan. Some $1.5 billion of that $5 billion is under an accelerated program.

$FedEx (FDX.US)$ topped analyst expectations with its latest financial report, sending shares of the shipping company higher in after-hours trading on Thursday.

The three-month period that ended Nov. 30 brought in revenue of $23.5 billion and adjusted net income of $1.3 billion. Adjusted earnings came in at $4.55 per share — down from $4.83 last year but above analyst expectations of $4.28 for the Memphis-based delivery company

Revenue also surpassed analyst expectations of $22.414 billion.

"FedEx operating income grew in our second quarter, driven by strong revenue growth and effective management of our cost and expected labor availability challenges," Michael C. Lenz, FedEx Corp. executive vice president and chief financial officer, said in a press statement.

In light of the strong earrings, FedEx reinstated its original 2022 EPS outlook to between $20.50 to $21.50 after lowering it to a range of $19.75 to $21 amid declining numbers in September. The company also announced a $5 billion share buyback program in addition to the 2.3 million shares authorized in its previous plan. Some $1.5 billion of that $5 billion is under an accelerated program.

6

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)