Overall, looking at it.

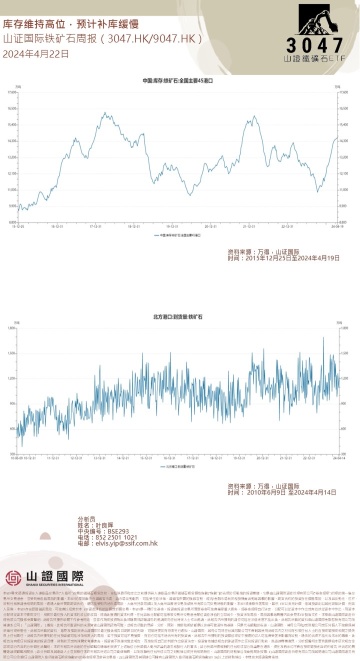

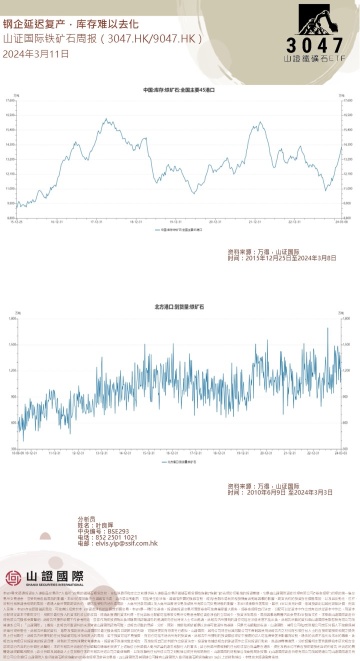

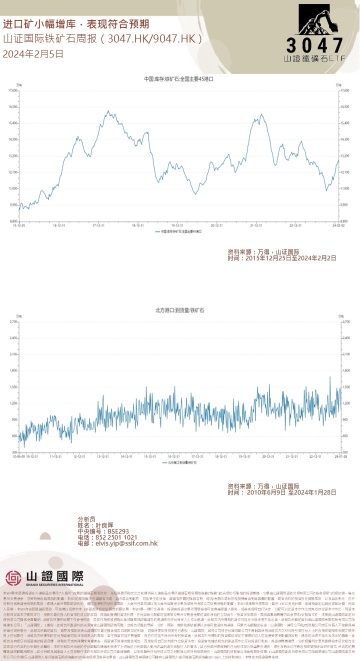

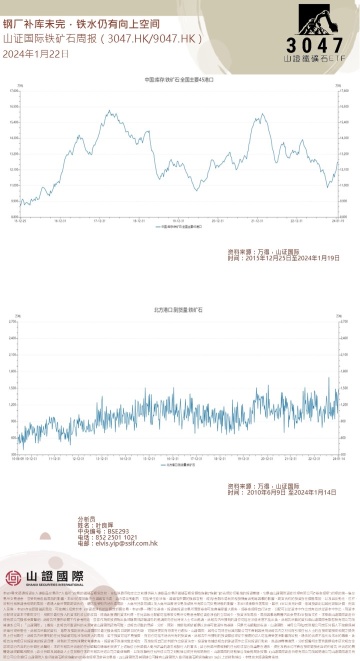

In addition to the gradual production resumption of steel enterprises and fluctuations in overseas supply, this week, positive expectations for industry end demand were once again released at the policy level, driving further rise in ore prices. Looking ahead, as supply disruptions gradually stabilize, the logic of production resumption brought about by the repair of steel enterprise profits remains the main driving force for the upward trend in ore prices.

On the supply side

Global shipping total volume is 23.92 million tons, a weekly decrease of 8.54 million tons, with 45 ports receiving a total of 25.28 million tons, an increase of 0.92 million tons compared to the previous week.

The impact of the Australian cyclone has temporarily subsided, and global ore shipping is gradually recovering due to the resumption of Australian shipments. Currently, apart from FMG, the four major mines have all released financial reports for the first quarter. It is worth noting that the remaining three mines have not adjusted their annual shipping targets, so we expect these three major mines to maintain their previous shipping plans, thereby driving the overall shipping volume in Australia to rise. However, in Brazil, due to Vale's control over the shipping pace and continuous rain disturbances in the northern ports, it is expected that its shipments will be somewhat limited.

On the demand side

The blast furnace startup rate of 247 steel mills is 78.86%, an increase of 0.45 percentage points compared to last week, a decrease of 5.73 percentage points compared to the same period last year; the utilization rate of blast furnace ironmaking capacity is 84.59%, an increase of 0.54 percentage points compared to...

In addition to the gradual production resumption of steel enterprises and fluctuations in overseas supply, this week, positive expectations for industry end demand were once again released at the policy level, driving further rise in ore prices. Looking ahead, as supply disruptions gradually stabilize, the logic of production resumption brought about by the repair of steel enterprise profits remains the main driving force for the upward trend in ore prices.

On the supply side

Global shipping total volume is 23.92 million tons, a weekly decrease of 8.54 million tons, with 45 ports receiving a total of 25.28 million tons, an increase of 0.92 million tons compared to the previous week.

The impact of the Australian cyclone has temporarily subsided, and global ore shipping is gradually recovering due to the resumption of Australian shipments. Currently, apart from FMG, the four major mines have all released financial reports for the first quarter. It is worth noting that the remaining three mines have not adjusted their annual shipping targets, so we expect these three major mines to maintain their previous shipping plans, thereby driving the overall shipping volume in Australia to rise. However, in Brazil, due to Vale's control over the shipping pace and continuous rain disturbances in the northern ports, it is expected that its shipments will be somewhat limited.

On the demand side

The blast furnace startup rate of 247 steel mills is 78.86%, an increase of 0.45 percentage points compared to last week, a decrease of 5.73 percentage points compared to the same period last year; the utilization rate of blast furnace ironmaking capacity is 84.59%, an increase of 0.54 percentage points compared to...

Translated

+1

1

1

Overall, looking at it.

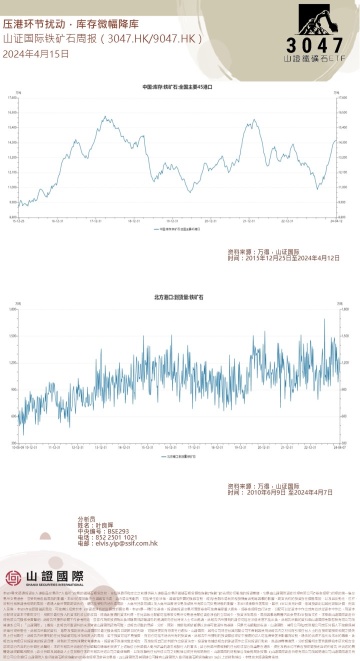

Under the dual impact of the gradual resumption of domestic steel enterprises and the disruption of overseas supply, iron ore prices have shown a smooth bottom rebound trend. Looking ahead, the expectation for the resumption of work by steel companies remains strong. Although the shipping disturbances in Australia have temporarily subsided, the rainfall situation in the northern ports of Brazil should not be ignored, and it is expected that the supporting factors for the rebound in iron ore prices will still exist. However, the problem of high iron ore inventories is also becoming increasingly prominent and difficult to resolve effectively. $SSIF DCE Iron Ore Futures Index ETF (03047.HK)$

On the supply side

The global total shipment volume is 32.458 million tons, a weekly decrease of 1.425 million tons. The total volume of 45 harbors to harbor is 25.819 million tons, an increase of 0.206 million tons compared to the previous week.

The impact of hurricanes has subsided, and considering Rio Tinto and FMG's plans to increase shipping levels in the second quarter to achieve annual targets, we expect the future shipping volume in Australia to rebound significantly. However, for Brazil, potential disruptions from rainfall still persist in shipping ports in the northern region in mid-to-late April. At the same time, the shipping of non-mainstream mines in South Africa, India, and other countries is significantly suppressed, so it is expected that the shipping volume of these non-mainstream mines will be difficult to return to high levels.

On the demand side

- 247 steel mills have a blast furnace capacity utilization rate of 78.41%, a decrease of 0.6% compared to last week, and a decrease of 6.33% compared to the same period last year...

Under the dual impact of the gradual resumption of domestic steel enterprises and the disruption of overseas supply, iron ore prices have shown a smooth bottom rebound trend. Looking ahead, the expectation for the resumption of work by steel companies remains strong. Although the shipping disturbances in Australia have temporarily subsided, the rainfall situation in the northern ports of Brazil should not be ignored, and it is expected that the supporting factors for the rebound in iron ore prices will still exist. However, the problem of high iron ore inventories is also becoming increasingly prominent and difficult to resolve effectively. $SSIF DCE Iron Ore Futures Index ETF (03047.HK)$

On the supply side

The global total shipment volume is 32.458 million tons, a weekly decrease of 1.425 million tons. The total volume of 45 harbors to harbor is 25.819 million tons, an increase of 0.206 million tons compared to the previous week.

The impact of hurricanes has subsided, and considering Rio Tinto and FMG's plans to increase shipping levels in the second quarter to achieve annual targets, we expect the future shipping volume in Australia to rebound significantly. However, for Brazil, potential disruptions from rainfall still persist in shipping ports in the northern region in mid-to-late April. At the same time, the shipping of non-mainstream mines in South Africa, India, and other countries is significantly suppressed, so it is expected that the shipping volume of these non-mainstream mines will be difficult to return to high levels.

On the demand side

- 247 steel mills have a blast furnace capacity utilization rate of 78.41%, a decrease of 0.6% compared to last week, and a decrease of 6.33% compared to the same period last year...

Translated

+1

1

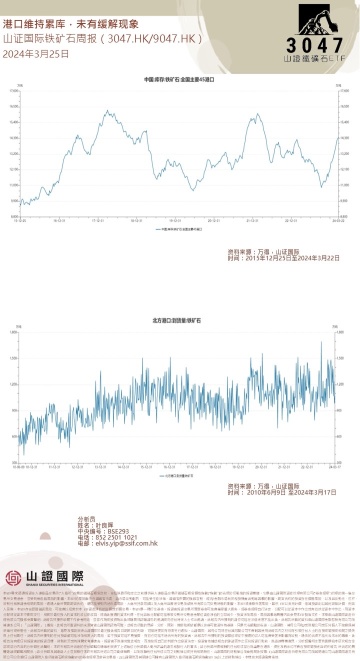

Overall, looking at it

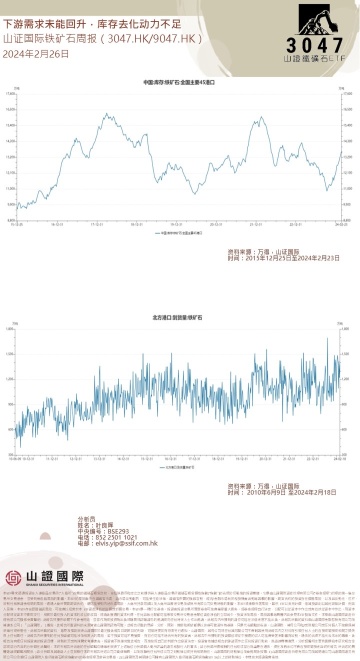

- Recent decrease in scrap steel arrivals has led to the possibility of increased molten iron output in steel mills. However, steel inventory remains at a high level, thus still facing significant inventory pressure. Despite the demand for increased molten iron output, this also requires further improvement in steel production and sales. In the short term, current port inventories are high, which will continue to exert downward pressure on ore prices. Although there is a trend of increased molten iron output, the fundamentally weak demand for iron ore has not been fundamentally improved. $SSIF DCE Iron Ore Futures Index ETF (03047.HK)$

On the supply side

• Global total shipping volume of 28.35 million tons, weekly decrease of 2.87 million tons, australia's shipping volume of 15.67 million tons, weekly decrease of 3.29 million tons, brazil's shipping volume of 6.41 million tons, weekly increase of 0.14 million tons.

• Due to the impact of hurricanes in the Western Australian waters, the global ore shipping volume in this period has experienced a decline. However, apart from the mainstream mines in Australia and Brazil, the shipping volume of other non-mainstream mines has continued to rise and reached a new high level for the year.

On the demand side

• 247 steel mills' blast furnace operating rate is 76.9%, up by 0.75% from the previous week, and down by 5.83% year-on-year; blast furnace ironmaking capacity utilization rate is 82.79%, up by 0.21% compared to the previous period, and down by 6.4%

- Recent decrease in scrap steel arrivals has led to the possibility of increased molten iron output in steel mills. However, steel inventory remains at a high level, thus still facing significant inventory pressure. Despite the demand for increased molten iron output, this also requires further improvement in steel production and sales. In the short term, current port inventories are high, which will continue to exert downward pressure on ore prices. Although there is a trend of increased molten iron output, the fundamentally weak demand for iron ore has not been fundamentally improved. $SSIF DCE Iron Ore Futures Index ETF (03047.HK)$

On the supply side

• Global total shipping volume of 28.35 million tons, weekly decrease of 2.87 million tons, australia's shipping volume of 15.67 million tons, weekly decrease of 3.29 million tons, brazil's shipping volume of 6.41 million tons, weekly increase of 0.14 million tons.

• Due to the impact of hurricanes in the Western Australian waters, the global ore shipping volume in this period has experienced a decline. However, apart from the mainstream mines in Australia and Brazil, the shipping volume of other non-mainstream mines has continued to rise and reached a new high level for the year.

On the demand side

• 247 steel mills' blast furnace operating rate is 76.9%, up by 0.75% from the previous week, and down by 5.83% year-on-year; blast furnace ironmaking capacity utilization rate is 82.79%, up by 0.21% compared to the previous period, and down by 6.4%

Translated

+1

2

Overall, looking at it

• The ore price has been running below $120 for two consecutive weeks, but this price drop has not led to a continuous improvement in the profits of domestic steel companies or forced non-mainstream global mines to cut production. It can be seen that the price drop has not changed its fundamentally weak situation. Therefore, it is expected that the ore price will probably further decline in the later period to seek a new supply-demand balance. $SSIF DCE Iron Ore Futures Index ETF (03047.HK)$

On the supply side

• The global shipping total volume is 31.256 million tons, with a weekly increase of 5.219 million tons. Australia's shipping volume increased by 4.26 million tons on a weekly basis; the total volume of Hong Kong port arrivals is 23.77 million tons, with an increase of 3.46 million tons compared to the previous week.

The weather disturbance has ended, and shipments from Australia have rebounded significantly, leading to a global surge in ore shipments to a year-to-date high. At the same time, shipments from Brazil and non-Australian mines have increased, especially in the non-mainstream sector, recent ore price corrections have not triggered production cuts in non-mainstream mines. Looking ahead, there is a forecast for a hurricane disturbance in mid-March at the ports of Western Australia, while non-mainstream mines continue to monitor the supply disturbance caused by the ore price decline. It is expected that the global shipping levels will further increase, but the probability of maintaining the current high levels is high.

On the demand side

247 steel mills have a blast furnace operating rate of 75.6%, up 0.41% from the previous week, and a year-on-year decrease of 6.4%; the blast furnace ironmaking capacity utilization rate is 83.11%, and is being observed...

• The ore price has been running below $120 for two consecutive weeks, but this price drop has not led to a continuous improvement in the profits of domestic steel companies or forced non-mainstream global mines to cut production. It can be seen that the price drop has not changed its fundamentally weak situation. Therefore, it is expected that the ore price will probably further decline in the later period to seek a new supply-demand balance. $SSIF DCE Iron Ore Futures Index ETF (03047.HK)$

On the supply side

• The global shipping total volume is 31.256 million tons, with a weekly increase of 5.219 million tons. Australia's shipping volume increased by 4.26 million tons on a weekly basis; the total volume of Hong Kong port arrivals is 23.77 million tons, with an increase of 3.46 million tons compared to the previous week.

The weather disturbance has ended, and shipments from Australia have rebounded significantly, leading to a global surge in ore shipments to a year-to-date high. At the same time, shipments from Brazil and non-Australian mines have increased, especially in the non-mainstream sector, recent ore price corrections have not triggered production cuts in non-mainstream mines. Looking ahead, there is a forecast for a hurricane disturbance in mid-March at the ports of Western Australia, while non-mainstream mines continue to monitor the supply disturbance caused by the ore price decline. It is expected that the global shipping levels will further increase, but the probability of maintaining the current high levels is high.

On the demand side

247 steel mills have a blast furnace operating rate of 75.6%, up 0.41% from the previous week, and a year-on-year decrease of 6.4%; the blast furnace ironmaking capacity utilization rate is 83.11%, and is being observed...

Translated

+1

3

Overall, looking at it.

After the holiday, the high supply of ore and the slower-than-expected demand recovery are the core drivers of the price pressure on ore. Looking ahead, the high delivery volume of ore is expected to show a trend of initial suppression and subsequent rise, but due to the impact of high transportation, the absolute level of arrivals at the port still remains high compared to the same period. Some steel companies have delayed resuming production, leading to an increase in the expected output of molten iron in March, but the continued poor profitability of steel companies has also laid the groundwork for uncertainty in the later resumption of production by steel companies. In summary, it is expected that ore prices will remain volatile against a backdrop of high supply. $SSIF DCE Iron Ore Futures Index ETF (03047.HK)$

On the supply side

Global total shipping volume is 30.47 million tons, with a weekly increase of 4.58 million tons, Australian shipping volume increased by 2.43 million tons weekly; 45 ports received a total of 25.29 million tons, a decrease of 0.01 million tons compared to last week.

After the holiday, Fortescue Metals Group's shipping has returned to normal levels, and the current ore prices have not significantly affected the production and shipping of non-mainstream mines. Therefore, global ore shipping has once again risen and reached a new high for the year. The four major mines' shipping is expected to remain at a high level compared to the same period, while the shipping of non-mainstream mines lags behind the changes in ore prices, with short-term shipping expected to maintain high levels for the year and the same period.

On the demand side

• The blast furnace capacity utilization rate of 247 steel mills is 75.63%, a decrease of 0.74% from the previous week, and a 5.35% decrease from the same period last year; the blast furnace iron production capacity utilization rate is 83%....

After the holiday, the high supply of ore and the slower-than-expected demand recovery are the core drivers of the price pressure on ore. Looking ahead, the high delivery volume of ore is expected to show a trend of initial suppression and subsequent rise, but due to the impact of high transportation, the absolute level of arrivals at the port still remains high compared to the same period. Some steel companies have delayed resuming production, leading to an increase in the expected output of molten iron in March, but the continued poor profitability of steel companies has also laid the groundwork for uncertainty in the later resumption of production by steel companies. In summary, it is expected that ore prices will remain volatile against a backdrop of high supply. $SSIF DCE Iron Ore Futures Index ETF (03047.HK)$

On the supply side

Global total shipping volume is 30.47 million tons, with a weekly increase of 4.58 million tons, Australian shipping volume increased by 2.43 million tons weekly; 45 ports received a total of 25.29 million tons, a decrease of 0.01 million tons compared to last week.

After the holiday, Fortescue Metals Group's shipping has returned to normal levels, and the current ore prices have not significantly affected the production and shipping of non-mainstream mines. Therefore, global ore shipping has once again risen and reached a new high for the year. The four major mines' shipping is expected to remain at a high level compared to the same period, while the shipping of non-mainstream mines lags behind the changes in ore prices, with short-term shipping expected to maintain high levels for the year and the same period.

On the demand side

• The blast furnace capacity utilization rate of 247 steel mills is 75.63%, a decrease of 0.74% from the previous week, and a 5.35% decrease from the same period last year; the blast furnace iron production capacity utilization rate is 83%....

Translated

+1

1

1

Overall, looking at it

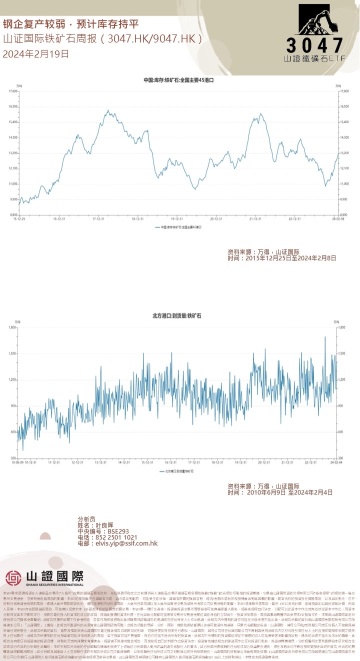

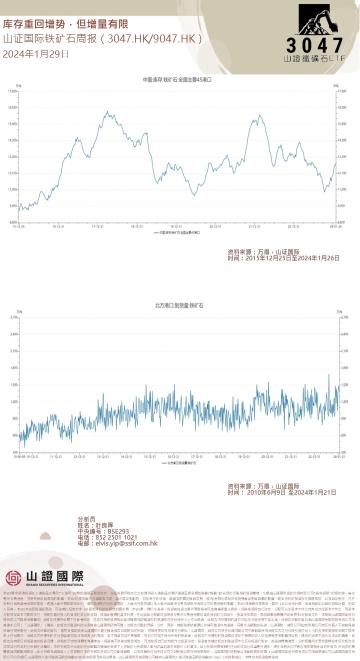

• Import ore arrival levels after the holiday still have room for decline, while iron production on the demand side continues to recover, with increased production of iron being continuously suppressed by poor steel company profits. It is expected that total imported ore inventory will peak, with a decrease in inventory levels at the port and steel company inventories after the holiday, resulting in the accumulation of ore resources mainly at the port level. $SSIF DCE Iron Ore Futures Index ETF (03047.HK)$

On the supply side

• Globally, 25.89 million tons were shipped, a decrease of 2.66 million tons compared to the previous period. Among them, Australia shipped 14.82 million tons, a decrease of 1.31 million tons compared to the previous period, Brazil shipped 5.74 million tons, a decrease of 1.38 million tons compared to the previous period, and non-mainstream shipments increased by 0.03 million tons compared to the previous period.

- Global ore shipments before the holiday were higher than the same period in the past three years, and FMG's shipment level has returned to the same high level. During the long holiday, Rio Tinto had a train derailment accident, but the impact is expected to be relatively small as the derailment occurred in a double-track section. The level of arrivals at ports is expected to decrease to a certain extent around mid-February due to the decrease in Brazilian ore shipments at the beginning of the year. Due to the influence of the Spring Festival, domestic ore production decreased before the holiday, but it is expected to recover after the holiday.

On the demand side

- Two blast furnaces are undergoing routine maintenance, which reduces the daily production of molten iron by 0.0042 million tons. The estimated operating rate is 76.53%, a decrease of 0 compared to before the holiday...

• Import ore arrival levels after the holiday still have room for decline, while iron production on the demand side continues to recover, with increased production of iron being continuously suppressed by poor steel company profits. It is expected that total imported ore inventory will peak, with a decrease in inventory levels at the port and steel company inventories after the holiday, resulting in the accumulation of ore resources mainly at the port level. $SSIF DCE Iron Ore Futures Index ETF (03047.HK)$

On the supply side

• Globally, 25.89 million tons were shipped, a decrease of 2.66 million tons compared to the previous period. Among them, Australia shipped 14.82 million tons, a decrease of 1.31 million tons compared to the previous period, Brazil shipped 5.74 million tons, a decrease of 1.38 million tons compared to the previous period, and non-mainstream shipments increased by 0.03 million tons compared to the previous period.

- Global ore shipments before the holiday were higher than the same period in the past three years, and FMG's shipment level has returned to the same high level. During the long holiday, Rio Tinto had a train derailment accident, but the impact is expected to be relatively small as the derailment occurred in a double-track section. The level of arrivals at ports is expected to decrease to a certain extent around mid-February due to the decrease in Brazilian ore shipments at the beginning of the year. Due to the influence of the Spring Festival, domestic ore production decreased before the holiday, but it is expected to recover after the holiday.

On the demand side

- Two blast furnaces are undergoing routine maintenance, which reduces the daily production of molten iron by 0.0042 million tons. The estimated operating rate is 76.53%, a decrease of 0 compared to before the holiday...

Translated

+1

3

1

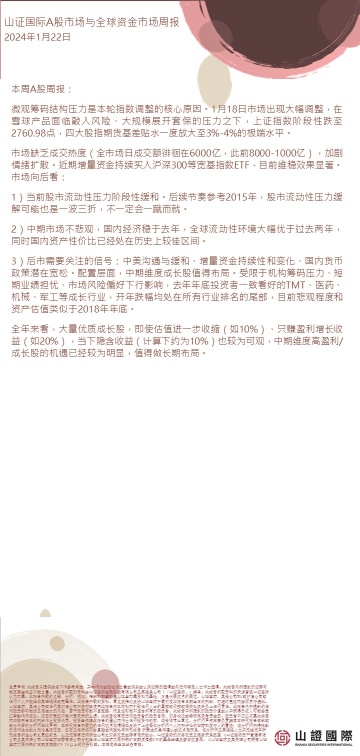

Overall

• The two major upward supports for mineral prices this week — steel companies' inventory replenishment and policy incentives were all exhausted before the holiday season. At the same time, steel companies increased maintenance before the holiday season due to poor profit levels, weakening expectations for marginal improvements in ore fundamentals. Steel companies have limited efforts to resume production after the holiday season. Overall, the average daily output of iron and water in February is difficult to return to more than 2.3 million tons. As a result, it is difficult to effectively store post-holiday ore. The port sector expects a significant increase in inventory pressure after the holiday season. $SSIF DCE Iron Ore Futures Index ETF (03047.HK)$

On the supply side

• Global shipments of 29.69 million tons, an increase of 3.4 million tons, of which Australia shipped 17.203 million tons, an increase of 2.115 million tons, and Brazil shipped 5.726 million tons, a decrease of 716,000 tons over the previous month.

• Thanks to the recovery in mainstream mine delivery levels and non-mainstream mines maintaining high shipping levels at high mineral prices, overall global ore shipments have further rebounded. Looking at the later stages, there is still room for the FMG shipment level to pick up. Combined with the weather conditions in Australia and Pakistan over the next week, there is limited disruption to shipments, and ore shipments are expected to pick up steadily. The amount of imported domestic ore arriving in Hong Kong has been declining for two consecutive weeks. Currently, the amount arriving in Hong Kong has dropped to normal levels during the same period.

Demand side

• The operating rate of blast furnaces in 247 steel mills was 76.5%, down 0.3% from the previous month; blast furnace iron production...

• The two major upward supports for mineral prices this week — steel companies' inventory replenishment and policy incentives were all exhausted before the holiday season. At the same time, steel companies increased maintenance before the holiday season due to poor profit levels, weakening expectations for marginal improvements in ore fundamentals. Steel companies have limited efforts to resume production after the holiday season. Overall, the average daily output of iron and water in February is difficult to return to more than 2.3 million tons. As a result, it is difficult to effectively store post-holiday ore. The port sector expects a significant increase in inventory pressure after the holiday season. $SSIF DCE Iron Ore Futures Index ETF (03047.HK)$

On the supply side

• Global shipments of 29.69 million tons, an increase of 3.4 million tons, of which Australia shipped 17.203 million tons, an increase of 2.115 million tons, and Brazil shipped 5.726 million tons, a decrease of 716,000 tons over the previous month.

• Thanks to the recovery in mainstream mine delivery levels and non-mainstream mines maintaining high shipping levels at high mineral prices, overall global ore shipments have further rebounded. Looking at the later stages, there is still room for the FMG shipment level to pick up. Combined with the weather conditions in Australia and Pakistan over the next week, there is limited disruption to shipments, and ore shipments are expected to pick up steadily. The amount of imported domestic ore arriving in Hong Kong has been declining for two consecutive weeks. Currently, the amount arriving in Hong Kong has dropped to normal levels during the same period.

Demand side

• The operating rate of blast furnaces in 247 steel mills was 76.5%, down 0.3% from the previous month; blast furnace iron production...

Translated

+1

2

Overall

• The supply and demand side of ore continued to decline in the supply and demand side of the pre-holiday season and the improvement in iron and water production. However, it is expected that demand for replenishment of steel mills will gradually come to an end, and the upward support for ore will weaken. At the same time, the recent rise in mineral prices also depends on renewed efforts on the policy side, but as the Spring Festival approaches, the probability that further policies will be introduced has declined. There is a possibility that ore prices will rise and fall, but the overall trend continues to fluctuate at a high level. $SSIF DCE Iron Ore Futures Index ETF (03047.HK)$

On the supply side

• Global shipments were 26.29 million tons, a year-on-month decrease of 650,000 tons, of which Australia shipped 1.588 million tons, a decrease of 650,000 tons, Brazil shipped 6.442 million tons, 690,000 fewer tons, and non-mainstream shipments were 4.761 million tons, an increase of 690,000 tons over the previous month.

• In addition to the slow recovery of FMG shipments, shipments from other mines remained normal or high during the same period. Among them, shipments from non-mainstream mines remained high, and in the later stages, FMG shipments continued to resume. The impact of the weather in Australia and Pakistan will be weak in the next week. Global ore shipments are expected to pick up. Domestic arrival levels are expected to remain high and fall back to Hong Kong based on the decline in Australian shipments in the previous period.

Demand side

• The operating rate of blast furnaces in 247 steel mills was 76.82%, up 0.59% from last week and 0.13% from last year; utilization of blast furnace ironmaking capacity...

• The supply and demand side of ore continued to decline in the supply and demand side of the pre-holiday season and the improvement in iron and water production. However, it is expected that demand for replenishment of steel mills will gradually come to an end, and the upward support for ore will weaken. At the same time, the recent rise in mineral prices also depends on renewed efforts on the policy side, but as the Spring Festival approaches, the probability that further policies will be introduced has declined. There is a possibility that ore prices will rise and fall, but the overall trend continues to fluctuate at a high level. $SSIF DCE Iron Ore Futures Index ETF (03047.HK)$

On the supply side

• Global shipments were 26.29 million tons, a year-on-month decrease of 650,000 tons, of which Australia shipped 1.588 million tons, a decrease of 650,000 tons, Brazil shipped 6.442 million tons, 690,000 fewer tons, and non-mainstream shipments were 4.761 million tons, an increase of 690,000 tons over the previous month.

• In addition to the slow recovery of FMG shipments, shipments from other mines remained normal or high during the same period. Among them, shipments from non-mainstream mines remained high, and in the later stages, FMG shipments continued to resume. The impact of the weather in Australia and Pakistan will be weak in the next week. Global ore shipments are expected to pick up. Domestic arrival levels are expected to remain high and fall back to Hong Kong based on the decline in Australian shipments in the previous period.

Demand side

• The operating rate of blast furnaces in 247 steel mills was 76.82%, up 0.59% from last week and 0.13% from last year; utilization of blast furnace ironmaking capacity...

Translated

+1

2

Overall, looking at it

• Later, the domestic arrival resources further decreased, while steel enterprises continued production, both leading to marginal improvement in the ore fundamentals, which helps the ore price stabilize after continuous decline. At the same time, imported ore inventories accelerated flow to ports and steel mills, focusing on the price pressure brought by the increase in port ore inventories.

On the supply side

• Global shipments of 26.936 million tons, an increase of 0.031 million tons from the previous period, including 15.739 million tons from Australia, a decrease of 1.237 million tons from the previous week, 7.131 million tons from Brazil, an increase of 2.955 million tons from the previous period, and 4.07 million tons from non-mainstream shipments, a decrease of 1.69 million tons from the previous period.

Global ore shipments have been relatively low, but looking ahead, the impact of the FMG train derailment incident has ended. It is expected that FMG shipments will significantly rebound in the future, while some non-mainstream mines are expected to maintain high shipment levels, leading to an overall increase in ore shipments. Last week, ore arrivals approached 30 million tons, the second highest point in recent years. However, with the decline in Australian shipments since the beginning of the year, the arrival levels are expected to show a top reversal trend.

On the demand side

247 steel mills had a blast furnace capacity utilization rate of 76.23%, up 0.15% from the previous week and an increase of 0.26% from the previous year. The blast furnace ironmaking capacity utilization rate was 82.98%, an increase of 0.42% compared to the previous period but a decrease of 0.12% year-on-year. The steel mill profitability rate was 26.41%, a decrease of 0.43% from the previous period.

• Later, the domestic arrival resources further decreased, while steel enterprises continued production, both leading to marginal improvement in the ore fundamentals, which helps the ore price stabilize after continuous decline. At the same time, imported ore inventories accelerated flow to ports and steel mills, focusing on the price pressure brought by the increase in port ore inventories.

On the supply side

• Global shipments of 26.936 million tons, an increase of 0.031 million tons from the previous period, including 15.739 million tons from Australia, a decrease of 1.237 million tons from the previous week, 7.131 million tons from Brazil, an increase of 2.955 million tons from the previous period, and 4.07 million tons from non-mainstream shipments, a decrease of 1.69 million tons from the previous period.

Global ore shipments have been relatively low, but looking ahead, the impact of the FMG train derailment incident has ended. It is expected that FMG shipments will significantly rebound in the future, while some non-mainstream mines are expected to maintain high shipment levels, leading to an overall increase in ore shipments. Last week, ore arrivals approached 30 million tons, the second highest point in recent years. However, with the decline in Australian shipments since the beginning of the year, the arrival levels are expected to show a top reversal trend.

On the demand side

247 steel mills had a blast furnace capacity utilization rate of 76.23%, up 0.15% from the previous week and an increase of 0.26% from the previous year. The blast furnace ironmaking capacity utilization rate was 82.98%, an increase of 0.42% compared to the previous period but a decrease of 0.12% year-on-year. The steel mill profitability rate was 26.41%, a decrease of 0.43% from the previous period.

Translated

+1

2

In the TV drama “Blossoming Flowers,” the battle between Strong and Bao is dazzling and relishing. The essence is who has the institutional temperament and who can last a long time. In fact, there is no understanding in the drama, but there is no doubt that the job of investing in stocks is a professional technique that may seem easy to get started with, but it is actually a troubling professional technique. Especially when it comes to bear markets, it's easier to fall into a situation where butterflies swim in a cesspit.

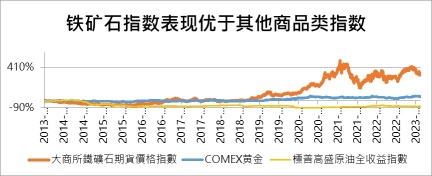

Fortunately for investors, there is another more interesting investment tool, which has become a profitable delivery issue in the bear market — iron ore ETF (3047.HK). Iron ore ETFs don't have as many bosses and tricks behind the stock investments in “Blossoming Flowers”; they are relatively simple and straightforward. $SSIF DCE Iron Ore Futures Index ETF (03047.HK)$

The price fluctuation of iron ore ETFs is divided into two parts. One is the rise and fall of the iron ore spot itself, which is affected by changes in supply and demand at the stage; the other part is tiered income, which allows investors to easily obtain more returns that surpass the rise and fall of iron ore (historical statistics). $SSIF DCE Iron Ore Futures Index ETF (09047.HK)$

First, price fluctuations in iron ore ETFs are closely related to iron ore spot. Iron ore prices are affected by multiple factors such as the global economic situation, supply-demand relationships, and political factors. However, for investors, there is no need to worry too much about the rise and fall of iron ore stocks,...

Fortunately for investors, there is another more interesting investment tool, which has become a profitable delivery issue in the bear market — iron ore ETF (3047.HK). Iron ore ETFs don't have as many bosses and tricks behind the stock investments in “Blossoming Flowers”; they are relatively simple and straightforward. $SSIF DCE Iron Ore Futures Index ETF (03047.HK)$

The price fluctuation of iron ore ETFs is divided into two parts. One is the rise and fall of the iron ore spot itself, which is affected by changes in supply and demand at the stage; the other part is tiered income, which allows investors to easily obtain more returns that surpass the rise and fall of iron ore (historical statistics). $SSIF DCE Iron Ore Futures Index ETF (09047.HK)$

First, price fluctuations in iron ore ETFs are closely related to iron ore spot. Iron ore prices are affected by multiple factors such as the global economic situation, supply-demand relationships, and political factors. However, for investors, there is no need to worry too much about the rise and fall of iron ore stocks,...

Translated

+5

1

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)