Is September really the most volatile month? 🤔 I'm betting February might give it a run for its money this year. Black swan events, like last Monday's Deep Seek news (GPUs shaking up the AI game!), can hit hard and fast. Factor in potential tariffs, rising CPI, and looming unemployment, and things could get interesting. My strategy? Dollar-cost averaging into total stock market and global total stock market index funds. I'm particularly bullish on ETFs from Columbia, Brazil...

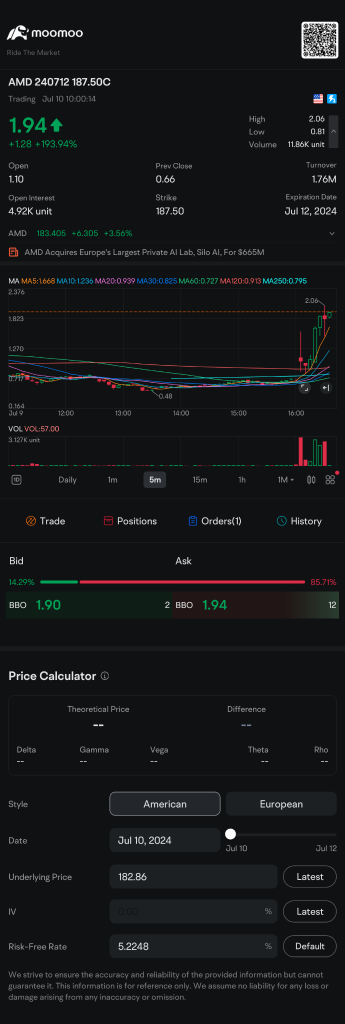

This is a great opportunity to take a lesson to get a good education as to have a market cycle in semiconductor goes. using a number of resources in the industry I have taken a strategy of DCA which stands for dollar cost averaging to deploy funds into a select group of semiconductor stocks. turning point for me was the general bearishness of the industry and constant Doom scenarios articulated by a number of stock traders and CNBC pundits. and the words of the great Warren Buffett...

3

1

the milestones in my life: as my daughter went from high school to college I went to a different phase of my investing playbook. during the time that my daughter was in school before College I typically invested more in individual stocks. as time has went on and the markets have become volatile because of economic political and social events that have been come inextricably linked together, that has caused me to examine index funds. I have looked at diversification strate...

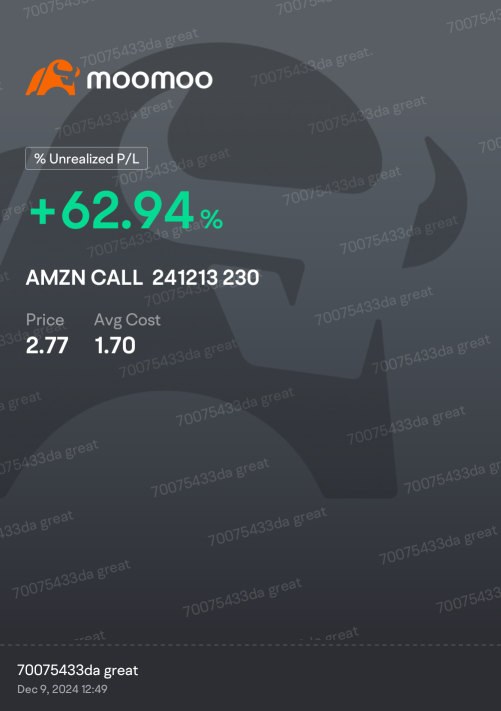

I've had a great experience doing the past several months eliminating the noise. I've also focused on not giving much attention to the headlines. I focused on what was near and dear to me, which was fact-based technical analysis and research. this enable me to put together a selective portfolio built on several themes that were focused on being consistent long-term winners even after downturn. I focused on it leveraged ETFs and biotech, technology and short crude n...

3

2

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)