Al Luan 102571073

liked

Something wrong with my moomoo🛠🛠🛠

Why everything is red 💔💔💔

$Tesla(TSLA.US$ $Rivian Automotive(RIVN.US$ $NVIDIA(NVDA.US$ $Apple(AAPL.US$ $GameStop(GME.US$ $AMC Entertainment(AMC.US$

Why everything is red 💔💔💔

$Tesla(TSLA.US$ $Rivian Automotive(RIVN.US$ $NVIDIA(NVDA.US$ $Apple(AAPL.US$ $GameStop(GME.US$ $AMC Entertainment(AMC.US$

24

Al Luan 102571073

liked

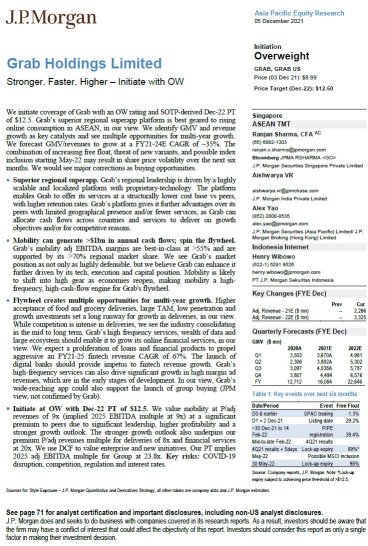

$Grab Holdings(GRAB.US$ JP Morgan initiation Overweight at $12.50 Price Target from 12/3.

PS - be aware how much stock is available to trade per the company's slide below.

PS - be aware how much stock is available to trade per the company's slide below.

5

4

Al Luan 102571073

liked

By Julianna

Investors appear to be losing patience with Ark Investment Management's genomics fund.![]()

![]()

$ARK Genomic Revolution ETF(ARKG.US$ is an actively managed ETF that focus on health care, information technology, materials, energy, and consumer discretionary.

Companies within ARKG are focused on and are expected to substantially benefit from extending and enhancing the quality of human and other life by incorporating technological and scientific developments and advancements in genomics into their business.

- according to ARKG fund description.

However, ARKG is down 30% this year as investors shun health-care stocks in favor for more cyclical names that perform well during an economic recovery. Even so, this ETF is faring far worse than the broader biotech sector, with the $Dow Jones U.S. Biotechnology Index(.DJUSBT.US$up 11.35% this year.![]()

![]()

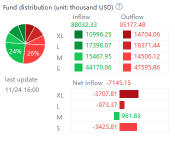

ARKG is currently trading at $65.16 a share, 43% lower from its peak in this February. The genomics fund has also seen the largest outflows among Ark's ETFs this year.![]()

![]()

It's interesting that typically loyal Ark investors have been bailing on the ETF.

The fund's assets have been chopped in half since February. While I don't believe the ETF is experiencing some of sort of 'doom loop,' clearly the outflows are putting downward price pressure on the underlying holdings and testing the will of remaining fund owners.

- said Nate Geraci, president of The ETF Store, an advisory firm.

![]()

![]() FOLLOW ME to know more about ETFs

FOLLOW ME to know more about ETFs

PLZ leave your comments and likes below![]()

ARKG's top two holdings, $Teladoc Health(TDOC.US$and $Exact Sciences(EXAS.US$, heavily impact its performance, with drops of 47% and 33.5% this year, respectively.![]()

![]()

![]()

The recent outflows may be due to investors looking for shorter-term opportunities into the year-end and freeing up cash.

- said Sylvia Jablonski, chief investment officer at Defiance ETFs.

Ark Chief Executive Officer Cathie Wood is well-known for prioritizing longer term investments over short-term gains.![]()

![]()

This is a 5-10 year hold. AI in health care is going to change the way that we can predict, treat and manage the most difficult diseases like cancer, and the Ark fund gives investors access to the companies who are on the cutting edge of that research.

- Jablonski added.

Have you ever invested in the Biotechnology sector? Do you agree with Jablonski's opinion?![]()

![]()

Source: Bloomberg

Investors appear to be losing patience with Ark Investment Management's genomics fund.

$ARK Genomic Revolution ETF(ARKG.US$ is an actively managed ETF that focus on health care, information technology, materials, energy, and consumer discretionary.

Companies within ARKG are focused on and are expected to substantially benefit from extending and enhancing the quality of human and other life by incorporating technological and scientific developments and advancements in genomics into their business.

- according to ARKG fund description.

However, ARKG is down 30% this year as investors shun health-care stocks in favor for more cyclical names that perform well during an economic recovery. Even so, this ETF is faring far worse than the broader biotech sector, with the $Dow Jones U.S. Biotechnology Index(.DJUSBT.US$up 11.35% this year.

ARKG is currently trading at $65.16 a share, 43% lower from its peak in this February. The genomics fund has also seen the largest outflows among Ark's ETFs this year.

It's interesting that typically loyal Ark investors have been bailing on the ETF.

The fund's assets have been chopped in half since February. While I don't believe the ETF is experiencing some of sort of 'doom loop,' clearly the outflows are putting downward price pressure on the underlying holdings and testing the will of remaining fund owners.

- said Nate Geraci, president of The ETF Store, an advisory firm.

PLZ leave your comments and likes below

ARKG's top two holdings, $Teladoc Health(TDOC.US$and $Exact Sciences(EXAS.US$, heavily impact its performance, with drops of 47% and 33.5% this year, respectively.

The recent outflows may be due to investors looking for shorter-term opportunities into the year-end and freeing up cash.

- said Sylvia Jablonski, chief investment officer at Defiance ETFs.

Ark Chief Executive Officer Cathie Wood is well-known for prioritizing longer term investments over short-term gains.

This is a 5-10 year hold. AI in health care is going to change the way that we can predict, treat and manage the most difficult diseases like cancer, and the Ark fund gives investors access to the companies who are on the cutting edge of that research.

- Jablonski added.

Have you ever invested in the Biotechnology sector? Do you agree with Jablonski's opinion?

Source: Bloomberg

+1

128

25

Al Luan 102571073

liked

By Danilo

Hey, mooers! Here are things you need to know before the opening bell:

- U.S. stock futures struggled for direction early Wednesday morning after a two-day sell-off in tech shares, pressured by rising rates which boosted energy and financial stocks.

- Apple's lawsuit seeks to bar the surveillance-software company from using the iPhone maker's products.

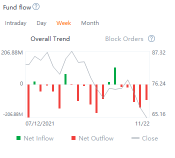

Market Snapshot

U.S. stock futures struggled for direction early Wednesday morning after a two-day sell-off in tech shares, pressured by rising rates which boosted energy and financial stocks.

$Dow Jones Industrial Average(.DJI.US$ futures shed 124 points. $S&P 500 Index(.SPX.US$ sat below the flatline while $NASDAQ 100 Index(.NDX.US$ futures lost 36 points.

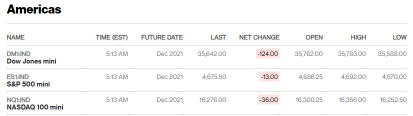

Market Temperature

Read more: Market Temperature (11/24)

Top News

Stock futures waver ahead of data, Fed minutes

U.S. stock futures were edging down ahead of a wave of economic data, including gross domestic product and consumer spending, and the release of minutes from the Federal Reserve's recent meeting.

Thanksgiving travelers will face high gas prices, long lines

The TSA expects to greet 20 million flyers. Those driving will pay on average $3.40 a gallon for unleaded gas.

Strong demand, shortages push up prices in U.S. and Europe

Businesses continue to contend with cost inflation even as supply constraints show signs of easing, according to recent surveys.

Fed nominations leave questions over regulation

President Biden's decision to reappoint Jerome Powell and elevate governor Lael Brainard signals continuity on monetary policy but leaves open questions on the direction the central bank will take in regulating Wall Street.

Samsung picks Texas for $17 billion chip-making factory

The investment adds to a wave of expanded semiconductor production amid global parts shortages.

Apple sues Israeli firm NSO over spyware, claiming iPhone hacks

The lawsuit seeks to bar the surveillance-software company from using the iPhone maker's products. $Apple(AAPL.US)$

Musk's tax bill on stock options fell along with Tesla's share price

While a sliding stock price eases the $Tesla(TSLA.US$ CEO's short-term tax bill, it also limits the deductions that his company is able to take.

Read More

Retail traders jump back into tiny biotechs ahead of holiday

Here's what Powell's nomination for 2nd term as Fed chairman means for markets

Is it reliable? Musk drove Tesla for an hour using FSD function only

Tesla fans hit JPMorgan's Yelp page with 1-star reviews

Rocket Lab CEO: Companies not reusing rockets are making 'a dead-end product'

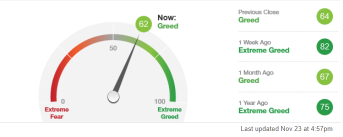

Key Events This Week

Source: CNBC, Dow Jones Newswires, Bloomberg

Hey, mooers! Here are things you need to know before the opening bell:

- U.S. stock futures struggled for direction early Wednesday morning after a two-day sell-off in tech shares, pressured by rising rates which boosted energy and financial stocks.

- Apple's lawsuit seeks to bar the surveillance-software company from using the iPhone maker's products.

Market Snapshot

U.S. stock futures struggled for direction early Wednesday morning after a two-day sell-off in tech shares, pressured by rising rates which boosted energy and financial stocks.

$Dow Jones Industrial Average(.DJI.US$ futures shed 124 points. $S&P 500 Index(.SPX.US$ sat below the flatline while $NASDAQ 100 Index(.NDX.US$ futures lost 36 points.

Market Temperature

Read more: Market Temperature (11/24)

Top News

Stock futures waver ahead of data, Fed minutes

U.S. stock futures were edging down ahead of a wave of economic data, including gross domestic product and consumer spending, and the release of minutes from the Federal Reserve's recent meeting.

Thanksgiving travelers will face high gas prices, long lines

The TSA expects to greet 20 million flyers. Those driving will pay on average $3.40 a gallon for unleaded gas.

Strong demand, shortages push up prices in U.S. and Europe

Businesses continue to contend with cost inflation even as supply constraints show signs of easing, according to recent surveys.

Fed nominations leave questions over regulation

President Biden's decision to reappoint Jerome Powell and elevate governor Lael Brainard signals continuity on monetary policy but leaves open questions on the direction the central bank will take in regulating Wall Street.

Samsung picks Texas for $17 billion chip-making factory

The investment adds to a wave of expanded semiconductor production amid global parts shortages.

Apple sues Israeli firm NSO over spyware, claiming iPhone hacks

The lawsuit seeks to bar the surveillance-software company from using the iPhone maker's products. $Apple(AAPL.US)$

Musk's tax bill on stock options fell along with Tesla's share price

While a sliding stock price eases the $Tesla(TSLA.US$ CEO's short-term tax bill, it also limits the deductions that his company is able to take.

Read More

Retail traders jump back into tiny biotechs ahead of holiday

Here's what Powell's nomination for 2nd term as Fed chairman means for markets

Is it reliable? Musk drove Tesla for an hour using FSD function only

Tesla fans hit JPMorgan's Yelp page with 1-star reviews

Rocket Lab CEO: Companies not reusing rockets are making 'a dead-end product'

Key Events This Week

Source: CNBC, Dow Jones Newswires, Bloomberg

+1

66

3

Al Luan 102571073

liked

Semiconductors, automobiles and the potential for tie-ups between the two industries took the spotlight in the tech sector with seemingly everyone from $Apple(AAPL.US$ to $Qualcomm(QCOM.US$ getting behind the wheel this week.

Let's start with $Apple(AAPL.US$ which said...Absolutely nothing. But, reports that the company has developed a semiconductor "breakthrough", and will produce a fully autonomous electric car within four year were enough to send just about everyone wondering what companies might benefit from Apple putting a so-called "iCar" on the road.

Other chip companies involved into automotive industry actually did have a lot to say during the week. One of those was $NVIDIA(NVDA.US$, which got a big boost on Wall Street following its better-than-expected earnings report. Nvidia (NVDA) also said it was still pushing ahead with efforts to acquire British chip-technology company Arm Holdings despite more governmental inquiries into the proposed $40 billion acquisition.

$Qualcomm(QCOM.US$ wouldn't be outdone, as it said it secured a deal to provide its chip technology to BMW for a new generation of the automakers self-driving cars. Qualcomm Chief Executive Cristiano Amon also touted the company's automotive plans as part of its efforts to diversity into new industries for its chip products.

If that wasn't enough, $General Motors(GM.US$ also said it was working with Qualcomm and other chipmakers to supply semiconductors for its vehicles in an effort to get around chip industry supply shortages.

Back to Apple for a moment. Chief Executive Tim Cook said Apple employees should plan on returning to the office, at least part time, on February 1. Apple also started up a new service program that will let consumers perform their own repairs on some Apple products.

Streaming TV companies weren't being quiet this week, either. $Netflix(NFLX.US$ unveiled a new website where it will show its top-rated TV shows and movies every week.

$Disney(DIS.US$ said it is raising the price of its Hulu Live TV service by $5 to $69.99 a month, but will include ESPN+ and Disney+ as part of the streaming package.

$Roku Inc(ROKU.US$ took a hit after analyst Michael Nathanson cut his rating on the company's stock to sell due to slower advertising growth on the Roku Channel. There were also reports that Roku is developing more than 50 original shows for the Roku Channel.

After a bidding war between some of the largest TV broadcasters and streamers, $Comcast(CMCSA.US$managed to renew its deal to carry games of the English Premier League for another six years.

For people who use $Uber Technologies(UBER.US$ a lot, the ride-sharing leader unveiled its new Uber One program where, for a monthly or annual fee, subscribers can get discounts on ride and free food and grocery delivery from Uber Eats.

Let's start with $Apple(AAPL.US$ which said...Absolutely nothing. But, reports that the company has developed a semiconductor "breakthrough", and will produce a fully autonomous electric car within four year were enough to send just about everyone wondering what companies might benefit from Apple putting a so-called "iCar" on the road.

Other chip companies involved into automotive industry actually did have a lot to say during the week. One of those was $NVIDIA(NVDA.US$, which got a big boost on Wall Street following its better-than-expected earnings report. Nvidia (NVDA) also said it was still pushing ahead with efforts to acquire British chip-technology company Arm Holdings despite more governmental inquiries into the proposed $40 billion acquisition.

$Qualcomm(QCOM.US$ wouldn't be outdone, as it said it secured a deal to provide its chip technology to BMW for a new generation of the automakers self-driving cars. Qualcomm Chief Executive Cristiano Amon also touted the company's automotive plans as part of its efforts to diversity into new industries for its chip products.

If that wasn't enough, $General Motors(GM.US$ also said it was working with Qualcomm and other chipmakers to supply semiconductors for its vehicles in an effort to get around chip industry supply shortages.

Back to Apple for a moment. Chief Executive Tim Cook said Apple employees should plan on returning to the office, at least part time, on February 1. Apple also started up a new service program that will let consumers perform their own repairs on some Apple products.

Streaming TV companies weren't being quiet this week, either. $Netflix(NFLX.US$ unveiled a new website where it will show its top-rated TV shows and movies every week.

$Disney(DIS.US$ said it is raising the price of its Hulu Live TV service by $5 to $69.99 a month, but will include ESPN+ and Disney+ as part of the streaming package.

$Roku Inc(ROKU.US$ took a hit after analyst Michael Nathanson cut his rating on the company's stock to sell due to slower advertising growth on the Roku Channel. There were also reports that Roku is developing more than 50 original shows for the Roku Channel.

After a bidding war between some of the largest TV broadcasters and streamers, $Comcast(CMCSA.US$managed to renew its deal to carry games of the English Premier League for another six years.

For people who use $Uber Technologies(UBER.US$ a lot, the ride-sharing leader unveiled its new Uber One program where, for a monthly or annual fee, subscribers can get discounts on ride and free food and grocery delivery from Uber Eats.

306

9

Al Luan 102571073

liked

88

18

Al Luan 102571073

liked

Al Luan 102571073

liked

Translated

19

Al Luan 102571073

liked

Q&A is a session under a company's earnings conference that institutional and retailinvestors ask some most-concerned questions to the management. On this page, you may find out some valuable info that might affect the stock price in the following weeks. $Lucid Group(LCID.US$

Key Takeaways:

Attitudes: themanagement feels like sitting in a terrific place today with a $4.8 billion.

Goals: Laser focused on growing the scale towards 20,000 units next year. But we're planning on 500,000 units by the end of the decade.

Products: the SUV Gravity is ready for production late '23.

Congrats on your first quarter as a public Company. 90,000 units capacity by 2023 seems a little bit pedestrian, right? As you think about your volume, if you could tell us where you're headed?

Laser focused on growing the scale towards 20,000 units next year. But we're planning on 500,000 units by the end of the decade. We have a plan in place to expand Casa Grande to that level. And we've also got localization of manufacturing. We've got incredible high value in our manufacturing as well because we manufacture the entire technology suite, the battery, the motor, the inverter, the whole electric powertrain, in-house. So we're not just buying in parts here and just having value that way. There's a whole lot of in-built value-add to the cars that we've got. But of course, we also plan probes in other parts of the world, the Middle East and in China, and this is going to be part of our global expansion plan.

Would you consider a greater issuance to raise capital, to maybe accelerate this 90,000 units capacity in 2023. And hopefully maybe grow even faster than what you've been talking about.

We're sitting in a terrific place today with a $4.8 billion as of September 30th. That can get us well through 2022. You're going to see a large CapEx increase happening next year. So we're already doing that acceleration. And in June, we announced that we were going to be bringing forward $350 million of planned CapEx investments from future periods into the 2021 to 2023 periods, and also increasing overall between 2021 and 2026 by 6% to 7%. So we are going to accelerate in our ability to deploy CapEx. And if the opportunity presents itself -- you might recall that our prior versions of our motto suggested that, 2024 and beyond that we might start to step down our CapEx but then opportunity is there for continued expansion and we are ready for it. We will certainly go after it.

You have a knockout products with best-in-class range. How do you view gravities differentiation in the market?

We've made a whole bunch of advances with Gravity project. It's very close to my heart. We're getting it ready for production late '23 and I think it's going to be equally as disruptive in the SUV space as Air is in its sedan space. We're going to deploy the space concept, miniaturization of the electric car train, incredible range for its class, and it's going to have 1 or 2 really big dialing, unique features as well. I am super excited about Gravity.

Congrats on the MotorTrend Car of the Year Award. I had a question on the delta of reservations from the 13 at the end of the quarter to the over 17 now. So I'd be curious what the like-for-like is of North American reservations within that delta? Then maybe within international, how much of a Saudi versus non Saudi or any color that would be helpful?

We don't international reservations before we announce the 13,000, also, the bulk of reservations is our home markets, U.S. and we haven't even opened up the big market and teacher, which is China. But absolutely Saudi is great because it's our biggest market number of reservations, and that's really heartening that the country which is gained its wealth based upon its carbon economy is so forward-looking and sees the efforts in corrective product.

On your distribution strategy, can you remind us why the advantages of going direct to consumer and why you are not using a franchise model?

The important thing here is that we are creating a new brand. It's not just about the product. The product defines the brand, but there's more here than just Lucid Air and a luxury brand. And the consumer experience in the consumer journey is too precious to delegate to third-party. We need to choreograph the consumer's journey through discovery, through intrigue, through purchase and ownership, and how better than to do it directly. You can also just driving consistency in messaging as well, you're not working with independent franchises and dealerships that it just really allows a lot more control

This article is a script from the Q&A session of Lucid's earnings call on Nov 16. In order to facilitate reading, we have made appropriate cuts. If you want to know more details, you can click here to re-watch the earnings call.

Key Takeaways:

Attitudes: themanagement feels like sitting in a terrific place today with a $4.8 billion.

Goals: Laser focused on growing the scale towards 20,000 units next year. But we're planning on 500,000 units by the end of the decade.

Products: the SUV Gravity is ready for production late '23.

Congrats on your first quarter as a public Company. 90,000 units capacity by 2023 seems a little bit pedestrian, right? As you think about your volume, if you could tell us where you're headed?

Laser focused on growing the scale towards 20,000 units next year. But we're planning on 500,000 units by the end of the decade. We have a plan in place to expand Casa Grande to that level. And we've also got localization of manufacturing. We've got incredible high value in our manufacturing as well because we manufacture the entire technology suite, the battery, the motor, the inverter, the whole electric powertrain, in-house. So we're not just buying in parts here and just having value that way. There's a whole lot of in-built value-add to the cars that we've got. But of course, we also plan probes in other parts of the world, the Middle East and in China, and this is going to be part of our global expansion plan.

Would you consider a greater issuance to raise capital, to maybe accelerate this 90,000 units capacity in 2023. And hopefully maybe grow even faster than what you've been talking about.

We're sitting in a terrific place today with a $4.8 billion as of September 30th. That can get us well through 2022. You're going to see a large CapEx increase happening next year. So we're already doing that acceleration. And in June, we announced that we were going to be bringing forward $350 million of planned CapEx investments from future periods into the 2021 to 2023 periods, and also increasing overall between 2021 and 2026 by 6% to 7%. So we are going to accelerate in our ability to deploy CapEx. And if the opportunity presents itself -- you might recall that our prior versions of our motto suggested that, 2024 and beyond that we might start to step down our CapEx but then opportunity is there for continued expansion and we are ready for it. We will certainly go after it.

You have a knockout products with best-in-class range. How do you view gravities differentiation in the market?

We've made a whole bunch of advances with Gravity project. It's very close to my heart. We're getting it ready for production late '23 and I think it's going to be equally as disruptive in the SUV space as Air is in its sedan space. We're going to deploy the space concept, miniaturization of the electric car train, incredible range for its class, and it's going to have 1 or 2 really big dialing, unique features as well. I am super excited about Gravity.

Congrats on the MotorTrend Car of the Year Award. I had a question on the delta of reservations from the 13 at the end of the quarter to the over 17 now. So I'd be curious what the like-for-like is of North American reservations within that delta? Then maybe within international, how much of a Saudi versus non Saudi or any color that would be helpful?

We don't international reservations before we announce the 13,000, also, the bulk of reservations is our home markets, U.S. and we haven't even opened up the big market and teacher, which is China. But absolutely Saudi is great because it's our biggest market number of reservations, and that's really heartening that the country which is gained its wealth based upon its carbon economy is so forward-looking and sees the efforts in corrective product.

On your distribution strategy, can you remind us why the advantages of going direct to consumer and why you are not using a franchise model?

The important thing here is that we are creating a new brand. It's not just about the product. The product defines the brand, but there's more here than just Lucid Air and a luxury brand. And the consumer experience in the consumer journey is too precious to delegate to third-party. We need to choreograph the consumer's journey through discovery, through intrigue, through purchase and ownership, and how better than to do it directly. You can also just driving consistency in messaging as well, you're not working with independent franchises and dealerships that it just really allows a lot more control

This article is a script from the Q&A session of Lucid's earnings call on Nov 16. In order to facilitate reading, we have made appropriate cuts. If you want to know more details, you can click here to re-watch the earnings call.

111

3

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)