Apektung

voted

Mark your calendars, folks! Nvidia's Q3 earnings drop on November 20, and the market is buzzing with excitement. This could be the quarter that defines 2025 for the AI giant! 🌟

Here’s the setup:

- Nvidia is forecasting $32.5B revenue with a 75% gross margin—that’s insane efficiency for a company of this scale! 💎

- Analysts are even more bullish, predicting $32.94B revenue and $0.74 EPS, which would mean doubling last year’s Q3 revenue. Massive. 📈

O...

Here’s the setup:

- Nvidia is forecasting $32.5B revenue with a 75% gross margin—that’s insane efficiency for a company of this scale! 💎

- Analysts are even more bullish, predicting $32.94B revenue and $0.74 EPS, which would mean doubling last year’s Q3 revenue. Massive. 📈

O...

+1

9

3

Apektung

liked

RECAP

The $Dow Jones Industrial Average (.DJI.US)$ rebounded after pulling out of a Boeing slump. Indexes opened cautious, but built towards a rebound after the S&P 500 shed 1.5% last week to break a two-month winning streak.

$Dow Jones Industrial Average (.DJI.US)$ climbed 0.58%, the $S&P 500 Index (.SPX.US)$ rose 1.41%, and the $Nasdaq Composite Index (.IXIC.US)$ climbed 2.20%. Large tech stocks led the way; all "Magnificent Seven" stocks were...

The $Dow Jones Industrial Average (.DJI.US)$ rebounded after pulling out of a Boeing slump. Indexes opened cautious, but built towards a rebound after the S&P 500 shed 1.5% last week to break a two-month winning streak.

$Dow Jones Industrial Average (.DJI.US)$ climbed 0.58%, the $S&P 500 Index (.SPX.US)$ rose 1.41%, and the $Nasdaq Composite Index (.IXIC.US)$ climbed 2.20%. Large tech stocks led the way; all "Magnificent Seven" stocks were...

31

3

Apektung

voted

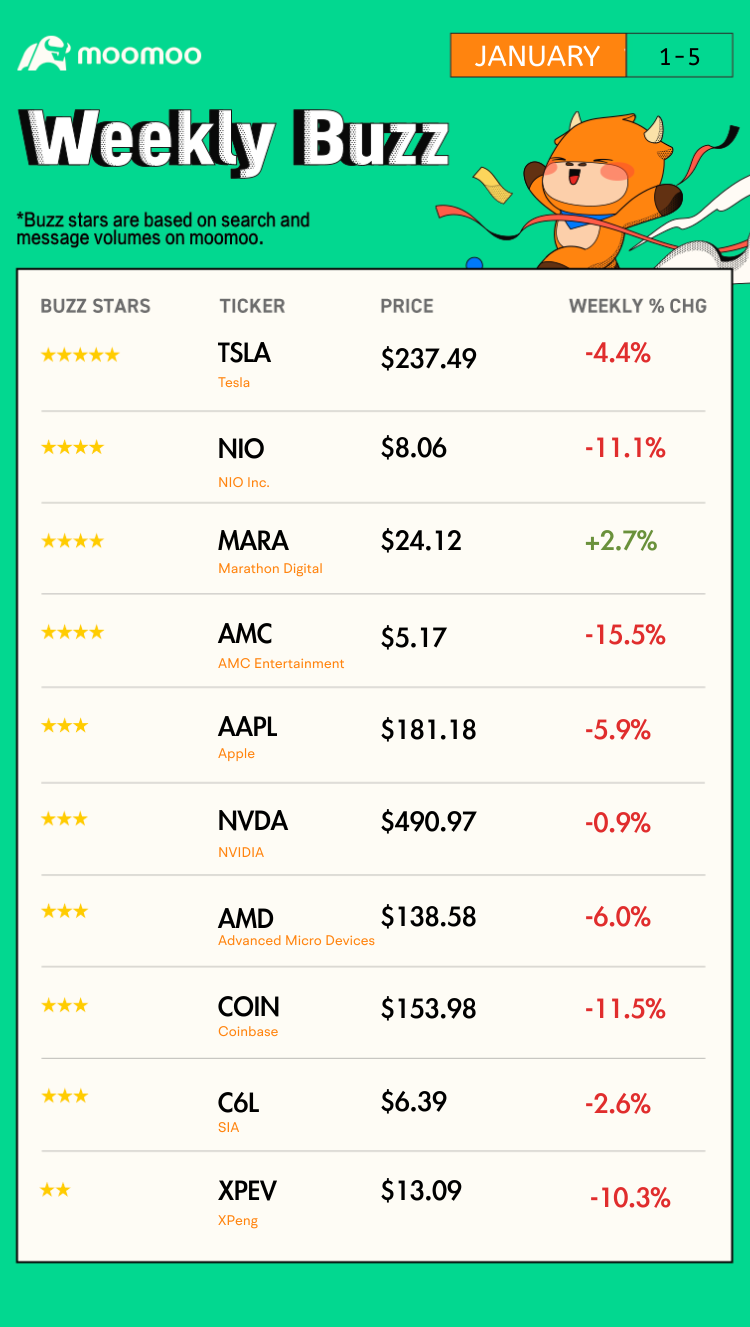

Happy Friday, mooers! Welcome back to Weekly Buzz, where we review the news, performance and community sentiment of the selected buzzing stocks on moomoo platform based on search and message volumes of this week! Answer the Weekly Topic question for a chance to win an award next week!

Make Your Choice

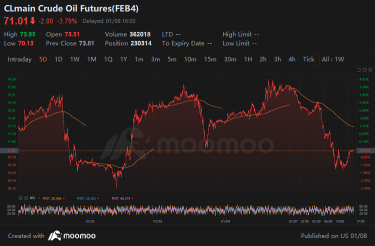

Weekly Buzz: Strong jobs data dragged down Q1 rate cut odds

Wall Street's bulls wavered in the first trading week of 2024 as some invest...

Make Your Choice

Weekly Buzz: Strong jobs data dragged down Q1 rate cut odds

Wall Street's bulls wavered in the first trading week of 2024 as some invest...

64

16

14

Apektung

liked

$Foghorn Therapeutics (FHTX.US)$ buy buy buy

2

2

Apektung

liked

$Ardelyx (ARDX.US)$ is today the day it goes to 2? we shall seeeeee...

4

8

Apektung

liked

$Triterras (TRIT.US)$ I believe it will reach at least $10

5

Apektung

liked

Columns Market Temperature (10/27)

The fear and greed index was developed by CNNMoney to measure two of the primary emotions that influence how much investors are willing to pay for stocks.

The fear and greed index is measured on a daily, weekly, monthly, and yearly basis. In theory, the index can be used to gauge whether the stock market is fairly priced. This is based on the logic that excessive fear tends to drive down share prices, and too much greed tends to have the opposite effect.

Be fearful when others are greedy. Be greedy when others are fearful.

---Warren Buffett

Fear & Greed Index

What emotion is driving the market?

Market Momentum: Extreme Greed

The S&P 500 is 5.18% above its 125-day average. This is further above the average than has been typical during the last two years and rapid increases like this often indicate extreme greed.

Last changed Oct 25 from a Greed rating.

Stock Price Breadth: Greed

The McClellan Volume Summation Index measures advancing and declining volume on the NYSE. During the last month, approximately 8.47% more of each day's volume has traded in advancing issues than in declining issues, pushing this indicator towards the upper end of its range for the last two years.

Last changed Oct 22 from a Neutral rating.

Stock Price Strength: Extreme Fear

The number of stocks hitting 52-week highs exceeds the number hitting lows but is at the lower end of its range, indicating fear.

Last changed May 20 from a Fear rating.

$S&P 500 Index (.SPX.US)$ $Nasdaq Composite Index (.IXIC.US)$ $Digital World Acquisition Corp (DWAC.US)$ $Tesla (TSLA.US)$ $Alphabet-A (GOOGL.US)$

The fear and greed index is measured on a daily, weekly, monthly, and yearly basis. In theory, the index can be used to gauge whether the stock market is fairly priced. This is based on the logic that excessive fear tends to drive down share prices, and too much greed tends to have the opposite effect.

Be fearful when others are greedy. Be greedy when others are fearful.

---Warren Buffett

Fear & Greed Index

What emotion is driving the market?

Market Momentum: Extreme Greed

The S&P 500 is 5.18% above its 125-day average. This is further above the average than has been typical during the last two years and rapid increases like this often indicate extreme greed.

Last changed Oct 25 from a Greed rating.

Stock Price Breadth: Greed

The McClellan Volume Summation Index measures advancing and declining volume on the NYSE. During the last month, approximately 8.47% more of each day's volume has traded in advancing issues than in declining issues, pushing this indicator towards the upper end of its range for the last two years.

Last changed Oct 22 from a Neutral rating.

Stock Price Strength: Extreme Fear

The number of stocks hitting 52-week highs exceeds the number hitting lows but is at the lower end of its range, indicating fear.

Last changed May 20 from a Fear rating.

$S&P 500 Index (.SPX.US)$ $Nasdaq Composite Index (.IXIC.US)$ $Digital World Acquisition Corp (DWAC.US)$ $Tesla (TSLA.US)$ $Alphabet-A (GOOGL.US)$

+1

28

1

3

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)