AVICENNA

liked

$Global-E Online (GLBE.US)$ This share has been up & down within a day. sometimes the range is as big as 6USD difference. 3rd time for me to buy in & sell out

17

AVICENNA

liked

$PayPal (PYPL.US)$ The Fintech sector, including industry pioneer PayPal has taken a wallop on Wall Street recently.

PayPal has seen its shares plunge from highs near $310 a share in August to lows below $190 recently.

PayPal forecast 55 million net-new active users this year and Schulman said it remains on target to deliver that number. The company also is expected to meet the target of 750 million total users by 2025.

When asked about involvement in the popular buy-now, pay-later space, Schulman, president and CEO of PayPal said that while PayPal doesn't get a lot of the hype, it is one of the top four players in the world. Buy-now, pay-later sales were up 400% year-over-year on Black Friday.

PayPal has seen its shares plunge from highs near $310 a share in August to lows below $190 recently.

PayPal forecast 55 million net-new active users this year and Schulman said it remains on target to deliver that number. The company also is expected to meet the target of 750 million total users by 2025.

When asked about involvement in the popular buy-now, pay-later space, Schulman, president and CEO of PayPal said that while PayPal doesn't get a lot of the hype, it is one of the top four players in the world. Buy-now, pay-later sales were up 400% year-over-year on Black Friday.

14

1

AVICENNA

liked

2021 is the first year i started to invest in stocks. What a rocky year to start off with🤣 l’d like to share my 3 biggest mistakes and experiences as a new investor.

First of all, I recalled that I had a dilemma - buy at all time high if not it will go higher and never come back down OR wait till it drops. It’s scary to see the price increasing higher and higher. I asked myself “do I buy now when it’s all time high or wait and buy when the price drops?” I waited only to see it increased 😂 and I hurried to enter the market to buy only to see it dropped and dropped further 🥲

One other mistake I made was not a very smart decision to buy shares of a single company with a lump sum and lastly, the mistake was to invest ALL my capital in my portfolio.

What’s wrong with the mistake above and what have I learned is that, firstly, I learned to ONLY buy what I can afford. When we see the price at all time high, we all hope for a discount but it can go either way so i have decided to BUY only if I can AFFORD to LOSE. Of course, I have to do homework to find out if it’s a good company that I can invest in for a long term.👍

Secondly, investing with a lump sum with all capital made me realise that I do not have enough cash to buy when the price drops for dollar cost averaging and i realised I have to keep checking on my account balance because I fear that I might blow my account.

So what I did was that I decided to sell one of the stocks that takes up a greater portion of my portfolio. And before I decide to sell, I was hoping that it will go up to breakeven. However it didn’t and I sell at a greater loss. Good news is that I was still able to preserve most of it. 🥲

This investment experience allows me to realise the importance of patience, value and risk management. I learned that the guts to selling stock (that is either going to harm your capital or losses its value) at a loss is also a must-have in order to prevent the losses from snowballing.

When I first started out, I focused on growth stocks. Now with the extra capital from what I sold as mentioned above, I invest part of it into SG dividend stocks, with the rest as back up capital. This allows me to not worry so much when the market crashes as I have the capital to dollar cost average. It also helped me to not frantically check on my portfolio every now and then, knowing that I have the capital to prevent margin call. Even if I lose all the money in stocks, part of it is still in cash (for future investment if there’s good stocks or dollar cost averaging) this allows me to have a peace of mind as I know I won’t be losing all of my money.

Stocks are for long term and investing a lump sum can bring quick cash but also increase the risk. Right now I learned how to manage risk and also allowing myself to hold stocks for long periods of time. I believe it’s personal risk and investment preference so i believe everyone has their own way of investing (market timing, lump sum, dollar cost averaging, etc). I hope I have shared some insights and also to remind myself of the things I learn and I hope moomoo will continue to provide good investment experience for us. Wishing everyone Merry Xmas and looking forward to 2022!

$DBS Group Holdings (D05.SG)$ $Roundhill Ball Metaverse ETF (META.US)$ $Apple (AAPL.US)$

First of all, I recalled that I had a dilemma - buy at all time high if not it will go higher and never come back down OR wait till it drops. It’s scary to see the price increasing higher and higher. I asked myself “do I buy now when it’s all time high or wait and buy when the price drops?” I waited only to see it increased 😂 and I hurried to enter the market to buy only to see it dropped and dropped further 🥲

One other mistake I made was not a very smart decision to buy shares of a single company with a lump sum and lastly, the mistake was to invest ALL my capital in my portfolio.

What’s wrong with the mistake above and what have I learned is that, firstly, I learned to ONLY buy what I can afford. When we see the price at all time high, we all hope for a discount but it can go either way so i have decided to BUY only if I can AFFORD to LOSE. Of course, I have to do homework to find out if it’s a good company that I can invest in for a long term.👍

Secondly, investing with a lump sum with all capital made me realise that I do not have enough cash to buy when the price drops for dollar cost averaging and i realised I have to keep checking on my account balance because I fear that I might blow my account.

So what I did was that I decided to sell one of the stocks that takes up a greater portion of my portfolio. And before I decide to sell, I was hoping that it will go up to breakeven. However it didn’t and I sell at a greater loss. Good news is that I was still able to preserve most of it. 🥲

This investment experience allows me to realise the importance of patience, value and risk management. I learned that the guts to selling stock (that is either going to harm your capital or losses its value) at a loss is also a must-have in order to prevent the losses from snowballing.

When I first started out, I focused on growth stocks. Now with the extra capital from what I sold as mentioned above, I invest part of it into SG dividend stocks, with the rest as back up capital. This allows me to not worry so much when the market crashes as I have the capital to dollar cost average. It also helped me to not frantically check on my portfolio every now and then, knowing that I have the capital to prevent margin call. Even if I lose all the money in stocks, part of it is still in cash (for future investment if there’s good stocks or dollar cost averaging) this allows me to have a peace of mind as I know I won’t be losing all of my money.

Stocks are for long term and investing a lump sum can bring quick cash but also increase the risk. Right now I learned how to manage risk and also allowing myself to hold stocks for long periods of time. I believe it’s personal risk and investment preference so i believe everyone has their own way of investing (market timing, lump sum, dollar cost averaging, etc). I hope I have shared some insights and also to remind myself of the things I learn and I hope moomoo will continue to provide good investment experience for us. Wishing everyone Merry Xmas and looking forward to 2022!

$DBS Group Holdings (D05.SG)$ $Roundhill Ball Metaverse ETF (META.US)$ $Apple (AAPL.US)$

74

1

AVICENNA

liked

$Lucid Group (LCID.US)$ Average car price in USA is $45,031. Higher you go the less you sell.

$Lucid Group (LCID.US)$

$79k - $171k.

$Gores Guggenheim (GGPI.US)$

$38k-$52k.

$Gores Guggenheim (GGPI.US)$

is going to sell their SUV in 2022 for less than a

$Lucid Group (LCID.US)$ sedan.

$Lucid Group (LCID.US)$

$79k - $171k.

$Gores Guggenheim (GGPI.US)$

$38k-$52k.

$Gores Guggenheim (GGPI.US)$

is going to sell their SUV in 2022 for less than a

$Lucid Group (LCID.US)$ sedan.

12

AVICENNA

liked

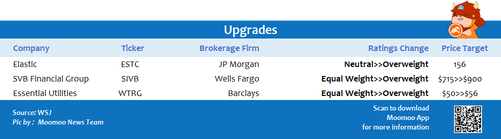

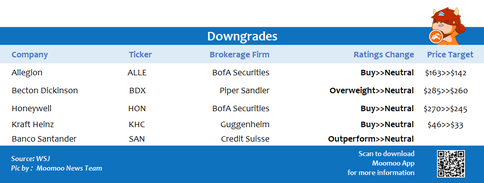

Wednesday, December 8, 2021

By Danilo

$SVB Financial (SIVB.US)$ $Allegion (ALLE.US)$ $Honeywell (HON.US)$ $Roblox (RBLX.US)$ $Global-E Online (GLBE.US)$

By Danilo

$SVB Financial (SIVB.US)$ $Allegion (ALLE.US)$ $Honeywell (HON.US)$ $Roblox (RBLX.US)$ $Global-E Online (GLBE.US)$

+1

60

AVICENNA

liked

$PayPal (PYPL.US)$ The first international civilian payment software!

Translated

11

AVICENNA

liked

$SPDR S&P 500 ETF (SPY.US)$ $Invesco QQQ Trust (QQQ.US)$ Yesterday the Fed announced 3 interest rate hikes to tackle inflation in 2022. This hawkish move pushed the stock market up after nearly a week of constant decline.

Why didn't this push the stock market down further? My understanding is that if there are planned interest rate hikes, this tends to decrease equity valuations so the market goes down. Can someone explain why it went up?

Why didn't this push the stock market down further? My understanding is that if there are planned interest rate hikes, this tends to decrease equity valuations so the market goes down. Can someone explain why it went up?

16

1

AVICENNA

liked

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)