Babyonemoretime

liked

Hey all!![]()

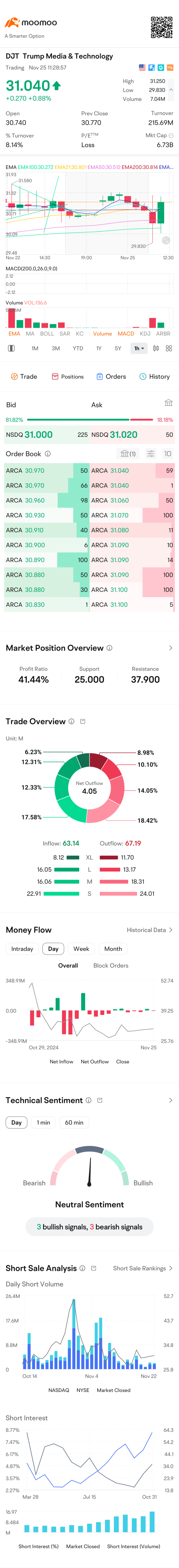

From the premarket alone. Index is going on to extreme greed in the market!![]()

![]()

![]()

Based on the chart alone and in the premarket. Dow hitting 45k, Nasdaq hitting 20k, S&P touching 6k trying to push above.

I fear for retailers as there might be a frenzy of FOMO.

Traders I wish you all the best in your trades. Is either bulls are going to win or the bears are going to win.

I am anticipating a high vix for the day! 🚀

$CBOE Volatility S&P 500 Index (.VIX.US)$

3 indexes below! ...

From the premarket alone. Index is going on to extreme greed in the market!

Based on the chart alone and in the premarket. Dow hitting 45k, Nasdaq hitting 20k, S&P touching 6k trying to push above.

I fear for retailers as there might be a frenzy of FOMO.

Traders I wish you all the best in your trades. Is either bulls are going to win or the bears are going to win.

I am anticipating a high vix for the day! 🚀

$CBOE Volatility S&P 500 Index (.VIX.US)$

3 indexes below! ...

18

Babyonemoretime

liked

2

Babyonemoretime

liked

Translated

11

Babyonemoretime

liked

Unsupported feature.

Please use the mobile app.

18

1

Babyonemoretime

liked

Petronas Chemicals Group $PCHEM (5183.MY)$ Amid a sharp increase in forex losses, in the third quarter of the 2024 fiscal year (ending in September), there was a shift from profit to loss, with a significant loss of 0.789 million ringgit, compared to a net profit of 0.424 million ringgit in the same period last year.

This is also the first time Petronas Chemicals Group has incurred a quarterly loss since its IPO.

Regardless, Petronas Chemicals Group recorded a revenue of 7.986 billion ringgit in the third quarter, a 17.72% year-on-year increase.

In the first 9 months of the current financial year, Petronas Chemicals Group netted 0.656 billion ringgit, a sharp 58.59% year-on-year decline, while revenue increased by 8.20% year-on-year to 23.213 billion ringgit.

Petronas Chemicals Group stated that due to the weakening of the US dollar against the ringgit, the company incurred unrealized foreign exchange losses when revaluing the accounts payable of its subsidiary Pengerang Petrochemical Company (PPC) and reassessing the shareholder loans issued to PPC, leading to the main reason for the third-quarter profit turning into loss.

"PPC is a company operating in US dollars. Recently, the US dollar weakening against the ringgit has resulted in a forex loss of 0.536 billion ringgit on the revaluation of accounts payable, while the revaluation of shareholder loans has also caused a forex loss of 0.492 billion ringgit."

The total forex loss amounts to 1.1 billion.

In addition to other business forex losses, PetroChina Petrochemical faced a total forex loss of 1.1 billion ringgit in the third quarter.

Under the impact of the aforementioned forex losses, PetroChina Petrochemical's other expenses in the third quarter surged from 2 million ringgit in the same period last year to 11 million ringgit...

This is also the first time Petronas Chemicals Group has incurred a quarterly loss since its IPO.

Regardless, Petronas Chemicals Group recorded a revenue of 7.986 billion ringgit in the third quarter, a 17.72% year-on-year increase.

In the first 9 months of the current financial year, Petronas Chemicals Group netted 0.656 billion ringgit, a sharp 58.59% year-on-year decline, while revenue increased by 8.20% year-on-year to 23.213 billion ringgit.

Petronas Chemicals Group stated that due to the weakening of the US dollar against the ringgit, the company incurred unrealized foreign exchange losses when revaluing the accounts payable of its subsidiary Pengerang Petrochemical Company (PPC) and reassessing the shareholder loans issued to PPC, leading to the main reason for the third-quarter profit turning into loss.

"PPC is a company operating in US dollars. Recently, the US dollar weakening against the ringgit has resulted in a forex loss of 0.536 billion ringgit on the revaluation of accounts payable, while the revaluation of shareholder loans has also caused a forex loss of 0.492 billion ringgit."

The total forex loss amounts to 1.1 billion.

In addition to other business forex losses, PetroChina Petrochemical faced a total forex loss of 1.1 billion ringgit in the third quarter.

Under the impact of the aforementioned forex losses, PetroChina Petrochemical's other expenses in the third quarter surged from 2 million ringgit in the same period last year to 11 million ringgit...

Translated

22

6

Babyonemoretime

liked

$Full Truck Alliance (YMM.US)$

The risk assessment for YMM stands at a moderate level(6/10) primarily due to the mixed signals from its financial and operational parameters. The company's liquidity and recent performance indicators offer a buffer against immediate vulnerabilities. However, the significant float size, lack of profitability, and low proximity to the 52-week high increase uncertainty in expected performance. While the positive news sentiment on earnings provides some stability, the ...

The risk assessment for YMM stands at a moderate level(6/10) primarily due to the mixed signals from its financial and operational parameters. The company's liquidity and recent performance indicators offer a buffer against immediate vulnerabilities. However, the significant float size, lack of profitability, and low proximity to the 52-week high increase uncertainty in expected performance. While the positive news sentiment on earnings provides some stability, the ...

5

Babyonemoretime

liked

$GameStop (GME.US)$ At this point we can't deny that GME is ready and set for a moass. Technical analysis proofed it, fundementals of the company proofed it, news proofed it. What else should they do to confirm it?? At this point shorties are fked, they are gonna trap themselves once again in the loophole. In fact, this will be a huge one as the explosion haven't occur yet, but still at the consolidation phase and it's already surpassed the bottom of the major surge...

13

4

Babyonemoretime

liked

$NVIDIA (NVDA.US)$

Today the MACD index is -1.08, the green histogram is shorter, the stock price rose by 4.89%, the financial report is about to be released in the next few days, let's wait and see. A divergence at the top of the stock price appeared a couple of days ago, indicating a potential drop in the stock price. Yesterday, 11/18, the stock price fell back to test the 137.15 support.

Today the MACD index is -1.08, the green histogram is shorter, the stock price rose by 4.89%, the financial report is about to be released in the next few days, let's wait and see. A divergence at the top of the stock price appeared a couple of days ago, indicating a potential drop in the stock price. Yesterday, 11/18, the stock price fell back to test the 137.15 support.

Translated

7

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)