becca555

liked

A historic surge of cash has swept into exchange-traded funds, spurring asset managers to launch new trading strategies that could be undone by a market downturn.

This year's inflows into ETFs world-wide crossed the $1 trillion mark for the first time at the end of November, surpassing last year's total of $735.7 billion, according to Morningstar Inc. data. That wave of money, along with rising markets, pushing global ETF assets to nearly $9.5 trillion, more than double where the industry stood at the end of 2018.

Most of that money has gone into low-cost U.S. funds that track indexes run by Vanguard Group, $Blackrock (BLK.US)$ and $State Street (STT.US)$, which together control more than three-quarters of all U.S. ETF assets. Analysts said rising stock markets, including a 25% lift for the S&P 500 this year, and a lack of high-yielding alternatives have boosted interest in such funds. $Fidelity Blue Chip Growth Etf (FBCG.US)$ $SPDR S&P 500 ETF (SPY.US)$

You have this historical precedent where you have tumultuous equity markets, and more and more investors have made their way to index products.”

--- said Rich Powers, head of ETF and index product management at Vanguard.

Follow me to know more about ETFs![]()

![]()

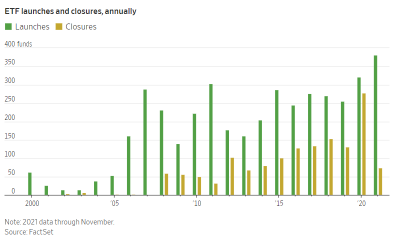

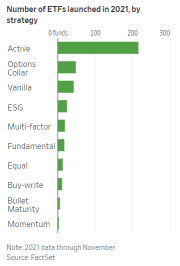

Asset managers long known for running mutual funds are rushing to take advantage of investors' interest in active ETFs. More than half of the record 380 ETFs launched in the U.S. this year are actively managed.

--- according to FactSet.

Fidelity, Putnam and $T. Rowe Price (TROW.US)$ are among the firms that have rolled out actively managed ETFs in 2021. Firms new to ETFs have also entered the fray. The top 20 fastest-growing ETFs, largely run by Vanguard and $Blackrock (BLK.US)$, this year pulled in nearly 40% of all flows, charged an average fee of less than 0.10 percentage point and tracked benchmarks of some sort.

Many active ETFs remain comparatively small and charge fees higher than passive funds, putting a swath of new products at risk of closing over the next several years. ETFs usually need between $50 million and $100 million in assets within five years of launching to become profitable, analysts and executives say; funds below those levels have tended to close.

Of the nearly 600 active ETFs in the U.S., three-fifths have less than $100 million in assets; more than half are below $50 million.

--- according to FactSet data.

You' re going to see a lot of those firms take a hard look at their future.”

--- said Elisabeth Kashner, FactSet’s director of ETF research.

Analysts also said the success of ARK Investment Management Chief Executive Cathie Wood in 2020 showed how active ETFs can score big returns and pull in substantial sums of money. Several of ARK's funds doubled last year, and its assets approached $60 billion earlier this year, though many of its bets have slumped in 2021. $ARK Innovation ETF (ARKK.US)$ $ARK Genomic Revolution ETF (ARKG.US)$

Most other active managers aren't doing much better. Two-thirds of large-cap managers of mutual funds have fallen short of benchmarks this year, while roughly 10% of the 371 U.S. active ETFs with full-year performance data are beating the S&P 500. More than a third are flat or negative for 2021.

Did you invest in ETFs this year? How was your return?![]()

![]()

Source: Wall Street Journal

This year's inflows into ETFs world-wide crossed the $1 trillion mark for the first time at the end of November, surpassing last year's total of $735.7 billion, according to Morningstar Inc. data. That wave of money, along with rising markets, pushing global ETF assets to nearly $9.5 trillion, more than double where the industry stood at the end of 2018.

Most of that money has gone into low-cost U.S. funds that track indexes run by Vanguard Group, $Blackrock (BLK.US)$ and $State Street (STT.US)$, which together control more than three-quarters of all U.S. ETF assets. Analysts said rising stock markets, including a 25% lift for the S&P 500 this year, and a lack of high-yielding alternatives have boosted interest in such funds. $Fidelity Blue Chip Growth Etf (FBCG.US)$ $SPDR S&P 500 ETF (SPY.US)$

You have this historical precedent where you have tumultuous equity markets, and more and more investors have made their way to index products.”

--- said Rich Powers, head of ETF and index product management at Vanguard.

Follow me to know more about ETFs

Asset managers long known for running mutual funds are rushing to take advantage of investors' interest in active ETFs. More than half of the record 380 ETFs launched in the U.S. this year are actively managed.

--- according to FactSet.

Fidelity, Putnam and $T. Rowe Price (TROW.US)$ are among the firms that have rolled out actively managed ETFs in 2021. Firms new to ETFs have also entered the fray. The top 20 fastest-growing ETFs, largely run by Vanguard and $Blackrock (BLK.US)$, this year pulled in nearly 40% of all flows, charged an average fee of less than 0.10 percentage point and tracked benchmarks of some sort.

Many active ETFs remain comparatively small and charge fees higher than passive funds, putting a swath of new products at risk of closing over the next several years. ETFs usually need between $50 million and $100 million in assets within five years of launching to become profitable, analysts and executives say; funds below those levels have tended to close.

Of the nearly 600 active ETFs in the U.S., three-fifths have less than $100 million in assets; more than half are below $50 million.

--- according to FactSet data.

You' re going to see a lot of those firms take a hard look at their future.”

--- said Elisabeth Kashner, FactSet’s director of ETF research.

Analysts also said the success of ARK Investment Management Chief Executive Cathie Wood in 2020 showed how active ETFs can score big returns and pull in substantial sums of money. Several of ARK's funds doubled last year, and its assets approached $60 billion earlier this year, though many of its bets have slumped in 2021. $ARK Innovation ETF (ARKK.US)$ $ARK Genomic Revolution ETF (ARKG.US)$

Most other active managers aren't doing much better. Two-thirds of large-cap managers of mutual funds have fallen short of benchmarks this year, while roughly 10% of the 371 U.S. active ETFs with full-year performance data are beating the S&P 500. More than a third are flat or negative for 2021.

Did you invest in ETFs this year? How was your return?

Source: Wall Street Journal

49

7

becca555

liked and commented on

Hello mooers~~![]()

![]()

This Thursday is Thanksgiving day. Happy Thanksgiving to all the mooers![]()

![]()

Thanksgiving is a time to pray, accompany, and appreciate. Every year, we say thanks to our family and friends, for the accompany and support they give us. We also send gifts to them, to show our love and blessing![]()

![]()

This year, in addition to the gift you prepared, moomoo also select gifts for your friends and you![]()

![]()

For US mooers:Come and see what we prepared for you>>

For SG mooers:Come and see what we prepared for you>>

We sincerely invite you to share this gift from moomoo to your family and friends, accompanied with the words you wanna say to them. Every participators have opportunity to win 999 points* as extra Thanksgiving Gift![]()

![]()

Duration

Nov.23, 2021 - Nov.30, 2021

How to join?

30 words above to your friend or family posted in comment area+ link of Thanksgiving gift from moomoo

![]() Guidance: Click the gift link above ( choose US/SG according to your area) > Click [ Share with friends] > Copy link > paste link in your comment

Guidance: Click the gift link above ( choose US/SG according to your area) > Click [ Share with friends] > Copy link > paste link in your comment

Extra Thanksgiving Gift

666 points for TOP 3 earliest qualified sharings![]()

999 points for TOP 3 best quality sharings![]()

99 points for all qualified sharings![]()

Note:

1. All posts should be originated and posted in our event duration (Nov.23, 2021 - Nov.30, 2021).

2. Winners will be announced by Dec.3, 2021, and the points reward will be delivered within 2 weeks after the end of event.

3. We will only select winners with qualified sharings (30 words above to your friend or family posted in comment area+ link of Thanksgiving gift from moomoo).

This Thursday is Thanksgiving day. Happy Thanksgiving to all the mooers

Thanksgiving is a time to pray, accompany, and appreciate. Every year, we say thanks to our family and friends, for the accompany and support they give us. We also send gifts to them, to show our love and blessing

This year, in addition to the gift you prepared, moomoo also select gifts for your friends and you

For US mooers:Come and see what we prepared for you>>

For SG mooers:Come and see what we prepared for you>>

We sincerely invite you to share this gift from moomoo to your family and friends, accompanied with the words you wanna say to them. Every participators have opportunity to win 999 points* as extra Thanksgiving Gift

Duration

Nov.23, 2021 - Nov.30, 2021

How to join?

30 words above to your friend or family posted in comment area+ link of Thanksgiving gift from moomoo

Extra Thanksgiving Gift

666 points for TOP 3 earliest qualified sharings

999 points for TOP 3 best quality sharings

99 points for all qualified sharings

Note:

1. All posts should be originated and posted in our event duration (Nov.23, 2021 - Nov.30, 2021).

2. Winners will be announced by Dec.3, 2021, and the points reward will be delivered within 2 weeks after the end of event.

3. We will only select winners with qualified sharings (30 words above to your friend or family posted in comment area+ link of Thanksgiving gift from moomoo).

![[Friendsgiving] Dear friends, I prepare a gift for you...](https://ussnsimg.moomoo.com/4611325608379529374.jpg/thumb)

90

53

#For this, i’m grateful. having to cross path with with Moomoo, thanks to my friend that have introduce me on this platform, having chance to join the opportunity to learn more on investment and making investing on US stocks a breeze. thank you🙏🏻

1

becca555

voted

Thanksgiving is a time for food, friends and family. It's also a time to pause, reflect on our lives and think about what we're thankful for.

The question we want to ask you on this Thanksgiving day is--What are you grateful for during your investing journey? Is it your supporting family? Your investing pals? Your profittable stock? A book you read? Maybe a guru? The list goes on and on. There are so many things that we appreciate and feel grateful deep down in our heart. Why don't you take this chance to say a big thank-you now!?

What stocks are you most thankful for this year? Or on the contrary, which stocks teach you a lesson? Be it success or setback, there's always a reason for us to be grateful because it made us grow stonger and become more experienced in investing.

Trading or investing is never an easy job. Thankfully, our family or friends provides emotional support during challenging time, encouragement along investing life's twists and turns, and the comfort of being understood and accepted for what you want to do with life.

Do you have a guru that guides you at the beginning of your investing journey? Do you find any book that's helpful for you to make a decision? There are countless online lessons and books you can turn to when you are at a loss. Which one do you want to express your thanks to?

By the time we decided to invest and started to learn from the ground up, we made a brave decision and hard choice. Don't forget that we are a courageous man/ woman and we should feel thankful for that.

5 best posts will get 1,888 points;

10 featured posts will get 888 points;

All participants will get 88 points.

Duration: Now – Nov. 29, 11:59 PM (ET)

Note:

1. Only relevant posts and those add topic #For this, I am grateful count. (Please post under the topic.)

2. Minimum word requirement: 50 words

3. Winners will be announced on Dec. 2nd.

Thank you, and best of luck to all of our trading or investing endeavors. Do forget to attach a picture of your thanksgiving dinner while joining the the topic here #For this, I am grateful

252

30

$NIO Inc (NIO.US)$ let’s catch up with the other

20

becca555

liked

$AMC Entertainment (AMC.US)$ I very rarely post anyone's vids anymore but what he says needs to be heard https://youtu.be/R_wERKbivxM

62

12

becca555

liked

$Delta Air Lines (DAL.US)$ DAL needs to test the bottom of 37-38 once again, confirm stability before starting to rise. I have always been bullish on aviation because this is essential and the government will support them, no need to worry too much.

Translated

7

Love the new reward system![]()

1

1

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)