Bigcat118

voted

Hi, mooers. Welcome back to "Mooers' Stories", where we present mooers' insights and experiences. Have you ever tried to take courses in moomoo Learn and sharpen your investing skills in Papertrade? This time, we invite @Jamesim, the growing star of 2021, to share his investing journey in our community.![]()

Notes: All the information comes from the interviewee and is published under the interviewee's consent. The testimonial provided herein may not represent other cus...

Notes: All the information comes from the interviewee and is published under the interviewee's consent. The testimonial provided herein may not represent other cus...

+2

53

61

15

Bigcat118

liked

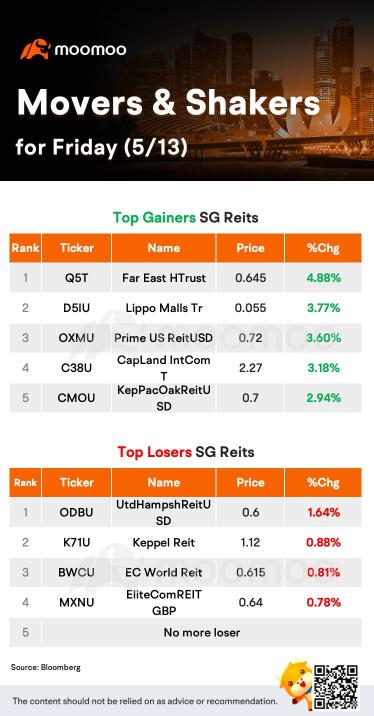

Singapore real estate investment trusts can benefit from their safe-haven status during a time of market volatility as the U.S. Fed raises interest rates, analysts from DBS say in a research note.

The Fed's clarity on its rate-rise trajectory will likely lead to more price stability for Singapore REITs, they say.

What are Real Estate Investment Trusts (REITs)?

Real Estate Investment Trusts (REITs) are funds that invest in a port...

The Fed's clarity on its rate-rise trajectory will likely lead to more price stability for Singapore REITs, they say.

What are Real Estate Investment Trusts (REITs)?

Real Estate Investment Trusts (REITs) are funds that invest in a port...

1537

1277

382

Bigcat118

voted

Pierre andurand, founder and star fund manager of hedge fund andurand capital management, pointed out that since the increase in global crude oil supply is difficult to make up for the losses caused by Russia's crude oil embargo, the oil price will reach $200 by the end of this year.

He is a famous bull in the oil market. He made a lot of money from accurately predicting the sharp rise in oil prices in 2008 and the epic slump in 2020.

$Camber Energy (CEI.US)$ $Imperial Petroleum (IMPP.US)$ $W&T Offshore (WTI.US)$ $Occidental Petroleum (OXY.US)$ $S&P 500 Index (.SPX.US)$ $Nasdaq Composite Index (.IXIC.US)$ $Dow Jones Industrial Average (.DJI.US)$ $Brent Last Day Financial Futures(FEB5) (BZmain.US)$

He is a famous bull in the oil market. He made a lot of money from accurately predicting the sharp rise in oil prices in 2008 and the epic slump in 2020.

$Camber Energy (CEI.US)$ $Imperial Petroleum (IMPP.US)$ $W&T Offshore (WTI.US)$ $Occidental Petroleum (OXY.US)$ $S&P 500 Index (.SPX.US)$ $Nasdaq Composite Index (.IXIC.US)$ $Dow Jones Industrial Average (.DJI.US)$ $Brent Last Day Financial Futures(FEB5) (BZmain.US)$

5

1

Bigcat118

commented on

Dear mooers,

We are coming to the end of a very unusual year full of uncertainty. Whether good or bad, we all witnessed the history.

Before you want to see what you can expect in 2022, let's have a little break and take a guess of the closing price of the S&P 500.

A happy ending or a tragedy? Go big or go home? Place your bet NOW!

Win Reward:

Place your bet on the closing price of the $S&P 500 Index (.SPX.US)$ (i.e.4800.11) on Friday...

We are coming to the end of a very unusual year full of uncertainty. Whether good or bad, we all witnessed the history.

Before you want to see what you can expect in 2022, let's have a little break and take a guess of the closing price of the S&P 500.

A happy ending or a tragedy? Go big or go home? Place your bet NOW!

Win Reward:

Place your bet on the closing price of the $S&P 500 Index (.SPX.US)$ (i.e.4800.11) on Friday...

453

1070

104

Bigcat118

liked

$Camber Energy (CEI.US)$ lets hope for some green

5

Bigcat118

liked

$Camber Energy (CEI.US)$ We all know that the filing was pending on SEC side. Nothing has change except good chance to buy more at cheaper price!

11

Bigcat118

liked

Stock slide may ease in Asia after tumble in U.S.

The global stock slide may ease Tuesday when markets open in Asia as investors digest the impact of curbs against the omicron virus variant and the outlook for President Joe Biden's stymied economic agenda.

Australian shares fluctuated, and futures for Japan and Hong Kong signaled a steady start. U.S. contracts climbed modestly after the $S&P 500 Index (.SPX.US)$ posted its biggest three-day drop since September. Lower volumes ahead of the Christmas holiday period threaten to exacerbate market moves.

Wall Street money machine booms as 445 ETFs debut in epic year

A corner of Wall Street already enjoying a reputation for explosive growth has gone supernova, with a record 445 new products in 2021 so far, according to data compiled by Bloomberg.

Behind the rapid expansion is a deluge of new cash as investors chase an economic recovery from the coronavirus, while equity mutual funds fall out of favor. About $900 billion has flowed into the ETF market since the start of the year -- also easily a record. Barely any funds are getting shuttered.

Traders sent $30 billion into the dip and this time got bruised

Down hard for a second day Monday, the S&P 500 has now posted back-to-back, 1%-plus swoons twice in the past month. The failure to bounce is rattling those conditioned to anticipate it and comes as a litany of stressors weighs on bulls. Last week, when the S&P 500 fell on all but one day, investors poured $30 billion into exchange-traded funds focusing on U.S. equities, the largest inflow since March.

Amazon slides below support level as big tech weakness continues

Shares of $Amazon (AMZN.US)$ finished under a key technical level for the first time in more than a month. The decline came amid for U.S. equities, and after last week's downturn in high-growth names that was triggered by the Federal Reserve's hawkish pivot. $Apple (AAPL.US)$ lost 0.8%, while $Microsoft (MSFT.US)$ dropped 1.2% and $Meta Platforms (FB.US)$ tumbled 2.5%.

Electric vehicle stocks tumble after Manchin rejects Biden's climate and social plan

Shares of electric vehicle companies tumbled Monday following the apparent failure of President Joe Biden's "Build Back Better" plan that includes significant incentives for the growing sector.

The stocks of EV start-ups such as $Lordstown Motors (RIDE.US)$, $Faraday Future Intelligent Electric Inc. (FFIE.US)$ and $Nikola (NKLA.US)$ all shed more than 7% Monday. The EV incentives under the Build Back Better plan include up to $12,500 per vehicle and are viewed as critical to spur consumer demand.

Oracle to buy medical records company Cerner in its biggest acquisition ever

Enterprise software giant $Oracle (ORCL.US)$ will buy electronic medical records company $Cerner (CERN.US)$ in an all-cash deal for $95 per share, or approximately $28.3 billion in equity value. The massive acquisition is the biggest ever for Oracle.

Oracle shares were down 6% initially after the companies announced the deal.

Elon Musk says he will pay over $11 billion in taxes this year

"For those wondering, I will pay over $11 billion in taxes this year," Elon Musk tweeted Monday.

Stock options Musk was awarded in 2012 are set to expire in August next year. In order to exercise them, he has to pay income tax on the gain. The $Tesla (TSLA.US)$ and SpaceX chief has been sparring with prominent Democrats on Twitter lately over the issue of tax avoidance.

Shopping in stores on the final Saturday before Christmas down 26% from pre-pandemic levels

A lack of foreign tourists opening up their wallets and another wave of coronavirus cases in some major U.S. cities played a role in hindering shopper traffic on the final Saturday before Christmas from returning to pre-pandemic levels.

Visits to retail stores dropped 26.3% on Saturday compared with the Saturday before Christmas in 2019, according to preliminary data from Sensormatic Solutions. Year over year, though, store traffic jumped 19.4%, Sensormatic said.

Source: Bloomberg, CNBC

The global stock slide may ease Tuesday when markets open in Asia as investors digest the impact of curbs against the omicron virus variant and the outlook for President Joe Biden's stymied economic agenda.

Australian shares fluctuated, and futures for Japan and Hong Kong signaled a steady start. U.S. contracts climbed modestly after the $S&P 500 Index (.SPX.US)$ posted its biggest three-day drop since September. Lower volumes ahead of the Christmas holiday period threaten to exacerbate market moves.

Wall Street money machine booms as 445 ETFs debut in epic year

A corner of Wall Street already enjoying a reputation for explosive growth has gone supernova, with a record 445 new products in 2021 so far, according to data compiled by Bloomberg.

Behind the rapid expansion is a deluge of new cash as investors chase an economic recovery from the coronavirus, while equity mutual funds fall out of favor. About $900 billion has flowed into the ETF market since the start of the year -- also easily a record. Barely any funds are getting shuttered.

Traders sent $30 billion into the dip and this time got bruised

Down hard for a second day Monday, the S&P 500 has now posted back-to-back, 1%-plus swoons twice in the past month. The failure to bounce is rattling those conditioned to anticipate it and comes as a litany of stressors weighs on bulls. Last week, when the S&P 500 fell on all but one day, investors poured $30 billion into exchange-traded funds focusing on U.S. equities, the largest inflow since March.

Amazon slides below support level as big tech weakness continues

Shares of $Amazon (AMZN.US)$ finished under a key technical level for the first time in more than a month. The decline came amid for U.S. equities, and after last week's downturn in high-growth names that was triggered by the Federal Reserve's hawkish pivot. $Apple (AAPL.US)$ lost 0.8%, while $Microsoft (MSFT.US)$ dropped 1.2% and $Meta Platforms (FB.US)$ tumbled 2.5%.

Electric vehicle stocks tumble after Manchin rejects Biden's climate and social plan

Shares of electric vehicle companies tumbled Monday following the apparent failure of President Joe Biden's "Build Back Better" plan that includes significant incentives for the growing sector.

The stocks of EV start-ups such as $Lordstown Motors (RIDE.US)$, $Faraday Future Intelligent Electric Inc. (FFIE.US)$ and $Nikola (NKLA.US)$ all shed more than 7% Monday. The EV incentives under the Build Back Better plan include up to $12,500 per vehicle and are viewed as critical to spur consumer demand.

Oracle to buy medical records company Cerner in its biggest acquisition ever

Enterprise software giant $Oracle (ORCL.US)$ will buy electronic medical records company $Cerner (CERN.US)$ in an all-cash deal for $95 per share, or approximately $28.3 billion in equity value. The massive acquisition is the biggest ever for Oracle.

Oracle shares were down 6% initially after the companies announced the deal.

Elon Musk says he will pay over $11 billion in taxes this year

"For those wondering, I will pay over $11 billion in taxes this year," Elon Musk tweeted Monday.

Stock options Musk was awarded in 2012 are set to expire in August next year. In order to exercise them, he has to pay income tax on the gain. The $Tesla (TSLA.US)$ and SpaceX chief has been sparring with prominent Democrats on Twitter lately over the issue of tax avoidance.

Shopping in stores on the final Saturday before Christmas down 26% from pre-pandemic levels

A lack of foreign tourists opening up their wallets and another wave of coronavirus cases in some major U.S. cities played a role in hindering shopper traffic on the final Saturday before Christmas from returning to pre-pandemic levels.

Visits to retail stores dropped 26.3% on Saturday compared with the Saturday before Christmas in 2019, according to preliminary data from Sensormatic Solutions. Year over year, though, store traffic jumped 19.4%, Sensormatic said.

Source: Bloomberg, CNBC

64

5

8

Bigcat118

liked

$Camber Energy (CEI.US)$ Just being so willful.

Translated

32

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)