Brenda

reacted to and voted

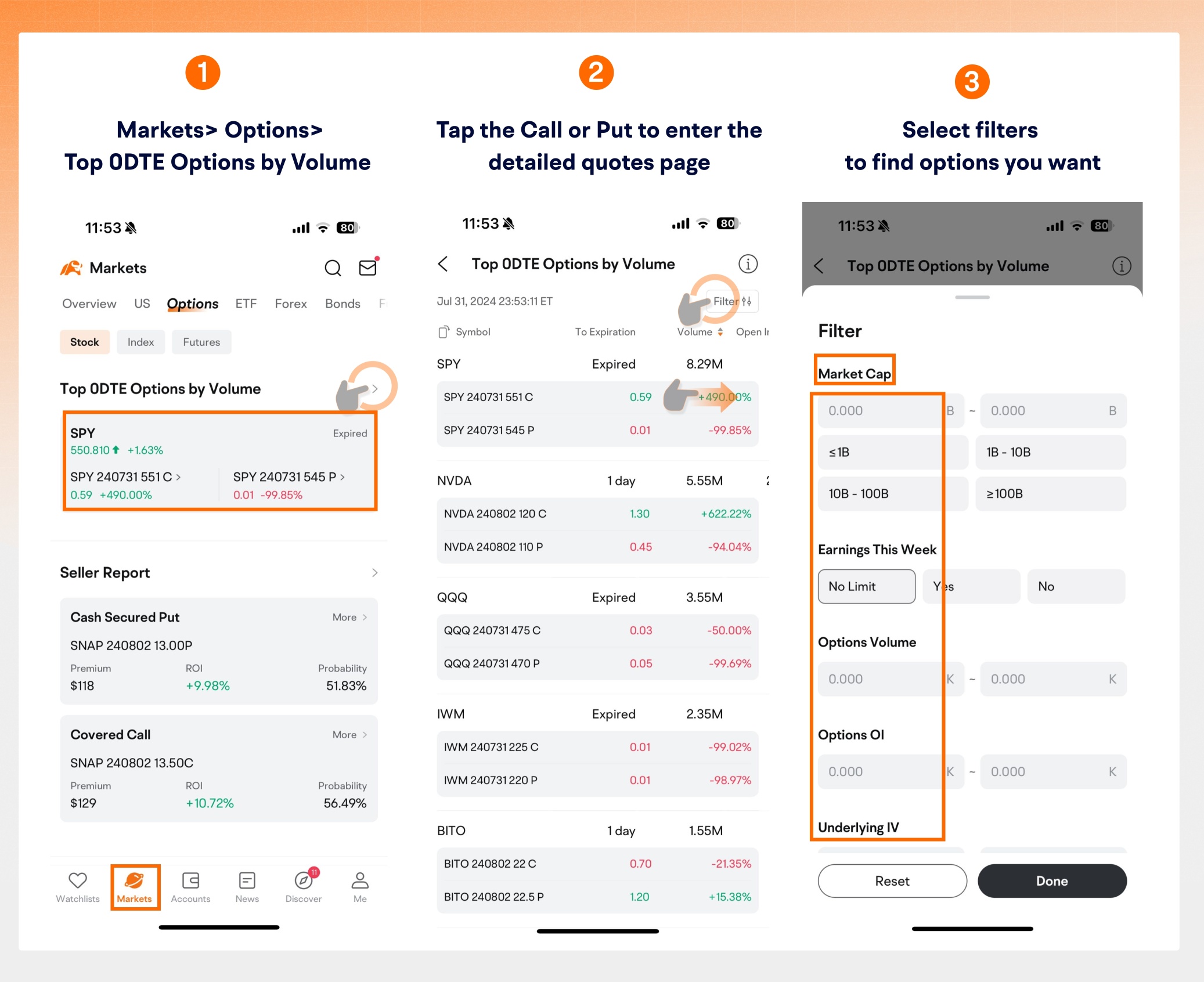

We're excited to introduce a new insightful tool that can complement how you research and trade options -- Top 0DTE Options by Volume feature. Designed specifically for traders who seek to capture market movements as they unfold, this feature provides access to real-time updates on soon-to-expire options, so you can quickly make informed decisions.

69

6

15

Brenda

commented on

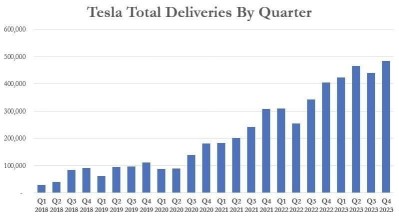

$Tesla (TSLA.US)$ is expected to deliver 432,000 vehicles for this quarter, which is almost equal to 422,875 deliveries in 2023 Q1, according to Kalshi data. Kalshi is a regulated exchange & prediction market where you can trade on the outcome of real-world events, such as buying and selling contracts.

Tesla hit a record 484,507 deliveries in Q4 2023. The previous quarterly delivery record was in Q2 with 466,140.

What F...

Tesla hit a record 484,507 deliveries in Q4 2023. The previous quarterly delivery record was in Q2 with 466,140.

What F...

32

11

46

Brenda

liked

You can't make this up:

Fitch just downgraded the United States' credit rating and said they lost confidence in the government's "fiscal management."

Fitch basically just called the US fiscally irresponsible.

As we saw in the 2011 debt ceiling crisis, cutting the US credit rating is expensive.

Borrowing costs rise and confidence in the system is lost.

Now, history has repeated itself.

Only this time, the debt ceiling is effectively uncapped until January 1st, 2025.

Meanwhile, spending "unexpecte...

Fitch just downgraded the United States' credit rating and said they lost confidence in the government's "fiscal management."

Fitch basically just called the US fiscally irresponsible.

As we saw in the 2011 debt ceiling crisis, cutting the US credit rating is expensive.

Borrowing costs rise and confidence in the system is lost.

Now, history has repeated itself.

Only this time, the debt ceiling is effectively uncapped until January 1st, 2025.

Meanwhile, spending "unexpecte...

4

1

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)