So many investment opportunities are worth noting! Click to view the 2025 investment outlook>>

$NVIDIA (NVDA.US)$ $Apple (AAPL.US)$ $Oracle (ORCL.US)$ $Tesla (TSLA.US)$ $Advanced Micro Devices (AMD.US)$ $Alphabet-C (GOOG.US)$ $Microsoft (MSFT.US)$ $Apple (AAPL.US)$ $Eli Lilly and Co (LLY.US)$ $Meta Platforms (META.US)$ $Netflix (NFLX.US)$

$NVIDIA (NVDA.US)$ $Apple (AAPL.US)$ $Oracle (ORCL.US)$ $Tesla (TSLA.US)$ $Advanced Micro Devices (AMD.US)$ $Alphabet-C (GOOG.US)$ $Microsoft (MSFT.US)$ $Apple (AAPL.US)$ $Eli Lilly and Co (LLY.US)$ $Meta Platforms (META.US)$ $Netflix (NFLX.US)$

5

1

As a Moomoo user one should know that on the mobile app, it provides tons of features allowing new beginner to season veterans to make full use of the features and functions provided. You could literally do almost everything on the app.

In this post, I will be share some of the features I used most often in the Moomoo mobile app for me to keep track of my portfolio whenever I go after using the app for 3 years.

1) –Cus...

In this post, I will be share some of the features I used most often in the Moomoo mobile app for me to keep track of my portfolio whenever I go after using the app for 3 years.

1) –Cus...

+40

280

38

116

here are no short sellers with a track record.

Neither are there technical analysts.

Think about what that means...

Value investing is the clear winner when it comes to longevity in our field.

It's also the strategy that is constantly being misrepresented to investors by a variety of market participants (e.g., media, investment managers, journalists, etc.).

Buying stocks with low P/E ratios is not value investing.

Making assumptions about the future of a business and c...

Neither are there technical analysts.

Think about what that means...

Value investing is the clear winner when it comes to longevity in our field.

It's also the strategy that is constantly being misrepresented to investors by a variety of market participants (e.g., media, investment managers, journalists, etc.).

Buying stocks with low P/E ratios is not value investing.

Making assumptions about the future of a business and c...

11

This start-up stock exchange just won approval from the SEC to allow nonstop trading 23 hours a day, 5 days a week.

Trading technology pioneer Dmitri Galinov's 24 Exchange has secured regulatory approval to launch what could become America's first near round-the-clock equities trading venue, marking a potential watershed moment for US market structure. The extended hour trading is subject to Equity Data Plans making changes that would facilitate overnight trading hours...

Trading technology pioneer Dmitri Galinov's 24 Exchange has secured regulatory approval to launch what could become America's first near round-the-clock equities trading venue, marking a potential watershed moment for US market structure. The extended hour trading is subject to Equity Data Plans making changes that would facilitate overnight trading hours...

1

2

Bitcoin is scratching the $100,000 milestone for the first time ever. Is it a sign of finally becoming mainstream or not? And what’s behind? Let’s take a look.

Bitcoin’s value has increased by almost 160% this year alone and it’s a matter of time before it will hit the $100,000 mark.

What are the drivers behind this spectacular rise?

1. There are high expectations from the newly US elected government that they will take a very friendly crypto approach. The optimism...

Bitcoin’s value has increased by almost 160% this year alone and it’s a matter of time before it will hit the $100,000 mark.

What are the drivers behind this spectacular rise?

1. There are high expectations from the newly US elected government that they will take a very friendly crypto approach. The optimism...

22

Step 2 : Trendlines

Swing Trading = Trend Trading

If you buy a stock at a support level, but overall trend still a downward trend, it will likely go lower too.

4 Things to take note when drawing Trendline

It should have gentle slope

It should cover everything including the wicks

3 point touches

Trend Line more than 15 candle (hourly timeframe)

Compared to horizontal trendlines, non-horizontal trendlines are more meaningful and useful in show the trend...

Swing Trading = Trend Trading

If you buy a stock at a support level, but overall trend still a downward trend, it will likely go lower too.

4 Things to take note when drawing Trendline

It should have gentle slope

It should cover everything including the wicks

3 point touches

Trend Line more than 15 candle (hourly timeframe)

Compared to horizontal trendlines, non-horizontal trendlines are more meaningful and useful in show the trend...

+5

11

1

1

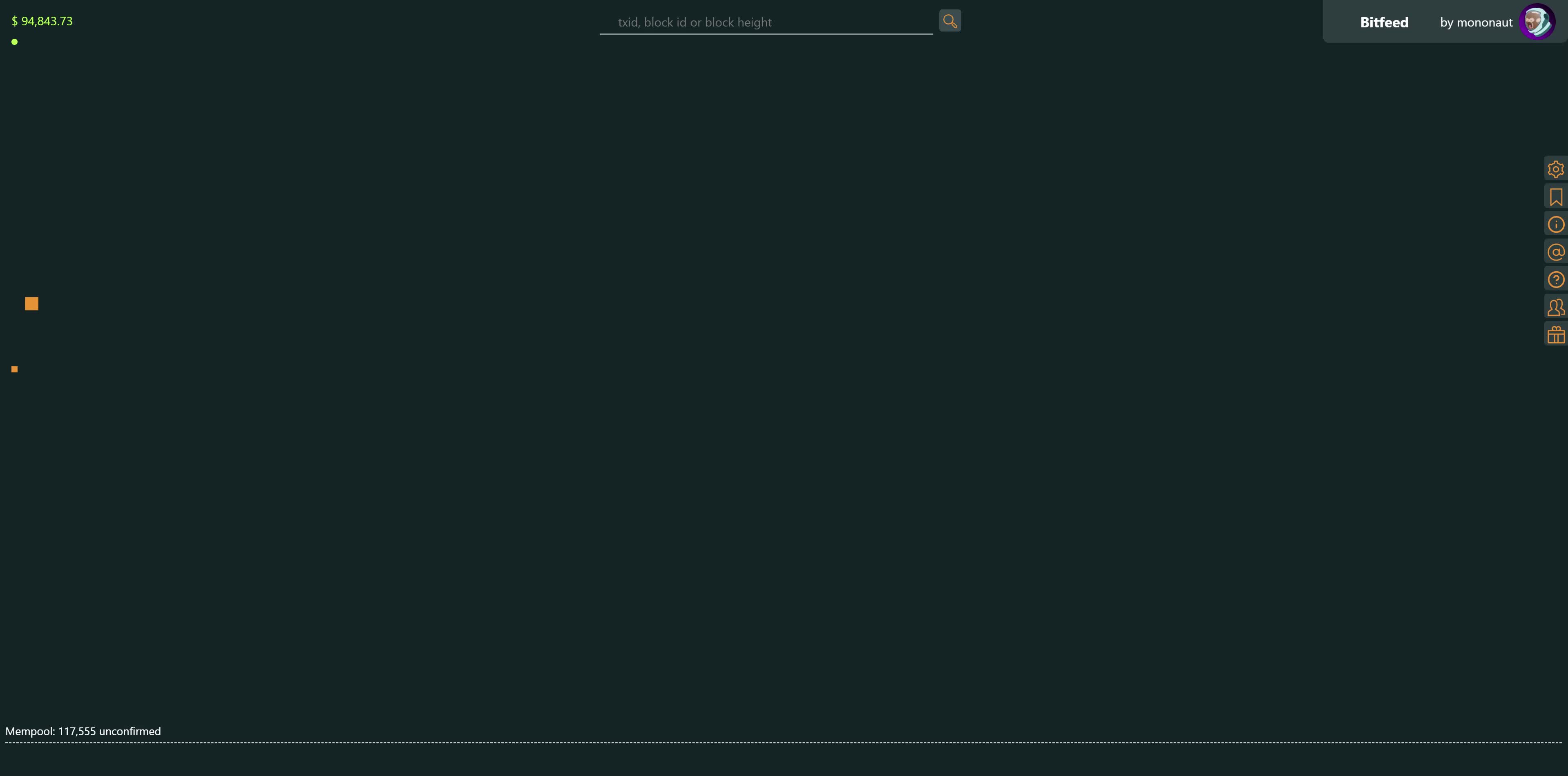

Here is a LIVE visualisation of Bitcoin grouping transactions into a block and confirming them onto the blockchain.

This is one of my favourite tools to show new people to Bitcoin what is happening on the ledger.

Watch for yourself: Bitfeed

$Bitcoin (BTC.CC)$ $Coinbase (COIN.US)$ $MicroStrategy (MSTR.US)$ $IREN Ltd (IREN.US)$ $CleanSpark (CLSK.US)$ $MARA Holdings (MARA.US)$ $iShares Bitcoin Trust (IBIT.US)$ $Grayscale Bitcoin Trust (GBTC.US)$ $Valkyrie Bitcoin Fund (BRRR.US)$ #��������...

This is one of my favourite tools to show new people to Bitcoin what is happening on the ledger.

Watch for yourself: Bitfeed

$Bitcoin (BTC.CC)$ $Coinbase (COIN.US)$ $MicroStrategy (MSTR.US)$ $IREN Ltd (IREN.US)$ $CleanSpark (CLSK.US)$ $MARA Holdings (MARA.US)$ $iShares Bitcoin Trust (IBIT.US)$ $Grayscale Bitcoin Trust (GBTC.US)$ $Valkyrie Bitcoin Fund (BRRR.US)$ #��������...

6

1

"The age of AI is in full steam, propelling a global shift to NVIDIA computing" - Jensen Huang

Revenue +94%

*Data Center +112%

*Gaming +15%

*Professional Vis. +17%

*Automotive +72%

EBIT +110%

EPS of $0.78, beating expectations of $0.75

🛎 Revenue of $35.1B, beating expectations of $33.1B

Stock is DOWN 4.7% as guidance underwhelms lofty expectations.

Here are the results for $NVDA NVIDIA Q3 FY25 (October quarter).

• Revenue +17% Q/Q to $35.1B ($2.0B beat).

• Gross margin...

Revenue +94%

*Data Center +112%

*Gaming +15%

*Professional Vis. +17%

*Automotive +72%

EBIT +110%

EPS of $0.78, beating expectations of $0.75

🛎 Revenue of $35.1B, beating expectations of $33.1B

Stock is DOWN 4.7% as guidance underwhelms lofty expectations.

Here are the results for $NVDA NVIDIA Q3 FY25 (October quarter).

• Revenue +17% Q/Q to $35.1B ($2.0B beat).

• Gross margin...

27

2

Michael Saylor to present to the Microsoft Board next month on buyiong Bitcoin for their corporate treasury

$MicroStrategy (MSTR.US)$ $Coinbase (COIN.US)$ $iShares Bitcoin Trust (IBIT.US)$ $IREN Ltd (IREN.US)$ $Microsoft (MSFT.US)$ $Alphabet-C (GOOG.US)$ $Apple (AAPL.US)$ $Advanced Micro Devices (AMD.US)$ $NVIDIA (NVDA.US)$ $Super Micro Computer (SMCI.US)$ $CleanSpark (CLSK.US)$ $Bitcoin (BTC.CC)$ $Vanguard S&P 500 ETF (VOO.US)$ $SPDR S&P 500 ETF (SPY.US)$ $iShares Core S&P 500 ETF (IVV.US)$ $iShares Russell 2000 ETF (IWM.US)$ $ARK 21Shares Bitcoin ETF (ARKB.US)$ $Valkyrie Bitcoin Fund (BRRR.US)$ $VanEck Bitcoin Trust (HODL.US)$

$MicroStrategy (MSTR.US)$ $Coinbase (COIN.US)$ $iShares Bitcoin Trust (IBIT.US)$ $IREN Ltd (IREN.US)$ $Microsoft (MSFT.US)$ $Alphabet-C (GOOG.US)$ $Apple (AAPL.US)$ $Advanced Micro Devices (AMD.US)$ $NVIDIA (NVDA.US)$ $Super Micro Computer (SMCI.US)$ $CleanSpark (CLSK.US)$ $Bitcoin (BTC.CC)$ $Vanguard S&P 500 ETF (VOO.US)$ $SPDR S&P 500 ETF (SPY.US)$ $iShares Core S&P 500 ETF (IVV.US)$ $iShares Russell 2000 ETF (IWM.US)$ $ARK 21Shares Bitcoin ETF (ARKB.US)$ $Valkyrie Bitcoin Fund (BRRR.US)$ $VanEck Bitcoin Trust (HODL.US)$

8

1

1

Trading Methods

Find the method that you wish to start. Would recommend start with swing trading first rather than intraday or scalping to start.

Important to understand for trader to be profitable

Managing your Risk to Reward ratio with a strict and well defined trading plan

5 Steps to Price Action

1) Determine the stock trend direction

Is it currently a up or down trend stock?

- You can use Exponential Moving Average 20 days (EMA20)for that

- Set i...

Find the method that you wish to start. Would recommend start with swing trading first rather than intraday or scalping to start.

Important to understand for trader to be profitable

Managing your Risk to Reward ratio with a strict and well defined trading plan

5 Steps to Price Action

1) Determine the stock trend direction

Is it currently a up or down trend stock?

- You can use Exponential Moving Average 20 days (EMA20)for that

- Set i...

+11

38

2

6

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)