BullsBears

commented on

BullsBears

liked

Time for another look at the SREITs sector. I examine the challenging environment and explore why we are facing down side pressure. I reiterated on the importance of being selective when it comes SREITs.

iEdge S-Reit Index Weekly Review 28 Oct 24 - Dividends Pay For My Kopi

In the companion podcast we dive into:

• Why is the interest rate cut not helping

• Accepting the challenging situation

• Being selective in SREITs may help

• Why some SREITs are doing well

• Why some SREITs are not doin...

iEdge S-Reit Index Weekly Review 28 Oct 24 - Dividends Pay For My Kopi

In the companion podcast we dive into:

• Why is the interest rate cut not helping

• Accepting the challenging situation

• Being selective in SREITs may help

• Why some SREITs are doing well

• Why some SREITs are not doin...

26

1

What is the situation of $Dyna-Mac (NO4.SG)$ float, can it remain listed? In light of the Hanwha takeover offer.

2

10

$Top Glove (BVA.SG)$

Can we at least get to 0.280?

Can we at least get to 0.280?

1

1

BullsBears

reacted to

BullsBears

liked

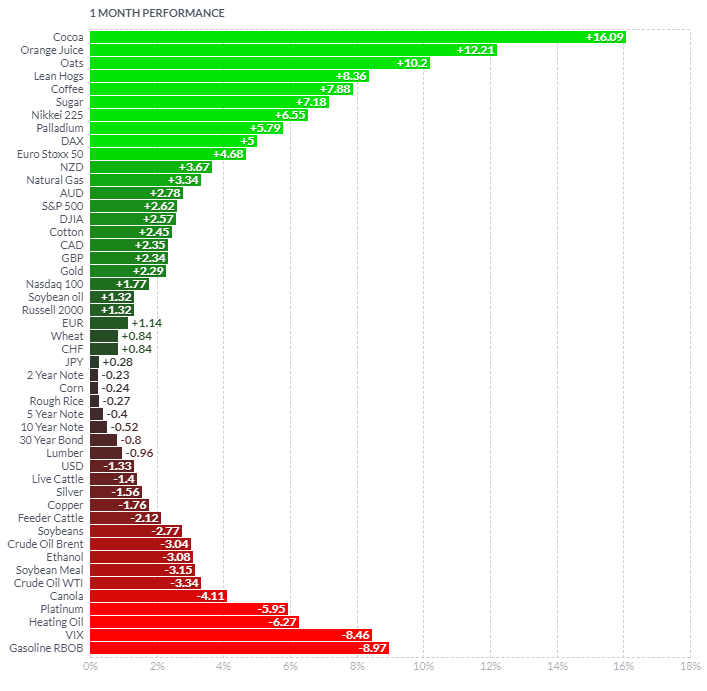

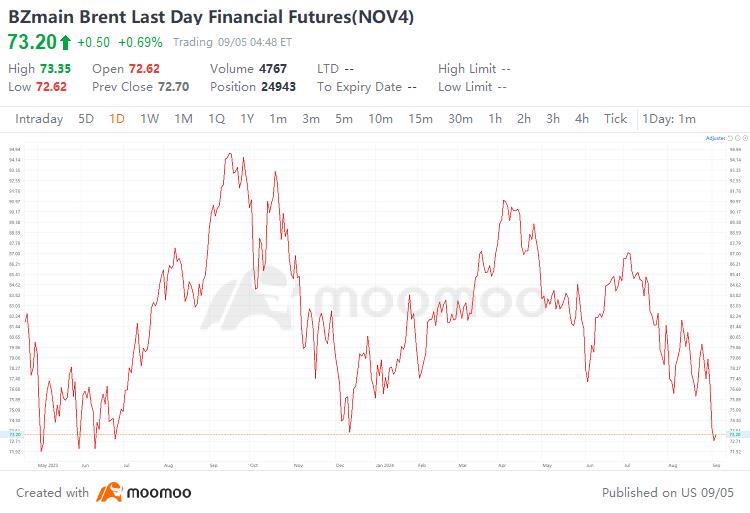

Hedge funds have adopted the most bearish position on commodity prices in over a decade, driven by worries of an intensified economic downturn affecting demand for various raw materials ranging from crude oil to metals. In August, notable price declines were observed in oil, iron ore, and copper.

As per Bloomberg data from mid-August, money managers have amassed a record net-short position of nearly 153,000 futures and options across 20 commodity...

As per Bloomberg data from mid-August, money managers have amassed a record net-short position of nearly 153,000 futures and options across 20 commodity...

+4

26

3

$Top Glove (BVA.SG)$ seems to have bottomed.

BullsBears

commented on

$NVIDIA (NVDA.US)$ Reject 129 again 😂😂😂

3

6

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)

BullsBears : Wtf this stock