ctm03232012

liked

Last week's review 👉🏻Market Review + Position Analysis (29/07-02/08 2024)

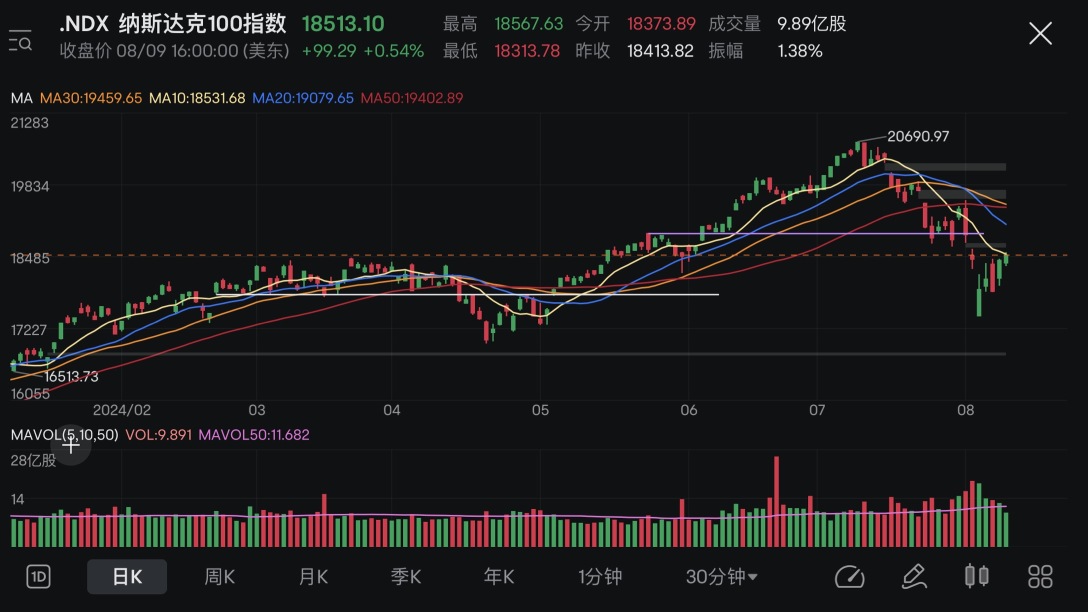

Quick review of the market this week:

$NASDAQ 100 Index (.NDX.US)$ The trading volume gradually decreased day by day throughout this week;

$S&P 500 Index (.SPX.US)$ Distributed on Monday;

$Russell 2000 Index (.RUT.US)$ Distributed on Monday and Wednesday;

NDX > SPX > RUT.

Currently, what can be seen is a large number of buyers entering the market after a sharp drop on Monday, and the candlestick pattern and trading volume clearly describe this behavior. Subsequent trading volume has decreased day by day, and the price has slowly rebounded, indicating that a significant amount of supply has been digested. There are too many possibilities for what may happen next, so perhaps the best strategy here is to simplify and wait for confirmation of recent days (FTD) or the index breaking through the moving average before entering the market with full force for a long position.

Weekly charts:

The charts here provide a clearer picture. NDX returned to within the ascending trendlines and above the 30MA after the plunge, while SPX almost touched the lower edge of the ascending trendlines and then returned above the 30MA and 20MA. RUT retested the previous major base, to see if there is any tennis behavior here. Overall, it's not very optimistic at the moment, but it's not a time to be pessimistic either.

Breadth records:

There has been a turnaround since last Friday, with 5 consecutive up days this week. Let's see if it will recover, and how long it will take to recover.

The market...

Quick review of the market this week:

$NASDAQ 100 Index (.NDX.US)$ The trading volume gradually decreased day by day throughout this week;

$S&P 500 Index (.SPX.US)$ Distributed on Monday;

$Russell 2000 Index (.RUT.US)$ Distributed on Monday and Wednesday;

NDX > SPX > RUT.

Currently, what can be seen is a large number of buyers entering the market after a sharp drop on Monday, and the candlestick pattern and trading volume clearly describe this behavior. Subsequent trading volume has decreased day by day, and the price has slowly rebounded, indicating that a significant amount of supply has been digested. There are too many possibilities for what may happen next, so perhaps the best strategy here is to simplify and wait for confirmation of recent days (FTD) or the index breaking through the moving average before entering the market with full force for a long position.

Weekly charts:

The charts here provide a clearer picture. NDX returned to within the ascending trendlines and above the 30MA after the plunge, while SPX almost touched the lower edge of the ascending trendlines and then returned above the 30MA and 20MA. RUT retested the previous major base, to see if there is any tennis behavior here. Overall, it's not very optimistic at the moment, but it's not a time to be pessimistic either.

Breadth records:

There has been a turnaround since last Friday, with 5 consecutive up days this week. Let's see if it will recover, and how long it will take to recover.

The market...

Translated

+15

44

ctm03232012

liked

"Even if you lose, the only thing you should do is lose with integrity." - Rockefeller

Last week's link 👉🏻Market Review + Position Analysis (22/07-26/07 2024)

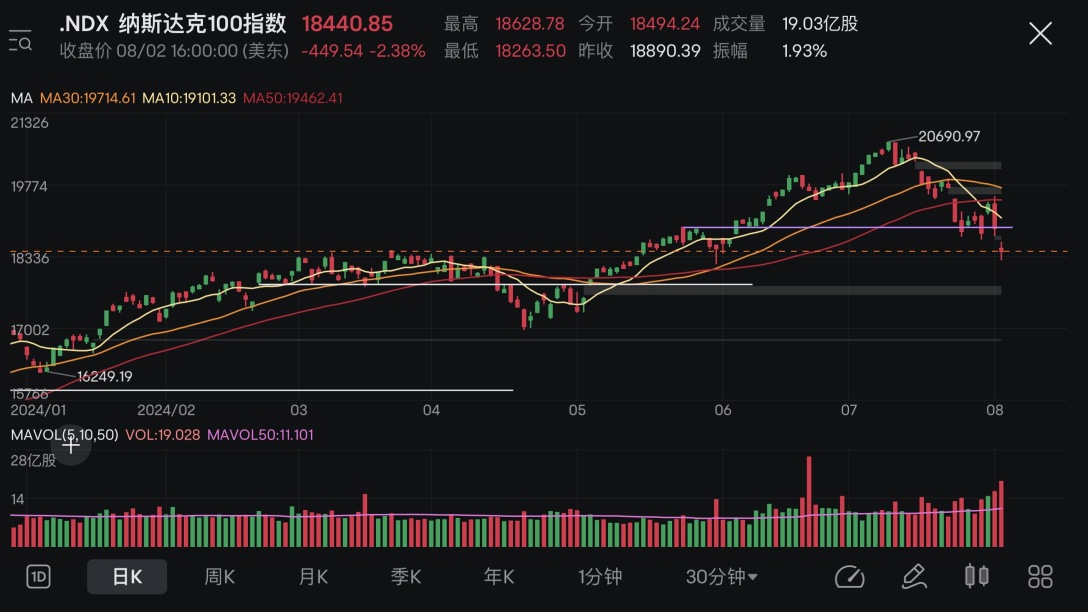

Quick review of the market this week:

$NASDAQ 100 Index (.NDX.US)$ Distribute on Tuesday, Thursday, and Friday, accumulate on Wednesday.

$S&P 500 Index (.SPX.US)$ Distribute on Tuesday and Friday, accumulate on Wednesday.

$Russell 2000 Index (.RUT.US)$ Accumulate on Tuesday and Wednesday, distribute on Thursday.

RUT > SPX > NDX.

SPX on Wednesday presented an imprecise resemblance to recent days ( <1.7%, and an excessively large proportion of gaps), leading to panic selling triggered by data on Thursday and Friday (unemployment rate, Sam rule, recession route, etc.), with a huge trading volume; NDX and SPX moved far below the 50MA after Friday's plunge, while RUT temporarily stopped above the 50MA; the weekend social circle is filled with extremely pessimistic emotions, with pros and cons, letting the future market provide its own answer.

Weekly charts:

NDX has reached a critical position: the 30-week moving average and the bottom of the upward trendline starting from January 2023.

SPX fell below the 10-week moving average.

RUT has also reached the 10-week moving average and the previous breakout point. It remains to be seen whether it's an egg or a tennis ball, and the market needs to answer this question.

Record the market yourself...

Last week's link 👉🏻Market Review + Position Analysis (22/07-26/07 2024)

Quick review of the market this week:

$NASDAQ 100 Index (.NDX.US)$ Distribute on Tuesday, Thursday, and Friday, accumulate on Wednesday.

$S&P 500 Index (.SPX.US)$ Distribute on Tuesday and Friday, accumulate on Wednesday.

$Russell 2000 Index (.RUT.US)$ Accumulate on Tuesday and Wednesday, distribute on Thursday.

RUT > SPX > NDX.

SPX on Wednesday presented an imprecise resemblance to recent days ( <1.7%, and an excessively large proportion of gaps), leading to panic selling triggered by data on Thursday and Friday (unemployment rate, Sam rule, recession route, etc.), with a huge trading volume; NDX and SPX moved far below the 50MA after Friday's plunge, while RUT temporarily stopped above the 50MA; the weekend social circle is filled with extremely pessimistic emotions, with pros and cons, letting the future market provide its own answer.

Weekly charts:

NDX has reached a critical position: the 30-week moving average and the bottom of the upward trendline starting from January 2023.

SPX fell below the 10-week moving average.

RUT has also reached the 10-week moving average and the previous breakout point. It remains to be seen whether it's an egg or a tennis ball, and the market needs to answer this question.

Record the market yourself...

Translated

+20

16

ctm03232012

liked

$E-mini NASDAQ 100 Futures(DEC4) (NQmain.US)$ There is no hope within next week.

Translated

2

ctm03232012

liked

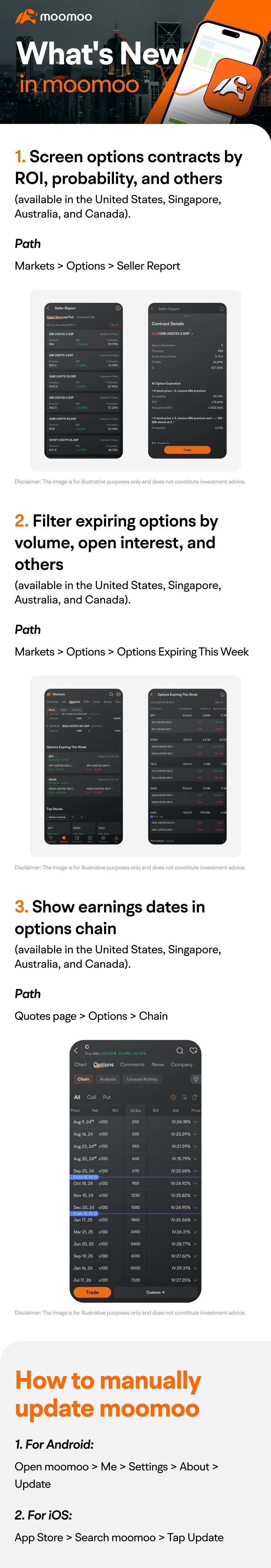

Hey there, mooers! Welcome back to "What's new in moomoo"!

We're excited to announce a trio of new features in our options trading toolkit, all designed to elevate your trading game:

![]() Seller Report: Utilize key metrics like return on investment and probability to efficiently select options contracts that match your requirements. (Tap here to try this feature)

Seller Report: Utilize key metrics like return on investment and probability to efficiently select options contracts that match your requirements. (Tap here to try this feature)

![]() Options Expiring This Week: Wit...

Options Expiring This Week: Wit...

We're excited to announce a trio of new features in our options trading toolkit, all designed to elevate your trading game:

Expand

Expand 15

3

ctm03232012

commented on

$NVIDIA (NVDA.US)$ Why do so many people draw their own conclusions before the meeting is even finished?

2

3

ctm03232012

liked

Last week in review 👉🏻Market Review+Position Analysis (20/05-24/05 2024)

“History clearly shows that almost every superstock was in a clear upward trend before rising sharply. In fact, 99% of stocks traded above the 200-day moving average before a sharp rise, and 96% traded above the 50-day moving average.” -Mark Minervini

A quick review of this week's markets:

$NASDAQ 100 Index (.NDX.US)$ Fundraising on Tuesday, distribution on Thursday, disagreement on Friday;

$S&P 500 Index (.SPX.US)$ Divided on Tuesday, distributed on Wednesday and Thursday, and attracted on Friday;

$Dow Jones Industrial Average (.DJI.US)$ It is distributed on Tuesday, distributed on Thursday, and attracted on Friday.

NDX>SPX>DJI.

Another wonderful week, summed up in one sentence: capital has baptized participants in inertial thinking again and again (history is always repeated, and the mentality of market participants has always been the same);

This is why trading requires a system, rules, and circumvents all emotions as much as possible;

At the same time, the market also brought us a layer of high-quality filters, so you can gradually see who are the flowers and who are the weeds in the garden.

NDX and SPX weekly charts:

The area around 10MA was backtested at the same time, and in a very short time...

“History clearly shows that almost every superstock was in a clear upward trend before rising sharply. In fact, 99% of stocks traded above the 200-day moving average before a sharp rise, and 96% traded above the 50-day moving average.” -Mark Minervini

A quick review of this week's markets:

$NASDAQ 100 Index (.NDX.US)$ Fundraising on Tuesday, distribution on Thursday, disagreement on Friday;

$S&P 500 Index (.SPX.US)$ Divided on Tuesday, distributed on Wednesday and Thursday, and attracted on Friday;

$Dow Jones Industrial Average (.DJI.US)$ It is distributed on Tuesday, distributed on Thursday, and attracted on Friday.

NDX>SPX>DJI.

Another wonderful week, summed up in one sentence: capital has baptized participants in inertial thinking again and again (history is always repeated, and the mentality of market participants has always been the same);

This is why trading requires a system, rules, and circumvents all emotions as much as possible;

At the same time, the market also brought us a layer of high-quality filters, so you can gradually see who are the flowers and who are the weeds in the garden.

NDX and SPX weekly charts:

The area around 10MA was backtested at the same time, and in a very short time...

Translated

+24

23

ctm03232012

commented on

2

7

ctm03232012

commented on

$NVIDIA (NVDA.US)$ The opportunity to short NVDA is coming. It would be suicidal to chase after it now.

Translated

5

2

ctm03232012

commented on

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)