cutie miao

liked

Asian stocks set to climb; Treasuries may drop

Asian stocks looked set to climb Friday, bolstered by improving sentiment toward Chinese shares. Treasury futures suggested higher yields when cash trading resumes after a holiday.

Australian shares rose, while equity contracts for Japan and Hong Kong advanced. A gauge of U.S.-listed Chinese stocks jumped more than 5%, helped by Alibaba's blowout Singles' Day shopping festival. S&P 500 futures were in the green after the index snapped a two-day drop.

Next-Tesla tag sends Rivian above $100 billion without sales

$RIVN.US$ reached a market value of over $100 billion two days after its initial public offering, drawing comparisons to $TSLA.US$.

But there are stark differences: When Tesla went public in 2010, the Elon Musk-led firm disclosed $93 million in revenue and losses far below the $1 billion Rivian reported for the first half. What's more, Tesla's initial market capitalization was about $2 billion and didn’t reach $90 billion until 2020.

Musk throws fresh shade at Rivian a day after Rival's big IPO

Elon Musk doesn't exactly sound optimistic about the prospects of Rivian, even after the rival electric-vehicle maker's blockbuster IP0.

Tesla's chief executive officer said he hopes Rivian can boost production rates and get cash flow to break-even. But in a tweet Thursday he also noted that of hundreds of startups, "Tesla is the only American carmaker to reach high volume production & positive cash flow in past 100 years."

Elon Musk sells around $5 billion of Tesla stock

Tesla CEO Elon Musk sold nearly $5 billion in Tesla stocks, according to financial filings on Wednesday evening. He still holds more than 166 million shares. Filings showed Musk is selling a block of Tesla shares via a plan that he set in motion on Sept. 14 this year.

Before that sale plan was made public, he asked his 62.5 million Twitter followers to vote in an informal poll, telling them their vote would determine the future of his Tesla holdings. The filings reveal that, in fact, he knew some of his shares were slated for sale this week.

U.S.-listed Chinese stocks soar after record singles' day sales

Shares of Chinese companies listed in the U.S. rallied Thursday amid investor optimism after blowout Singles' Day sales.

The Nasdaq Golden Dragon Index jumped 5.1%, the most since Oct. 7, after $BABA.US$ and $JD.US$'s Singles' Day shopping festival posted record sales.

U.S. shoppers outspend Chinese to restore luxury market, study shows

Global consumer spending on personal luxury goods, including the latest sneaker trend or design collaboration, is forecast to spike by 29% this year, to 283 billion euros ($325 billion). That's a return to 2019 levels and a turnaround from the gloom of the 2020 pandemic lockdowns that shuttered stores and halted international travel.

Consumers have shifted spending to high-quality furnishings, as many have been spending time at home instead of globe-trotting.

Disney's magical pricing power can't outpace inflation right now

$DIS.US$ shares are negative this year and well behind the $.SPX.US$ return. The company's third-quarter earnings did not help, with streaming subscriber adds slowing while costs for content and its Parks business rise.

Disney has pricing power unlike most other firms, but it can't escape inflation in the short term as capital spending increases and margins come under pressure.

SARK launches as short interest in ARKK jumps to new record

The first exchange traded fund to take an inverse exposure to another ETF rose by 5.5 per cent on its first two days of trading, mirroring the day's fall in Cathie Wood's flagship $21bn $ARKK.US$.

Its trading volume of $843,000 on day one comes as short interest in ARKK has shot up to a new record of 17.3 per cent of its shares, with a market value of $3.7bn, currently being borrowed by investors betting on a sell-off, according to S3 Partners, a specialist data provider. This is up from just 2 per cent at the turn of the year and 15.3 per cent a month ago.

Source: Bloomberg, CNBC, Financial Times

Asian stocks looked set to climb Friday, bolstered by improving sentiment toward Chinese shares. Treasury futures suggested higher yields when cash trading resumes after a holiday.

Australian shares rose, while equity contracts for Japan and Hong Kong advanced. A gauge of U.S.-listed Chinese stocks jumped more than 5%, helped by Alibaba's blowout Singles' Day shopping festival. S&P 500 futures were in the green after the index snapped a two-day drop.

Next-Tesla tag sends Rivian above $100 billion without sales

$RIVN.US$ reached a market value of over $100 billion two days after its initial public offering, drawing comparisons to $TSLA.US$.

But there are stark differences: When Tesla went public in 2010, the Elon Musk-led firm disclosed $93 million in revenue and losses far below the $1 billion Rivian reported for the first half. What's more, Tesla's initial market capitalization was about $2 billion and didn’t reach $90 billion until 2020.

Musk throws fresh shade at Rivian a day after Rival's big IPO

Elon Musk doesn't exactly sound optimistic about the prospects of Rivian, even after the rival electric-vehicle maker's blockbuster IP0.

Tesla's chief executive officer said he hopes Rivian can boost production rates and get cash flow to break-even. But in a tweet Thursday he also noted that of hundreds of startups, "Tesla is the only American carmaker to reach high volume production & positive cash flow in past 100 years."

Elon Musk sells around $5 billion of Tesla stock

Tesla CEO Elon Musk sold nearly $5 billion in Tesla stocks, according to financial filings on Wednesday evening. He still holds more than 166 million shares. Filings showed Musk is selling a block of Tesla shares via a plan that he set in motion on Sept. 14 this year.

Before that sale plan was made public, he asked his 62.5 million Twitter followers to vote in an informal poll, telling them their vote would determine the future of his Tesla holdings. The filings reveal that, in fact, he knew some of his shares were slated for sale this week.

U.S.-listed Chinese stocks soar after record singles' day sales

Shares of Chinese companies listed in the U.S. rallied Thursday amid investor optimism after blowout Singles' Day sales.

The Nasdaq Golden Dragon Index jumped 5.1%, the most since Oct. 7, after $BABA.US$ and $JD.US$'s Singles' Day shopping festival posted record sales.

U.S. shoppers outspend Chinese to restore luxury market, study shows

Global consumer spending on personal luxury goods, including the latest sneaker trend or design collaboration, is forecast to spike by 29% this year, to 283 billion euros ($325 billion). That's a return to 2019 levels and a turnaround from the gloom of the 2020 pandemic lockdowns that shuttered stores and halted international travel.

Consumers have shifted spending to high-quality furnishings, as many have been spending time at home instead of globe-trotting.

Disney's magical pricing power can't outpace inflation right now

$DIS.US$ shares are negative this year and well behind the $.SPX.US$ return. The company's third-quarter earnings did not help, with streaming subscriber adds slowing while costs for content and its Parks business rise.

Disney has pricing power unlike most other firms, but it can't escape inflation in the short term as capital spending increases and margins come under pressure.

SARK launches as short interest in ARKK jumps to new record

The first exchange traded fund to take an inverse exposure to another ETF rose by 5.5 per cent on its first two days of trading, mirroring the day's fall in Cathie Wood's flagship $21bn $ARKK.US$.

Its trading volume of $843,000 on day one comes as short interest in ARKK has shot up to a new record of 17.3 per cent of its shares, with a market value of $3.7bn, currently being borrowed by investors betting on a sell-off, according to S3 Partners, a specialist data provider. This is up from just 2 per cent at the turn of the year and 15.3 per cent a month ago.

Source: Bloomberg, CNBC, Financial Times

87

2

cutie miao

liked

cutie miao

liked

I was at a loss at what to buy so I decided to take reference from the investment guru Warren Buffet. One of the cornerstone investment from Berkshire was $BAC.US$ so I decided to follow suit. Luckily the economy take a turn for the better and bank stocks came back in favour. At the end of the day, stock price are an investor's expectation for the future but being contrarian can pay off.

29

1

cutie miao

liked

$AXP.US$ Buffett’s Berkshire Hathaway made nearly $9 billion this year from investments in American Express, bringing its total unrealized gains on this stock to approximately $26 billion. According to the latest statistics, Buffett's corporate group holds 152 million shares of American Express. As of Wednesday's close, these shares are worth about 27.3 billion U.S. dollars. Buffett and his team only spent $1.3 billion that year, so even if dividends are not included, their rate of return is as high as 20 times.

Article excerpted from the US Stock Research Agency

Article excerpted from the US Stock Research Agency

4

cutie miao

liked and commented on

For beginners, placing an order sometimes can be a difficult task.

In this video, we will guide you on how to place a market/limit order.

Follow us for more tutorials.

For more guides, please refer to moomoo courses at https://live.moomoo.com/college

![]() Have fun with your financial journey on moomoo!

Have fun with your financial journey on moomoo!

$AMC.US$ $TSLA.US$ $.SPX.US$ $SPY.US$ $.IXIC.US$

In this video, we will guide you on how to place a market/limit order.

Follow us for more tutorials.

For more guides, please refer to moomoo courses at https://live.moomoo.com/college

$AMC.US$ $TSLA.US$ $.SPX.US$ $SPY.US$ $.IXIC.US$

![[Video Tutorial] How to place an order on moomoo?](https://ussnsimg.moomoo.com/202106170000078178e2dd5e936.jpg/thumb)

6131

6911

cutie miao

liked and commented on

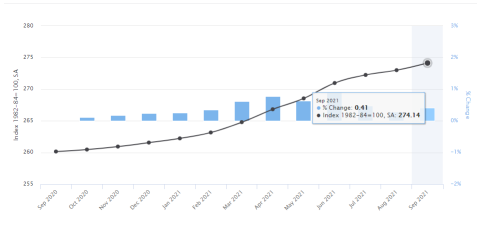

What is CPI?

The Consumer Price Index (CPI) is a measure that examines the weighted average of prices of a basket of consumer goods and services, such as transportation, food, and medical care.

Inflation is the decline of a given currency's purchasing power over time; or, alternatively, a general rise in prices. So CPI is the most widely used measure of inflation.

What happened recently?

U.S. consumer prices overall rose 0.4% in September, pushing the y-o-y gain to 5.4%. CPI increased slightly more than expected in September as food and energy price rises offset declines in used cars .

"Food and energy are more variable, but that's where the problem is," said Bob Doll, chief investment officer at Crossmark Global Investments. " Hopefully, we start solving our supply shortage problem.”

Recently, the International Monetary Fund warned that the Fed and its global peers should be preparing contingency plans should inflation prove persistent. That would mean raising interest rates sooner than expected to control the price gains.

$.SPX.US$ $.IXIC.US$ $.DJI.US$

The Consumer Price Index (CPI) is a measure that examines the weighted average of prices of a basket of consumer goods and services, such as transportation, food, and medical care.

Inflation is the decline of a given currency's purchasing power over time; or, alternatively, a general rise in prices. So CPI is the most widely used measure of inflation.

What happened recently?

U.S. consumer prices overall rose 0.4% in September, pushing the y-o-y gain to 5.4%. CPI increased slightly more than expected in September as food and energy price rises offset declines in used cars .

"Food and energy are more variable, but that's where the problem is," said Bob Doll, chief investment officer at Crossmark Global Investments. " Hopefully, we start solving our supply shortage problem.”

Recently, the International Monetary Fund warned that the Fed and its global peers should be preparing contingency plans should inflation prove persistent. That would mean raising interest rates sooner than expected to control the price gains.

$.SPX.US$ $.IXIC.US$ $.DJI.US$

103

15

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)