Cynthia 8787

liked

Dear mooers,

We are coming to the end of a very unusual year full of uncertainty. Whether good or bad, we all witnessed the history.

Before you want to see what you can expect in 2022, let's have a little break and take a guess of the closing price of the S&P 500.

A happy ending or a tragedy? Go big or go home? Place your bet NOW!

Win Reward:

Place your bet on the closing price of the $S&P 500 Index (.SPX.US)$ (i.e.4800.11) on Friday...

We are coming to the end of a very unusual year full of uncertainty. Whether good or bad, we all witnessed the history.

Before you want to see what you can expect in 2022, let's have a little break and take a guess of the closing price of the S&P 500.

A happy ending or a tragedy? Go big or go home? Place your bet NOW!

Win Reward:

Place your bet on the closing price of the $S&P 500 Index (.SPX.US)$ (i.e.4800.11) on Friday...

452

1070

Cynthia 8787

liked

107

13

Cynthia 8787

liked

The U.S. stock markets have been hovering near records since November. Investors are taking a breather amid the recent volatility.

This week, the U.S. stock markets rebounded from the last week's pullback before and on the quadruple witching day.

Have you noticed the market trends in time and grasped the trading time?

Too busy and have no time?

How to strike a balance between investment and work?

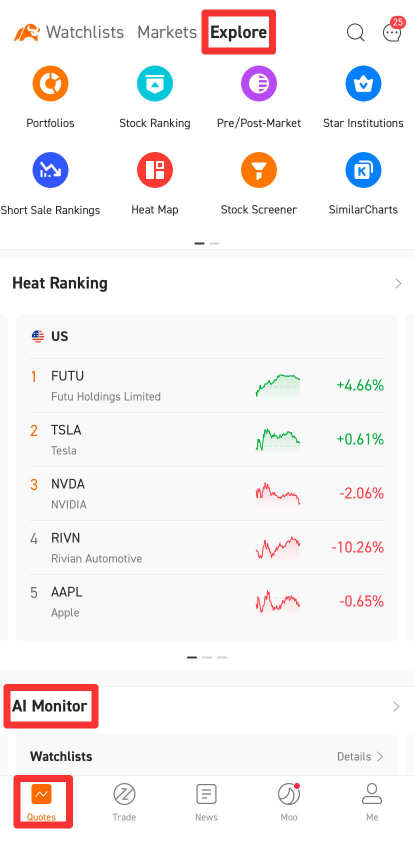

Maybe you can't help but want to know one of our most popular features-AI Monitor.

[Everyday Power]

What is AI Monitor:

AI Monitor aims to pay close attention to the real-time abnormal trend of the market and make investment more manageable. It issues alerts to help you seize trading opportunities and seize investment opportunities.

How to find it:

Quotes - Explore - AI Monitor

Don't forget that continuous learning and research are necessary for successful investment. The assistance of AI Monitor is the icing on the cake.

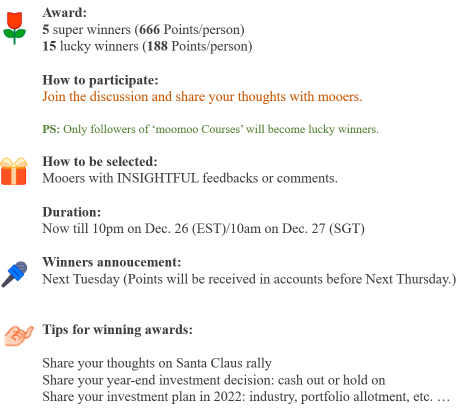

[In Discussion]

Some investors believe that the market is ready for the「Santa Claus rally」.

What is Santa Claus rally?

The Santa Claus rally describes a rise in the stock market over the last five trading days of December and January's first two trading days.

The seven-day combo yielded positive returns for nearly 78% of the time from 1950 to 2019

Do you believe in Santa Claus rally? Will it affect your investment decisions? What's your plan for the 2022 investment?

[Weekly Wins]

For more investment knowledge and trends, welcome to Courses in the Community.

$S&P 500 Index (.SPX.US)$ $Dow Jones Industrial Average (.DJI.US)$ $Nasdaq Composite Index (.IXIC.US)$

This week, the U.S. stock markets rebounded from the last week's pullback before and on the quadruple witching day.

Have you noticed the market trends in time and grasped the trading time?

Too busy and have no time?

How to strike a balance between investment and work?

Maybe you can't help but want to know one of our most popular features-AI Monitor.

[Everyday Power]

What is AI Monitor:

AI Monitor aims to pay close attention to the real-time abnormal trend of the market and make investment more manageable. It issues alerts to help you seize trading opportunities and seize investment opportunities.

How to find it:

Quotes - Explore - AI Monitor

Don't forget that continuous learning and research are necessary for successful investment. The assistance of AI Monitor is the icing on the cake.

[In Discussion]

Some investors believe that the market is ready for the「Santa Claus rally」.

What is Santa Claus rally?

The Santa Claus rally describes a rise in the stock market over the last five trading days of December and January's first two trading days.

The seven-day combo yielded positive returns for nearly 78% of the time from 1950 to 2019

Do you believe in Santa Claus rally? Will it affect your investment decisions? What's your plan for the 2022 investment?

[Weekly Wins]

For more investment knowledge and trends, welcome to Courses in the Community.

$S&P 500 Index (.SPX.US)$ $Dow Jones Industrial Average (.DJI.US)$ $Nasdaq Composite Index (.IXIC.US)$

+1

133

63

Cynthia 8787

liked

Even beyond the launch of the first U.S. Bitcoin futures ETF, cryptocurrency funds notched some notable global milestones in 2021.

The number of crypto-tracking investment vehicles worldwide more than doubled to 80 from just 35 at the end of 2020. Assets soared to $63 billion, compared to $24 billion at the start of the year.

--- according to Bloomberg Intelligence data

Globally, it's obviously a phenomenon that's starting to take off. If you look at inflows on a volume perspective, not only has it been steady even with the price corrections that Bitcoin is notoriously famous for, but you're seeing a lot of institutions jump in.”

--- Leah Wald, chief executive of crypto asset manager Valkyrie Investments, said on Bloomberg's "QuickTake Stock" streaming program.

Grayscale Investments LLC is the largest asset manager in the digital-assets space, with the $30 billion $Grayscale Bitcoin Trust (GBTC.US)$ ranking as the world's largest crypto fund.

The First U.S. bitcoin-linked ETF $ProShares Bitcoin ETF (BITO.US)$ incepted in October, which recevied a lot of attention. It only took two days for the fund to accumulate $1 billion.

Unlike an ETF directly connected to spot Bitcoin, the futures-backed products such as BITO are vulnerable to so-called associated with managing contracts. It's likely that investor demand would be even higher if physically backed funds were allowed to launch in the U.S., according to Bloomberg Intelligence.

I can't help but think that the assets in this space would be even larger if we had more efficient structures, like spot ETFs, in the U.S.”

--- said James Seyffart, Bloomberg Intelligence ETF analyst.

Watch now: What crypto's breakout year means for the market in 2022

Indeed, flows into the ProShares fund have stalled, with the ETF down more than 30% since its mid-October launch. Meanwhile, similar products from Valkyrie and VanEck have less than $70 million in assets combined.

Valkyrie's Wald is optimistic that flows will pick up in 2022. Institutional money managers are likely waiting to see how the U.S. futures-backed ETF handle the roll costs, she said.

That specific vehicle, I think a lot of money managers want to look at the metrics before jumping in. We're excited about what next year has to hold.”

--- Wald said.

Source: Bloomberg

The number of crypto-tracking investment vehicles worldwide more than doubled to 80 from just 35 at the end of 2020. Assets soared to $63 billion, compared to $24 billion at the start of the year.

--- according to Bloomberg Intelligence data

Globally, it's obviously a phenomenon that's starting to take off. If you look at inflows on a volume perspective, not only has it been steady even with the price corrections that Bitcoin is notoriously famous for, but you're seeing a lot of institutions jump in.”

--- Leah Wald, chief executive of crypto asset manager Valkyrie Investments, said on Bloomberg's "QuickTake Stock" streaming program.

Grayscale Investments LLC is the largest asset manager in the digital-assets space, with the $30 billion $Grayscale Bitcoin Trust (GBTC.US)$ ranking as the world's largest crypto fund.

The First U.S. bitcoin-linked ETF $ProShares Bitcoin ETF (BITO.US)$ incepted in October, which recevied a lot of attention. It only took two days for the fund to accumulate $1 billion.

Unlike an ETF directly connected to spot Bitcoin, the futures-backed products such as BITO are vulnerable to so-called associated with managing contracts. It's likely that investor demand would be even higher if physically backed funds were allowed to launch in the U.S., according to Bloomberg Intelligence.

I can't help but think that the assets in this space would be even larger if we had more efficient structures, like spot ETFs, in the U.S.”

--- said James Seyffart, Bloomberg Intelligence ETF analyst.

Watch now: What crypto's breakout year means for the market in 2022

Indeed, flows into the ProShares fund have stalled, with the ETF down more than 30% since its mid-October launch. Meanwhile, similar products from Valkyrie and VanEck have less than $70 million in assets combined.

Valkyrie's Wald is optimistic that flows will pick up in 2022. Institutional money managers are likely waiting to see how the U.S. futures-backed ETF handle the roll costs, she said.

That specific vehicle, I think a lot of money managers want to look at the metrics before jumping in. We're excited about what next year has to hold.”

--- Wald said.

Source: Bloomberg

46

7

Cynthia 8787

liked

Cynthia 8787

liked

$GENTING HK (00678.HK)$ don’t fear, it will going up.

51

1

Cynthia 8787

liked

$Roku Inc (ROKU.US)$ break the barrier and go back to 400!!

49

1

Cynthia 8787

liked

$Netflix (NFLX.US)$ $Disney (DIS.US)$ $Amazon (AMZN.US)$ In order to regain market share from Amazon and Disney, Netflix cut prices by as much as 60% in India. In a statement on Tuesday, Netflix said it would cut the price of the entry-level package by 60% to 199 rupees ($2.60) per month from 499 rupees, while the price of the remaining three-tier packages ranged from 18% to 60%. The new price will make streaming services more accessible to Indian viewers,because Indian consumers are very price sensitive.

13

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)