Dineyh

liked

In the past 3 years, China's auto market has been hot, attracting many new brands leading to an internal competition trend. Seeing the limitless internal competition may trigger consumers' mindset of delaying purchases to enjoy discounts, cooling down the auto market next year.

Expecting consumers to postpone their car purchase decisions in anticipation of further price reductions for existing non-domestic models, CICC analysts predict that China's total auto sales next year will decrease by 8% to 0.73 million units from this year's 0.79 million, due to the internal competition.

"We believe that with the high base effect becoming evident and no bullish factors supporting it, next year's auto market is expected to cool down and will struggle to maintain the current high sales levels."

In fact, there have been signs of a decline in auto sales. Looking back, in November, the country's auto sales were 0.0675 million units, already declining by 3% monthly, and compared with the same period last year, it has dropped by 8%.

Toyota's sales decreased by 6.7%; the sales of the second domestic car and Baoteng, the two domestic car manufacturers, were also poor last month, decreasing by 5.7% and 5.0% respectively.

That being said, analysts pointed out that Perodua's sales from the beginning of the year to now are close to 0.326 million units, expected to exceed its 2023 full-year sales of 0.33 million units, further refreshing the annual sales record.

Entering 2025, prolonged price wars in the auto industry and soft orders have led analysts to lower their expectations.

Foreign cars are facing more impact.

However, analysts still emphasize that the decline in car sales is mainly from non-domestic brands, especially as new entrants like China's Auto Manufacturers join the market, intensifying industry competition.

"Therefore, I...

Expecting consumers to postpone their car purchase decisions in anticipation of further price reductions for existing non-domestic models, CICC analysts predict that China's total auto sales next year will decrease by 8% to 0.73 million units from this year's 0.79 million, due to the internal competition.

"We believe that with the high base effect becoming evident and no bullish factors supporting it, next year's auto market is expected to cool down and will struggle to maintain the current high sales levels."

In fact, there have been signs of a decline in auto sales. Looking back, in November, the country's auto sales were 0.0675 million units, already declining by 3% monthly, and compared with the same period last year, it has dropped by 8%.

Toyota's sales decreased by 6.7%; the sales of the second domestic car and Baoteng, the two domestic car manufacturers, were also poor last month, decreasing by 5.7% and 5.0% respectively.

That being said, analysts pointed out that Perodua's sales from the beginning of the year to now are close to 0.326 million units, expected to exceed its 2023 full-year sales of 0.33 million units, further refreshing the annual sales record.

Entering 2025, prolonged price wars in the auto industry and soft orders have led analysts to lower their expectations.

Foreign cars are facing more impact.

However, analysts still emphasize that the decline in car sales is mainly from non-domestic brands, especially as new entrants like China's Auto Manufacturers join the market, intensifying industry competition.

"Therefore, I...

Translated

20

Dineyh

liked

$Tesla (TSLA.US)$

Amazing rally. Another big dip the next day? or continue rally?

Amazing rally. Another big dip the next day? or continue rally?

3

4

Dineyh

liked

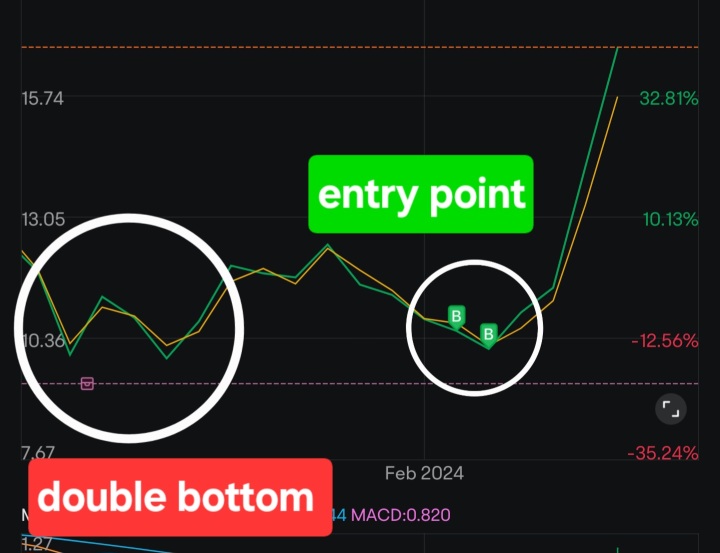

Discover how to identify and buy stocks at their lowest point—right before they skyrocket! In this video, I’ll reveal a proven strategy using cup and handle to catch the bottom and position yourself for massive breakouts.

One key pattern I’ll break down is the cup and handle, a classic setup that signals explosive potential.

But here’s the twist—I don’t settle for the typical entry. Instead, I’ll show you how to buy at the bottom of the handle...

One key pattern I’ll break down is the cup and handle, a classic setup that signals explosive potential.

But here’s the twist—I don’t settle for the typical entry. Instead, I’ll show you how to buy at the bottom of the handle...

56

1

Dineyh

liked

Buy Low, Sell High. Is Investing Really That Simple?

In a word, yes! However, achieving this simplicity requires several basic strategies and patience. If you're looking to get rich quickly, this article is not for you.

We all know the adage: "Buy low, sell high." However, an equally important but less known phrase is "time in the market, not timing the market."

The Pitfalls of Perfect Timing

Attempting to time the market's bottom for the perfect entry point is a...

In a word, yes! However, achieving this simplicity requires several basic strategies and patience. If you're looking to get rich quickly, this article is not for you.

We all know the adage: "Buy low, sell high." However, an equally important but less known phrase is "time in the market, not timing the market."

The Pitfalls of Perfect Timing

Attempting to time the market's bottom for the perfect entry point is a...

+2

75

31

24

Dineyh

liked

Winstar Capital Berhad (WINSTAR), which has debuted on 19th December 2024 had shown a strong uptrend to challenge the key resistance of RM0.600, where we can also see in the bars below (MCDX Plus indicator) is showing an accumulation by investors. We deem this breakout as an opportunity for investors to take up a position in WINSTAR.

TP: RM0.650

SP: RM0.565

TP: RM0.650

SP: RM0.565

3

Dineyh

liked

$NVIDIA (NVDA.US)$

In trading, timing is everything. Sometimes the best move is to wait for the perfect setup rather than chasing the market. Here's why:

1. Avoid Emotional Decisions: Impulsive trades often lead to losses.

2. Better Risk Management: Waiting for clear signals reduces unnecessary risk.

3. Improved Accuracy: Patience allows you to align technical analysis with market conditions for higher probability trades.

Example:

Today, I found a...

In trading, timing is everything. Sometimes the best move is to wait for the perfect setup rather than chasing the market. Here's why:

1. Avoid Emotional Decisions: Impulsive trades often lead to losses.

2. Better Risk Management: Waiting for clear signals reduces unnecessary risk.

3. Improved Accuracy: Patience allows you to align technical analysis with market conditions for higher probability trades.

Example:

Today, I found a...

+3

7

Dineyh

liked

$Advanced Micro Devices (AMD.US)$ Chasing high and selling low is a common but irrational investment behavior, mainly referring to investors blindly buying (chasing high) when stock or other asset prices rise, and selling (selling low) out of panic when prices fall. The specific meanings are as follows:

Chasing high prices.

• Definition: When the price is already relatively high or even close to the top, investors buy at a high price because they are afraid of 'missing out' on further gains.

• Consequences: Once the price experiences a pullback or reversal, investors may suffer significant losses.

Bear Market

• Definition: When the price drops significantly or approaches the bottom, investors sell at a low price due to fear of further decline.

• Consequence: After the price stabilizes and rebounds, investors may miss the opportunity for a rebound, while locking in losses.

Psychological reasons

• Herd mentality: seeing others making money, afraid of missing opportunities, so chasing high; seeing others selling off in panic, worried about continuing losses, so selling off.

• Emotion-driven: driven by greed to chase high prices, driven by fear to sell low, lacking rational judgement.

Example

• Chasing high: A certain stock rose from 10 yuan to 30 yuan, investors bought in because of the short-term rapid increase, but later fell back to 20 yuan, resulting in significant losses.

• Sell-off: a stock drops from 30 yuan to 10 yuan, investors worry about further decline and sell, resulting in a subsequent rebound to 20 yuan, missing profit opportunities.

Methods of response

1. Develop a plan: clearly define the price range for buying and selling to avoid emotional trading.

...

Chasing high prices.

• Definition: When the price is already relatively high or even close to the top, investors buy at a high price because they are afraid of 'missing out' on further gains.

• Consequences: Once the price experiences a pullback or reversal, investors may suffer significant losses.

Bear Market

• Definition: When the price drops significantly or approaches the bottom, investors sell at a low price due to fear of further decline.

• Consequence: After the price stabilizes and rebounds, investors may miss the opportunity for a rebound, while locking in losses.

Psychological reasons

• Herd mentality: seeing others making money, afraid of missing opportunities, so chasing high; seeing others selling off in panic, worried about continuing losses, so selling off.

• Emotion-driven: driven by greed to chase high prices, driven by fear to sell low, lacking rational judgement.

Example

• Chasing high: A certain stock rose from 10 yuan to 30 yuan, investors bought in because of the short-term rapid increase, but later fell back to 20 yuan, resulting in significant losses.

• Sell-off: a stock drops from 30 yuan to 10 yuan, investors worry about further decline and sell, resulting in a subsequent rebound to 20 yuan, missing profit opportunities.

Methods of response

1. Develop a plan: clearly define the price range for buying and selling to avoid emotional trading.

...

Translated

17

6

1

Dineyh

liked

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)