Durian Tank

voted

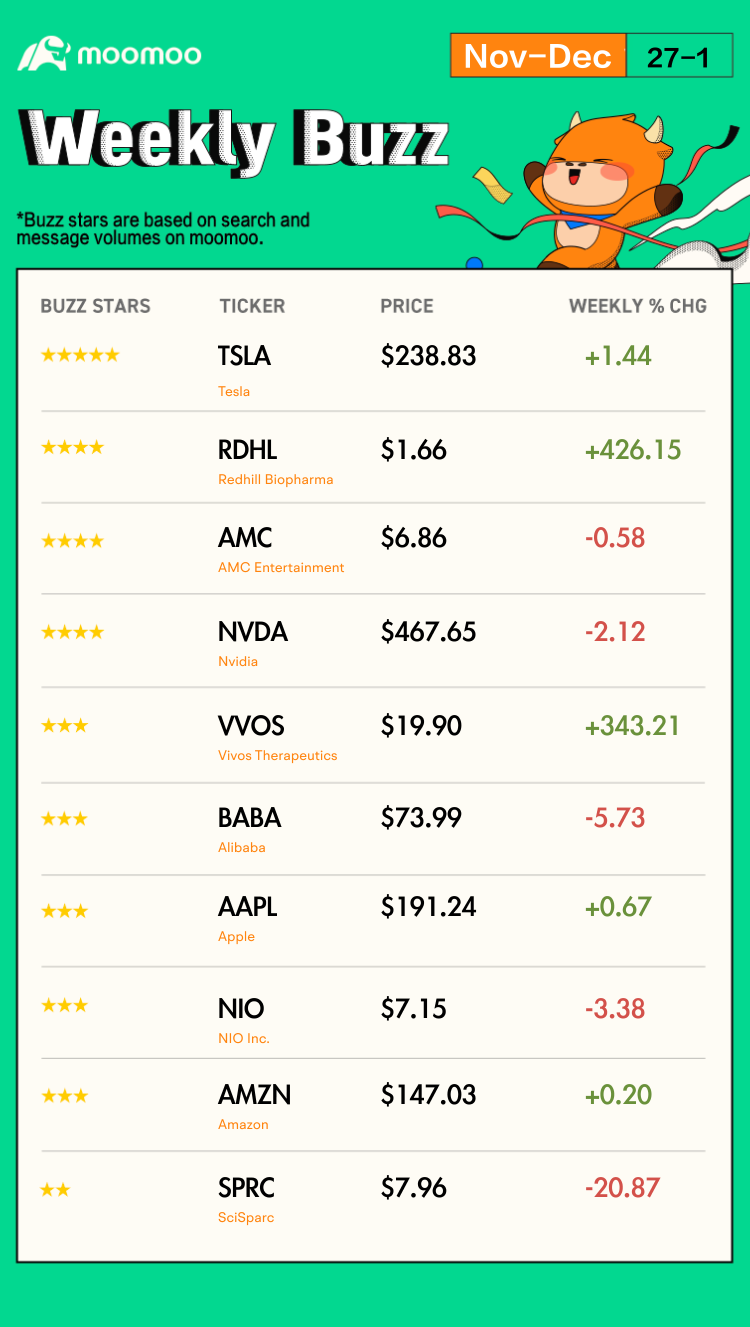

Happy Friday, mooers! Welcome back to Weekly Buzz, where we review the news, performance and community sentiment of the selected buzzing stocks on moomoo platform based on search and message volumes of this week! Answer the Weekly Topic question for a chance to win an award next week!

Make Your Choice

Weekly Buzz: November ends with sharp gains

U.S. stocks opened mostly lower on Friday after capping off a spectacular November for markets. Equities finis...

Make Your Choice

Weekly Buzz: November ends with sharp gains

U.S. stocks opened mostly lower on Friday after capping off a spectacular November for markets. Equities finis...

55

13

Durian Tank

commented on

$BARK Inc (BARK.US)$ If you own more than 100 shares, please tell us your average cost.

6

Durian Tank

voted

EV stocks have multiplied in $Tesla (TSLA.US)$ wake and as electric cars look to go mainstream — but not all are created equal. Some car stocks are more ready than others for an EV future. Here are the top-rated electric vehicle makers and EV plays.

$Tesla (TSLA.US)$ $Ford Motor (F.US)$ $Li Auto (LI.US)$

$Tesla (TSLA.US)$ $Ford Motor (F.US)$ $Li Auto (LI.US)$

8

Durian Tank

commented on

4

2

Durian Tank

commented on

Durian Tank

liked

$PayPal (PYPL.US)$ is down now but it is a long term growth Fintech company. it could overtake ViSA or Mastercard in size in the future.

13

Durian Tank

reacted to and commented on

$BARK Inc (BARK.US)$ nobody here?

5

4

Durian Tank

liked and commented on

$Apple (AAPL.US)$ dont understand... isnt their sales doing great? why keep falling

1

5

Durian Tank

commented on

On September 29, Evergrande’s stocks collectively rose on the disk. Today, Evergrande announced the sale of its shares in Shengjing Bank. Mainland real estate stocks were boosted collectively.

Why do real estate companies do insurance business?

Why buy banking business?

Real estate itself is highly leveraged, and insurance and banks themselves are highly leveraged. With the existence of the pre-sale system and other forms, before real estate companies used development loans, pre-financing, and even pre-financing, some real estate companies even had almost no own funds for land auctions. Taking bank and insurance funds, multi-layer nesting, and finding trusts for packaging, is itself a high-end game of the brutal development of real estate companies in the past. If you have time, I can recommend everyone to take a look at the equity and capital structure of the "Baoji Wanzhi" back then.

I have done real estate investment before, a small and medium-sized real estate company. In its name, full coverage of financing and full coverage of investment. To put it bluntly, one is to find local governments to expand land through personal connections and relationships. On the other hand, it is to find major financial institutions to obtain loans and find financing lines, which is a kind of empty glove. White wolf.

Speaking of the matter itself, can Evergrande’s “tens of billions” of funds return blood? Welcome to discuss, leave a message to discuss! $EVERG VEHICLE (00708.HK)$ $EVERGRANDE (03333.HK)$ $SUNAC (01918.HK)$ $SHENGJINGBANK (02066.HK)$

China Evergrande announced on the Hong Kong Stock Exchange that a wholly-owned subsidiary has sold 1.75 billion non-tradable domestic shares of Shengjing Bank to Shenyang Shengjing Financial Holdings Investment Group Co., Ltd., accounting for 19.93% of Shengjing Bank’s issued shares; the consideration is RMB per share 5.7 yuan, totaling 99.93 billion yuan.

China Evergrande announced that the company’s liquidity problems have had a huge negative impact on Shengjing Bank. The introduction of state-owned enterprise transferees as major shareholders will help stabilize Shengjing Bank’s operations and at the same time help the company’s remaining holdings of Shengjing Bank. The bank's 14.57% equity value increased and maintained its value. The settlement of the sale requires the cooperation of Shengjing Bank. Shengjing Bank requires that all proceeds from the sale be used to repay the related debts of the Group to Shengjing Bank.

Why do real estate companies do insurance business?

Why buy banking business?

Real estate itself is highly leveraged, and insurance and banks themselves are highly leveraged. With the existence of the pre-sale system and other forms, before real estate companies used development loans, pre-financing, and even pre-financing, some real estate companies even had almost no own funds for land auctions. Taking bank and insurance funds, multi-layer nesting, and finding trusts for packaging, is itself a high-end game of the brutal development of real estate companies in the past. If you have time, I can recommend everyone to take a look at the equity and capital structure of the "Baoji Wanzhi" back then.

I have done real estate investment before, a small and medium-sized real estate company. In its name, full coverage of financing and full coverage of investment. To put it bluntly, one is to find local governments to expand land through personal connections and relationships. On the other hand, it is to find major financial institutions to obtain loans and find financing lines, which is a kind of empty glove. White wolf.

Speaking of the matter itself, can Evergrande’s “tens of billions” of funds return blood? Welcome to discuss, leave a message to discuss! $EVERG VEHICLE (00708.HK)$ $EVERGRANDE (03333.HK)$ $SUNAC (01918.HK)$ $SHENGJINGBANK (02066.HK)$

China Evergrande announced on the Hong Kong Stock Exchange that a wholly-owned subsidiary has sold 1.75 billion non-tradable domestic shares of Shengjing Bank to Shenyang Shengjing Financial Holdings Investment Group Co., Ltd., accounting for 19.93% of Shengjing Bank’s issued shares; the consideration is RMB per share 5.7 yuan, totaling 99.93 billion yuan.

China Evergrande announced that the company’s liquidity problems have had a huge negative impact on Shengjing Bank. The introduction of state-owned enterprise transferees as major shareholders will help stabilize Shengjing Bank’s operations and at the same time help the company’s remaining holdings of Shengjing Bank. The bank's 14.57% equity value increased and maintained its value. The settlement of the sale requires the cooperation of Shengjing Bank. Shengjing Bank requires that all proceeds from the sale be used to repay the related debts of the Group to Shengjing Bank.

1

3

Durian Tank

liked and commented on

$Lucid Group (LCID.US)$

(LCID buy price 25.60)

(LCID sell price 24.60)

Have a bar inside if the opening is above the buy price we must wait for the break of the maximum 26.13 of the closing candle of the daily chart. always wait for confirmation.

If the opening is above the buy zone, we must wait for there to be a break of the 24.62.00 low and the sell price, we wait for the retest at mv 9 or 10, 5mn chart period, remember not to anticipate.

(LCID buy price 25.60)

(LCID sell price 24.60)

Have a bar inside if the opening is above the buy price we must wait for the break of the maximum 26.13 of the closing candle of the daily chart. always wait for confirmation.

If the opening is above the buy zone, we must wait for there to be a break of the 24.62.00 low and the sell price, we wait for the retest at mv 9 or 10, 5mn chart period, remember not to anticipate.

2

2

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)