Edward Egendoerfer

commented on

The market has been very volatile in both direction after the down move since Black Friday. I have explained in detail in the Sunday's webinar since 5 Dec because Wyckoff phase A is still unfolding.

I have also mentioned deterioration in the market breadth, which is a red flag in the market several times. Take a look below how the market breadth behaves before a stock market crash if you haven’t:

https://finance.yahoo.com/news/market-breadth-behaves-stock-market-113842940.html

Just in case you are wondering why the stocks in your watchlist have a huge draw down yet the indices like $S&P 500 Index (.SPX.US)$ $Nasdaq (NDAQ.US)$ $Dow Jones Industrial Average (.DJI.US)$ are still a few % away from all time high, you might want to check out the stocks that will make or break the indices where those 5 - $Apple (AAPL.US)$ $Microsoft (MSFT.US)$ $Amazon (AMZN.US)$ $Tesla (TSLA.US)$ $NVIDIA (NVDA.US)$ accounted for 40% in the Nasdaq 100:

https://finance.yahoo.com/news/5-stocks-break-nasdaq-100-133816168.html

Watch my detailed market analysis (fresh out from yesterday live webinar) with the focus on S&P 500 where you will find out:

1. How to interpret the FOMC bullish momentum bar

2. The "honest bar" that revealed the direction

3. The key levels and the likely scenario to happen.

This is a bifurcated market given the current market condition.

- Potential long: a handful of stocks in the strong sector such as $Real Estate Select Sector Spdr Fund (The) (XLRE.US)$ (REIT), $Consumer Staples Select Sector SPDR Fund (XLP.US)$ (Consumer Staples)

- Potential short: Growth stocks and small cap are badly hit. Hint: look for stocks under $ARK Genomic Revolution ETF (ARKG.US)$ ETF.

Safe trading.

I have also mentioned deterioration in the market breadth, which is a red flag in the market several times. Take a look below how the market breadth behaves before a stock market crash if you haven’t:

https://finance.yahoo.com/news/market-breadth-behaves-stock-market-113842940.html

Just in case you are wondering why the stocks in your watchlist have a huge draw down yet the indices like $S&P 500 Index (.SPX.US)$ $Nasdaq (NDAQ.US)$ $Dow Jones Industrial Average (.DJI.US)$ are still a few % away from all time high, you might want to check out the stocks that will make or break the indices where those 5 - $Apple (AAPL.US)$ $Microsoft (MSFT.US)$ $Amazon (AMZN.US)$ $Tesla (TSLA.US)$ $NVIDIA (NVDA.US)$ accounted for 40% in the Nasdaq 100:

https://finance.yahoo.com/news/5-stocks-break-nasdaq-100-133816168.html

Watch my detailed market analysis (fresh out from yesterday live webinar) with the focus on S&P 500 where you will find out:

1. How to interpret the FOMC bullish momentum bar

2. The "honest bar" that revealed the direction

3. The key levels and the likely scenario to happen.

This is a bifurcated market given the current market condition.

- Potential long: a handful of stocks in the strong sector such as $Real Estate Select Sector Spdr Fund (The) (XLRE.US)$ (REIT), $Consumer Staples Select Sector SPDR Fund (XLP.US)$ (Consumer Staples)

- Potential short: Growth stocks and small cap are badly hit. Hint: look for stocks under $ARK Genomic Revolution ETF (ARKG.US)$ ETF.

Safe trading.

25

2

2

Edward Egendoerfer

commented on

as always be well informed and be the first to know. its the only way to seize opportunities. if you dont make a choice the choice will be made for you

3

2

Edward Egendoerfer

commented on

One is to believe in history. History will repeat itself, and if you forget this one, you will be in a dangerous situation. All bubbles will burst, and all investment craziness will disappear. The task of investors is to survive market volatility.

Second is not to be a borrower, nor a lender. If investors borrow money to invest, it will interfere with investment capabilities. Investment portfolios that do not use leverage will not be liquidated, while investments that use leverage will face this risk. Leverage will impair the patience of investors themselves. Although it temporarily increases investor returns, it will eventually be destroyed suddenly.

Third is not to put all your assets on the same boat. Allocation of investment in several different areas, and as many as possible, this can increase the resilience of the portfolio and enhance the ability to withstand shocks. Obviously, when investment targets are numerous and different, investors are more likely to survive the critical period when their main assets fall.

Fourth is to have patience and focus on the long-term. Investors must wait patiently for a good card. If the waiting time is long enough, the market price may become very cheap. This is the margin of safety for investors to invest.

Fifth is to stay away from the crowd and focus only on value. The best way to resist crowd agitation is to pay attention to the intrinsic value of individual stocks calculated by yourself.

$Meta Platforms (FB.US)$ $Tesla (TSLA.US)$ $Boeing (BA.US)$ $Netflix (NFLX.US)$ $Microsoft (MSFT.US)$ $NIO Inc (NIO.US)$

Second is not to be a borrower, nor a lender. If investors borrow money to invest, it will interfere with investment capabilities. Investment portfolios that do not use leverage will not be liquidated, while investments that use leverage will face this risk. Leverage will impair the patience of investors themselves. Although it temporarily increases investor returns, it will eventually be destroyed suddenly.

Third is not to put all your assets on the same boat. Allocation of investment in several different areas, and as many as possible, this can increase the resilience of the portfolio and enhance the ability to withstand shocks. Obviously, when investment targets are numerous and different, investors are more likely to survive the critical period when their main assets fall.

Fourth is to have patience and focus on the long-term. Investors must wait patiently for a good card. If the waiting time is long enough, the market price may become very cheap. This is the margin of safety for investors to invest.

Fifth is to stay away from the crowd and focus only on value. The best way to resist crowd agitation is to pay attention to the intrinsic value of individual stocks calculated by yourself.

$Meta Platforms (FB.US)$ $Tesla (TSLA.US)$ $Boeing (BA.US)$ $Netflix (NFLX.US)$ $Microsoft (MSFT.US)$ $NIO Inc (NIO.US)$

3

2

Edward Egendoerfer

commented on

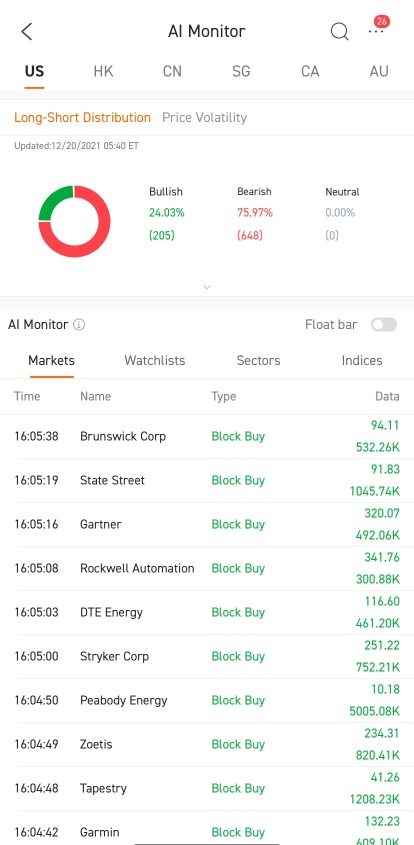

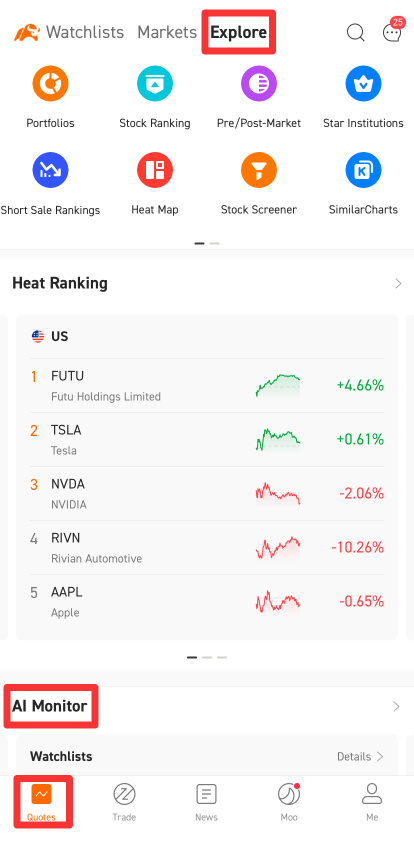

Are you always missing out on great opportunities? Try moomoo's AI Monitor feature. Our system will automatically monitor the market sentiment and alert you on the stocks you may find interesting.

![]() What is AI Monitor

What is AI Monitor

AI Monitor aims to keep tabs on the real-time abnormal movements of the market to make investing easier. It issues alerts to help you get the good timing of trades and seize investment opportunities.

It monitors the fluctuations...

AI Monitor aims to keep tabs on the real-time abnormal movements of the market to make investing easier. It issues alerts to help you get the good timing of trades and seize investment opportunities.

It monitors the fluctuations...

202

8

8

Edward Egendoerfer

liked

$Futu Holdings Ltd (FUTU.US)$ Futu just started corrections or otherwise. Good to hold if small volume or repositioning. Profiteering guys👍

6

2

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)

Edward Egendoerfer : caulking