Elaine339

liked

$AMC Entertainment(AMC.US$ go sleep , there is no going up hahahah

5

9

Elaine339

liked

I see a lot of people sounding the alarm on oil stocks, saying things like:

-We're nearing the top and it will drop soon after summer.

-Demand destruction is coming oil will crash.

-Renewables will drive oil down in next 2-3 years.

For people who believe oil is not a good long term hold, how do you interpret Warren Buffet's massive investment in Chevron and Occidental? For example, do you think that:

-He's wrong.

-He might be invest...

-We're nearing the top and it will drop soon after summer.

-Demand destruction is coming oil will crash.

-Renewables will drive oil down in next 2-3 years.

For people who believe oil is not a good long term hold, how do you interpret Warren Buffet's massive investment in Chevron and Occidental? For example, do you think that:

-He's wrong.

-He might be invest...

6

Elaine339

liked

There is a well-known stock tomorrow, and it may have a big chance... Now it's slowly maturing, and 80% will appear tomorrow... If you say it too early, it won't work because the bookmaker doesn't like it...

Translated

12

9

Elaine339

liked

I think there are no absolute short-term or long-term traders in the field of investment. The short term and long term mainly depends on what stage the market is currently at. For example, at a time when the US market is currently at 36,000 high, and the political economy is in turmoil, and many unfavorable factors are plagued, is it still foolish to buy a high-priced stock and hold it for a long time? So I think the current situation is more suitable for short-term investments.

Since I've been in the stock market for a long time, I have accumulated rich experience when it comes to long-term and short-term investments. Here are some tips to share:

Stock selection: (only suitable for speculators with considerable experience in US stocks)

1. In order to reduce sudden losses, we must persist in the short term. Choose stocks with good fundamentals, and at least be more resistant to emergencies.

2- It must be actively traded in hot stocks. Investment groups, corporations, and companies participating in hot stocks are also sent in and out more frequently, making it easier to get out and enter.

3- You must choose stocks that often pull out of the Jiaotong University band. In the “W” movement trajectory, it is easy to grasp the highs and lows, and the volatility is high, making it easier to make a profit for the day.

Various types of analysis and judgment:

In fact, there is no absolutely correct technology or basic investment law in the stock market, because all research methods are hindsight. The rise and fall of stocks is completely undefined; it depends entirely on the chips in the hands of the bookmaker or main player.

All the technical indicators we have seen function like roadside signs, but the direction indicated is not eternal. When the dealer harvests, they can immediately replace the move forward with a U Turn. As a result, the technical and basic players all die together. Therefore, we must not be obsessed with a tool; it is best to be able to do basic stock selection, technical analysis, market trend research, grasp financial news, and predict the right timing.”

Short-term speculation is the most taboo:

1- Don't take too many moves:

I personally think that short-term speculation should not be carried out very often. It is sometimes easy to make mistakes when there are too many trades, and it is also easy to be misled by false timing, thus making wrong decisions.

2- Don't overfinance hype:

Short-term speculation is also easy to make mistakes. If you use a large amount of capital to buy stocks, when you make mistakes, it will make you panic and lose your mind easily.

3- Don't buy unfamiliar stocks:

Only play with the 300 stocks you have selected (you need to sort them well). These are all stocks you usually watch and have good fundamentals, so they are easier to operate. If you keep following the top ten popular stocks in US stocks that vary every day, you will definitely raise a white flag quickly, especially some small, messy pharmaceutical stocks. It's also common for them to drop 80% as soon as you enter the market.

The following provides several highly credible short-term rebound signals:

1- Stocks with good fundamentals fell 60% over a long period of time, falling from 100 yuan to breaking the 52-week minimum support line of 40 yuan, which means that a rebound will come at any time.

Please pay special attention. On Fridays, when trading is generally slow, the main force often struggles to push down at the last drop, causing the stock price to suddenly drop rapidly, get stuck at the bottom, and take the initiative to buy food quickly. This is the point of purchase.

2. Stock selection techniques for similar stocks:

Six relatively good cannabis stocks, solar energy stocks, or other types of stocks on one board, regardless of a long-term decline or rebound, or a sudden rebound in today's sharp decline. The reaction of similar stocks to prices is divided into quick and slow due to differences in weight. If two or three of them have already started to rebound, don't doubt it any more. If you look at the same trend chart, then take a quick shot.

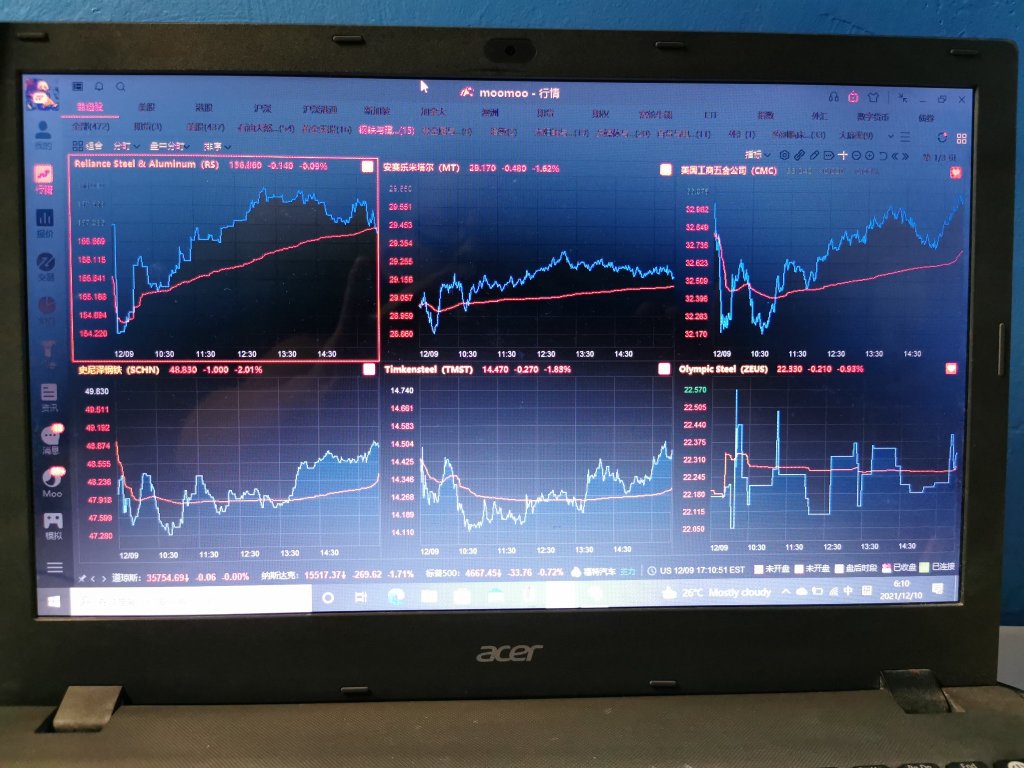

As shown in the picture, there are differences in reaction between the six steel infrastructure stocks, but in the end, the trend is recovering lost ground.

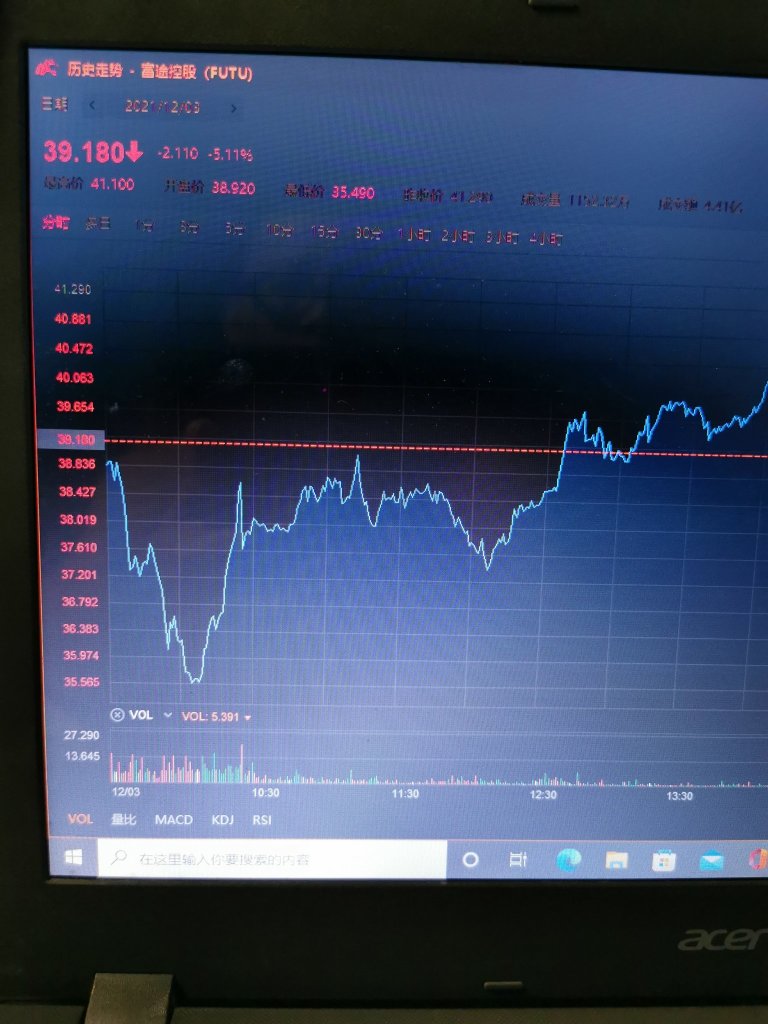

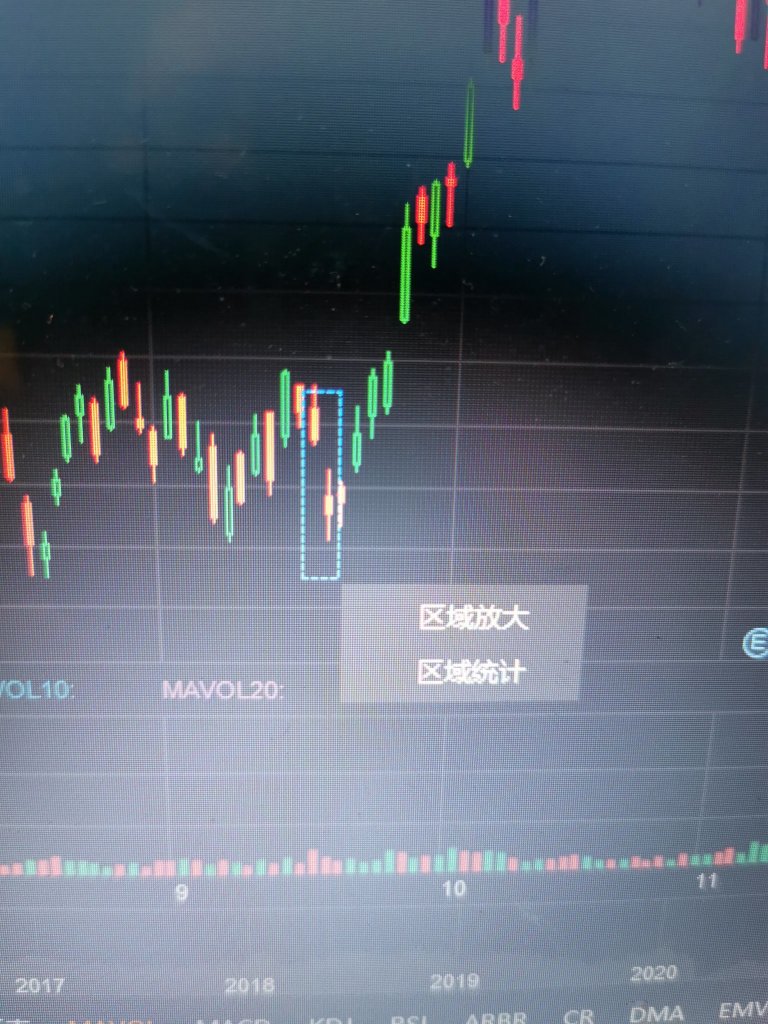

3- Keep a close eye on the long-term downward trend. The following stocks with the yin and yang candlestick marks suddenly appear. This sign can be seen before the day closes. After all, all FUTU provides is a real-time chart every minute (Futu Bull B), so there is enough time for you to buy, and it's just a mistake, and you won't lose much.

Remedies in case of errors:

Short-term players often experience selling stocks too early. As a result, stocks continue to rise, and speculators are often dumbfounded and overwhelmed. The following characteristics can help you make up your mind:

1- If you buy the wrong stock, the chart trend is one of the following:

It has been rising since the beginning, with little decline, and continued to rise. This type of trend is the strongest in the daily chart, and is stable and firm, and usually continues to rise until the closing of the market. So if you make a mistake in selling halfway through, you can make up for it when you pull it back a bit.

2- You've been holding on for a whole week. After you sold, he suddenly started to gain, don't hesitate to make up for it quickly. Don't forget that this was originally the stock you were looking for, and it was clearly analyzed before.

One last golden remark:

A stock market crash or financial turmoil has caused the stock market to plummet. Remember not to be afraid, seize the opportunity, and buy high-quality stocks that you can't usually buy at all. This stage is the stage where you can earn tens of trillions or even dollars, and it is the safest stage, because bookmakers don't have time to target you.

As for now, the US stock market is 36,000, and there are major economic problems. In addition to the COVID-19 pandemic, US inflation is getting worse and worse, and there are landmines everywhere. If you have your own funds for the short term, it will greatly reduce the risk of being trapped for a long time after a thunderstorm.

Since I've been in the stock market for a long time, I have accumulated rich experience when it comes to long-term and short-term investments. Here are some tips to share:

Stock selection: (only suitable for speculators with considerable experience in US stocks)

1. In order to reduce sudden losses, we must persist in the short term. Choose stocks with good fundamentals, and at least be more resistant to emergencies.

2- It must be actively traded in hot stocks. Investment groups, corporations, and companies participating in hot stocks are also sent in and out more frequently, making it easier to get out and enter.

3- You must choose stocks that often pull out of the Jiaotong University band. In the “W” movement trajectory, it is easy to grasp the highs and lows, and the volatility is high, making it easier to make a profit for the day.

Various types of analysis and judgment:

In fact, there is no absolutely correct technology or basic investment law in the stock market, because all research methods are hindsight. The rise and fall of stocks is completely undefined; it depends entirely on the chips in the hands of the bookmaker or main player.

All the technical indicators we have seen function like roadside signs, but the direction indicated is not eternal. When the dealer harvests, they can immediately replace the move forward with a U Turn. As a result, the technical and basic players all die together. Therefore, we must not be obsessed with a tool; it is best to be able to do basic stock selection, technical analysis, market trend research, grasp financial news, and predict the right timing.”

Short-term speculation is the most taboo:

1- Don't take too many moves:

I personally think that short-term speculation should not be carried out very often. It is sometimes easy to make mistakes when there are too many trades, and it is also easy to be misled by false timing, thus making wrong decisions.

2- Don't overfinance hype:

Short-term speculation is also easy to make mistakes. If you use a large amount of capital to buy stocks, when you make mistakes, it will make you panic and lose your mind easily.

3- Don't buy unfamiliar stocks:

Only play with the 300 stocks you have selected (you need to sort them well). These are all stocks you usually watch and have good fundamentals, so they are easier to operate. If you keep following the top ten popular stocks in US stocks that vary every day, you will definitely raise a white flag quickly, especially some small, messy pharmaceutical stocks. It's also common for them to drop 80% as soon as you enter the market.

The following provides several highly credible short-term rebound signals:

1- Stocks with good fundamentals fell 60% over a long period of time, falling from 100 yuan to breaking the 52-week minimum support line of 40 yuan, which means that a rebound will come at any time.

Please pay special attention. On Fridays, when trading is generally slow, the main force often struggles to push down at the last drop, causing the stock price to suddenly drop rapidly, get stuck at the bottom, and take the initiative to buy food quickly. This is the point of purchase.

2. Stock selection techniques for similar stocks:

Six relatively good cannabis stocks, solar energy stocks, or other types of stocks on one board, regardless of a long-term decline or rebound, or a sudden rebound in today's sharp decline. The reaction of similar stocks to prices is divided into quick and slow due to differences in weight. If two or three of them have already started to rebound, don't doubt it any more. If you look at the same trend chart, then take a quick shot.

As shown in the picture, there are differences in reaction between the six steel infrastructure stocks, but in the end, the trend is recovering lost ground.

3- Keep a close eye on the long-term downward trend. The following stocks with the yin and yang candlestick marks suddenly appear. This sign can be seen before the day closes. After all, all FUTU provides is a real-time chart every minute (Futu Bull B), so there is enough time for you to buy, and it's just a mistake, and you won't lose much.

Remedies in case of errors:

Short-term players often experience selling stocks too early. As a result, stocks continue to rise, and speculators are often dumbfounded and overwhelmed. The following characteristics can help you make up your mind:

1- If you buy the wrong stock, the chart trend is one of the following:

It has been rising since the beginning, with little decline, and continued to rise. This type of trend is the strongest in the daily chart, and is stable and firm, and usually continues to rise until the closing of the market. So if you make a mistake in selling halfway through, you can make up for it when you pull it back a bit.

2- You've been holding on for a whole week. After you sold, he suddenly started to gain, don't hesitate to make up for it quickly. Don't forget that this was originally the stock you were looking for, and it was clearly analyzed before.

One last golden remark:

A stock market crash or financial turmoil has caused the stock market to plummet. Remember not to be afraid, seize the opportunity, and buy high-quality stocks that you can't usually buy at all. This stage is the stage where you can earn tens of trillions or even dollars, and it is the safest stage, because bookmakers don't have time to target you.

As for now, the US stock market is 36,000, and there are major economic problems. In addition to the COVID-19 pandemic, US inflation is getting worse and worse, and there are landmines everywhere. If you have your own funds for the short term, it will greatly reduce the risk of being trapped for a long time after a thunderstorm.

Translated

+2

6

3

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)