elvinhuang

voted

Hey mooers! ![]()

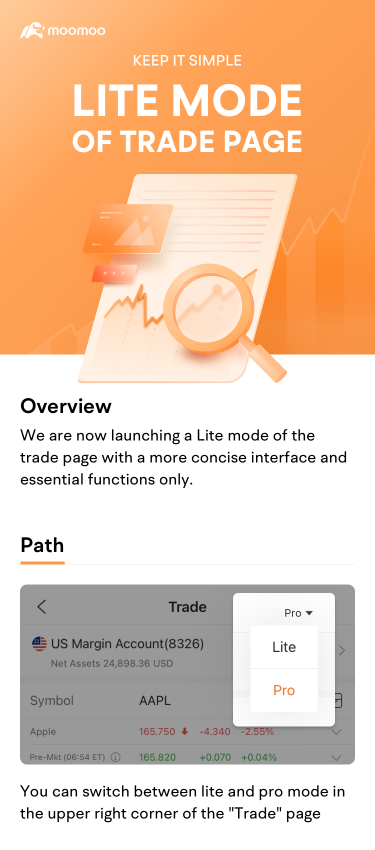

If you have recently made transactions on moomoo, you may come up with a question: why the trade page looks different?

This is exactly the main course today. Ladies and gentlemen, please allow Team moomoo to introduce you in detail, the Lite Mode of trade page.![]()

Let's gooooo!

You are welcome to share your experience and feedback on using the trade page in the comment area! And also don't forget you still got #Talk to PM to have a direct c...

If you have recently made transactions on moomoo, you may come up with a question: why the trade page looks different?

This is exactly the main course today. Ladies and gentlemen, please allow Team moomoo to introduce you in detail, the Lite Mode of trade page.

Let's gooooo!

You are welcome to share your experience and feedback on using the trade page in the comment area! And also don't forget you still got #Talk to PM to have a direct c...

35

32

elvinhuang

liked

Time flies!![]() You have completed another journey forCo-Wise: What push you to press the "trade" button?Thank you for all your participation. In this topic, 77% mooers chose to usefundamentalanalysis to "trade" stocks, 13% focused ontechnicalanalysis, while 10% relied onnews. @Marsnbsp;Mooosaid it's a game, just like the Squid Game. @mooboosaid that inflation made him trade. For more high-quality views from other mooers, let's take a look.

You have completed another journey forCo-Wise: What push you to press the "trade" button?Thank you for all your participation. In this topic, 77% mooers chose to usefundamentalanalysis to "trade" stocks, 13% focused ontechnicalanalysis, while 10% relied onnews. @Marsnbsp;Mooosaid it's a game, just like the Squid Game. @mooboosaid that inflation made him trade. For more high-quality views from other mooers, let's take a look.![]()

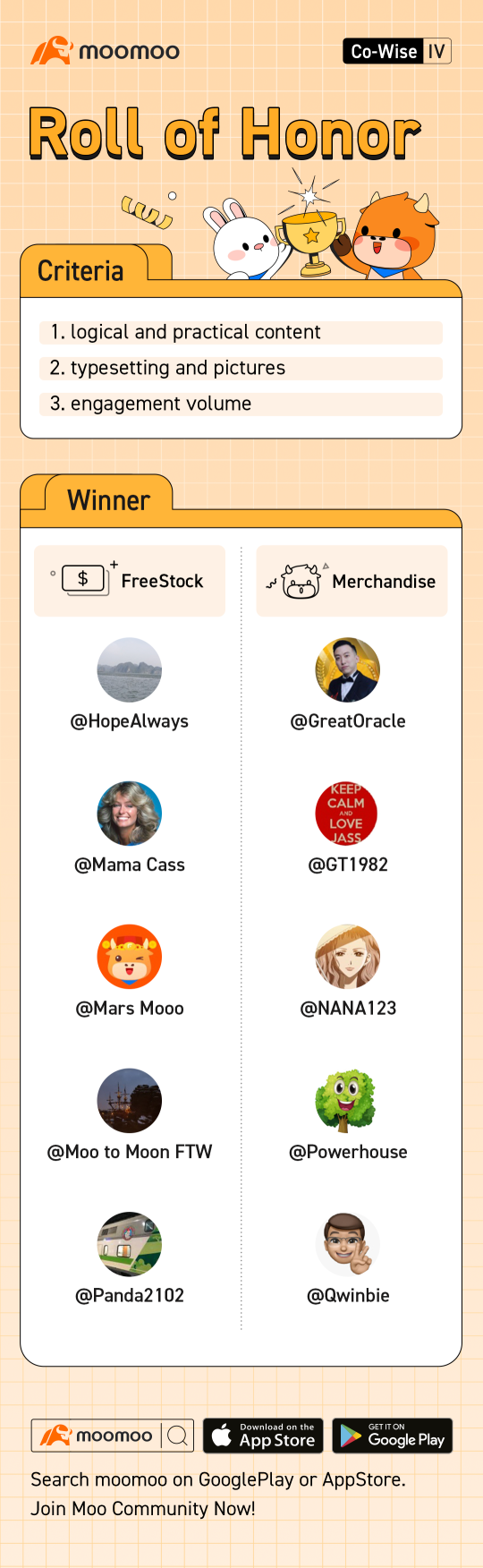

Here comes the reward for your hard work: 5 best postswill be rewarded with 1 specific stock respectively,5 outstanding postswill be rewarded with moomoo mascots, and other posts with a minimum of 30 words will be rewarded with88 points. Congratulations to all the winners!![]()

![]()

![]()

(*The following collection is sorted according to the first letter of the mooers' nicknames, which doesn't constitute a recommendation ranking)

*You will receive your rewards within 15 working days.

Part Ⅰ: High-Quality Article Collection

![]() Author: @GreatOracle

Author: @GreatOracle

Title:swing daily trader only use 20% fundamentals data

Opinion: I rely more on the technical stats. Checking: 1. MA 5, 10 and 20. 2. Williams %R (I only entry when the chart start to go over -20%) 3. MCD chart at Golden Cross. 4. Stochastic showing uptrend. 5. Check earnings date so it have time to rally up then try to sell 3 days before earnings date at peak price.

![]() Author: @GT1982

Author: @GT1982

Title:When Do I Press the Buy Button?

Opinion: I set several target prices to enter based on support/resistance levels over several time frames. When the price alert is triggered, I will not press the buy button straightaway. Rather, I treat it as a fluid figure which I will sit up and place closer attention to when hit.

![]() Author: @HopeAlways

Author: @HopeAlways

Title:Fundamental Analysis

Opinion: I would mainly use financial metrics to decide if a stock is attractively priced before I press the "trade" button. Learning how to interpret financial metrics help me to value a stock. The cornerstone financial metric to value a business is the price-to-earnings ratio or better known as P/E ratio.

![]() Author: @Moonbsp;tonbsp;Moonnbsp;FTW

Author: @Moonbsp;tonbsp;Moonnbsp;FTW

Title:What’s your beliefs and what’s your risk appetite?

Opinion: There can be many methods/indicators – be it theoretical, practical or luck (maybe)? In my opinion, I’m more of the 40-30-20-10. 40%: Research on the Company/Stock and anything related to it. 30%: The theoretical analysis. 20%: Reading on the news surrounding the Company/Stock, the Trend and what’s stirring the market. 10%: Luck!

![]() Author: @Mamanbsp;Cass

Author: @Mamanbsp;Cass

Title:Aha Fundamental Trade Button Motivators

Opinion: Does this company provide a product or service that I will use in ANY economy? If the answer is "no", then I don't care how pretty they are on paper, I'm out. If the answer is "yes" then I'm jumping up and down on that Trade button! Never invest in a business you can't understand.

![]() Author: @Marsnbsp;Mooo

Author: @Marsnbsp;Mooo

Title:This is just a game

Opinion: As for me, pressing the trade button is more of like a game, just like the television series, Squid Game, which is now streaming in NFLX. In Squid Game, players does not only uses their skills, they also relies on information (or news) and luck in order to be alive for the next game.

![]() Author: @NANA123

Author: @NANA123

Title:Which strategy prompted you to press the "trade" button?

Opinion: I think we should figure out what the trading model is before confirming our stock picking ideas. I only participate in those stocks whose daily line has just broken through the half-year line or the annual line, use a standard to define the trend, and then filter out all the stocks that don't have a trend.

![]() Author: @Powerhouse

Author: @Powerhouse

Title:Money and cash return will drive you to trade now!

Opinion: There is no 100% right or wrong as to when to click trade for a stock but rather, the best use of information at that moment to make the best decision. The sooner you get in, the better. Don't wait to buy stocks. Buy stocks and wait. Time in the market beats timing the market.

![]() Author: @Panda2102

Author: @Panda2102

Title:Best time to press the trade button

Opinion: After I done my macro level research and zoomed into a list of selected companies, I put them through a framework and score them. The mission statement, the moat, the network effect, the switching cost, low cost advantage, optionality, the ratio for PE, PEG, Cash, Debt, Free Cash flow and the ownership of the company.

![]() Author: @Qwinbie

Author: @Qwinbie

Title:What Push You to Press The Trade Button?

Opinion: After selecting a bundle of high-quality stocks in the stock screener, I will have five shortlisted stocks. I will see the GMMA indicator of all the 5 stocks and decide which one has the most suitable price to buy. Once the analysis is done, I will press the “trade button” based on my monthly budget.

After reading these wonderful posts, mooers might say "Time in the market is much better than timing the market." Most mooers follow the advice given by great Warren Buffets and have their own trading systems.![]() If you want to view more, please click the topic again:What push you to press the "trade" button?And you can find some writing inspiration from @moomoo Academy:How to quickly select position stocks from your watchlists?Share your thoughts and join the discussion. Don't forget to leave your comment and tell mooers about what you have learned.

If you want to view more, please click the topic again:What push you to press the "trade" button?And you can find some writing inspiration from @moomoo Academy:How to quickly select position stocks from your watchlists?Share your thoughts and join the discussion. Don't forget to leave your comment and tell mooers about what you have learned.![]()

Part Ⅱ: Vote for "Mentor Moo"

It's voting time again. Now let's choose the Mentor Moo for this topic. Whose ideas do you think are the best and how can you learn more from him/her?![]()

The selection rules will take into account the following factors: logical and practical content, type setting and pictures, and interaction with other mooers.

The one who gets the most votes at the end of the poll will win the "mentor moo" title. What a crowning honor!![]() Come and support your favorite tutor, your vote means a lot to them.

Come and support your favorite tutor, your vote means a lot to them.

A systematic framework for decision making can help simplify the process and maximize returns. Tell us what you gained from this topic in the comments section. In three days, our new "Mentor Moo" will be published. Let's see who can get the majority's support and gain this glory. If you want to be honored too, please join in the next topic! Looking forward to your views.![]()

Disclaimer:All investment involves risk. Neither Futu Inc, nor Futu SG, nor moomoo endorses any particular investment strategy. You should carefully consider your investment goals and objectives when deciding on an investment strategy. Past performance is no guarantee of future results.

Here comes the reward for your hard work: 5 best postswill be rewarded with 1 specific stock respectively,5 outstanding postswill be rewarded with moomoo mascots, and other posts with a minimum of 30 words will be rewarded with88 points. Congratulations to all the winners!

(*The following collection is sorted according to the first letter of the mooers' nicknames, which doesn't constitute a recommendation ranking)

*You will receive your rewards within 15 working days.

Part Ⅰ: High-Quality Article Collection

Title:swing daily trader only use 20% fundamentals data

Opinion: I rely more on the technical stats. Checking: 1. MA 5, 10 and 20. 2. Williams %R (I only entry when the chart start to go over -20%) 3. MCD chart at Golden Cross. 4. Stochastic showing uptrend. 5. Check earnings date so it have time to rally up then try to sell 3 days before earnings date at peak price.

Title:When Do I Press the Buy Button?

Opinion: I set several target prices to enter based on support/resistance levels over several time frames. When the price alert is triggered, I will not press the buy button straightaway. Rather, I treat it as a fluid figure which I will sit up and place closer attention to when hit.

Title:Fundamental Analysis

Opinion: I would mainly use financial metrics to decide if a stock is attractively priced before I press the "trade" button. Learning how to interpret financial metrics help me to value a stock. The cornerstone financial metric to value a business is the price-to-earnings ratio or better known as P/E ratio.

Title:What’s your beliefs and what’s your risk appetite?

Opinion: There can be many methods/indicators – be it theoretical, practical or luck (maybe)? In my opinion, I’m more of the 40-30-20-10. 40%: Research on the Company/Stock and anything related to it. 30%: The theoretical analysis. 20%: Reading on the news surrounding the Company/Stock, the Trend and what’s stirring the market. 10%: Luck!

Title:Aha Fundamental Trade Button Motivators

Opinion: Does this company provide a product or service that I will use in ANY economy? If the answer is "no", then I don't care how pretty they are on paper, I'm out. If the answer is "yes" then I'm jumping up and down on that Trade button! Never invest in a business you can't understand.

Title:This is just a game

Opinion: As for me, pressing the trade button is more of like a game, just like the television series, Squid Game, which is now streaming in NFLX. In Squid Game, players does not only uses their skills, they also relies on information (or news) and luck in order to be alive for the next game.

Title:Which strategy prompted you to press the "trade" button?

Opinion: I think we should figure out what the trading model is before confirming our stock picking ideas. I only participate in those stocks whose daily line has just broken through the half-year line or the annual line, use a standard to define the trend, and then filter out all the stocks that don't have a trend.

Title:Money and cash return will drive you to trade now!

Opinion: There is no 100% right or wrong as to when to click trade for a stock but rather, the best use of information at that moment to make the best decision. The sooner you get in, the better. Don't wait to buy stocks. Buy stocks and wait. Time in the market beats timing the market.

Title:Best time to press the trade button

Opinion: After I done my macro level research and zoomed into a list of selected companies, I put them through a framework and score them. The mission statement, the moat, the network effect, the switching cost, low cost advantage, optionality, the ratio for PE, PEG, Cash, Debt, Free Cash flow and the ownership of the company.

Title:What Push You to Press The Trade Button?

Opinion: After selecting a bundle of high-quality stocks in the stock screener, I will have five shortlisted stocks. I will see the GMMA indicator of all the 5 stocks and decide which one has the most suitable price to buy. Once the analysis is done, I will press the “trade button” based on my monthly budget.

After reading these wonderful posts, mooers might say "Time in the market is much better than timing the market." Most mooers follow the advice given by great Warren Buffets and have their own trading systems.

Part Ⅱ: Vote for "Mentor Moo"

It's voting time again. Now let's choose the Mentor Moo for this topic. Whose ideas do you think are the best and how can you learn more from him/her?

The selection rules will take into account the following factors: logical and practical content, type setting and pictures, and interaction with other mooers.

The one who gets the most votes at the end of the poll will win the "mentor moo" title. What a crowning honor!

A systematic framework for decision making can help simplify the process and maximize returns. Tell us what you gained from this topic in the comments section. In three days, our new "Mentor Moo" will be published. Let's see who can get the majority's support and gain this glory. If you want to be honored too, please join in the next topic! Looking forward to your views.

Disclaimer:All investment involves risk. Neither Futu Inc, nor Futu SG, nor moomoo endorses any particular investment strategy. You should carefully consider your investment goals and objectives when deciding on an investment strategy. Past performance is no guarantee of future results.

140

59

elvinhuang

liked

When it comes to trading lingo, it’s a jungle out there, with trading expressions that can be difficult to understand. We’ve rounded up the usual suspects and tamed them into short definitions so you can speculate with confidence. ![]()

![]() First and foremost, let's say a big thanks to our amazing mooers to contribute so many good ideas by joining the topic #What lingos did you learn along the way? Thank you all!

First and foremost, let's say a big thanks to our amazing mooers to contribute so many good ideas by joining the topic #What lingos did you learn along the way? Thank you all!

Please leave a thumbs-up or share it if you find this useful!

![]()

![]() Basic Terms

Basic Terms

Stonk: an intentional misspelling of stock

YOLO - You only live once and refers to people who invest heavily in a certain stock

HODL - Slang for "hold your position" and resist the urge to sell your holdings.

Hold the Line - A battle cry for users during volatility in the markets. When stocks favored by the forum began to drop, appeals to “hold the line” became common.

Falling knife - Refers to a sharp drop, which is commonly used in phrases like, "don't try to catch a falling knife," which can be translated to mean, "wait for the price to bottom out before buying it."

Hanging man - is a bearish candlestick pattern that forms at the end of an uptrend and warns of lower prices to come

Inverted hammer - a type of candlestick pattern found after a downtrend and is usually taken to be a trend-reversal signal

Gay Bear - It refers to people who WANT stocks to go down, and are seeking to profit off of the position, as “gay bears.” They are denoted by a picture of an LBGT flag and a bear emoji, or sometimes a strange video clip of dancing animated bears

I Eat Crayons - More subversive self-deprecation, often used by members of the group to imply that their foolhardy bets, and possible resulting losses, should not be mistaken for formal investment expertise

Paytience - Used as a reminder that patience generally pays off

Restricted Shares - Shares only available to company insiders

Tenbanger - An investment that rises to 10* its purchase price (or has the potential to do so)

Odd Lot - A trade where the position size is less than the standard lot

Babysitting - Holding onto a trade, despite losses, in the hope of breaking even or making a profit if the market turns around

Dark Pools - Liquidity that exists between institutions on private exchanges, and is not available to the public

Dip - The rapid decrease in the value of a coin or stock, or an entire market

Fiat - Currency issued by the government, e.g. US dollar

Circuit breakers - temporary measures that halt trading to curb panic-selling on stock exchanges

![]()

![]()

![]() Animals in Trading

Animals in Trading

Bulls - an upward trending market, a cycle of growth; the optimists who often go long

Bears - a depressed and/or downward-trending market; the bearish trader or investor is pessimistic

Stags - a short-term speculator, usually refers to a day trader, the opportunists

Wolves - the unethical stock market wunderkinds famous for unscrupulous success

Rabbits - the scalpers who buy shares for very short periods of time, ranging from a couple of weeks to intra-day buying and selling

Turtles - the long-term trader, trend-following trader

Pigs - the slaughtered, high-risk investors who is greedy, having forgotten their original investment strategy to focus on securing unrealistic future gains.

Ostrich - the ignorant investors who tend to ignore the bad news and bury their heads in the figurative sand.

Chicken - the fearful investors that are highly risk-averse and are really afraid to lose any amount. They are driven with so much fear that it sometimes overrides their common sense in making sound investment decisions.

Sheep - the herd-follower who lacks discipline and whose trading strategy is unfocused and predicated on the suggestions of others.

Whales - Whales are movers and shakers (whether a trust, bank or even an individual) with such a lot of capital that their buys and sells make waves in the market.

Bearwhale - Someone with a large position in a particular coin but with a 'bearish' vision.

Bullwhale - Someone with a large position in a particular coin but with a 'bullish' vision.

Apes - the meme, favorite strategy: HODL, favorite destination: moon /Moon and favorite mode of transport: rocket

Black swans - they look beautiful in white. But adding the word “black” – it killed it which resulting in a meaning of a completely unforeseen and unexpected stance

Grey rhinos - preparing for highly probable events that potentially could have a high impact. They are often neglected, are not random surprises, but occur after a series of warnings and visible evidence.

Unicorns - startups that have come to be valued at $1 billion or more

Hawks and doves - the central bank’s decisions regarding interest rates. ‘Hawkish’ are those in favour of raising the interest rate and a tighter monetary policy to curb inflation. A meeker ‘dove’ stance is of the opinion that the central bank should keep interest rates low or flat.

![]()

![]() Popular slang to define market/ investor moves

Popular slang to define market/ investor moves

Tanking - When a market falls suddenly.

Short squeeze - When traders who hold short positions are forced to close their trades due to the rapid price increase.

Long squeeze - the opposite of short squeeze when a market drops significantly and unexpectedly very quickly

Jigged out - when the market turns against a general trend, forcing traders to close their position.

Flip - Buying and selling for a quick profit, usually intraday.

Gamma squeeze - It occurs when the price of a stock surges in a short period of time, often associated with the purchase of call options to drive up the price.

The dead cat bounce - the last gap rallying movement of a ‘dead market, when a stock’s price rises from depression briefly, only to fall again.

Crunching - A market's price falling rapidly and going beyond a presumed support level.

Sell-off (Dumping) - When an abnormal amount of traders are selling a position.

Buy the dip - Place the trade when the price is down, on the assumption that it will rebound soon enough.

Pump and dump - A group of investors colluded and bought the same stock at the same time to momentarily drive up the price of the stock and to sell it a short time later to turn them into a profit. Thereafter the price will drop back to the normal level.

Bottom fishing - Buying or going long on securities after their prices have fallen considerably, expecting they will rise in time.

Ask slapping - Buying shares at the ask price.

Choppy - High volatility within a narrow range.

![]()

![]() WSB Special

WSB Special

To the moon - a rallying cry for certain stocks

ATH - all time high

Apes together strong - It's a clique or expression of solidarity with other common investors going for the same goal like buying AMC to the moon.

Paper hands - It means the investor is quick ot sell a stock at the first sign of trouble.

Diamond hands - Continuing to hold a stock despite losses, adversity, and volatility, confident that the price will increase.

DFV - Refers to the aforementioned Reddit user DeepF--kingValue, who posted about making call options for GameStop stock (NYSE:GME) and became the “granddaddy” of the GME stock surge

ROARING KITTY - The social media pseudonym of Keith Gill, a financial adviser in Massachusetts whose Reddit posts and YouTube video streams helped drive interest in GameStop's stock.

Bagholder - Someone who holds on to a coin or stock that has dropped in price and hopes it increases to the price where they originally purchased.

TENDIES - Shorthand for chicken tenders, which WSB uses as slang for profits on a trade.

![]()

![]() Acronym

Acronym

DD - Due diligence

DYODD- Do you own due diligence

FOMO - Fear of missing out

FUD - Fear, Uncertainty, and Doubt

MOASS - mother of all short squeezes

DYOR - Do your own research

PAD - Pump and Dump

NHOD - New High Of Day

OTM - Out of the money

ITM - In the money

FTD - Fail to deliver

HFT - High frequency trading

AMA - Ask me Anything

ATL - All Time Low, when coins or stock breaks its previous lowest price record.

BTD - Buy the dip

DCA - Dollar-cost averaging, an investment technique where a fixed sum of money is used to invest in coin or stocks.

DCB - Dead Cat Bounce, a brief price recovery before a major crash.

FA - Fundamental Analysis, a method to evaluate an investment by looking at its intrinsic value.

ETF - Exchange-Traded-Fund, a tradable product that follows the price of an underlying asset.

JOMO - Joy of Missing Out, refers to someone who is happy for not taking a certain position as the price keep on dropping.

Lambo - Abbreviation of Lamborghini, used often when the price is going to rise sharply so that one can pay for such car with the winnings.

LEAPS - long-term equity anticipation security, basically an options that is has a very long expiry (>=1 year).

PMCC - Poor man covered call. Using a deep in the money call LEAPS to cover the call option instead of the underlying stock (generally lower upfront payment)

![]()

![]() Crypto Special

Crypto Special

2FA (2 Factor Authentication) - A double layer security used to provide double protection to user account.

51% Attack - A possible attack on blockchain by a group of miners who hold more than 50% of the hash rate.

Airdrop - A way to distribute coins to end users for free or exchange for performing a small task.

Altcoin - Any cryptocurrency that is not bitcoin.

ICO - Initial Coin Offering. Issued to be exchanged on launch. Similar to IPO's.

Paper Wallet - The public and private keys of the cryptocurrency wallet held on a piece of paper.

Gas - Fee paid to miners for executing a transaction on the Ethereum blockchain.

POW - Proof of work, a requirement defined by computer calculation.

REKT - Used in the crypto community to indicate huge losses.

SAFU - A term used in cryptocurrency world to mean safe.

Wholecoiner - Someone who owns 1 full Bitcoin

Nocoiner - A person who does not possess any cryptocurrency.

OCD - Obsessive Cryptocurrency Disorder, for people who cannot stop monitoring their cryptocurrency daily.

Hot Wallet - Storing of crypto coins online, connected to the Internet.

Cold Wallet - Storing of crypto coins offline.

DAO - Decentralized Autonomous Organization, whereby it run by itself without any human interventions.

DEX - Decentralized Exchange, where people can do trading without the need of a middleman.

![]()

![]() Give a thumbs-up to acknowledge mooers' contribution and share this post if you find this useful!

Give a thumbs-up to acknowledge mooers' contribution and share this post if you find this useful!![]()

![]()

![]()

![]()

![]()

Cheers!

Please leave a thumbs-up or share it if you find this useful!

Stonk: an intentional misspelling of stock

YOLO - You only live once and refers to people who invest heavily in a certain stock

HODL - Slang for "hold your position" and resist the urge to sell your holdings.

Hold the Line - A battle cry for users during volatility in the markets. When stocks favored by the forum began to drop, appeals to “hold the line” became common.

Falling knife - Refers to a sharp drop, which is commonly used in phrases like, "don't try to catch a falling knife," which can be translated to mean, "wait for the price to bottom out before buying it."

Hanging man - is a bearish candlestick pattern that forms at the end of an uptrend and warns of lower prices to come

Inverted hammer - a type of candlestick pattern found after a downtrend and is usually taken to be a trend-reversal signal

Gay Bear - It refers to people who WANT stocks to go down, and are seeking to profit off of the position, as “gay bears.” They are denoted by a picture of an LBGT flag and a bear emoji, or sometimes a strange video clip of dancing animated bears

I Eat Crayons - More subversive self-deprecation, often used by members of the group to imply that their foolhardy bets, and possible resulting losses, should not be mistaken for formal investment expertise

Paytience - Used as a reminder that patience generally pays off

Restricted Shares - Shares only available to company insiders

Tenbanger - An investment that rises to 10* its purchase price (or has the potential to do so)

Odd Lot - A trade where the position size is less than the standard lot

Babysitting - Holding onto a trade, despite losses, in the hope of breaking even or making a profit if the market turns around

Dark Pools - Liquidity that exists between institutions on private exchanges, and is not available to the public

Dip - The rapid decrease in the value of a coin or stock, or an entire market

Fiat - Currency issued by the government, e.g. US dollar

Circuit breakers - temporary measures that halt trading to curb panic-selling on stock exchanges

Bulls - an upward trending market, a cycle of growth; the optimists who often go long

Bears - a depressed and/or downward-trending market; the bearish trader or investor is pessimistic

Stags - a short-term speculator, usually refers to a day trader, the opportunists

Wolves - the unethical stock market wunderkinds famous for unscrupulous success

Rabbits - the scalpers who buy shares for very short periods of time, ranging from a couple of weeks to intra-day buying and selling

Turtles - the long-term trader, trend-following trader

Pigs - the slaughtered, high-risk investors who is greedy, having forgotten their original investment strategy to focus on securing unrealistic future gains.

Ostrich - the ignorant investors who tend to ignore the bad news and bury their heads in the figurative sand.

Chicken - the fearful investors that are highly risk-averse and are really afraid to lose any amount. They are driven with so much fear that it sometimes overrides their common sense in making sound investment decisions.

Sheep - the herd-follower who lacks discipline and whose trading strategy is unfocused and predicated on the suggestions of others.

Whales - Whales are movers and shakers (whether a trust, bank or even an individual) with such a lot of capital that their buys and sells make waves in the market.

Bearwhale - Someone with a large position in a particular coin but with a 'bearish' vision.

Bullwhale - Someone with a large position in a particular coin but with a 'bullish' vision.

Apes - the meme, favorite strategy: HODL, favorite destination: moon /Moon and favorite mode of transport: rocket

Black swans - they look beautiful in white. But adding the word “black” – it killed it which resulting in a meaning of a completely unforeseen and unexpected stance

Grey rhinos - preparing for highly probable events that potentially could have a high impact. They are often neglected, are not random surprises, but occur after a series of warnings and visible evidence.

Unicorns - startups that have come to be valued at $1 billion or more

Hawks and doves - the central bank’s decisions regarding interest rates. ‘Hawkish’ are those in favour of raising the interest rate and a tighter monetary policy to curb inflation. A meeker ‘dove’ stance is of the opinion that the central bank should keep interest rates low or flat.

Tanking - When a market falls suddenly.

Short squeeze - When traders who hold short positions are forced to close their trades due to the rapid price increase.

Long squeeze - the opposite of short squeeze when a market drops significantly and unexpectedly very quickly

Jigged out - when the market turns against a general trend, forcing traders to close their position.

Flip - Buying and selling for a quick profit, usually intraday.

Gamma squeeze - It occurs when the price of a stock surges in a short period of time, often associated with the purchase of call options to drive up the price.

The dead cat bounce - the last gap rallying movement of a ‘dead market, when a stock’s price rises from depression briefly, only to fall again.

Crunching - A market's price falling rapidly and going beyond a presumed support level.

Sell-off (Dumping) - When an abnormal amount of traders are selling a position.

Buy the dip - Place the trade when the price is down, on the assumption that it will rebound soon enough.

Pump and dump - A group of investors colluded and bought the same stock at the same time to momentarily drive up the price of the stock and to sell it a short time later to turn them into a profit. Thereafter the price will drop back to the normal level.

Bottom fishing - Buying or going long on securities after their prices have fallen considerably, expecting they will rise in time.

Ask slapping - Buying shares at the ask price.

Choppy - High volatility within a narrow range.

To the moon - a rallying cry for certain stocks

ATH - all time high

Apes together strong - It's a clique or expression of solidarity with other common investors going for the same goal like buying AMC to the moon.

Paper hands - It means the investor is quick ot sell a stock at the first sign of trouble.

Diamond hands - Continuing to hold a stock despite losses, adversity, and volatility, confident that the price will increase.

DFV - Refers to the aforementioned Reddit user DeepF--kingValue, who posted about making call options for GameStop stock (NYSE:GME) and became the “granddaddy” of the GME stock surge

ROARING KITTY - The social media pseudonym of Keith Gill, a financial adviser in Massachusetts whose Reddit posts and YouTube video streams helped drive interest in GameStop's stock.

Bagholder - Someone who holds on to a coin or stock that has dropped in price and hopes it increases to the price where they originally purchased.

TENDIES - Shorthand for chicken tenders, which WSB uses as slang for profits on a trade.

DD - Due diligence

DYODD- Do you own due diligence

FOMO - Fear of missing out

FUD - Fear, Uncertainty, and Doubt

MOASS - mother of all short squeezes

DYOR - Do your own research

PAD - Pump and Dump

NHOD - New High Of Day

OTM - Out of the money

ITM - In the money

FTD - Fail to deliver

HFT - High frequency trading

AMA - Ask me Anything

ATL - All Time Low, when coins or stock breaks its previous lowest price record.

BTD - Buy the dip

DCA - Dollar-cost averaging, an investment technique where a fixed sum of money is used to invest in coin or stocks.

DCB - Dead Cat Bounce, a brief price recovery before a major crash.

FA - Fundamental Analysis, a method to evaluate an investment by looking at its intrinsic value.

ETF - Exchange-Traded-Fund, a tradable product that follows the price of an underlying asset.

JOMO - Joy of Missing Out, refers to someone who is happy for not taking a certain position as the price keep on dropping.

Lambo - Abbreviation of Lamborghini, used often when the price is going to rise sharply so that one can pay for such car with the winnings.

LEAPS - long-term equity anticipation security, basically an options that is has a very long expiry (>=1 year).

PMCC - Poor man covered call. Using a deep in the money call LEAPS to cover the call option instead of the underlying stock (generally lower upfront payment)

2FA (2 Factor Authentication) - A double layer security used to provide double protection to user account.

51% Attack - A possible attack on blockchain by a group of miners who hold more than 50% of the hash rate.

Airdrop - A way to distribute coins to end users for free or exchange for performing a small task.

Altcoin - Any cryptocurrency that is not bitcoin.

ICO - Initial Coin Offering. Issued to be exchanged on launch. Similar to IPO's.

Paper Wallet - The public and private keys of the cryptocurrency wallet held on a piece of paper.

Gas - Fee paid to miners for executing a transaction on the Ethereum blockchain.

POW - Proof of work, a requirement defined by computer calculation.

REKT - Used in the crypto community to indicate huge losses.

SAFU - A term used in cryptocurrency world to mean safe.

Wholecoiner - Someone who owns 1 full Bitcoin

Nocoiner - A person who does not possess any cryptocurrency.

OCD - Obsessive Cryptocurrency Disorder, for people who cannot stop monitoring their cryptocurrency daily.

Hot Wallet - Storing of crypto coins online, connected to the Internet.

Cold Wallet - Storing of crypto coins offline.

DAO - Decentralized Autonomous Organization, whereby it run by itself without any human interventions.

DEX - Decentralized Exchange, where people can do trading without the need of a middleman.

Cheers!

377

23

elvinhuang

liked

$Apple(AAPL.US$ $Intel(INTC.US$ He reminds me a little of Bill Gates but a little more fun.

I also like the plan for the next 5 years. They have a terrific balance sheet and while down a little right now they certainly aren't out. If they'd have persisted Bob Swan for 2 or 3 more years I think they'd be going down the road of IBM but with Pat i think they have brought in the right guy at the right time.

All buys are speculative of course but I'm buying at these levels and i'm totally happy to sit on the dividend income until things turn around... which of course is no guarantee but even if they do we are probably talking 2-3 years here at the earliest.

I also think mobileye is their ace in the hole. There are companies that are 5x behind mobileye with their technology and have marketcaps in the 15-20b dollar range in this crazy market. So the fact you get the thrown in as a freebie with intel just makes it a no brainer - for me at least.

I also like the plan for the next 5 years. They have a terrific balance sheet and while down a little right now they certainly aren't out. If they'd have persisted Bob Swan for 2 or 3 more years I think they'd be going down the road of IBM but with Pat i think they have brought in the right guy at the right time.

All buys are speculative of course but I'm buying at these levels and i'm totally happy to sit on the dividend income until things turn around... which of course is no guarantee but even if they do we are probably talking 2-3 years here at the earliest.

I also think mobileye is their ace in the hole. There are companies that are 5x behind mobileye with their technology and have marketcaps in the 15-20b dollar range in this crazy market. So the fact you get the thrown in as a freebie with intel just makes it a no brainer - for me at least.

12

elvinhuang

liked

$DBS Group Holdings(D05.SG$ This Week Will Break @32 🚀🚀

Translated

32

elvinhuang

liked

$DBS Group Holdings(D05.SG$ Soar to the sky in a flash

Translated

3

$Intel(INTC.US$ maintaining at this price for an hour 😅

elvinhuang

liked

Dear mooers, $Tesla(TSLA.US$ Q3 earnings conference call is coming up! How will this affect the stock price? What are you expecting from the market?

Earnings are definitely one ofthe most important driver of individual stock performance. Investors' perception and emotion are real strengths for the market!

What's your opinion on the trend of Tesla after the earnings release?

Win Reward:

Place your bet on TSLA's closing price (i.e.+3%) of Oct 21 ET / Oct 22 SGT before Oct 21 4:00 AM ET / Oct 22 4:00 PM SGT. The mooer with the closest bet will win 300 points!

You may also interested in:

Win ARK ETF: How Earnings Affect Stock Price?

Earnings are definitely one ofthe most important driver of individual stock performance. Investors' perception and emotion are real strengths for the market!

What's your opinion on the trend of Tesla after the earnings release?

Win Reward:

Place your bet on TSLA's closing price (i.e.+3%) of Oct 21 ET / Oct 22 SGT before Oct 21 4:00 AM ET / Oct 22 4:00 PM SGT. The mooer with the closest bet will win 300 points!

You may also interested in:

Win ARK ETF: How Earnings Affect Stock Price?

195

80

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)