ETF save the world

liked

3

ETF save the world

liked

$iShares 20+ Year Treasury Bond ETF (TLT.US)$

10 year yield on way to hit 5%

10 year yield on way to hit 5%

1

ETF save the world

liked

$Sheng Siong (OV8.SG)$ This is the beginning of an uptrend.

6

ETF save the world

liked

4

3

ETF save the world

voted

ETF save the world

liked

Translated

2

ETF save the world

liked

Just saying hi.

There hasn't been much activity recently, still the following four. Except xlv being a drag on eli lilly and co's performance, the rest are quite explosive. However, it's probably close to the end of this surge to 6000 points. After all, Trump has not taken office yet, maybe a bit overpriced.

$NVIDIA (NVDA.US)$

$The Health Care Select Sector SPDR® Fund (XLV.US)$

$Tesla (TSLA.US)$

$Bitcoin (BTC.CC)$

There hasn't been much activity recently, still the following four. Except xlv being a drag on eli lilly and co's performance, the rest are quite explosive. However, it's probably close to the end of this surge to 6000 points. After all, Trump has not taken office yet, maybe a bit overpriced.

$NVIDIA (NVDA.US)$

$The Health Care Select Sector SPDR® Fund (XLV.US)$

$Tesla (TSLA.US)$

$Bitcoin (BTC.CC)$

Translated

9

6

ETF save the world

liked

$iShares 20+ Year Treasury Bond ETF (TLT.US)$ $90 for 100 shares lying flat.

Translated

5

ETF save the world

voted

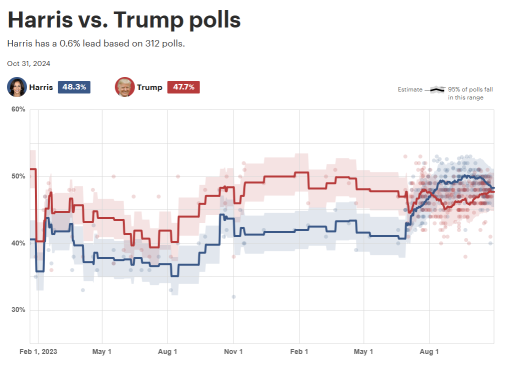

$Kamala Harris (LIST22990.US)$

Harris Trade Investment Opportunities:

1. Core Concept Stocks:

- Clean Energy Leaders: $First Solar (FSLR.US)$ , $NextEra Energy (NEE.US)$, $Bloom Energy (BE.US)$

- Electric Vehicle Supply Chain: $Tesla (TSLA.US)$ , $Rivian Automotive (RIVN.US)$ , $Lucid Group (LCID.US)$

- ESG-themed ETFs: $iShares Global Clean Energy ETF (ICLN.US)$ , �������...

23

14

17

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)