ex whywhyzee

commented on

$Advanced Micro Devices (AMD.US)$ why suddenly drop so much this few days?

4

ex whywhyzee

commented on

It's 60%of my portfolio and I have an average up to 6.57 per share after adding more at 20

So, fortunate enough to not technically be in the red. But my over all portfolio has decreased by over 300k since October so it's a little discouraging, but I'm holding for at least a few years, so I'm not really worried about the long term. $NIO Inc (NIO.US)$

How much are you losing on nio? How much of your portfolio is it?

So, fortunate enough to not technically be in the red. But my over all portfolio has decreased by over 300k since October so it's a little discouraging, but I'm holding for at least a few years, so I'm not really worried about the long term. $NIO Inc (NIO.US)$

How much are you losing on nio? How much of your portfolio is it?

4

2

ex whywhyzee

commented on

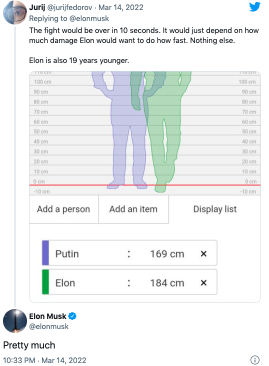

Columns Vote Now | Elon Musk challenges Vladimir Putin for 'single combat', says 'stakes are Ukraine'

“I hereby challenge Vladimir Putin to single combat,” Musk wrote on $Twitter (Delisted) (TWTR.US)$ Monday. “Stakes are Ukraine.”

Musk wrote out both Putin’s name and the word “Ukraine” in Cyrillic script.

But while Putin’s name was written out in Russian, “Ukraine” was written in Ukrainian, a show of support from the world’s richest man toward the plight of Ukrainian citizens after Russia’s unprovoked invasion ...

Musk wrote out both Putin’s name and the word “Ukraine” in Cyrillic script.

But while Putin’s name was written out in Russian, “Ukraine” was written in Ukrainian, a show of support from the world’s richest man toward the plight of Ukrainian citizens after Russia’s unprovoked invasion ...

42

54

ex whywhyzee

commented on

Weekly market recap

Stocks are coming off a losing week after last month's consumer price index made its largest annual increase in more than three decades. The major averages snapped a five-week winning streak.

The $Dow Jones Industrial Average (.DJI.US)$ dipped 0.6% and the $S&P 500 Index (.SPX.US)$ eased 0.3% last week. The tech-focused $Nasdaq Composite Index (.IXIC.US)$ was the main underperformer, dropping 0.7% as rising bond yields dented growth pockets of the market.

Here's a look at the return of S&P 500 sectors

This week ahead in focus

Third-quarter earnings season is entering the period when retailers dominate the daily reports. Big names will include Advance Auto Parts on Monday, followed by Walmart and Home Depot on Tuesday. Then Target, Lowe's, and TJX report on Wednesday and Alibaba Group Holding go on Thursday.

Non-retail highlights on the earnings calendar this week will include Lucid Group and Tyson Foods on Monday, Nvidia and Cisco Systems on Wednesday, and Applied Materials on Thursday.

Economic data releases this week include the Census Bureau's October retail-sales report on Tuesday and the Conference Board's Leading Economic Index for October on Thursday. Both are forecast to have climbed 0.8% from September.

Monday 11/15

$Advance Auto Parts (AAP.US)$ , $Lucid Group (LCID.US)$ , $Tyson Foods (TSN.US)$ , and $Warner Music (WMG.US)$ release quarterly results.

$Automatic Data Processing (ADP.US)$ hosts its 2021 investor day in Roseland, N.J.

Tuesday 11/16

$Walmart (WMT.US)$ reports third-quarter fiscal-2022 earnings before the opening bell. Shares of the retail behemoth have trailed the S&P 500 by 21 percentage points this year, despite Walmart raising full-year guidance.

$Home Depot (HD.US)$ and $TransDigm (TDG.US)$ report earnings.

$Cboe Global Markets (CBOE.US)$, $Enphase Energy (ENPH.US)$, $Hartford Financial Services (HIG.US)$, and $Qualcomm (QCOM.US)$ hold their annual investor days.

$Bristol-Myers Squibb (BMY.US)$ hosts an investor meeting in New York. CEO Giovanni Caforio will discuss the company's drug pipeline and strategic opportunities.

The National Association of Home Builders releases its NAHB/Wells Fargo Housing Market Index for November. Consensus estimate is for an 80 reading, even with the October figure. The index is off about 10% from its peak late last year, but home builders remain bullish on the housing market.

The Census Bureau reports on retail-sales spending for October. Expectations are for 0.8% month-over-month increase in retail sales. Excluding autos, spending is seen rising 0.9% This compares with gains of 0.7% and 0.8%, respectively, in September.

Wednesday 11/17

$Cisco (CSCO.US)$ , $Lowe's Companies (LOW.US)$ , $NVIDIA (NVDA.US)$ , $Target (TGT.US)$ , and $TJX Companies (TJX.US)$ announce quarterly results.

The Census Bureau reports new residential construction data for October. Economists forecast that privately owned housing starts will increase 2.2% to a seasonally adjusted annual rate of 1.59 million.

Thursday 11/18

$Alibaba (BABA.US)$ , $Applied Materials (AMAT.US)$ , $Intuit (INTU.US)$ , $JD.com (JD.US)$ , $Ross Stores (ROST.US)$ , and $Workday (WDAY.US)$ hold conference calls to discuss earnings.

$Cognizant (CTSH.US)$ , $Ingersoll Rand (IR.US)$ , and $Stryker Corp (SYK.US)$ host investor meetings.

$Johnson & Johnson (JNJ.US)$ holds an investor meeting to discuss its pharmaceuticals business.

Liberty Media hosts its annual investor meeting in New York. Companies presenting at the event are a mix of those owned by Liberty and those in which Liberty has a sizable stake, including the Atlanta Braves, $Charter Communications (CHTR.US)$, $Live Nation Entertainment (LYV.US)$, and $TripAdvisor (TRIP.US)$.

The Conference Board releases its Leading Economic Index for October. The consensus call is for a 0.8% monthly gain, to a 118.4 reading. The Conference Board is currently projecting a 5.7% GDP growth rate this year.

Friday 11/19

$Foot Locker (FL.US)$ reports earnings for its fiscal third quarter.

Source: CNBC, Dow Jones Newswires, jhinvestments

Stocks are coming off a losing week after last month's consumer price index made its largest annual increase in more than three decades. The major averages snapped a five-week winning streak.

The $Dow Jones Industrial Average (.DJI.US)$ dipped 0.6% and the $S&P 500 Index (.SPX.US)$ eased 0.3% last week. The tech-focused $Nasdaq Composite Index (.IXIC.US)$ was the main underperformer, dropping 0.7% as rising bond yields dented growth pockets of the market.

Here's a look at the return of S&P 500 sectors

This week ahead in focus

Third-quarter earnings season is entering the period when retailers dominate the daily reports. Big names will include Advance Auto Parts on Monday, followed by Walmart and Home Depot on Tuesday. Then Target, Lowe's, and TJX report on Wednesday and Alibaba Group Holding go on Thursday.

Non-retail highlights on the earnings calendar this week will include Lucid Group and Tyson Foods on Monday, Nvidia and Cisco Systems on Wednesday, and Applied Materials on Thursday.

Economic data releases this week include the Census Bureau's October retail-sales report on Tuesday and the Conference Board's Leading Economic Index for October on Thursday. Both are forecast to have climbed 0.8% from September.

Monday 11/15

$Advance Auto Parts (AAP.US)$ , $Lucid Group (LCID.US)$ , $Tyson Foods (TSN.US)$ , and $Warner Music (WMG.US)$ release quarterly results.

$Automatic Data Processing (ADP.US)$ hosts its 2021 investor day in Roseland, N.J.

Tuesday 11/16

$Walmart (WMT.US)$ reports third-quarter fiscal-2022 earnings before the opening bell. Shares of the retail behemoth have trailed the S&P 500 by 21 percentage points this year, despite Walmart raising full-year guidance.

$Home Depot (HD.US)$ and $TransDigm (TDG.US)$ report earnings.

$Cboe Global Markets (CBOE.US)$, $Enphase Energy (ENPH.US)$, $Hartford Financial Services (HIG.US)$, and $Qualcomm (QCOM.US)$ hold their annual investor days.

$Bristol-Myers Squibb (BMY.US)$ hosts an investor meeting in New York. CEO Giovanni Caforio will discuss the company's drug pipeline and strategic opportunities.

The National Association of Home Builders releases its NAHB/Wells Fargo Housing Market Index for November. Consensus estimate is for an 80 reading, even with the October figure. The index is off about 10% from its peak late last year, but home builders remain bullish on the housing market.

The Census Bureau reports on retail-sales spending for October. Expectations are for 0.8% month-over-month increase in retail sales. Excluding autos, spending is seen rising 0.9% This compares with gains of 0.7% and 0.8%, respectively, in September.

Wednesday 11/17

$Cisco (CSCO.US)$ , $Lowe's Companies (LOW.US)$ , $NVIDIA (NVDA.US)$ , $Target (TGT.US)$ , and $TJX Companies (TJX.US)$ announce quarterly results.

The Census Bureau reports new residential construction data for October. Economists forecast that privately owned housing starts will increase 2.2% to a seasonally adjusted annual rate of 1.59 million.

Thursday 11/18

$Alibaba (BABA.US)$ , $Applied Materials (AMAT.US)$ , $Intuit (INTU.US)$ , $JD.com (JD.US)$ , $Ross Stores (ROST.US)$ , and $Workday (WDAY.US)$ hold conference calls to discuss earnings.

$Cognizant (CTSH.US)$ , $Ingersoll Rand (IR.US)$ , and $Stryker Corp (SYK.US)$ host investor meetings.

$Johnson & Johnson (JNJ.US)$ holds an investor meeting to discuss its pharmaceuticals business.

Liberty Media hosts its annual investor meeting in New York. Companies presenting at the event are a mix of those owned by Liberty and those in which Liberty has a sizable stake, including the Atlanta Braves, $Charter Communications (CHTR.US)$, $Live Nation Entertainment (LYV.US)$, and $TripAdvisor (TRIP.US)$.

The Conference Board releases its Leading Economic Index for October. The consensus call is for a 0.8% monthly gain, to a 118.4 reading. The Conference Board is currently projecting a 5.7% GDP growth rate this year.

Friday 11/19

$Foot Locker (FL.US)$ reports earnings for its fiscal third quarter.

Source: CNBC, Dow Jones Newswires, jhinvestments

+2

167

10

ex whywhyzee

voted

Spoiler:

At the end of this post, there is a chance for you to win points!

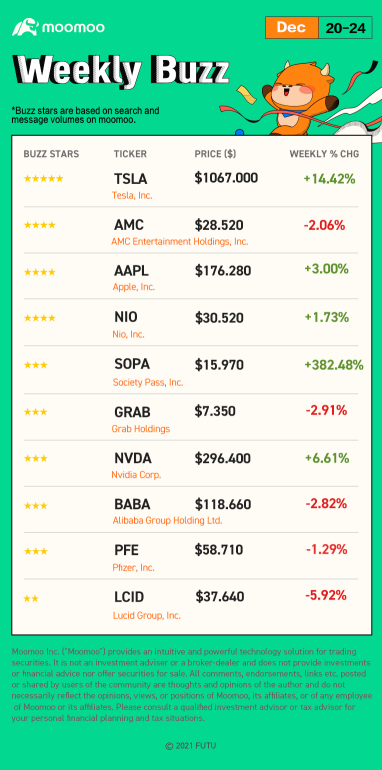

Happy Monday mooers! How's your Christmas going? Welcome back to Weekly Buzz, where we review the news, performance, and community sentiment of the selected buzzing stocks on moomoo platform based on search and message volumes of last week! (Nano caps are excluded.)

Part Ⅰ: Make Your Choices

Part Ⅱ: Buzzing Stocks List & Mooers Comments

Every major index moved upward, R...

At the end of this post, there is a chance for you to win points!

Happy Monday mooers! How's your Christmas going? Welcome back to Weekly Buzz, where we review the news, performance, and community sentiment of the selected buzzing stocks on moomoo platform based on search and message volumes of last week! (Nano caps are excluded.)

Part Ⅰ: Make Your Choices

Part Ⅱ: Buzzing Stocks List & Mooers Comments

Every major index moved upward, R...

+12

77

86

ex whywhyzee

liked

There are a few ground rules which I follow when it comes to trading.

First and foremost, I follow a system for everything. For my value investing, I do a certain amount of due diligence before starting a position in any stock. I look through articles, financial reports etc. before I decide if it is worth a buy. Similarly, for day-trading or momentum trading, I go in and go out of a trade solely based on technical indicators. When a system is followed, trades are consistent, and you know exactly what you're doing. You aren't just copying someone off Youtube. You aren't just buying because everyone is talking about it.

Second of all, I fight the urge every time I panic. Emotions are your biggest enemy in the stock market. Sometimes, when you followed your system but things go south, it may be tempting to panic-sell. When we're in this state, it's tough to make rational decisions. It is true that in some situations, for example, if a company is suddenly in a lot of trouble and its prospects are drastically affected, it may be a good idea to cut your losses. However, if your stocks are tanking because major indexes are falling, or because of FUD that's not directly related to the prospect of the company itself, then do think again. Distract yourself. Close the app. If you truly believe in the stock, you wouldn't be panicking. Warren Buffett has never tried to time the market. He is systematic and he does not let his emotions cloud his judgment. This is how it should be done.

Lastly, manage your risk well. Money management is important. I allocate a fixed percentage of my money to blue chips and ETFs. $Apple (AAPL.US)$ , $Berkshire Hathaway-B (BRK.B.US)$ and $SPDR S&P 500 ETF (SPY.US)$ are some examples. This is my retirement money. I also allocate a smaller percentage to riskier ventures like day-trading and momentum-trading. Finally, I allocate some percentage to stocks which have considerable risk associated with them, yet I am going to gamble on the long term prospects because I love what I see right now for these companies. These are mainly Chinese EVs like $NIO Inc (NIO.US)$ , fintechs like $Futu Holdings Ltd (FUTU.US)$ and $SoFi Technologies (SOFI.US)$ , to name a few.

Do not be the one guy who puts 90% of his savings into day trading, only to lose half of it in a week. Manage your risk and your money well. While you're at it, know how to put a stop loss or a trailing stop on your positions if necessary. This is especially important for day trading.

First and foremost, I follow a system for everything. For my value investing, I do a certain amount of due diligence before starting a position in any stock. I look through articles, financial reports etc. before I decide if it is worth a buy. Similarly, for day-trading or momentum trading, I go in and go out of a trade solely based on technical indicators. When a system is followed, trades are consistent, and you know exactly what you're doing. You aren't just copying someone off Youtube. You aren't just buying because everyone is talking about it.

Second of all, I fight the urge every time I panic. Emotions are your biggest enemy in the stock market. Sometimes, when you followed your system but things go south, it may be tempting to panic-sell. When we're in this state, it's tough to make rational decisions. It is true that in some situations, for example, if a company is suddenly in a lot of trouble and its prospects are drastically affected, it may be a good idea to cut your losses. However, if your stocks are tanking because major indexes are falling, or because of FUD that's not directly related to the prospect of the company itself, then do think again. Distract yourself. Close the app. If you truly believe in the stock, you wouldn't be panicking. Warren Buffett has never tried to time the market. He is systematic and he does not let his emotions cloud his judgment. This is how it should be done.

Lastly, manage your risk well. Money management is important. I allocate a fixed percentage of my money to blue chips and ETFs. $Apple (AAPL.US)$ , $Berkshire Hathaway-B (BRK.B.US)$ and $SPDR S&P 500 ETF (SPY.US)$ are some examples. This is my retirement money. I also allocate a smaller percentage to riskier ventures like day-trading and momentum-trading. Finally, I allocate some percentage to stocks which have considerable risk associated with them, yet I am going to gamble on the long term prospects because I love what I see right now for these companies. These are mainly Chinese EVs like $NIO Inc (NIO.US)$ , fintechs like $Futu Holdings Ltd (FUTU.US)$ and $SoFi Technologies (SOFI.US)$ , to name a few.

Do not be the one guy who puts 90% of his savings into day trading, only to lose half of it in a week. Manage your risk and your money well. While you're at it, know how to put a stop loss or a trailing stop on your positions if necessary. This is especially important for day trading.

69

17

ex whywhyzee

commented on

$NIO Inc (NIO.US)$ this stock is stubborn like hell. stucked.

4

2

$Luminar Technologies (LAZR.US)$ I bought shares, and it went down.

If you want to make money, do the opposite of what I do.

If you want to make money, do the opposite of what I do.

3

2

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)

ex whywhyzee Jamesbond86 : THIS