Tesla shares jump 10% on profit beat![]()

![]()

![]()

![]()

![]()

![]()

- Tesla Q3 Non-GAAP EPS of $0.72 beats by $0.12.

- Revenue of $25.18B (+7.8% Y/Y) misses by $490M.

- Capex: $3.51B vs. $2.46B in 3Q23. FCF: $2.74B vs. $848M in 3Q23

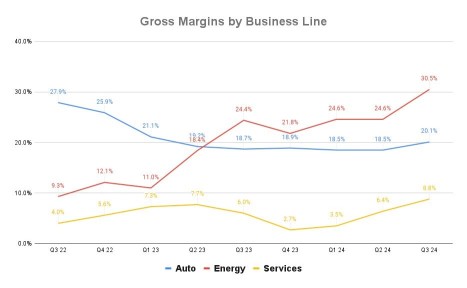

The entire reason $Tesla (TSLA.US)$ is surging, in one chart

Due to my own unique circumstances, I deal almost exclusively in common shares and ETFs.

For $Tesla (TSLA.US)$ , my favorites are $Direxion Daily TSLA Bull 2X Shares (TSLL.US)$ 2x bullish and $T-REX 2X LONG TESLA DAILY TARGET ETF (TSLT.US)$ 2X bullis...

- Tesla Q3 Non-GAAP EPS of $0.72 beats by $0.12.

- Revenue of $25.18B (+7.8% Y/Y) misses by $490M.

- Capex: $3.51B vs. $2.46B in 3Q23. FCF: $2.74B vs. $848M in 3Q23

The entire reason $Tesla (TSLA.US)$ is surging, in one chart

Due to my own unique circumstances, I deal almost exclusively in common shares and ETFs.

For $Tesla (TSLA.US)$ , my favorites are $Direxion Daily TSLA Bull 2X Shares (TSLL.US)$ 2x bullish and $T-REX 2X LONG TESLA DAILY TARGET ETF (TSLT.US)$ 2X bullis...

12

TD chief economist eats crow.![]()

![]()

1

1

I actually listened to the conference call the bank held to announce this, and as I heard the CEO and his VPs speak, something struck me. This may sound like a generalization:

CEO Bharat Masrani sounded like someone asleep at the wheel. He was noticeably slow to respond, and his answers were very vague—you wouldn’t think he was the CEO of one of the largest banks in North America. Just based on his communication style, I wasn’t surprised that this happened under his watch. I understand that Eng...

CEO Bharat Masrani sounded like someone asleep at the wheel. He was noticeably slow to respond, and his answers were very vague—you wouldn’t think he was the CEO of one of the largest banks in North America. Just based on his communication style, I wasn’t surprised that this happened under his watch. I understand that Eng...

5

3

Bank of Canada expected to do a 50 bps cut on Wednesday, and another 50 bps in Dec.

IMO, the recent economic data coming out of the US is a blip, and in the coming months we will see it follow the same trend as Canada has been a leading indicator as of late![]()

![]() $Bank of Nova Scotia (BNS.CA)$ $ISHARES S&P/TSX 60 INDEX ETF UNIT (XIU.CA)$ $The Toronto-Dominion Bank (TD.CA)$

$Bank of Nova Scotia (BNS.CA)$ $ISHARES S&P/TSX 60 INDEX ETF UNIT (XIU.CA)$ $The Toronto-Dominion Bank (TD.CA)$

IMO, the recent economic data coming out of the US is a blip, and in the coming months we will see it follow the same trend as Canada has been a leading indicator as of late

2

🔹 Revenue: $23.5B (Est. $23.3B) 🟢; UP +36% YoY

🔹 Gross Margin: 57.8% (Est. 55%) 🟢; UP from 54.3% YoY

🔹 Oper. Margin: 47.5% (Est. 44%) 🟢

🔹 Net Profit: NT$325.26B ($10.06B); All-time high

Q4'24 Guidance:

🔹 Revenue: $26.1B - $26.9B (Est. $24.94B) 🟢

🔹 Gross Margin: 57% - 59% (Est. 54.7%) 🟢

🔹 Operating Margin: 46.5% - 48.5% (Est. 44.3%) 🟢

FY'24 Outlook:

🔹 Revenue Growth: Close to 30% (up from mid-20%)

🔹 2024 CapEx: Slightly above $30B (Saw: 30-32B)

...

🔹 Gross Margin: 57.8% (Est. 55%) 🟢; UP from 54.3% YoY

🔹 Oper. Margin: 47.5% (Est. 44%) 🟢

🔹 Net Profit: NT$325.26B ($10.06B); All-time high

Q4'24 Guidance:

🔹 Revenue: $26.1B - $26.9B (Est. $24.94B) 🟢

🔹 Gross Margin: 57% - 59% (Est. 54.7%) 🟢

🔹 Operating Margin: 46.5% - 48.5% (Est. 44.3%) 🟢

FY'24 Outlook:

🔹 Revenue Growth: Close to 30% (up from mid-20%)

🔹 2024 CapEx: Slightly above $30B (Saw: 30-32B)

...

16

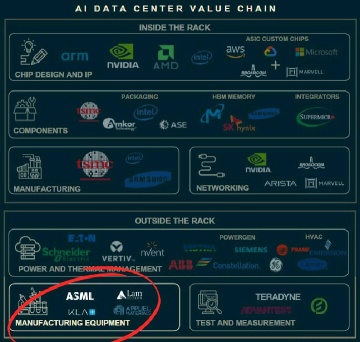

- Q3 bookings of €2.63B (vs. est. of €5.39B)

- '25 sales at €30-35B (vs. est. of €35.94B)

What's going on?

1. "competitive foundry dynamic" aka $INTC cut capex

2. "Limited capacity additions in memory" aka $MU & SK Hynix are converting existing overcapacity for HBM

3. This is on top of China restrictions (the only booming market for equipment)

People miss that semi-equipment follows its own cycle and is facing some headwinds after a strong capex cycle '21-23. ...

- '25 sales at €30-35B (vs. est. of €35.94B)

What's going on?

1. "competitive foundry dynamic" aka $INTC cut capex

2. "Limited capacity additions in memory" aka $MU & SK Hynix are converting existing overcapacity for HBM

3. This is on top of China restrictions (the only booming market for equipment)

People miss that semi-equipment follows its own cycle and is facing some headwinds after a strong capex cycle '21-23. ...

8

What do people think of this? Conspiracy theories or valuable facts?

The CPI chart on the home page reflects our estimate of inflation for today as if it were calculated the same way it was in 1990. The CPI on the Alternate Data Series tab here reflects the CPI as if it were calculated using the methodologies in place in 1980. In general terms, methodological shifts in government reporting have depressed reported inflation, moving the concept of the CPI ...

The CPI chart on the home page reflects our estimate of inflation for today as if it were calculated the same way it was in 1990. The CPI on the Alternate Data Series tab here reflects the CPI as if it were calculated using the methodologies in place in 1980. In general terms, methodological shifts in government reporting have depressed reported inflation, moving the concept of the CPI ...

2

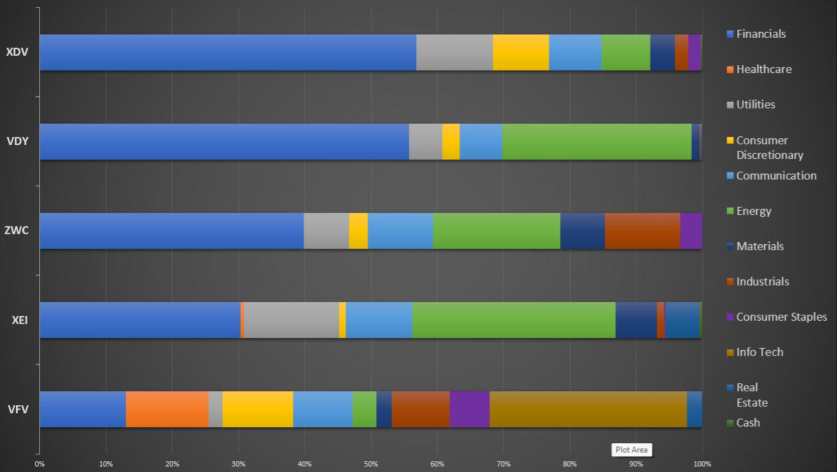

Compare the NAV of ZWC and VDY since 2017 inception. ZWC share price down about 11% while VDY is up about 40%.

Compare the actual payouts. ZWC has been between 0.10 and 0.11 monthly since 2017, so it is basically flat since inception. VDY total year div for 2017 was about $1.19 and in 2024 will be around $2.20 to $2.30. So getting close to doubling the dividend over those 7 years.

VDY has some extra risk because it is more concentrated, but it also has a much better total r...

Compare the actual payouts. ZWC has been between 0.10 and 0.11 monthly since 2017, so it is basically flat since inception. VDY total year div for 2017 was about $1.19 and in 2024 will be around $2.20 to $2.30. So getting close to doubling the dividend over those 7 years.

VDY has some extra risk because it is more concentrated, but it also has a much better total r...

1

Sharing two articles I read recently which discuss economic inequality in Canada using StatsCan data. See below for the links and some key excerpts:

——

Article 1: Income inequality in Canada rises to the highest level ever recorded: Statistics Canada | CBC News

Income inequality in Canada rises to the highest level ever recorded: Statistics Canada

The gap in the share of disposable income between the richest tw...

——

Article 1: Income inequality in Canada rises to the highest level ever recorded: Statistics Canada | CBC News

Income inequality in Canada rises to the highest level ever recorded: Statistics Canada

The gap in the share of disposable income between the richest tw...

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)