flukshun

liked

As of March 24, 2025, the volatility of Tesla's (Tesla, NASDAQ: TSLA) stock price is influenced by multiple factors, including market sentiment, changes in the company's fundamentals, the macroeconomic environment, and the competitive landscape of the industry. While I am unable to provide real-time data, I can analyze key points that may drive volatility in Tesla's stock price based on known trends and potentially influential factors.

1. possib...

1. possib...

10

flukshun

liked

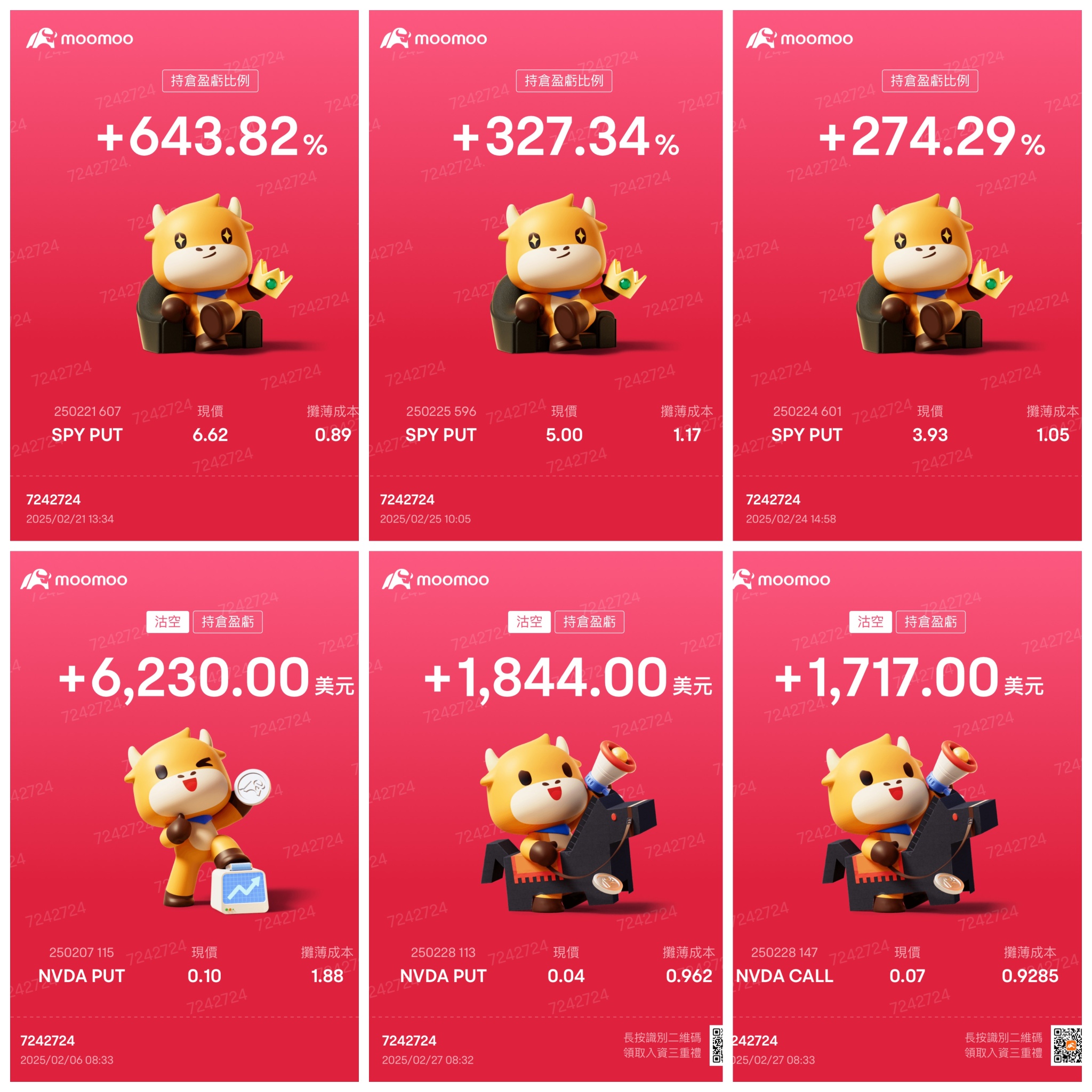

We're thrilled to bring you a special post on options trading with @7242724 (Yoyo) today.

Even though I'm still somewhat of a newbie in investing, I've already gained the kind of rich experience that ten years in traditional stock trading might not teach you. -- Said by @7242724

Dive into the p...

+5

77

35

15

flukshun

liked

Recently, the head of digital assets at Blackrock stated thatthe economic recession could become a major catalyst for Bitcoin (BTC), a viewpoint that has sparked heated discussion in the market. Bitcoin has long been referred to as "digital Gold" and has shown characteristics similar to safe-haven assets during periods of market turbulence. However, against the backdrop of a potential global economic slowdown, intertwined expectations of inflation and interest rate cuts, can Bitcoin truly become a safe-haven tool? How should investors assess its value? This article will examine fromthe perspectives of Historical Data, monetary policy impact, Institutions participation, regulatory risk, and Global economic trends, combined with "US stocks 101The analysis helps investors determine whether Bitcoin is worth including in their asset allocation.

How has Bitcoin responded to economic recessions in the past? What signals do historical data provide?

Since Bitcoin's birth in 2009, it has not experienced a complete economic recession cycle, so the market's view on its performance during recessions remains controversial. During the outbreak of the COVID-19 pandemic in 2020, Bitcoin plummeted in sync with US stocks, at that time BTC once collapsed from over $10,000 to $3,800.This shows that it still has a high correlation with risk assets. However, after the Federal Reserve initiated quantitative easing (QE) and large-scale stimulus policies were introduced, BTC quickly rebounded and reached a new high in 2021. $69,000 Historical high point. This trend indicates that although Bitcoin...

How has Bitcoin responded to economic recessions in the past? What signals do historical data provide?

Since Bitcoin's birth in 2009, it has not experienced a complete economic recession cycle, so the market's view on its performance during recessions remains controversial. During the outbreak of the COVID-19 pandemic in 2020, Bitcoin plummeted in sync with US stocks, at that time BTC once collapsed from over $10,000 to $3,800.This shows that it still has a high correlation with risk assets. However, after the Federal Reserve initiated quantitative easing (QE) and large-scale stimulus policies were introduced, BTC quickly rebounded and reached a new high in 2021. $69,000 Historical high point. This trend indicates that although Bitcoin...

Translated

8

flukshun

liked

Recently, the toy industry giant $Mattel (MAT.US)$ (NASDAQ: MAT) announced its Q4 2024 Earnings Reports, surpassing market expectations, attracting investor attention. This quarter, Mattel's revenue reached 1.65 billion USD., a growth compared to the same period last year. 1.6%Earnings per share (EPS) reached 0.35 USD, far exceeding market estimates of 0.20 USD.. Does this performance indicate that Mattel has successfully turned things around, or is it driven by short-term market sentiment? This article will analyze Mattel's investment potential through financial data, industry competition, and market trends, helping investors grasp the latest movements of this stock.

Revenue momentum is strong, Hot Wheels performs exceptionally well.

This quarter, Mattel's revenue performance was primarily driven by Hot Wheels , with strong sales propelling the brand to set historical sales records for seven consecutive years, leading to a year-on-year growth in the Vehicles product line. 14%In addition,The Action Figures, Building Sets & Games product line also grew. 5%, showing that the company's competitiveness in core categories remains strong.

However, Sales performance of Barbie did not meet expectations., leading to the doll category (Doll...

Revenue momentum is strong, Hot Wheels performs exceptionally well.

This quarter, Mattel's revenue performance was primarily driven by Hot Wheels , with strong sales propelling the brand to set historical sales records for seven consecutive years, leading to a year-on-year growth in the Vehicles product line. 14%In addition,The Action Figures, Building Sets & Games product line also grew. 5%, showing that the company's competitiveness in core categories remains strong.

However, Sales performance of Barbie did not meet expectations., leading to the doll category (Doll...

Translated

6

flukshun

liked

Should be alot more if Id held a little longer and sold a little sooner.🤓

5

flukshun

liked

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)