$HSI Futures(APR5) (HSImain.HK)$ $XPeng (XPEV.US)$ $Li Auto (LI.US)$ $NIO Inc (NIO.US)$ $E-mini S&P 500 Futures(JUN5) (ESmain.US)$ $Direxion Daily FTSE China Bull 3X Shares ETF (YINN.US)$ $Alibaba (BABA.US)$ $Taiwan Semiconductor (TSM.US)$ $JD.com (JD.US)$ $PDD Holdings (PDD.US)$ $SPDR S&P 500 ETF (SPY.US)$ $Invesco QQQ Trust (QQQ.US)$ Breaking News: China prepares stimulus plan

4

4

$HSI Futures(APR5) (HSImain.HK)$ $Alibaba (BABA.US)$ $JD.com (JD.US)$ $PDD Holdings (PDD.US)$ $NIO Inc (NIO.US)$ $Li Auto (LI.US)$ $XPeng (XPEV.US)$

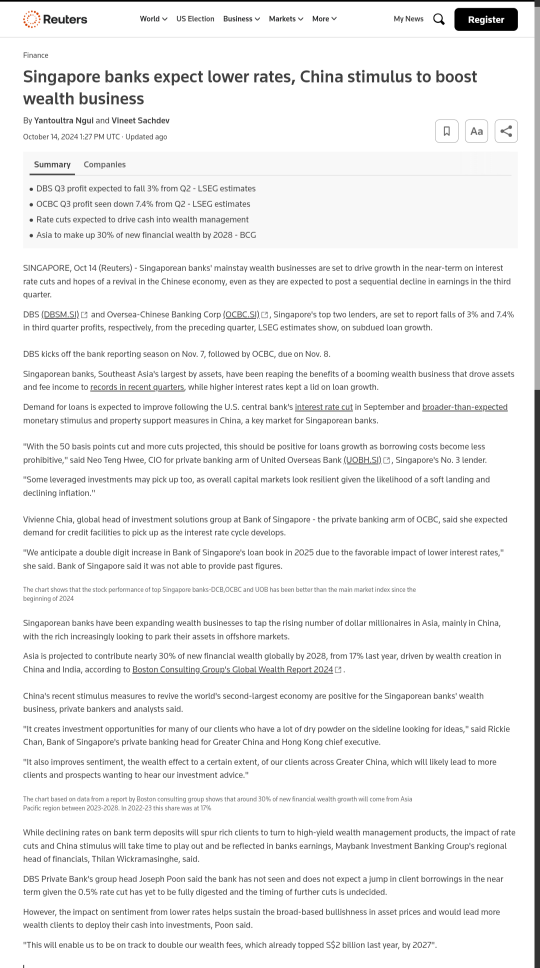

Singapore banks expect lower rates, China stimulus to boost wealth business

Singapore banks expect lower rates, China stimulus to boost wealth business

4

$HSI Futures(APR5) (HSImain.HK)$ Super early volatility 🥴 I wouldn't be surprised if China holds an emergency meeting to set the record straight.

1

3

$RTX Corp (RTX.US)$ $General Dynamics (GD.US)$ $Lockheed Martin (LMT.US)$ $Palantir (PLTR.US)$ $HUB Cyber Security (HUBC.US)$ $SPDR S&P 500 ETF (SPY.US)$

BREAKING 10/1/2024

: Israel says that Iran has fired a missile attack just moments ago with widespread trajectories.

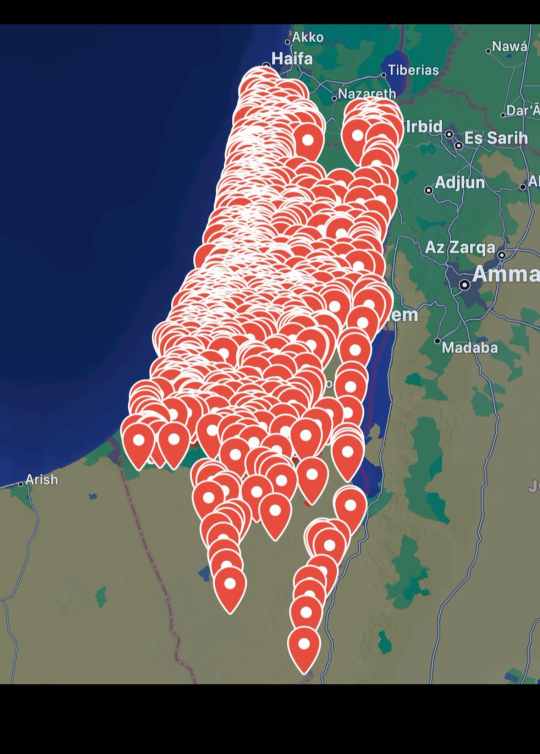

Below is the map of Israel’s sirens currently sounding.

This is one of the largest escalations since the conflict began.

BREAKING 10/1/2024

: Israel says that Iran has fired a missile attack just moments ago with widespread trajectories.

Below is the map of Israel’s sirens currently sounding.

This is one of the largest escalations since the conflict began.

1

3

$PDD Holdings (PDD.US)$ $Alibaba (BABA.US)$ $JD.com (JD.US)$ $NIO Inc (NIO.US)$ $iShares MSCI Hong Kong ETF (EWH.US)$ $H-Source Holdings Ltd (HSI.CA)$ $SPDR S&P 500 ETF (SPY.US)$ BREAKING NEWS 9/27: CHINA'S PBOC CUTS THE 7-DAY RRP RATE BY 20 BPS TO 1.5% FROM 1.7% AS THE CENTRAL BANK SCHEDULED.

6

2

$E-mini S&P 500 Futures(JUN5) (ESmain.US)$ https://finance.yahoo.com/news/china-unleashes-stimulus-blitz-push-012624919.html

(Bloomberg) -- China’s central bank unveiled a broad package of monetary stimulus measures to revive the world’s second-largest economy, underscoring mounting ...

(Bloomberg) -- China’s central bank unveiled a broad package of monetary stimulus measures to revive the world’s second-largest economy, underscoring mounting ...

5

$E-mini S&P 500 Futures(JUN5) (ESmain.US)$

9/19/2024

Jobless claims come in lower than expected.

US Initial Jobless Claims Actual 219k (Forecast 230k, Previous 230k, Revised 231k)

9/19/2024

Jobless claims come in lower than expected.

US Initial Jobless Claims Actual 219k (Forecast 230k, Previous 230k, Revised 231k)

1

$E-mini S&P 500 Futures(JUN5) (ESmain.US)$ Why, then, did the Fed decide not to leave cuts at 25 basis points? 🐂

$E-mini S&P 500 Futures(JUN5) (ESmain.US)$ SUMMARY OF FED CHAIR POWELL'S STATEMENT (9/18/24):

1. Fed believes that the economy is "strong overall"

2. Fed has "growing confidence" that strength in labor market can be maintained

3. Consumer spending has "remained resilient"

4. Inflation has eased but "remains above 2% target"

5. Labor market is now less tight than before pandemic

6. Fed is moving to a "neutral stance" but "not on any preset course"

1. Fed believes that the economy is "strong overall"

2. Fed has "growing confidence" that strength in labor market can be maintained

3. Consumer spending has "remained resilient"

4. Inflation has eased but "remains above 2% target"

5. Labor market is now less tight than before pandemic

6. Fed is moving to a "neutral stance" but "not on any preset course"

1

I haven't even had a chance to buy yet. The US market hasn't opened up. I'm waiting till Bell hopefully the price stays low, I'm accumulate for a future payout.

I haven't even had a chance to buy yet. The US market hasn't opened up. I'm waiting till Bell hopefully the price stays low, I'm accumulate for a future payout.

Goldman Sachs doesn't not raise something because they're shorting it.. get real my man.

Goldman Sachs doesn't not raise something because they're shorting it.. get real my man.![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)

FrankieSmilez OP : https://www.japantimes.co.jp/business/2025/03/03/markets/xi-china-stimulus-trade-war/

FrankieSmilez OP Derpy Trades : Derpy!