funny Bird_1720

liked

Stocks to Watch

Broadcom Inc (AVGO US) $Broadcom (AVGO.US)$

Daily Chart -[BULLISH ↗ *]AVGO US is holding above its ascending trendline support. As long as price is holding above 173.85 support level, we expect price to drift down towards its ascending trendline support before drifting towards 199.50 resistance level. Technical indicators advocate for a bullish scenario as well.

Alternatively: A daily candlestick closing below 173.85 su...

Broadcom Inc (AVGO US) $Broadcom (AVGO.US)$

Daily Chart -[BULLISH ↗ *]AVGO US is holding above its ascending trendline support. As long as price is holding above 173.85 support level, we expect price to drift down towards its ascending trendline support before drifting towards 199.50 resistance level. Technical indicators advocate for a bullish scenario as well.

Alternatively: A daily candlestick closing below 173.85 su...

+3

26

3

$UP Fintech (TIGR.US)$ Is there any basis for going to $20?

Translated

1

2

funny Bird_1720

commented on

$Reddit (RDDT.US)$ will drop below 50 later?

2

7

funny Bird_1720

voted

Spoiler: At the end of this post, there is a chance for you to win points! ![]() Happy Monday, mooers!

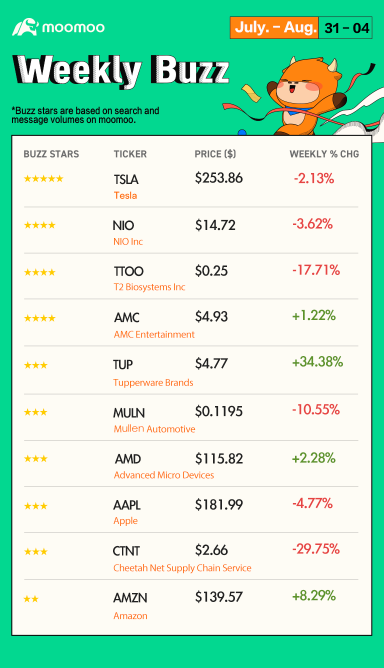

Happy Monday, mooers!![]() Welcome back to Weekly Buzz, where we review the news, performance, and community sentiment of the selected buzzing stocks on moomoo platform based on search and message volumes of last week! (Nano caps are excluded.)

Welcome back to Weekly Buzz, where we review the news, performance, and community sentiment of the selected buzzing stocks on moomoo platform based on search and message volumes of last week! (Nano caps are excluded.)

📊 Make Your Choices

💡Buzzing Stocks List & Mooers Comments

Stocks fell last week to close out a rare losi...

📊 Make Your Choices

💡Buzzing Stocks List & Mooers Comments

Stocks fell last week to close out a rare losi...

24

6

funny Bird_1720

liked

funny Bird_1720

liked and voted

[Rewards] NIO Q1 margins contracted sharply, and new launches are around the corner

Claim your Earnings Season offer by winning Rewards Points and discovering Investment Opportunities!

KEY Figures:

● Q1 total revenues were US$1,554.6 million, representing an increase of 7.7% YoY (year-on-year) and a decrease of 33.5% from the fourth quarter of 2022. The decrease in vehicle sales was mainly due to a lower average selling price as a result of the higher proportion o...

Claim your Earnings Season offer by winning Rewards Points and discovering Investment Opportunities!

KEY Figures:

● Q1 total revenues were US$1,554.6 million, representing an increase of 7.7% YoY (year-on-year) and a decrease of 33.5% from the fourth quarter of 2022. The decrease in vehicle sales was mainly due to a lower average selling price as a result of the higher proportion o...

47

24

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)